— Update 10.13.2022: Federal Judge Watson ruled that the DPP and the City and County of Honolulu shall not implement and enforce changing minimum rental terms from 30 days to 90 days. All STR rule updates are here –> Bill 41 (CO 22-7) – Oahu’s New Short-Term Rental Rules 2022 – Legal STR Properties

— Update 4.26.2022: Bill 41 (CO 22-7), Oahu’s latest updated short-term rental rules take effect 10.23.2022, prohibiting rental terms of less than 90 days (formerly 30 days) in residential neighborhoods. Existing rentals must comply by 4.23.2023. Also, STR properties (rental terms of less than 90 days) must be registered with a $1K initial registration fee, and a $500 annual renewal fee. All Waikiki Banyan and Waikiki Sunset condos are legal STRs subject to the terms of Bill 41. All STR rule updates are here –> Bill 41 (CO 22-7) – Oahu’s New Short-Term Rental Rules 2022 – Legal STR Properties

________________________________

Short-term vacation renting has been growing in popularity since the dawn of the sharing economy. VRBO started in 1995, but it was the start of HomeAway (2004) and Airbnb (2008) that forever changed the way the world looks at real estate.

Everyone wants a piece of the pie because it can be lucrative. Daily, we receive an ever-increasing number of new inquiries about which properties for sale might be suitable to rent out as short-term vacation rentals.

In response to the huge demand, we compiled the most comprehensive guide to Honolulu short-term vacation renting: Guide to Honolulu Condotels and Short-term Rental Condos.

Search all available condotels for sale.

For many out-of-state buyers, owning a short-term vacation rental property can fulfill a clever dual purpose. A unique combination that could deliver the best of both worlds:

- Maximum rental income potential – Short-term vacation renting with less than 30-day rental terms has the potential to generate significantly more rental income compared to longer-term 30-day minimum rental terms.

- Maximum rental flexibility. – You control the booking calendar and can block days to best fit your vacation plans. Enjoy the unit for your personal use between guest bookings.

See our related article Waikiki’s Condotel Reality analyzing and comparing different sample income statements.

Property owners get inspired by success stories of how others have turned their properties into cash cows. But every opportunity comes with certain risks associated.

Ignorance is not bliss. It can get you in trouble if you don’t know some basic rules, or worse if you blatantly disregard them.

Here we list three of the biggest risks for you to consider:

1) Illegal Short-Term Vacation Renting

“Even if your Porsche can go 200 mph, you still need to obey the traffic laws.”

The vast majority of residential neighborhoods and condo buildings do not allow short-term vacation renting (rental terms shorter than 30 days).

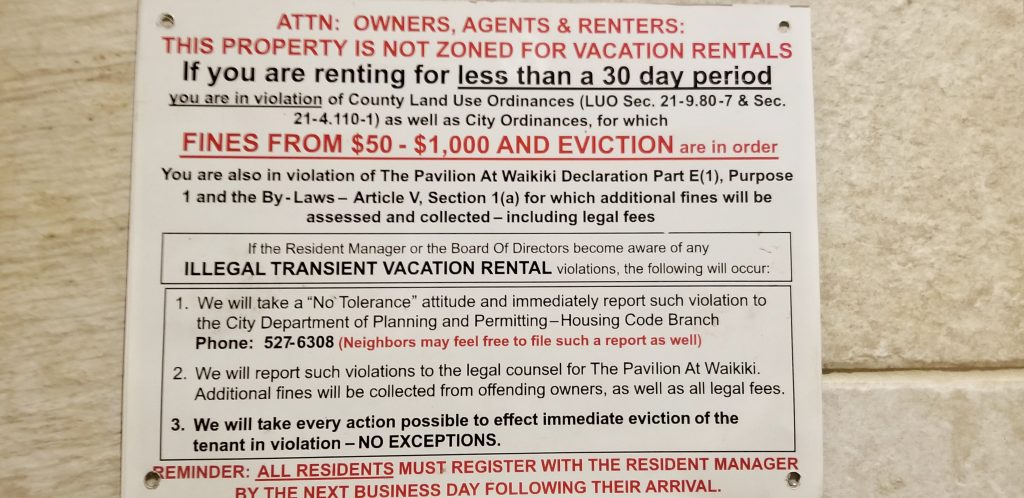

Here is a sign posted in a Waikiki residential condo lobby:

Short-term vacation renting is only allowed if:

a) the underlying zoning is ‘resort’, and

b) the building house rules do not prohibit short-term vacation renting.

