Update 8.11.2021: The Senate approved Amendment #3753 as part of the $3.5T Budget Reconciliation. For now, the tax treatment of 1031 exchanges is preserved. However, this resolution is non-binding and 1031 exchanges could be subject to future restrictions. – Stay tuned…

— We are blatant proponents for you to design and live your life on your terms. That includes choosing where and how you live.

We are strong advocates for homeownership and property rights. We believe in the tremendous benefits of owning your home in addition to owning a sensible portfolio of rental properties and other investments for wealth creation and retirement planning.

We are dedicated to excellence in assisting buyers and sellers of Hawaii real estate and providing important information to help you make better decisions.

See related article: 7 Real Estate Investment Strategies

“The only constant in life is change” ~ Heraclitus.

There are two potential changes that prompt us to reflect on how we might adjust navigating the future:

- The economic effects of COVID 19

- President-elect Biden’s tax proposal

We already discussed the effects of COVID 19 on the local economy and Hawaii real estate here and here. However, the changing economic outlook as a result of president Biden’s tax proposal will also need to be considered.

That’s a bit of guesswork with an undetermined degree of probability. Because, nobody knows yet what the final policies will look like, if, or when implemented. We shall see to what degree congress will support or stifle Biden’s plan.

However, as of this writing, Biden’s tax plan appears to include:

- Increasing taxes on the wealthy and restoring the top individual income tax rate to 39.6%.

- Increasing social security taxes on income over $400K/y.

- Increasing the US corporate tax rate from 21% to 28%.

- Increasing minimum taxes on profits earned by foreign subsidiaries of US firms from 10.5% to 21%.

- ROTH conversion tax rates may go up. – Could it be advantageous to convert your IRAs to a ROTH IRA?

- Limiting itemized deductions.

- Eliminating the ‘step-up in basis.’

- Increasing the capital gains tax rate from 23.8% to 39.6%.

- Limiting 1031 exchanges for real estate investors.

In particular, items 7., 8., and 9. could affect our real estate investment decisions. Now is the time to check with your favorite qualified tax professional how to best plan forward.

If you were considering selling an investment property, ask your tax professional, knowing what we know now…

- How might I benefit from adjusting my investment portfolio before new policies take effect?

- How might I benefit from a 1031 exchange instead of a regular cash-out sale?

“Real success comes from being flexible enough to change, to let go of what worked in the past, and to focus on what you need to thrive in the future.” ~ Shane Parrish

With the proper tax strategy, the necessary discipline, and successful execution it is possible to build substantial wealth over time. Learning some basic tools and strategies is prudent to successfully manage your finances for the rest of your life.

I meet many that buy investment properties and sometimes, for the lack of knowing any better, they cash out by selling without doing a 1031 exchange. In effect, they are reversing the tax benefits, canceling out one of the main reasons why they initially invested in real estate.

See related article: Real Estate – Tax Benefits Guide

Selling investment properties (without a 1031 exchange) could trigger the following taxes:

- 15% Long-term Capital Gains tax, or 20% for income earners with taxable income $441,451K+ (single) or $496,601K+ (joint) (2020). – Except, if you owned for less than 1 year, then the sale is subject to Short-term Capital Gains tax, the same rate as your ordinary income, which could be as high as 37% (2020).

- 3.8% Net Investment Income (NII) tax if the adjusted gross income is $200K+ (single) or $250K+ (joint).

- 25% Depreciation Recapture tax.

- Up to 11% Hawaii State tax, top marginal rate, depending on your income and filing status.

Let’s revisit one of the greatest tax planning strategies for real estate investors desiring long-term wealth creation:

1031 Tax Deferred Exchange

Section 1031 of the Internal Revenue Code provides real estate investors with a gift horse opportunity to build wealth and save taxes.

The sale of investment property typically is subject to capital gains taxes plus the depreciation recapture tax mentioned above. With a 1031 exchange, an investor, aka exchanger, could sell and buy investment properties and entirely defer those taxes until a later date.

A 1031 tax-deferred exchange is neither tax-free nor tax-exempt, however, there are ways how you might eventually eliminate most, if not the entire accrued tax liability. Always check with your favorite qualified tax professional regarding your specific circumstances.

