- The seller’s conveyance tax depends on the buyer’s intent to buy the property as their principal residence.

- Sellers save money on the conveyance tax by adjusting their sales price below certain threshold levels.

________________________________

Check out our other real estate tax articles, including our Guide to Honolulu property taxes, taxes on rental income, how to defer capital gains taxes with 1031 exchanges, HARPTA/FIRPTA withholdings, real estate tax benefits, filing for a home exemption, and other ways to save on your property taxes.

In today’s post, we discuss the Hawaii conveyance tax due to the state of Hawaii when you sell your Hawaii property. In most Hawaii real estate transactions, the seller pays the conveyance tax, except for developer sales of new construction projects.

If you are a seller or buyer of Hawaii real estate, you should be aware of two oddities related to the conveyance tax, which can save you big bucks…

________________________________

The Seller’s Conveyance Tax Depends On The Buyer’s Intent To Buy The Property As Their Principal Residence

Say again? – This is a strange rule that defies logic. As per Chapter 247-2 of the Conveyance Tax Law, Hawaii Revised Statutes, although the seller pays the conveyance tax, the tax rate depends on the buyer’s eligibility for a real property tax Homeowner’s Exemption for the property. Oddly, the seller’s Home Exemption status is entirely irrelevant!

- The seller pays a lower conveyance tax rate if the buyer is eligible for the home exemption.

- The seller pays a higher conveyance tax rate if the buyer is not eligible for the home exemption.

In other words, the seller gets rewarded or penalized based on the buyer’s eligibility. – Go figure.

The buyer simply declares their intent for the property usage by checking box F-7 (a) or F-7 (b) of the Hawaii purchase contract:

- F-7 (a) buying the property as the buyer’s principal residence, or

- F-7 (b) buying the property as other than the buyer’s principal residence.

It is assumed that if the buyer declares their intent to buy the property as their principal residence, they are eligible for the home exemption, reducing the seller’s conveyance tax rate.

On the closing date, the escrow company collects the appropriate conveyance tax from the seller and sends it to the tax office.

Of course, the buyer’s intent or eligibility could change immediately after closing. But that’s irrelevant, …water under the bridge. The tax has already been paid.

This strange rule creates perverse incentives for both the seller and the buyer:

- A seller that receives two comparable offers with the same price and the same closing date might favor an offer from a buyer that checked box F-7 (a) over an offer with box F-7 (b) checked.

- A buyer that submits a cash offer on a hot property competing against other cash offers might consider checking box F-7 (a) instead of F-7 (b) to gain an edge.

How much difference in the seller’s conveyance tax will it make if the buyer checks box F-7(a) versus F-7(b)?

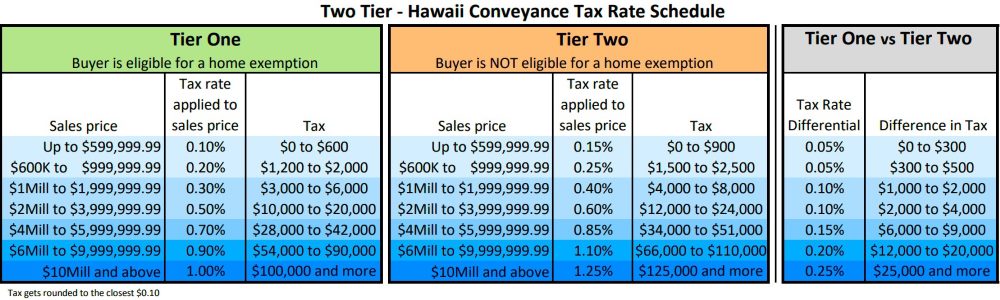

Two-Tier Conveyance Tax Rate Table

Tier One applies when the buyer checks box F-7(a), and Tier Two applies when the buyer checks box F-7(b). The difference at various sales prices is shown in the right column labeled Tier One vs Tier Two:

Examples:

- At a sales price of $1Mill, the difference in conveyance tax the seller pays is $1,000.

- At a sales price of $4Mill, the difference in conveyance tax the seller pays is $6,000.

- At a sales price of $6Mill, the difference in conveyance tax that the seller pays is $12,000.

- At a sales price of $10Mill, the difference in conveyance tax that the seller pays is $25,000.

________________________________

Sellers Save Money By Adjusting Their Sales Price Below The Tax Threshold Levels

Notice how the conveyance tax rate increases at distinct threshold levels. Whether you are a buyer or a seller, use this to your advantage when negotiating the sales price around these threshold levels.

The way Chapter 247-2 of the Conveyance Tax Law is written, reducing the sales price by a mere penny below the sales price threshold level reduces the seller’s conveyance tax by $ thousands.

The tax savings at the respective threshold levels are the difference or ‘the gap in the tax’ from one sales price bracket to the next. These differences/gaps are shown in the third column of each Tier One and Tier Two table.

Examples:

- Selling your home at $599,999.99 versus $600,000 saves you $600.

- Selling your home at $999,999.99 versus $1Mill saves you $1,000 under Tier One or $1,500 under Tier Two.

- Selling your home at $1,999,999.99 versus $2Mill saves you $4,000.

- Selling your home at $3,999,999.99 versus $4Mill saves you $8,000 under Tier One and $10,000 under Tier Two.

A dollar here and there adds up to some real money…

Congratulations. – You just saved $ thousands without breaking a sweat.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you’ll visit. We’d love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

we smart observation