There are three exceptions that would also allow short-term vacation renting:

1) The individual home or condo unit must have a NUC (Non-confirming Use Certificate to operate as a TVU – Transient Vacation Unit), or..

2) the condo building has an ongoing active hotel operation and the property is exempt from requiring owners to hold a valid NUC, as per an unofficial list from 1990 by the Dept of Planning & Permitting, or..

3) the property has a legal Bed & Breakfast license (NUC for operating a single-family home as a hosted TVU).

The city has not issued any new NUCs and B&B licenses since 1986. All existing NUCs need to be renewed every even-numbered year. Here is a list of current NUCs. The buildings that are exempt from NUC requirements are listed in our Condotel Guide.

This is basic stuff, except there are differences of opinions and entitlement issues.

Waikiki Lanais

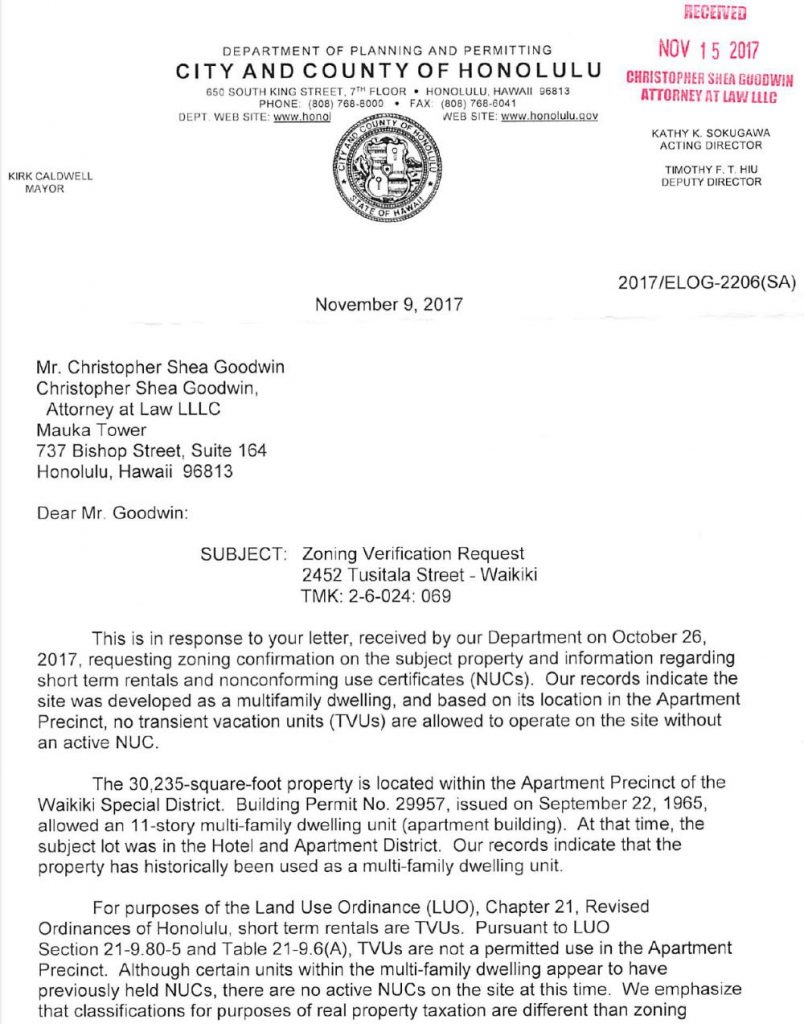

Consider the case of Waikiki Lanais, a popular Waikiki condo building.

