It’s become apparent that some persistent factors are having a clear effect on the Oahu real estate market, especially for condos.

The now longstanding inflation issue, higher interest rates, a weaker yen restraining the usually strong Japanese interest in Hawaii real estate, not to mention soaring condo association insurance premiums that are a new concern for shoppers in that market.

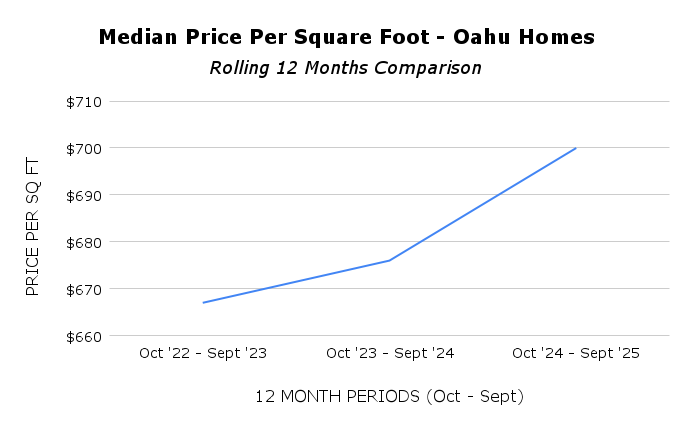

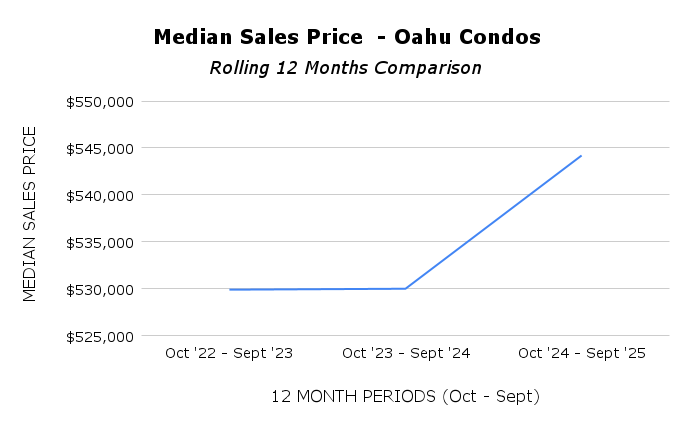

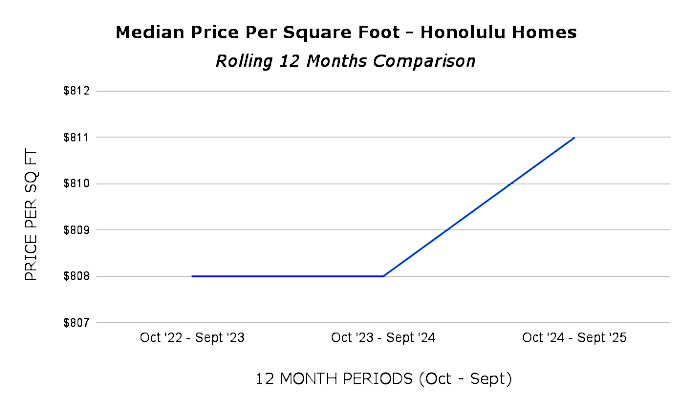

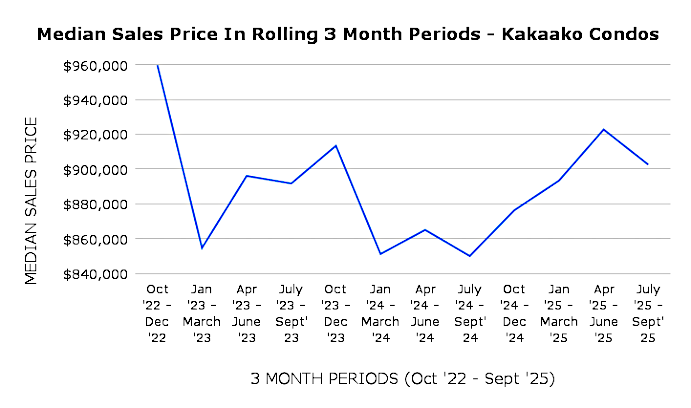

Even so, there is still healthy demand and average prices are stable, the median sales prices climbing over the last 3 years.

