New Hawaii Property Tax Rates 2017 – 2018

– We saw it coming, City Council just adjusted Hawaii’s new property tax rates for fiscal year July 1st 2017 through June 30th 2018.

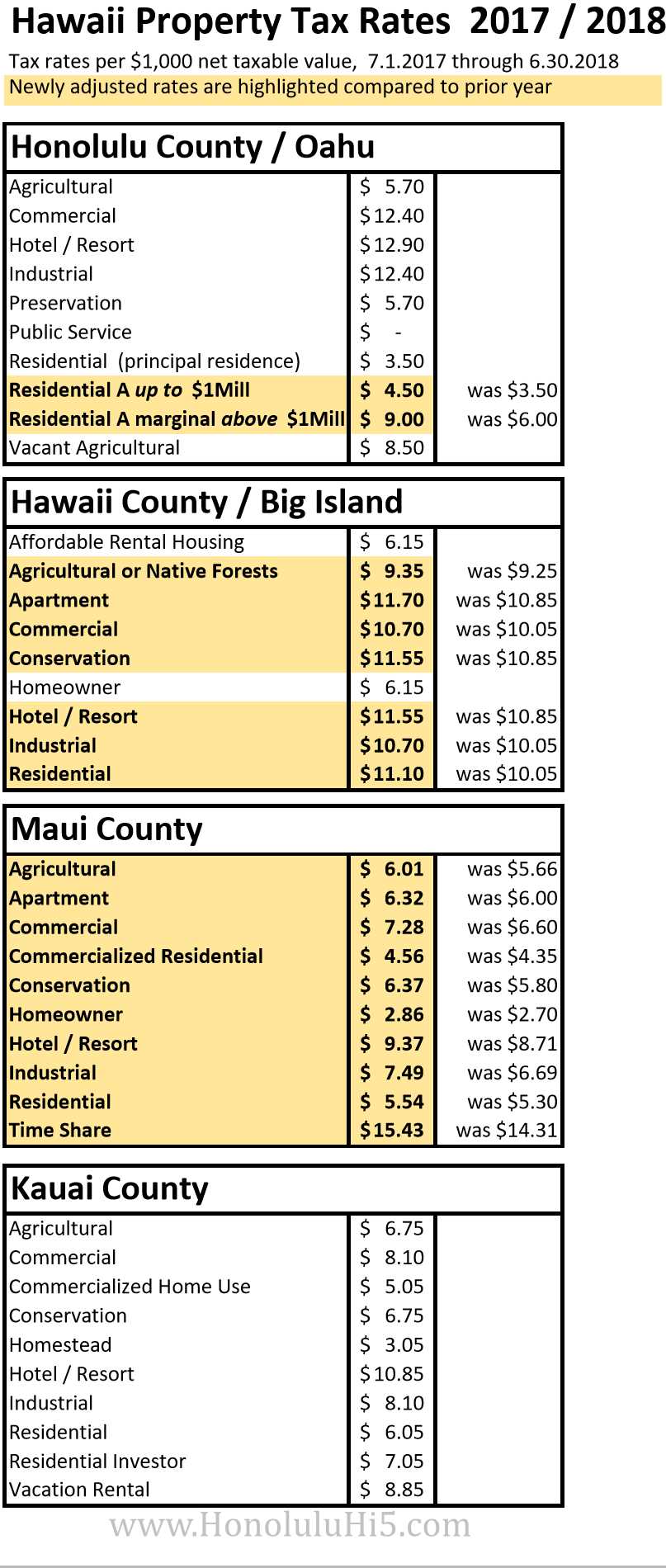

The big change for Honolulu County / Island of Oahu is the now two tiered Residential Rate ‘A’:

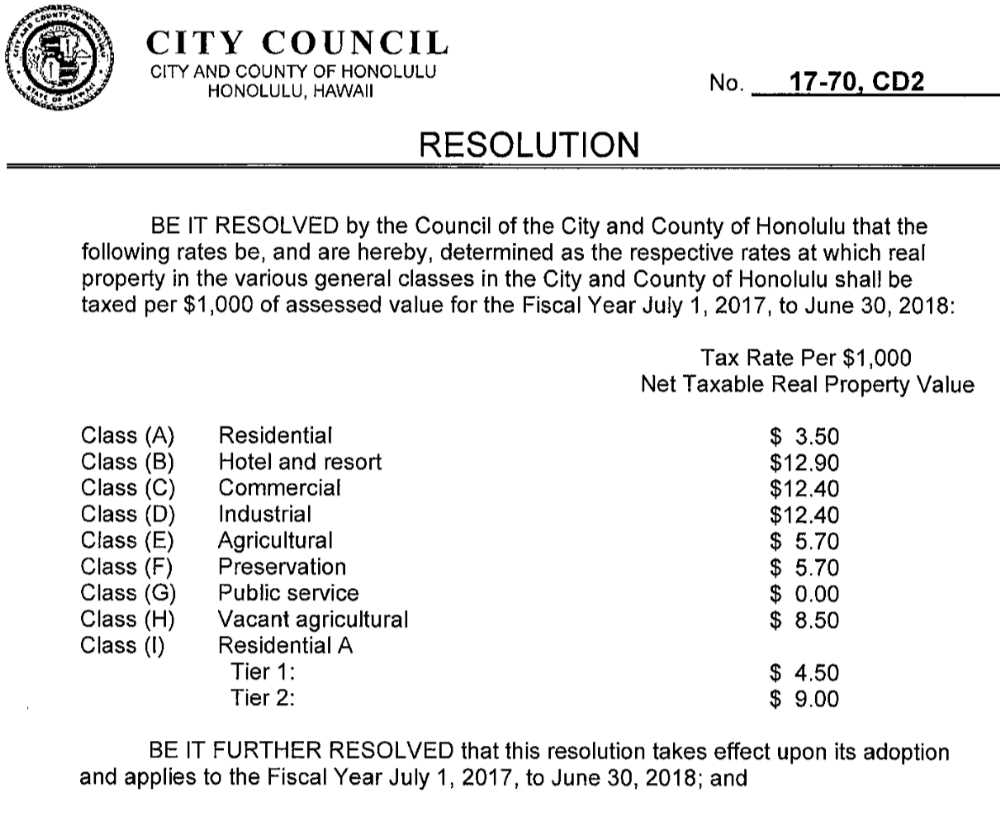

$4.50 per $1,000 (0.45%) of the net taxable value for Oahu Residential A property up to $1Mill.

$9.00 per $1,000 (0.9%) of the net taxable value for Oahu Residential A property above $1Mill.

Oahu’s property tax rate Residential ‘A’ applies to the following properties with a tax assessed value at $1Mill or above:

– Condominium units without Home Exemption.

– Residential lots zoned R-3.5, R-5, R-7.5, R-10, R-20, with either one or two single family homes, without Home Exemption.

– Residential vacant lots zoned R-3.5, R-5, R-7.5, R-10 and R-20.

How will this affect you:

– If you own residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value below $1Mill, your property tax rate will remain $3.50. – Residential ‘A” only kicks in if your property’s tax assessed value is $1Mill or above.

The two tiered rate Residential A works as follows:

-If you own residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value above $1Mill, your blended property tax rate will be $4.50 for the assessed value below $1Mill, and $9 for any portion of the assessed value above $1Mill.

-A sample residential condominium without Home Exemption and a net assessed value of $2Mill will be taxed $13,500 / y ($4.5K on the 1st $1Mill + $9K on the additional value above $1Mill) effective 7/1/2017.

Tax bills will be mailed to property owners on July 20, 2017 and payment is due by August 20, 2017.

What can you do about it:

If you are eligible, check here: claim your Home Exemption by September 30, 2017 and get your property tax rate reduced to $3.50 per $1,000 (0.35%) starting July 1st 2018.