- The underlying zoning is apartment precinct which prohibits short-term vacation renting.

- In contrast, the original 1978 Waikiki Lanais Declaration document reads: “The owners of the respective apartments shall have the absolute right to occupy, lease or rent such apartments for any lawful residential condominium use including hotel use.“ The Bylaws state: “The apartments of the project shall be used for any lawful purpose consistent with the zoning of the project.”

‘Lawful use’ and ‘consistency with zoning regulations’ is explicitly stated.

Here is a brief chronology of what reportedly has happened at the Waikiki Lanais, according to an inside source:

“A resident advised the board that short-term vacation renting is not permitted.

The board of directors requested and received a DPP letter confirming that short-term vacation renting is not allowed.

Waikiki Lanais owners were sent a copy of the letter.

The board of directors notified owners of several planned actions to enforce the rules, and the DPP began visiting the building regularly issuing citations.

The board received two lawsuit threats from two firms and went to mediation with one.

Board actions were suspended while waiting for the mediation results. The mediation failed.

Supposedly, as of this writing multiple properties are still being advertised and pro vacation renting owners are working on gaining majority interest on the board of directors.

Lawsuit threats were expressed and some board members including the board president, vice president, and the board’s attorney resigned.”

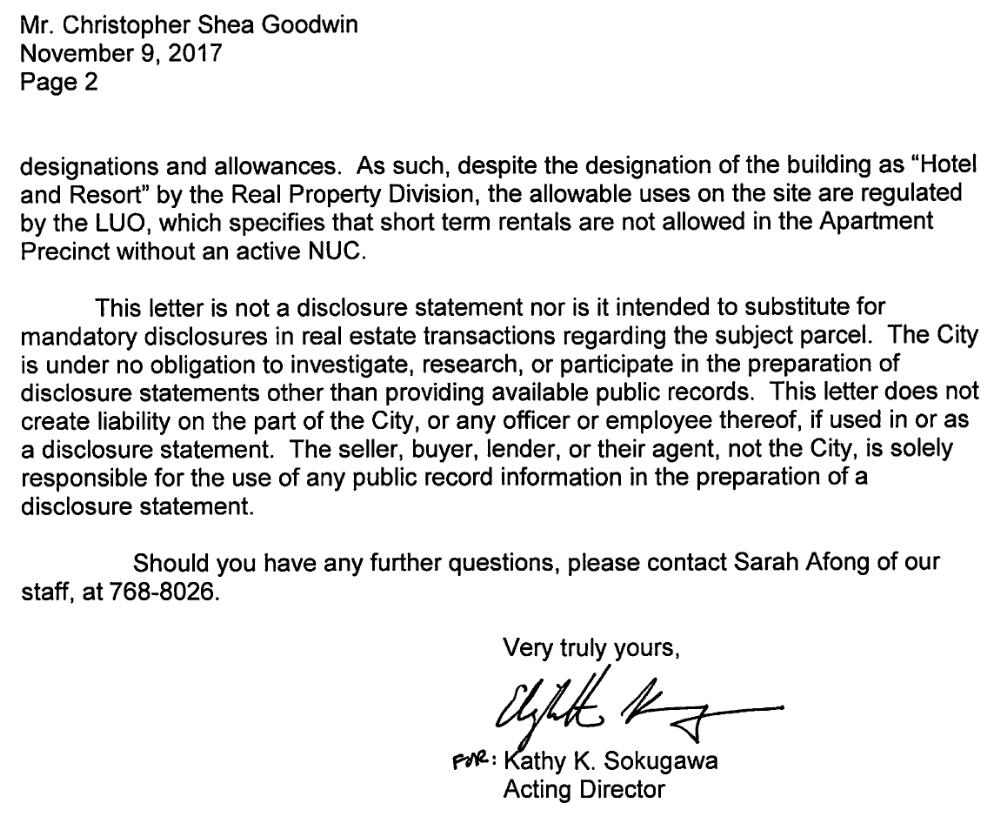

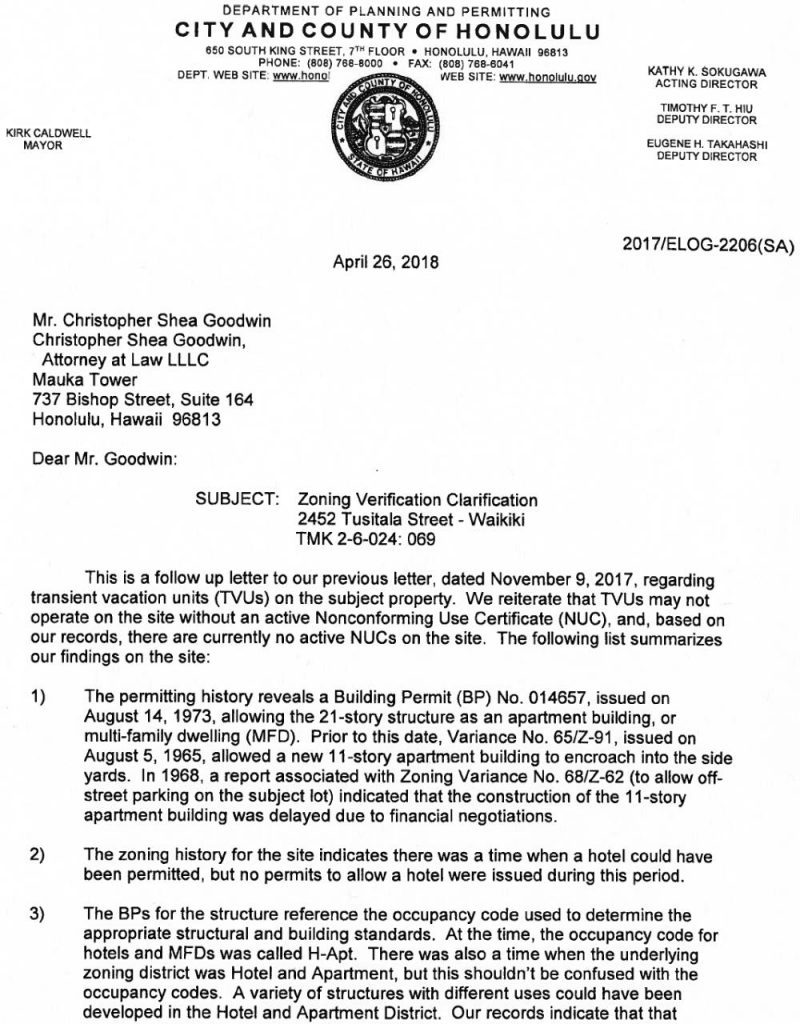