A proper 1031 exchange requires a ‘neutral’ Qualified Intermediary (QI) that you designate before the ‘to be relinquished’ property closes. Your QI facilitates the transaction, prepares the exchange documents, and holds the proceeds from the relinquished property until the closing of the replacement property. ‘Neutral’ means, the QI can not be an attorney or tax professional that has beenadvising you during the last 2 years.

For a successful tax deferred exchange, additional requirements must be met:

- Both, ‘relinquished’ and ‘replacement’ properties must be ‘investment properties’ located in the US. These can not be your primary residence or your second home.

- The title for both properties must match the same exchanger’s tax ID.

- To defer all taxes, the exchanger must reinvest all proceeds, and buy equal or greater value.

- To defer all taxes, the exchanger must obtain the same or greater debt on the replacement property. You may bring in additional cash, but equity cannot be replaced with additional debt.

- The exchanger must identify replacement properties in writing within 45 days and must close within 180 days of the relinquished properties’ closing date.

There are several variations of a 1031 exchange, including reverse exchanges, and construction exchanges. Additional rules apply. Always read the fine print.

I know one investor that completed the required 45-day ID notice on time but carelessly forgot to sign before submitting it! – This little missed detail resulted in a failed 1031 exchange and a $900K tax bill that could have easily been avoided. ☹ So much for paying attention.

See related article: Random Thoughts On Real Estate Risks, Rewards & Responsibilities – (RERRR)

________________________________

How Do These Savings Work?

By deferring taxes with a 1031 exchange, you are in effect using the IRS’s money interest-free to increase your real estate investment portfolio. You own, manage, and grow your portfolio with other people’s money (OPM), and you leverage into additional and more profitable assets.

