- Higher mortgage rates make for a slower market with slower demand and limited supply.

- Despite doomsday predictions, real estate prices remain robust due to continuing supply shortages.

________________________________

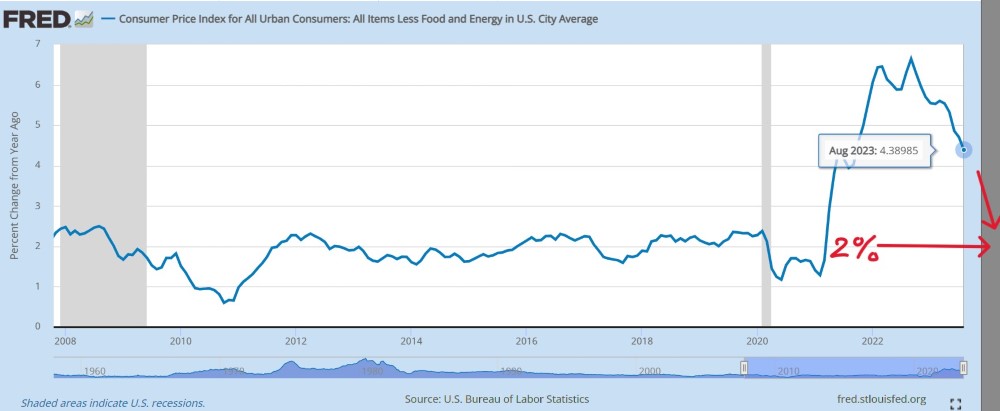

Fed Policy – Inflation Update

In September 2023, the Fed held off on rate hikes but suggested the possibility of one final rate hike before the end of 2023. The Fed also signaled the possibility of only two rate reductions next year.

In short, rates are at their peak or close to it but might stay up high for longer in 2024.

Fed Chair Jerome Powell said, “We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to our 2% goal over time.” “We are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks.”

So far, the Fed has done the impossible. The Fed used its tool to raise short-term rates and slow economic activity to

- successfully curb core CPI inflation while…

- avoiding a recession.

Here are some doubts that the Fed will keep rates ‘higher for longer.’

Almost there. The Fed’s long-term CPI inflation target is 2%. There has been substantial progress during the last 20 months. If the current trend continues, we could reach 2% inflation within a year. For now, it’s too early to be sure.

_________________________________

Mortgage Rates

The Fed controls only short-term rates. However, long-term mortgage rates are tied more closely to the 10-year treasury rate, which moves based on market demand and bond traders’ inflation expectations.

Since the end of the Great Recession, the 30-year fixed mortgage rate has averaged 1.7% above the 10-year treasury rate. The spread tends to widen during economic or geopolitical uncertainty, as it is now.

September 2023, the 10-year treasury rate hit 4.6% for the first time since 2007. At the same time, the average 30-y fixed mortgage rates climbed to 7.31% (!), the highest level in 20 years! The spread is larger than usual and eventually will narrow again.

It’s a good thing that finally the pesky inflation is coming down. There is reason to believe that 30-year mortgage rates might be peaking at this level.

________________________________

How Mortgage Rates Affect Buyers And Sellers

There are four types of buyers:

- First-time home buyers,

- Investors,

- Buyers who need to sell before buying,

- All-cash buyers.

The typical ‘first-time home buyer’ has little cash and needs a mortgage to get into their first home. ‘Investors’ are looking for cash flow and ROI on their money. The first-time home buyer and the investor are interest rate sensitive and might postpone their purchase until lower interest rates return.

Current homeowners could tap into their record-high equity when buying. But some of the ones that need to sell before buying might be reluctant to move sideways. If they are fortunate to have locked in a low mortgage rate in the 3-4% range with their existing home, why trade that mortgage for the current 7% going rate unless you need to?

Three of the above four buyer types are affected by higher interest rates. The all-cash buyer is entirely unfazed by higher mortgage rates. According to NAR, 27% of all transactions were all-cash in August 2023.

How about Sellers?

Some sellers have an existing 3-4% low 30-year mortgage rate; that’s an asset! It’s like free money for 30 years. Rather than selling their home, they opt to keep it. – A perverse incentive. Higher rates keep inventory away.

In conclusion, higher mortgage rates reduce the pool of ready and willing buyers and limit the number of motivated sellers. – Fewer fish in a smaller pond.

___________________________________

What does it mean for Hawaii real estate?