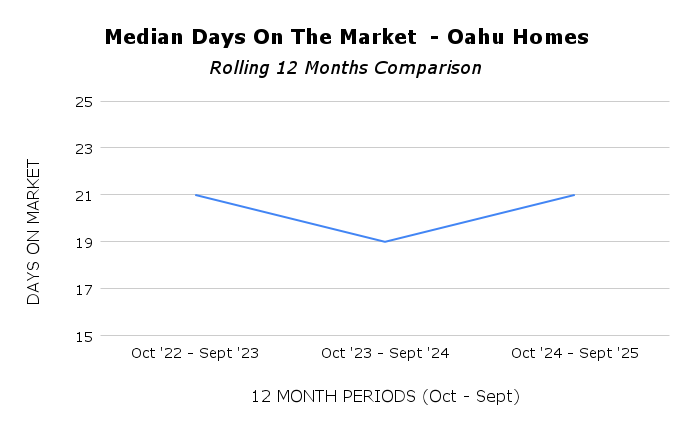

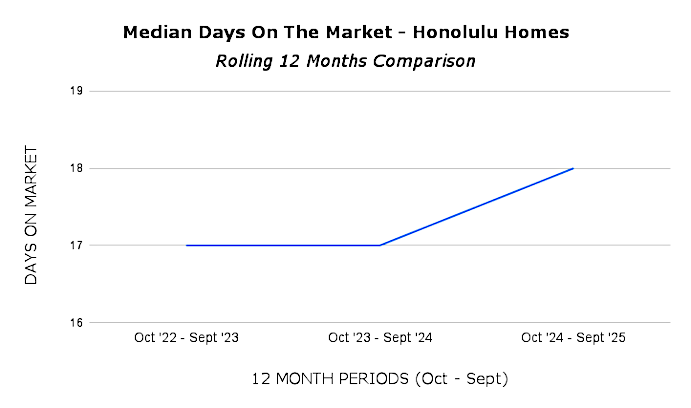

However, days on the market have gone up, giving buyers more time to shop around and negotiate.

The difference is that, while condos’ spans were up consistently each month year-to-year between the 2nd and 3rd of our 12 Month spans, Oahu homes actually were closing sooner during the last 12 months we measured up until April 2025, when they suddenly began a new trend of longer availability.

It need to be acknowledged that this late turn to added time on the market has only raised the last yearly median by 2 days for Oahu homes and 1 for Honolulu homes.

The 3 Month Comparison graphs for these properties should be consulted to understand the shift more fully.