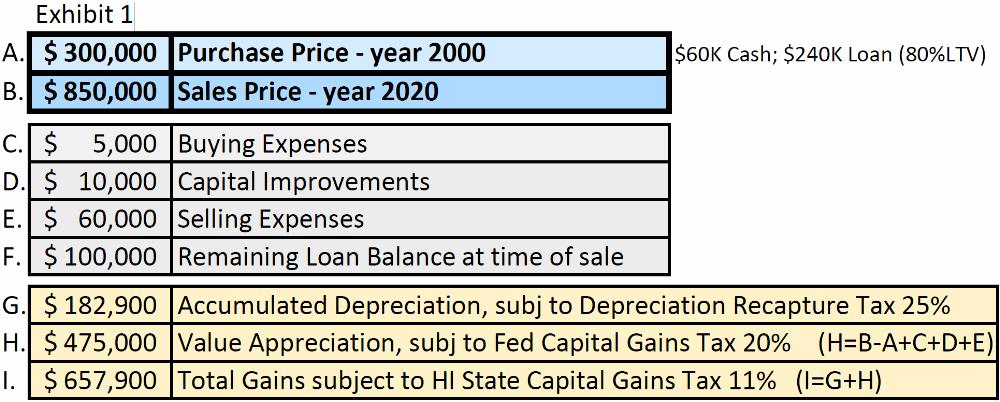

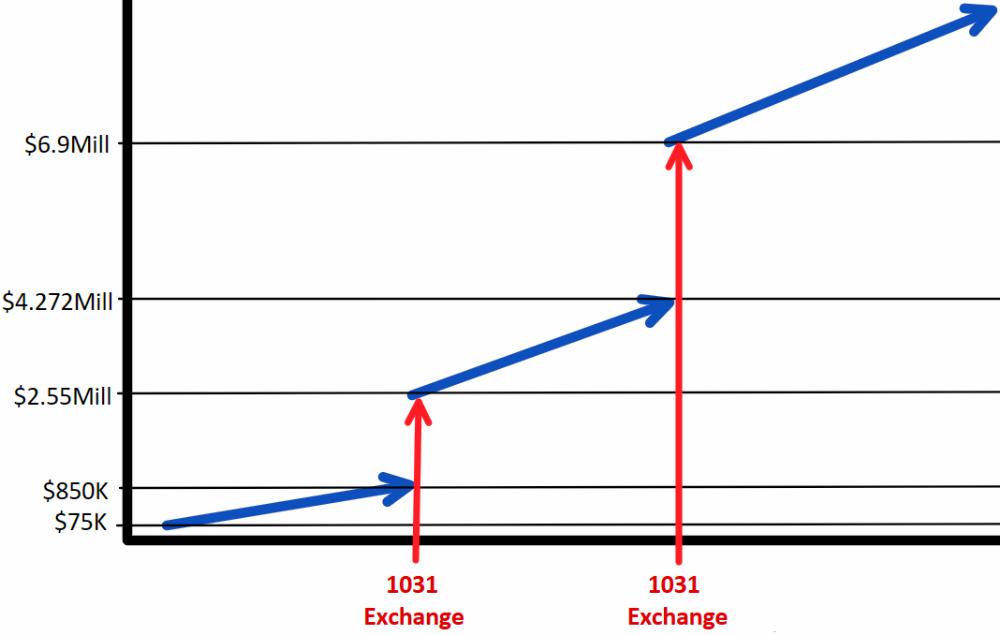

Here is an example of how the numbers work. The sample property was bought for a $300K Purchase Price (A.) and sold 20 years later for $850K Sales Price (B.). The purchase was made with a 60K cash downpayment (20%) and a $240K mortgage loan (80%LTV).

An additional $5K Buying Expenses (C.), including lender fees, title & escrow fees, etc.,were paid at the time of closing.

After the purchase, $10K was invested in Capital Improvements (D.). We call this forcing equity, where we upgrade the property and increase the rental income potential for the next 20 years.

Maintenance, repairs, and running expenses during the 20 years of ownership had been covered by adequate rental income cash flow. The property carried itself financially.

Selling Expenses (E.) amount to about $60K. That includes the real estate sales commission, conveyance tax, and title & escrow fees, etc.

Initially, our Cost Basis started with the price we paid with any associated expenses. That’s the original Purchase Price (A.) plus Buying Expenses (C.). But wait, there is more.

To calculate the taxes due at the time of sale, we use the Adjusted Cost Basis which also includes Capital Improvements (D.), Selling Expenses (E.), minus the Accumulated Depreciation (G.). Therefore the Adjusted Cost Basis = A+C+D+E-G.

Different tax rates apply to the Accumulated Depreciation (G.), Value Appreciation (H.), and the Total Gains (I.) realized at the time of sale.

The original $240K mortgage has been paid down over 20 years to $100K Remaining Loan Balance (F.)

Accumulated Depreciation (G.) is the depreciation deduction that we were able to claim on Schedule E of our tax return during the 20 years of ownership. The IRS allows us to depreciate the improvement value over 27.5 years (for residential real estate). The land value can not be depreciated.

We used the tax assessed value at the time of purchase to establish the ratio between improvement value vs total tax assessed value. For our sample property, the improvement value / total value = 0.8383, based on the tax assessment value at the time of purchase. We apply the ratio to the Purchase Price (A.) and divide it by 27.5 years:

$300K x 0.8383 = $251,490 / 27.5 years = $9,145 x 20 years = $182,900 Accumulated Depreciation (G.), which is subject to 25% Depreciation Recapture Tax (J.).

The Value Appreciation (H.) that is subject to 20% Capital Gains tax (K.) on the federal level equals your Final Sales Price (B.) minus your Cost Basis (H=B-[A+C+D+E]).

The Accumulated Depreciation (G.) plus the Value Appreciation (H.) add up to the Total Gains (I.) which are subject to the 3.8% NII tax (L.) plus 11% (top bracket) HI State Capital Gains tax (M.)

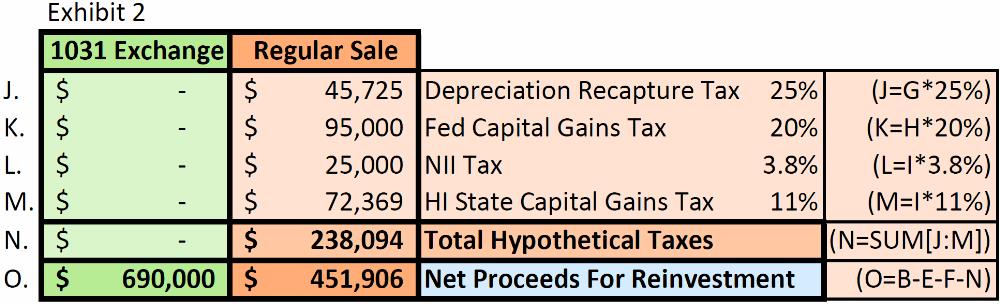

Exhibit 2 shows the Total Hypothetical Tax (N.) of $238,094 due when you sell without a 1031 exchange. That’s a whopper.