Note: There are no changes for Kauai County property tax rates, but incremental property tax rate increases take effect 7/1/2017 for Maui and Hawaii County. Changes from prior year are highlighted below:

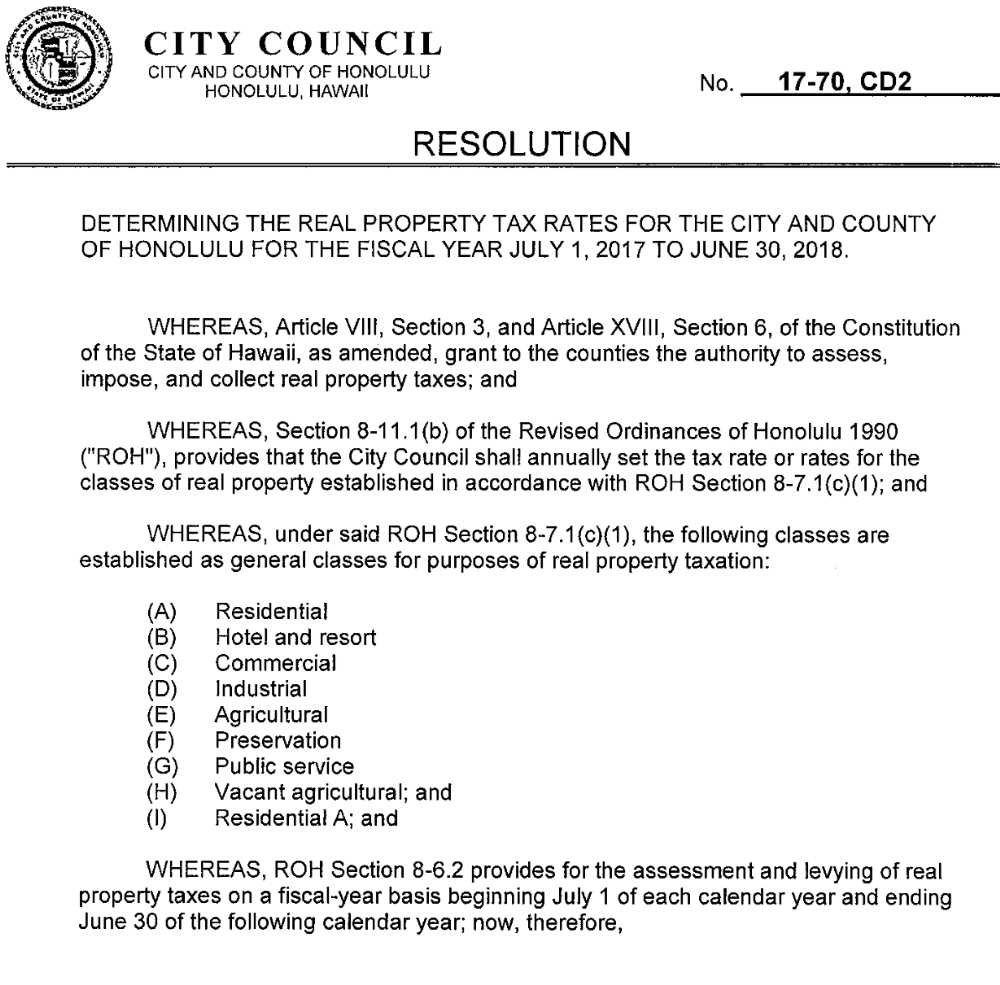

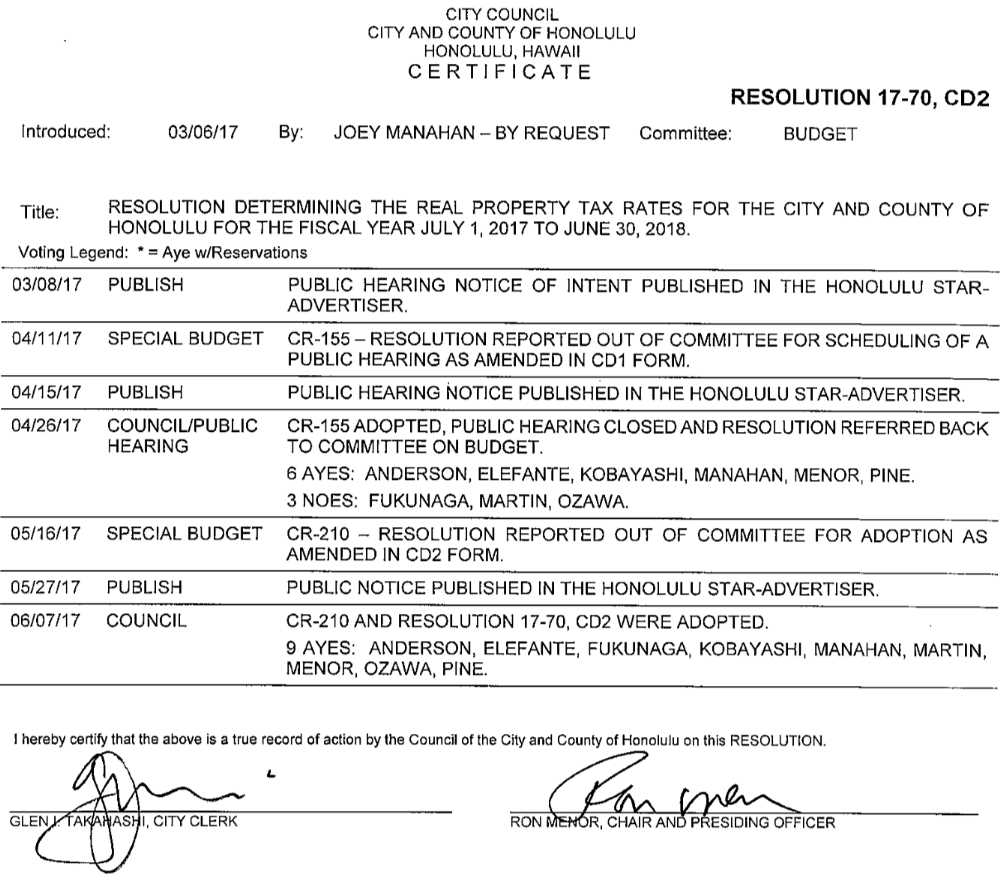

Btw, an earlier version of the bill labeled CD1 would have included an increase of Honolulu’s Hotel / Resort rate to $13.40. You can see below who voted in favor and against. The final version was eventually accepted unanimously and left the Hotel / Resort rate unchanged at $12.90.

Also, check our other post: Honolulu & Oahu Property Tax Rates, Payment, Exemption, Penalties, etc..

Let us know your thoughts. We like to hear from you. Show some Aloha: ‘Like’, ‘Share’ and ‘Comment’ below.

~ Mahalo & Aloha

Quick question… is the property value based on current year assessment or the original purchasing price of the property?

Aloha Gin Van,

Thanks for asking. – For Oahu properties the tax assessed values are established every year on October 1st based on ‘comparable sales’ (similar size & location) that recorded during the prior 12 months. That is irregardless if, or when the property sold. We do not have Prop 13 as California does.

The new assessed value on October 1 will be used to apply the current tax rate effective July 1st of the following year. That means tax assessed value lags behind the real market value by 1-2 years!

More reasons not to confuse the tax assessed value with the real market value are here: “Tax assessed vs appraised vs real market value”: https://www.hawaiiliving.com/faq/#afaq_3

Also check our related post: https://www.hawaiiliving.com/blog/property-taxes-in-honolulu-county-oahu-explained/

– Let us know if there is anything else we can do for you. We are here to help. 🙂 ~ Mahalo & Aloha

What a discriminating measure. Amazing but the norm for Hawaii politicians: better to hit hard the ones who don’t vote : no risk to lose their jobs.

The constant: politicians in Hawaii never had any idea how to bring to business and revenue to Hawaii aside new taxes…. great leadership at work.

Aloha Patrick Bertran,

Thank you for checking our blog and your comment.

~Mahalo & Aloha 🙂