— Update June 2019: Since the 11.9.2017 letter the DPP issued the following additional letters to clarify:

Oops! “Don’t take away my secret golden goose.” – If you bought a condo at the Waikiki Lanais thinking that short-term vacation renting is allowed because everyone else is doing it, then you might have bought based on false assumptions. Just because everyone else is going faster than the speed limit does not mean you can’t get a ticket. Perhaps it is prudent to check your source and ask better questions.

Have you considered the possibility that city zoning rules have greater jurisdiction, overriding the building documents and not the other way around? Drinking Coke Zero does not cancel the calories of donuts.

Of course, that is only a matter of opinion, subject to an attorney finding some loophole or precedent to argue otherwise.

We are not attorneys and we take no sides in the ongoing dispute. Instead, we are committed to excellence in providing real estate updates to help you with your real estate decisions.

Always check with your favorite qualified legal counsel.

For the record, since day one we have been advising all our clients that short-term vacation renting is not allowed at Waikiki Lanais. It has baffled us for years that the board of directors in the past blatantly allowed and actively participated in short-term renting and got away with it. I personally recall a conversation with a former board director that appeared to be in complete denial.

There are several other Waikiki buildings with similar dynamics!

As of this writing, it seems the Waikiki Lanais’ board might have wised up and is trying to act in accordance with the zoning law but poked a couple of beehives by doing so.