The after-tax net proceeds with a regular sale are $451,906 (O.). A successful 1031 exchange defers all taxes and increases your investable proceeds to $690,000 (O.)

Are your eyes glazing over? Your circumstances and actual numbers might differ slightly.

Perhaps you are in a lower income bracket where the tax will be less. Or perhaps you are an out-of-state, or an out-of-country seller, and therefore subject to the mandatory HARPTA and FIRPTA withholdings at the time of sale. – Oops. This is another small detail that some sellers overlook.

It pays to always consult with your qualified tax professional regarding your specific circumstances. For most sellers, tax savings with a 1031 exchange are substantial. Eliminating HARPTA & FIRPTA withholdings is a bonus for some.

See related article: Define The Purpose Of Your Purchase

________________________________

What Are We Going To Do With The Proceeds?

With a regular sale, at the end of the day, you put the $451,906 Net Proceeds (O.) in your pocket and be happy. You get to spend or reinvest it. Aren’t you lucky?

With a 1031 exchange, you don’t receive the money. You don’t get to spend it either. Instead, the QI holds the full $690,000 net proceeds until you instruct them to forward the money directly into the replacement properties’ escrow account.

You must meet specific due dates with the next steps:

- Identify replacement properties within 45 days, and

- Close on the replacement properties within 180 days of the closing of the first relinquished property.

Proper identification must be in writing with your wet signature and must be received by your QI before midnight of day 45 after the closing of your relinquished property.

You may sell or buy as many properties with a 1031 exchange as seem practical. However, the 45-day and 180-day time frames start from the closing of the first relinquished property.

No exceptions and no grace period.

You may use any one of the Three Identification Rules:

- Three Property Rule – You may identify up to three replacement properties and may buy one, two, or all three of those.

- 200% Rule – You may identify and buy any number of replacement properties, as long as the total fair market value is not greater than 200% of the relinquished properties.

- 95% Rule – You may identify more than three properties with a total value of more than 200% of the value of the relinquished properties, but then you must close on at least 95% of the value of the identified properties. In other words, you need to buy essentially everything you identify.

I completed dozens of 1031 exchanges with various number combinations, either selling six rental houses and buying one expensive investment property, or selling one rental and buying three replacement properties. In all exchanges, I used the ‘Three Property Rule.’ And most of our clients did the same.

________________________________

Growing Your Wealth – Ready To ‘Leapfrog’?

Not only do you save a huge chunk in taxes with a 1031 exchange. You can now leverage into better investments.

We discussed above that we “must obtain the same or greater debt on the replacement property.”

For our sample property, that means that the replacement properties must be financed with at least $100K to replace the Remaining Loan Balance (F) at the time of sale.

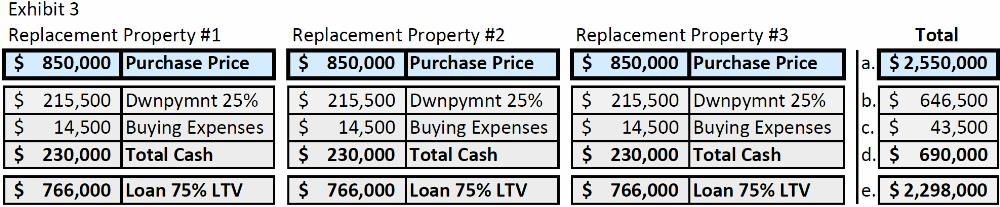

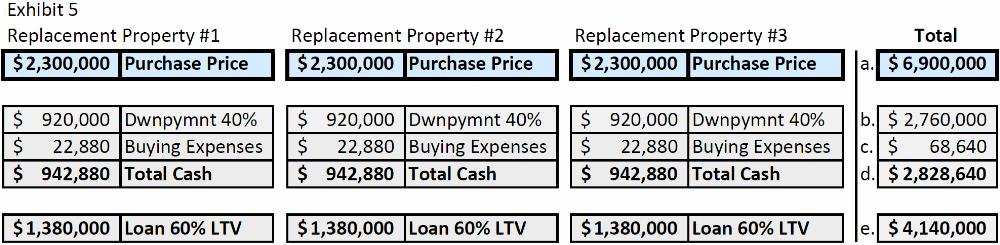

$690K cash proceeds plus new >$100K financing could buy you three replacement properties:

$690K proceeds which controlled $850K worth of real estate are now exchanged into $2.55Mill. You tripled your investment portfolio value, diversified, and accelerate your equity growth. Your overall leverage is 25%, and your cash flow might be roughly double.