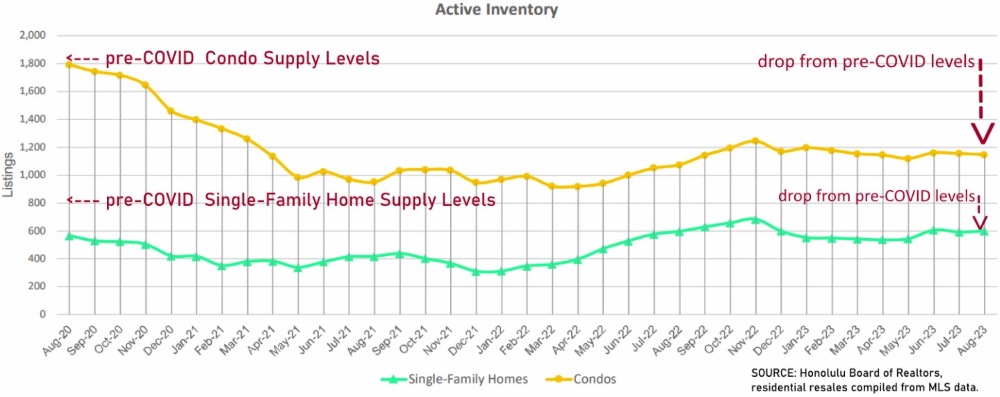

1) Supply – Active Inventory, Oahu Homes & Condos

Active inventory has changed little during the last six months and is considered low, remaining far below pre-COVID levels. (Data through 8.31. 2023):

________________________________

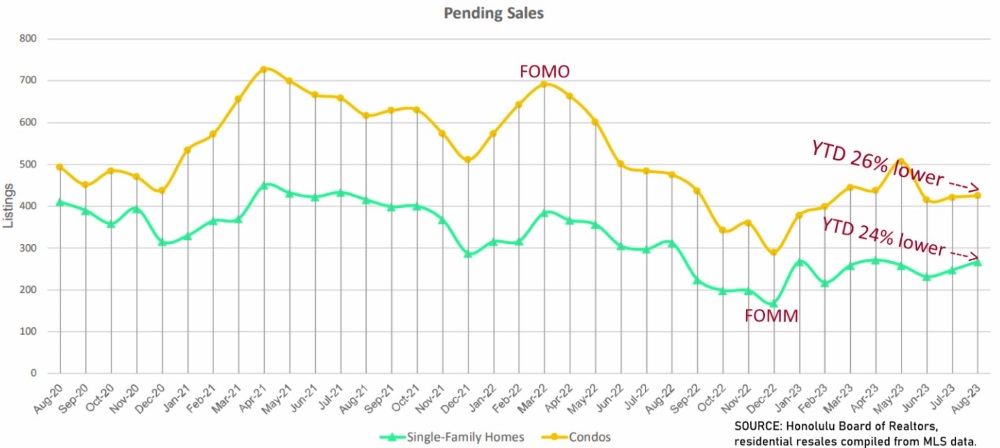

2) Demand – Pending Sales, Oahu Homes & Condos Currently In Escrow And Scheduled To Record

YTD Pending Sales are lower by 24% for Single-Family Homes and 26% for Condos compared with the same 8 months last year. ‘FOMO – The Fear Of Missing Out’ during the first three months of 2022 is in the distant past. That’s when interest rates started to jump in the spring of 2022. ‘FOMM – The Fear Of Making a Mistake’ marked the lowest level of pending sales in many years. (Data through 8.31. 2023):