Yet most recently, the DPP compliance office reportedly has taken a stance of “not wanting to police on behalf of the board any longer (!?)” – Could the lack of city enforcement fuel a false sense of security and entitlement among owners operating illegal short-term vacation rentals?

Perhaps the crux of the issue could be a potential conflict of interest between DPP’s enforcement branch and the state’s tax office. The city’s DPP enforcement branch is supposed to ‘enforce the law’ while the state tax department prefers that the DPP enforcement backs off. After all, the state needs all the revenue and aggressively ‘pursues tax collection irrespective if such short-term rental income is legal or not.’

Check a recent article about Hawaii’s tourism economy and illegal vacation rentals.

We leave the outcome up to the attorneys to resolve the issue for the Waikiki Lanais condo owners, the board of directors, and the government offices. Until then, let cool heads prevail and buyer beware.

May you balance the rights you deserve with the responsibility you must take.

Update June 2019: Oahu’s new short-term vacation rental regulation Bill 89 was signed into law!

We love to read your civil and enlightening thoughts in the comment section below.

Kakaako Condos

If you are thinking about short-term vacation renting in Kakaako, think again. Kakaako condos are subject to the Hawaii Community Development Authority Rules, which limits rental terms to 180 days minimum. See related article Kakaako Rental Rules.

Be mindful of the risk before you buy and proceed with caution.

2) Unique Market Volatility

“The short-term vacation rental income potential is only as good as the strength of the current tourism market.”

As mentioned, short-term vacation renting has the potential to generate significantly more income compared to long-term rental income. But that is only if tourism remains strong. Past performance is no guarantee of future results.

Any unforeseen black swan shock event could drastically reduce your income potential. That event could be geopolitical, severe weather, terrorism, a viral health scare, or the next recession might cause tourism activity to fluctuate with little notice.

Consider the case of the Ala Moana Hotel Condo. Extensively renovated in 2005 the hotel converted into the largest condotel in Hawaii with 1,150 condotel units. The majority of units are small studios with less than 300 sqft and no kitchen. This was before the 2008 – 2009 financial crisis. Investor condotel financing was readily available at 80% LTV, even for the units without a kitchen! Oceanview units started around $160K. Favorable 80% LTV financing prompted over 10,000 (!) potential buyers to line up in hopes of buying a piece of paradise.

Cash flow at the Ala Moana Hotel was always marginal. But the building looks grand and elegant at a price point that seemed affordable for buyers to enter the market.

In 2008-2009 tourism activity dropped in half as a result of the financial crisis.

The income for ocean view units dropped as low as $600/mo while the fixed expenses (maintenance fees and property taxes) remained at ~$800/mo. Your marginal cash flow turned into a negative $200/mo. If you had a mortgage at 6% (yes, that was the going rate) as most buyers did, your cash flow turned into a negative $1,100/mo, every month with no relief in sight, even when the unit was fully booked!

Oops. These small condotels are being bought by investors primarily based on the cash flow potential. When the cash flow diminishes or turns negative, the pool of buyers shrinks and property values drop.

Ala Moana Hotel oceanview units dropped by a staggering 50% to as low as $80K (!), cash purchases only. This price drop was significantly larger compared to the relatively benign 10% drop for the entire Oahu real estate market. No wonder the Ala Moana Hotel suffered a large number of foreclosures and lenders stopped lending entirely on condotels without full kitchens.

Eventually, the Ala Moana Hotel recovered and cash flow has returned. As of this writing, ocean view units are selling again from about $250K upwards. But it took a long time to recover.

Cash flow can be fickle, especially from short-term vacation renting. The lesson is to be prepared for any eventual worst-case scenarios. Unfortunate random events can happen to anyone. I’m a fan of Nassim Taleb’s work (Black Swan, Skin in the Game, Fooled by Randomness) where he states: “Never cross a river if it’s on average only four feet deep.”

3) Paying Your Taxes

What the DPP compliance office might lack in staff, willingness and ability, the tax department makes up for it in zest and vigor. Don’t take your responsibility of timely filing and paying the appropriate taxes lightly. There is no grace period with the tax office.

