- Random thoughts in the final quarter of 2021.

- How to avoid painting yourself into a corner – Exchange tip #1

- You may replace the value of the debt instead of the debt – Exchange tip #2

________________________________

First: The Good News!

President Biden’s plan of restricting 1031 exchanges is off the table, for now. So are corporate tax rate hikes. Biden said: “It’s unlikely that corporate tax rate hikes will be included in the plan. I don’t think we’re going to be able to get the vote.”

The stock market has been rallying as a result of it.

Are you curious as to who’s got the best crystal ball? Sorry, it ain’t us. We are only right 50% of the time. But here are a couple of expert predictions that might bring cheers to the season:

— Bill Miller, the legendary investor wrote in his most recent newsletter: “…we are in a bull market that began in March of 2009 and continues, accompanied by the typical and inevitable pullbacks and corrections. Its end will come either when stocks get too expensive relative to bonds or when earnings decline, neither of which is the case now.”

— Freddie Mac economists, the National Association of REALTORS®, and other housing groups are projecting strong housing demand for the rest of the year, even as mortgage rates move higher. NAR is forecasting mortgage rates to average 3.3% for the last quarter of 2021.” Experts: Rising Rates Won’t Deflate Buyer Demand | Realtor Magazine

See related article: Oahu Real Estate Market Update – Mid 2021

Forecast degradation quickly goes exponential. Unforeseen Black Swan events only become visible in hindsight. That’s why we recognize that trying to time the market is foolish.

It’s ‘time in the market,’ not timing the market. Historically, that’s true for both the stock market and Hawaii real estate. Every year, each has gone up roughly 70% of the time. Those are 70/30 odds.

Hawaii’s unemployment rate has been falling eight straight months from a record 21.9% in April 2020, to an 18-month low of 6.6% in September. Still some ways to go but moving in the right direction.

“You’re not lucky because more good things are actually happening; you’re lucky because you’re alert to them when they do.” ~ Maria Konnikova

________________________________

Second: The Chicken Or The Egg?

Life is thrilling because of the opportunity to learn something new every day. Here are two 1031 exchange details that might help you with your next exchange:

1) You Don’t Have 180 Days To Complete Your 1031 Exchange

As commonly known, a successful 1031 exchange is subject to meeting two deadlines that start counting from the closing date of the relinquished property:

- 45 days to identify replacement properties.

- 180 days to complete the tax exchange, or no later than the tax filing deadline, whichever comes first.

See related article: Climbing The Wealth Ladder With A 1031 Exchange

Typically, it’s the 45-day identification deadline that sneaks up fast and creates 1031 timing anxieties. For most transactions, 180 days is plenty of time to complete.

In case you closed your relinquished property between October 15 and December 30, you could file for an extension of your tax return deadline beyond the April 15 due date. The extension would give you the full 180 days to complete your exchange plus a six-month extension to file your return.

Except, I discovered that you don’t have 180 days when you paint yourself into a corner as I did. May you benefit and avoid the same mistake.

I sold an investment property last week via a 1031 exchange with the intent to buy a replacement property at a higher price with some new 50% LTV mortgage financing.

The lender explained that my total rental income on Schedule E 2020 looks a bit thin. This was due to last year’s COVID-related tourism shutdown. To improve my ability to obtain a new mortgage loan, I should reapply for a loan after I file my 2021 tax return in early January, merely two months from now. – Great idea, except:

Filing your return before you complete your exchange, automatically ends your 180-day exchange period! You must wait until you acquire all desired replacement property before you can file your tax return. Otherwise, the exchange fails and the sale of the relinquished property is taxable.

You can not amend your return and continue the exchange. – Oops.