________________________________

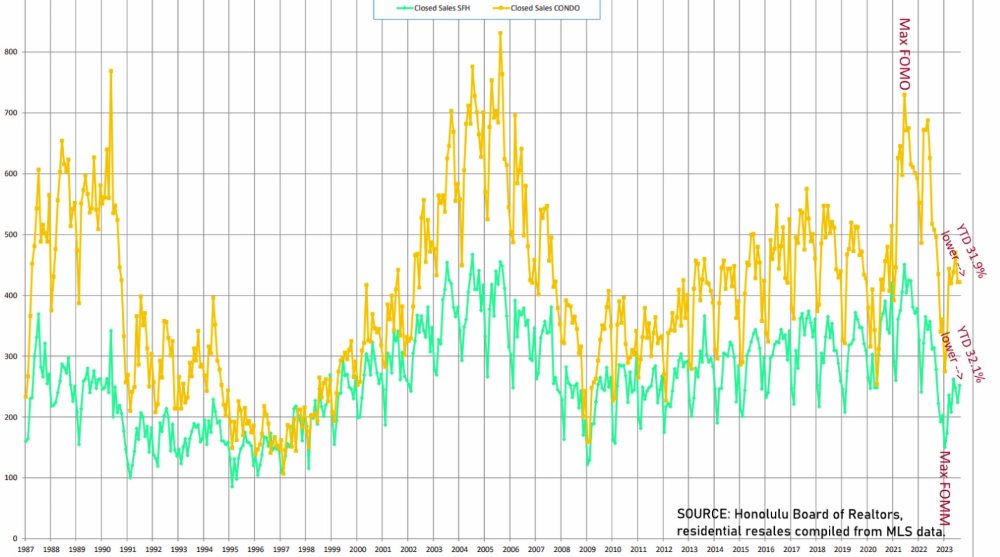

3) Demand – Closed Sales

Eventually, pending sales will turn into closed sales 30 to 60 days later. YTD Closed Sales are lower by 32.1% for Single-Family Homes and 31.9% for Condos, compared with the same 8 months last year. (Data through 8.31.2023):

________________________________

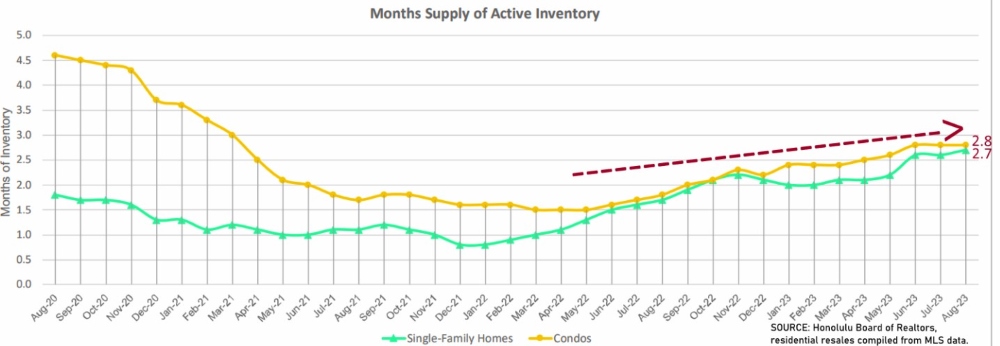

4) MRI – Months of Remaining Inventory, aka Months’ Supply of Active Inventory

MRI combines supply and demand into one ratio. MRI is the current active listings divided by the monthly closed sales rate. MRI shows us how fast the existing inventory sells. Or, how many months it would take to sell the current active inventory at the current monthly sales rate. The lower the MRI, the faster the existing inventory sells. When MRI is trending up, then the market is slowing down.

MRI hit a multi-decade record low at the start of 2022 and has been inching up through most of 2022, and 2023YTD. MRI is at 2.7 (Single-Family Homes) and 2.8 (Condos) well below 5.0, historically considered the mid-range benchmark for a balanced market. (Data through 8.31.2023):

________________________________

5) Median Sales Price – Oahu Single-Family Homes and Condos

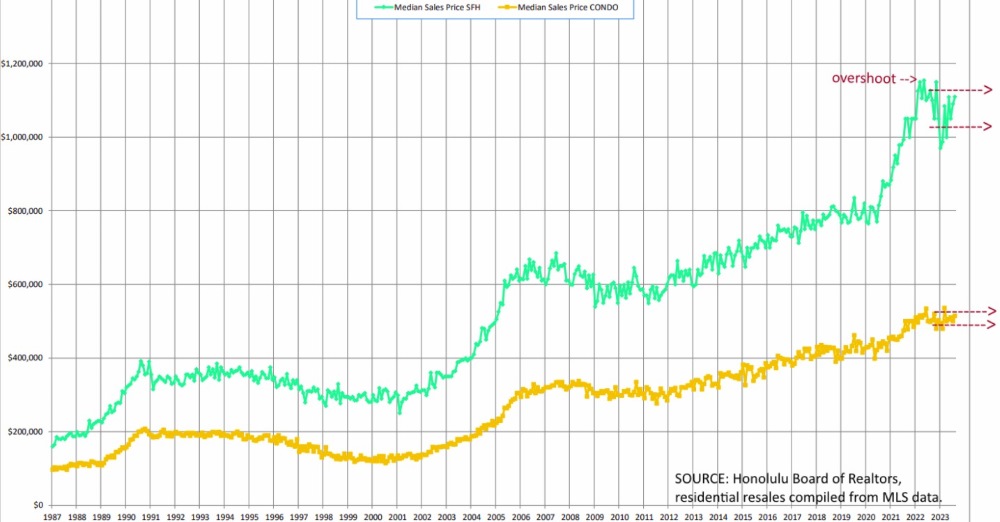

Median sales prices rose expeditiously and peaked in mid-2022. U.S. fiscal and monetary policy from March 2020 through the end of 2021 fueled extraordinary demand for Oahu real estate and drove prices to peak levels, combined with the ultra-low inventory.