Regardless where you live, if you receive income from a Waikiki condo, or any Oahu condo with rental terms less than 180 days per tenant, you will need to pay both:

1.) 4.5% GET on the GE Taxable Income = Gross Rent plus cleaning fee and GET collected (if any), before deducting expenses, and

2.) 10.25% TAT plus an additional 3% OTAT (effective 12.14.2021) on the TA Taxable Income (Gross Rent plus cleaning fee, before deducting expenses).

GET is due on ALL gross revenue collected including cleaning fees, and anything else you might collect from the tenant, including any collected GET (except separately collected TAT). This is before you take out management fees, marketing fees, Airbnb service fees, maintenance fees and all else you would otherwise be able to deduct on your federal tax return.

Many owners don’t get it right!

Example:

Let’s say one month you collect from the tenant a total of: $12,975.70. ($10K room rate revenue; plus $1,000 cleaning; plus $518.32 GET 4.712% based on $10K room rate + $1K cleaning; plus $1,127.50 TAT 10.25% based on $10K room rate +$1K cleaning; plus $330.00 OTAT based on $10K room rate + $1K cleaning.)

–> GET income to file: $11,518.32; ($10K + $1K cleaning + $518.32 GET collected) = GET due: $518.32

–> TAT income to file: $11K; TAT is due on the room rate revenue for rental terms shorter than 180 days and on the cleaning. = TAT due: $1,127.50.

—> OTAT income to file (effective 12.14.2022): $11K; OTAT is due on the room rate revenue for rental terms shorter than 180 days and on the cleaning. = OTAT due: $330.00.

What about if your condo is listed on the Airbnb website. Currently, the Airbnb site does not accommodate collecting separately for the GET, TAT and OTAT.

I have seen Airbnb listings where the host shares how they are collecting the GET tax separately at the time of guest arrival. But they mistakenly calculate the GET, TAT, OTAT based on the net room revenue only, but not on the cleaning fee. – Oops. The host not knowing any better explains: “It doesn’t seem fair otherwise.”

What you do as a property owner and vacation rental host is entirely up to you. Fair or not, we recommend filing and paying the appropriate taxes due in full and on time. GET, TAT & OTAT under-reporting and late filing trigger stiff penalties. Don’t take chances.

In the case of an audit, there is no statute of limitation on how many years the tax office wants to review and scrutinize your detailed records. Incomplete tax filing/payment can prompt the tax office to attach a lien on your property and prevent you from selling. ☹

To make the process as easy as possible, check our related article with video tutorials: GET, TAT & OTAT in Hawaii – The Easiest Way To File and Pay

In doubt, always check with your favorite qualified tax professional or the HI Dept of Taxation 808-587-4242.

Let us know what you think. We love to hear from

you. We are here to help.

Reciprocate Aloha! –‘Like’,

‘Share’, and ‘Comment’

below.

~ Mahalo & Aloha

I love it. Thank you very much for doing this and make it very clear with examples. I have been compiling my own information on STR from various websites including government information with lots of guessing and assumptions. Information in your website is very valuable and save me precious time, eliminate guessing and assumption. I have bookmarked your address for future references. I cannot thank you enough.

Very informative.

We hope Honolulu and the vacation rental owners get it together because there’s going to be millions of tourists/vacationers disgruntled when their rental unit gets canceled like what happened to us recently. Not nice 🤔😣

Aloha Joy Windels!

Thank you for your comment.

We hope so too. We will update any changes to the law here: https://www.hawaiiliving.com/blog/bill-89-honolulu-new-short-term-rental-rules-for-oahu/

I am very sorry to hear that your rental got canceled.

Hopefully you had a chance to discuss your grievance with your host, claim a refund, have traveler’s insurance to cover the rest, or find a legal rental unit in time.

We are experts in assisting buyers and sellers, but I regret, we don’t handle rentals.

Let us know if there is anything we can do for you.

~Mahalo & Aloha