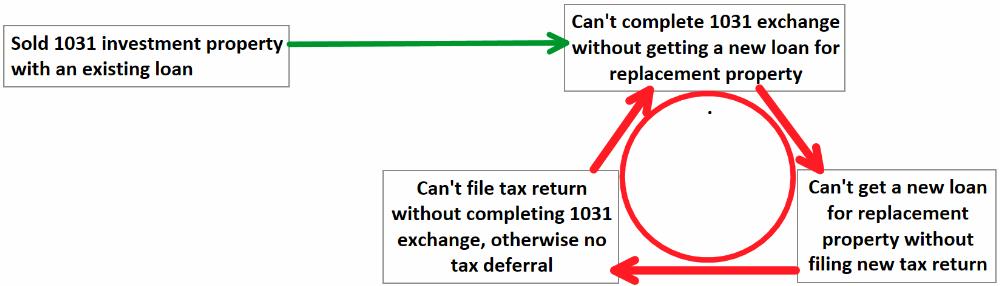

That’s the ‘What comes first’ conundrum loop:

Lesson Learned:

Know exactly your pre-qualification level to obtain new financing before you enter into a 1031 exchange.

If you already sold your relinquished property, consider completing your 1031 exchange with alternative financial resources, e.g. tap into your Home Equity Line Of Credit – HELOC, or borrow against your stock portfolio.

You could also complete your replacement property purchase with temporary cash from a ‘60-Day Rollover.’ However, that’s risky. You could be painting yourself into an even tighter corner.

Perhaps you have some other extra cash you could use. Using cash instead of a new mortgage brings us to the second 1031 detail that is good to know…

________________________________

2) You Don’t Need to Replace Your Existing Debt

If you want to defer all taxes with a 1031 exchange, you will need to roll all of your relinquished property net equity (sales price minus all closing costs) into the replacement property. And you will need to replace the existing debt(?) -Or, do you?

The IRS does not mandate that you must replace the existing debt with an equal or greater new debt on the replacement property.

Instead, the IRS merely requires you to replace only the value of the debt that you had on the relinquished property.

You may choose to replace the value of the debt with an equal or greater value of any combination of practical options, including:

- A new mortgage loan

- Cash

- Seller-financing

- Private money

That’s good to know when you are in a pickle. May you benefit and prosper.

_________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Due to the shortage Material shortage, our new house builder extended the completion day for 1 more month, which is beyond our 180 days deadline. What can I do?

Aloha Daniel Chiang!

I’ve been there with a new construction high-rise condo project some 15 years ago.

1) Convince the new house builder that you must close before the 180-day deadline and ask what it takes to do so. The developer might agree to record before completion but will require you to sign a ‘buying sight-unseen/hold-harmless liability waiver.’ It gets tricky when you need financing…

2) You might have to get interim portfolio financing (not conventional Fannie Mae/Freddie Mac financing) to close early even though the house is not finished. That usually means paying a higher interest rate than usual. Once the property is completed, you refinance the interim loan with a conventional loan at permanent more favorable terms.

A bit of a nuisance to jump through the hoops but well worth it if the tax deferral is substantial.

— Some thoughts on 1031 exchanging into a new construction condo here:

https://www.hawaiiliving.com/blog/7-residential-real-estate-investment-strategies/

Life is tough, and nobody said building wealth is easy.

Good luck.

~ Mahalo & Aloha

Nice system but what is the exit strategy if you don’t want to stay a landlord for life and don’t want to leave the properties to your heirs? Also is there a spreadsheet for multi property (same type) 1031 exchanges? E.g. Sell one buy 4? TurboTax sux!

Aloha James!

Life is simple.

If you don’t want to:

a) leave the properties to your heirs.

b) stay a landlord for life.

–> then sell, enjoy the proceeds and pay the tax. Live it up.

There is one other option. You could do a 1031 exchange into a DST (Delaware Statutory Trust).

It’s a pooled commercial real estate investment that pays a monthly distribution without the liability and the three terrible Ts: Tenants, Trash, and Toilets.

I discussed some pros and cons of DSTs here:

https://www.hawaiiliving.com/blog/confessions-of-a-real-estate-investor/

— I have done several multi-property 1031 exchanges, e.g., sell one and buy three, or sell six and buy one. My accountant figures out the depreciation details. I tried Turbo Tax once and compared it with how my accountant does it. I had a hard time getting the depreciation correct. My accountant was able to get me substantial savings over my attempt with Turbo Tax. Perhaps it was just me.

— Some excel spreadsheets that I use to stay organized are explained here:

https://www.hawaiiliving.com/blog/scale-your-real-estate-investments/

Good luck.

— Call us when you are ready to sell or buy.

That’s what we do best.

We are here to help.

~ Mahalo & Aloha