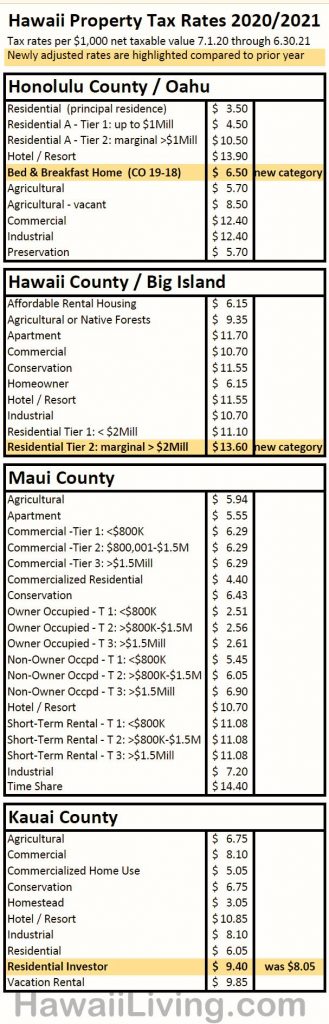

— The tax rate for Oahu’s new ‘Bed & Breakfast Home’ category is $6.50 per $1,000 assessed value. This new ‘B&B Home’ property tax rate will apply to properties obtaining new permits under CO 19-18, and does not affect the property tax rate for existing NUC properties (B&Bs & TVUs).

See related article: CO 19-18 (Bill 89) Honolulu – New Short-Term Rental Rules For Oahu

All other Oahu property tax rates remain the same.

See related article: Guide To Honolulu Property Taxes

— Hawaii County (Big Island of Hawaii) introduced a new ‘Residential Tier 2’ property tax rate which kicks in for the marginal assessed value at $2Mill and above.

— Kauai County raised the ‘Residential Investor’ property tax rate.

All property tax rates by county effective 7.1.2020 – 6.30.2021:

Recap – Oahu’s Two-Tiered Residential Rate ‘A’:

For residential properties other than your principal residence (No Home Exemption, this is either a 2nd home or a rental property) with an assessed value at $1Mill or above, the assessed value above $1Mill is taxed at $10.50 per $1,000 assessed value (1.05%).

Oahu’s property tax rate Residential ‘A’ applies to the following properties with a tax assessed value at $1Mill or above:

- – Condominium units without Home Exemption.

- – Residential lots zoned R-3.5, R-5, R-7.5, R-10, R-20, with either one or two single family homes, without Home Exemption.

- – Residential vacant lots zoned R-3.5, R-5, R-7.5, R-10 and R-20.

If you own a residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value below $1Mill, your property tax rate is $3.50. – Residential ‘A’ only kicks in if your property’s tax assessed value is $1Mill or above.

This Is How The Two-Tiered Residential Rate ‘A’ Gets Calculated:

If you own residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value above $1Mill, your blended property tax rate is $4.50 for the assessed value up to $1Mill, plus $10.50 for any portion of the assessed value above $1Mill.

– Example: A residential property without Home Exemption and a net assessed value of $2Mill is taxed $15,000/y ($4.5K on the 1st $1Mill plus $10.5K on the additional value above $1Mill).

What Can You Do About It?

If you are eligible, as an owner occupant you may claim your Home Exemption by September 30, 2020, but only if the property is your primary residence. The home exemption reduces your property tax rate to the low $3.50 per $1,000 (0.35%) residential rate starting July 1st, 2021.

See related article: Two Tips How To Lower Your Honolulu Property Tax

Oahu tax bills will be mailed to property owners by July 20, 2020, and payment is due by August 20, 2020.

Recap – Oahu’s Home Exemption Brackets:

- The standard home exemption amount is: $100K

- 65 and older: $140K (you must be 65 years of age by June 30th preceding the tax year the exemption is filed).

Additional home exemption age brakets that were previously available have been eliminated.

The new tax assessment notices for the fiscal year 2021 (starts July 1, 2021) will be sent by December 15, 2020. You may appeal the newly assessed value only between December 15, 2020, to January 15, 2021.

See related article: How To Appeal Your Property Tax Assessment

________________

Let us know your thoughts. We love to hear from you. Reciprocate Aloha: ‘Share’, ‘Like’, and ‘Comment’ below.

~ Mahalo & Aloha