The shock of sudden steep interest rates stifled demand, and the median sales price has consolidated since. After steep price increases, markets tend to overshoot their target before forming a new plateau where prices meander sideways for some time.

YTD Median Sales Prices are lower by 5.6% for Single-Family Homes and 1.6% for Condos compared with the same 8 months last year. – Are you still waiting for a crash?

Could this be another familiar pattern of overshooting and plateauing? It looks like what happened shortly after 1990 and 2007. (Data through 8.31. 2023):

In March 2023, we shared that the recent drop from the Summer 2022 peak in the Median Sales Price is likely the extent of a crash we will see. It bounced back since then and is morphing into a new plateau.

Remember that Hawaii is perceived as paradise. Hawaii real estate is a global commodity and a safe haven, especially during uncertain times.

Even with slow demand, prices could move sideways if inventory remains tight below pre-COVID levels.

- Watch for inventory increases above pre-COVID levels; then prices could soften.

We are now at the end or near the end of the Fed’s short-term rate hikes. 30-year mortgage rates reflect inflation expectations and can move 0-3 months before the 10-year treasury yield moves.

- Watch mortgage rates move lower. Demand and sales activity could rebound; then prices could move higher.

If you missed the buying opportunity during the ‘affordable’ price plateaus from 1998 through 2001, from 2009 through 2011, and during the record low <4% mortgage rates from 2012 through the spring of 2022. Don’t fret. The next opportunity plateau is forming now. Don’t miss it. It will only last as long as FOMM hangs around.

— If you read this far, you also deserve to know Barbara Corcoran’s and Elon Musk’s views on Real Estate.

____________________________________

Confused? Not Sure What To Do With This?

If this all seems like a bunch of noise or pepper in your eyes, then step back and zoom out.

“It is better to be roughly right than precisely wrong.” ~ John Maynard Keynes

What the market might do in the next three or six months has little relevance. What matters most is where you think real estate values will be in five, ten, or 20 years. — I’m convinced prices will be substantially higher at that time.

That’s why I upgraded my real estate portfolio and completed another 1031 exchange this summer despite high mortgage rates. I sold nine free and clear rentals, including six Oklahoma single-family home rentals, and leveraged into two more condotels at the Waikiki Banyan and the Waikiki Sunset.

I like collecting passive rental income for the rest of my life. Plus, I enjoy the appreciation potential with forever-limited supply in a scarce market. I explained more details in Wealth Creation with Real Estate. I consider some cash-flowing legal Hawaii condotels an excellent vehicle to accomplish that, because…

- Hawaii will always remain a desirable tourist destination for the people who can afford it, and

- Honolulu’s commitment to aggressively crack down on illegal short-term rentals further increases the demand for legal short-term rentals.

See related article: Guide to Condo Hotels in Waikiki, Honolulu – Short-Term Rental Condos