“Give me a lever and a place to stand and I will move the earth.” ~ Archimedes

________________________________

Three Reasons To Leverage

There are three main reasons why real estate investors use leverage:

- Increase Cash-On-Cash Returns

- Accelerate Equity Growth, Increase Appreciation and Principal Reduction

- Decrease Taxable Income, Increase Tax Deductions, e.g. Depreciation, etc.

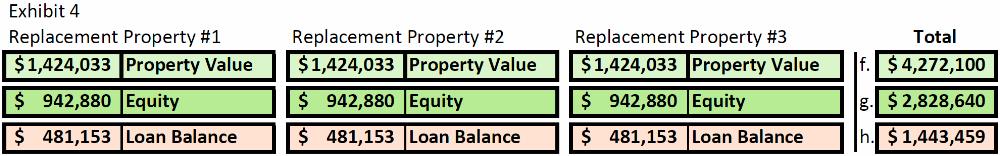

Let’s assume the market goes up on average 3.5% per year compounding for the next 15 years, then your portfolio will be worth $4,272,100 (f.). Your total loans will be paid down to $1,443,459 (h.). And your accumulated equity will have grown to $2,828,640 (g.).

This was accomplished with your initial cash investment of only $75K total ($60K initial cash downpayment, $5K Closing Costs (C.), and $10K in Capital Improvements (D.).

Give yourself credit for clever planning and executing using OPM and a 1031 exchange.

All other expenses were covered internally either from the cash flow or from the proceeds at the time of the exchange. No additional cash was required.

Ready for the next 1031 exchange? How about using your $2,828,640 equity from your 3 properties and exchange into three larger properties at $2.3Mill each, with 40% leverage. You now control $6.9Mill.

Perhaps, by now you have become a fan of 1031 exchanges but you have grown tired of the terrible three Ts: Tenants, Toilets, & Trash. And, you might wonder what kind of $2.3Mill property make sense as a rental?

You have graduated to the next level and leapfrogged into the category of commercial properties. Instead of three $2.3Mill residential properties, you might consider exchanging your equity into one or more Delaware Statutory Trusts (DST). The sky is the limit if you play it right.

Look for a future article about the benefits of DST investments.

________________________________

ROI – Return On Investment

Your ROI (Return On Investment) is a measure of the total wealth that your initial cash investment created. We calculate ROI as a percentage:

- ROI = Net Gain/Original cost x 100, …or more defined:

- ROI = (Current Equity – Original Cash Out Of Pocket) / Original Cash Out Of Pocket x 100, … or in our sample case:

- ROI = ($2,828,640 – $75,000) / $75,000 x 100 = 3,671.52% !

That’s an average annual return of 10.93% compounded over 35 years. – Sweet. That’s without counting any positive cash flow and without calculating tax deductions including the depreciation!

Congratulations. Not too shabby. You turned $75K into $2.8+Mill equity in 35 years. Nice little nest egg.

Now you know how it works. Apply the knowledge, rinse & repeat.

“You must own equity to gain your financial freedom. – You won’t get rich renting out your time, because you can’t earn non-linearly.” ~ Naval Ravikant

Regardless of how big or small your real estate portfolio currently is, upcycling with a 1031 exchange can add substantial wealth. – It’s your life. You get to design how you want to live it.

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

Also…, we want to make this The Best real estate website you visit, and we love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support, and we are dedicated to constant learning and growing with you. ~ Mahalo & Aloha

________________________________

Disclaimer: The author is an active real estate investor and a licensed real estate broker who has completed many 1031 exchanges. Hawaii Living is a real estate brokerage that assists countless real estate investors with growing their respective real estate portfolios. We are expert realtors, not professional tax advisers. For tax matters always check with your favorite qualified tax professional.