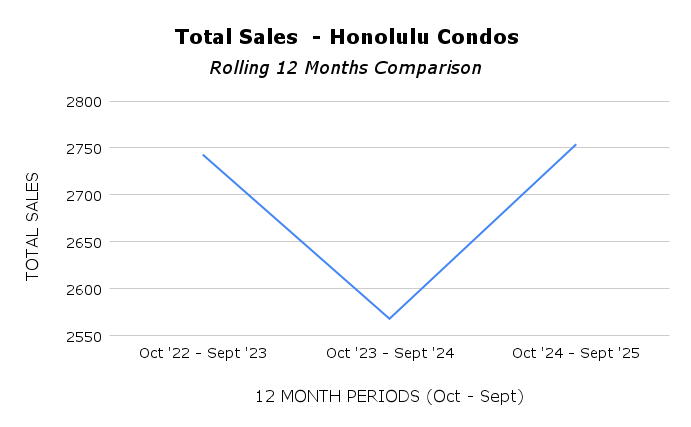

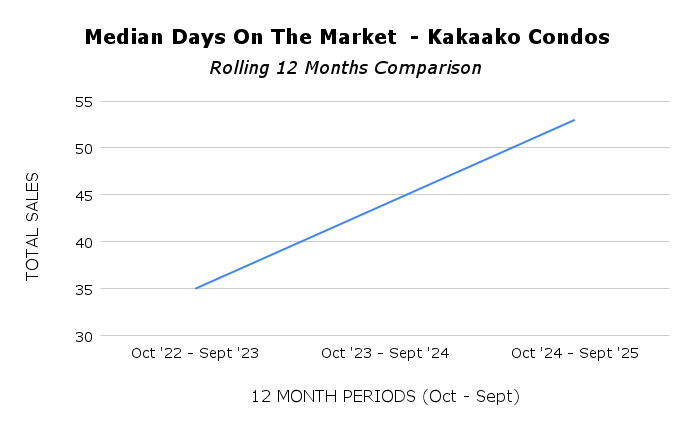

Condos, across every area we cover here, however, are seeing as much as an additional 2 weeks in their medians from the 1st 12 Months span to the 3rd.

In short, you don’t have the immediate competing offers happening as they did in the past.

Is This A Buyer’s Market?

This isn’t a pure Buyers’ Market, since overall pricing isn’t falling, but it is one that gives them more breathing room for negotiation.

Kakaako condos, as expected, drive the high end of the pricing for those residences with new projects being put on the market and existing property being newer construction.

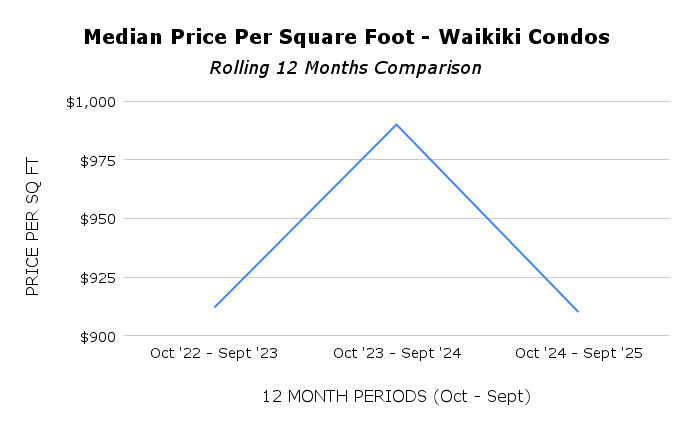

Waikiki condos are the outlier in that both median pricing and sales numbers spiked between the 1st and 2nd 12 Months, then experienced a decline, though they did still retain much of the earlier gains in sales prices.

As you’ll see, we’ve provided graphs of the quarterly fluctuations as well to tell a more complete story.

Below you’ll find graphs measuring market factors of Total Sales, Median Sales Price, Median Price Per Square Foot and Median Days on the Market each for, respectively, Oahu Homes, Oahu Condos, Honolulu Homes, Honolulu Condos, Kakaako Condos and Waikiki Condos.

First are Rolling 12 Month comparisons (Oct – Sept) for 3 years and then Rolling 3 Month comparisons beginning at October 2022 and ending September 2025.

OAHU HOMES – Rolling 12 Month Comparisons

OAHU HOMES – 3 Month Comparisons

OAHU CONDOS – Rolling 12 Month Comparison

OAHU CONDOS – 3 Month Comparisons

HONOLULU HOMES – Rolling 12 Month Comparison

HONOLULU HOMES – 3 Month Comparisons

HONOLULU CONDOS – Rolling 12 Month Comparison

HONOLULU CONDOS – 3 Month Comparisons

KAKAAKO CONDOS – Rolling 12 Month Comparisons

KAKAAKO CONDOS – 3 Month Comparisons

WAIKIKI CONDOS – Rolling 12 Month Comparisons

WAIKIKI CONDOS – 3 Month Comparisons

Conclusion

The Oahu real estate market is facing some headwinds, for sellers, in the current environment, but it remains strong.

Residences here continue to maintain, if note increase, in their value and attractiveness to buyers, even if the listings do stick around longer than they did a couple of years ago.

The bidding wars may be over for now, but further interest rate decreases and/or a slowing of inflation could heat up things quickly.

Reach out with any questions you may have, or if you are considering a purchase or sale on Oahu.

Tanner Botts

Realtor, RS-82688

Mobile: (808)343-5000

Email: Tanner@HawaiiLiving.com