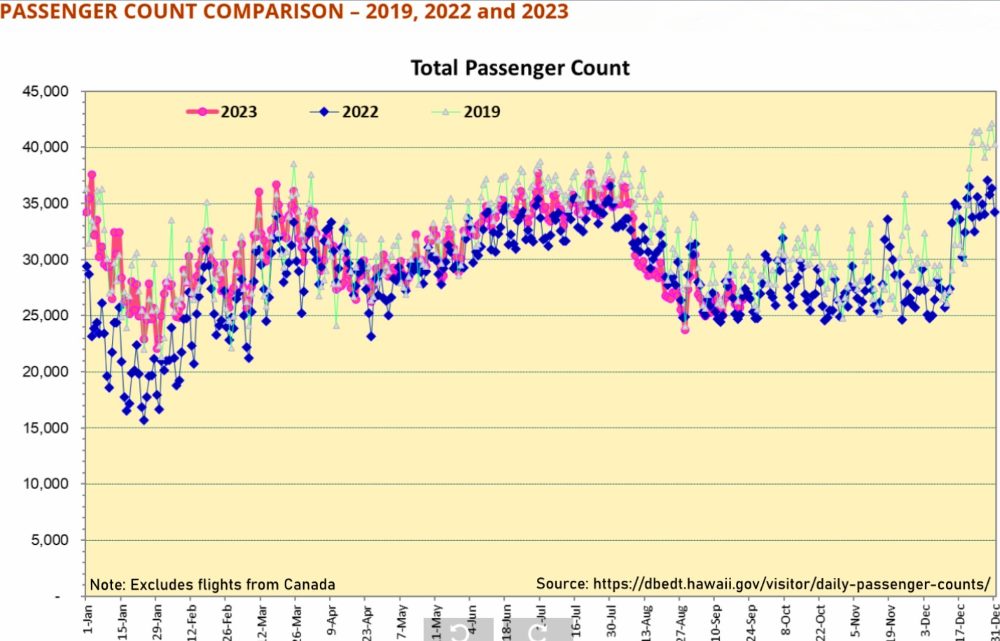

Hawaii tourism and daily passenger arrivals continue to run at full speed without any economic slowdown or recession fears (excluding Maui due to the tragic fire). International passengers, including Japanese, are returning in greater numbers compared to 2022.

__________________________________

What I Learned About Hawaii Real Estate While Visiting Monaco

Traveling offers a great opportunity to learn new ways to look at the world. This Summer, my wife and I visited Monaco, a thriving sovereign state on the French Riviera. Monaco’s size is only 0.8 sq miles. In comparison, Waikiki is about 3.4 sq miles, which is over 4 times larger than Monaco.

According to the CIA World Factbook, Monaco has the world’s highest life expectancy at nearly 90 years. Monaco has the world’s lowest poverty rate and the highest number of millionaires and billionaires per capita in the world. Monaco is also the most expensive real estate market on the planet, with an average price per square foot of over $5,100 (2020 data).

Most Honolulu luxury condos have an average price per square foot between $1,000 and $2,000 sq ft. Check Honolulu condo prices/sq ft and see for yourself. — We are undervalued by a long shot compared to Monaco. And Hawaii’s weather still beats the Mediterranean!

The above median sales price graph reflects the relentless long-term price appreciation of Hawaii real estate. Looking back in any year, the end of the graph would have been at the top, or close to the top, at that time. But it’s only the top of the market in relation to the past, and not the future.

Imagine that the average price per square foot for Honolulu real estate could double in the next 15 years and still be considered a bargain compared to Monaco.

________________________________

Final Thought

Unless you live with your parents, you rent or buy. Renting offers the flexibility of moving with short notice. But if you are committed to living in Hawaii, buying might be the better long-term option.

When you rent, you pay off your landlord’s home with little to show. When you buy, you pay off your own home and build equity. Waiting for lower prices and trying to time the market is a fool’s game.

Instead, consider that the best time to buy is when:

- you are ready to commit to living in the same neighborhood, and

- you found a suitable home that you can afford.

Choose, visualize, and design your desired outcome. Then take the most practical, feasible, and necessary action toward making it come true.

Manufacture your luck by positively influencing the areas of your life that are within your control.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you’ll visit. We’d love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Hi George,

Thanks for your update and information.

Interesting comments on Monaco real estate. I never been to Monaco and probably will never visit there. Even if I could afford to live there,which I can:t, I would not, as I prefer other places

Every country has interesting aspects in regards to its real estate market and Monaco is no different. Some things that differ from the one in Hawaii and the USA are:

1. No capital gains tax on any asset including real estate. Therefore no paperwork requirements for that asset. There is however, a 20% VAT on the sale of new apartments.

2. Limited or no income tax .Tax on rental income I believe is a whole 1% of the annual rent. No rental permits, limits or conditions on time period of rentals, and no tax for short term letting – yet of furnished properties. There is a hotel tax coming into effect in 2024.

3. Inheritance tax is 0% for transfer between parents and children or spouses.

So a very different taxation and permit/cost/paperwork environment. That would increase the value of real estate compared to other countries that have those costs.

Aloha Lee!

Thank you for your excellent observation on what makes Monaco so desirable for the ultra wealthy.

About half of the homes visible in the picture on the upper left hillside are outside of Monaco, on the French side of the border. These homes are much more affordable due to a lack of tax incentives.

Value is in the eye of the beholder.

For the ultra wealthy seeking tax shelter, it’s worth it to be a Monaco resident for the small inconvenience of an expensive real estate market. For many others, living on the French side makes more sense.

The simplified point I tried to make is that Hawaii prices seem high for most anyone that comes from a more affordable housing market.

But prices have the potential to move much higher despite how high they seem now.

Everyone should evaluate which neighborhood/city offers the best cost/benefit ratio for their budget and lifestyle requirements.

For me, it is Honolulu. The grass is not greener on the other side. Visiting Monaco and other cities/countries confirmed that, again.

You may have decided to make Hawaii your home too(?)

~ Mahalo & Aloha