Wealth Creation With Real Estate

– Much has been written about investing in real estate, yet many buyers have difficulty calculating the return. Here we break down the important components to consider. Each individual wealth building component might amount to modest returns. However, it is the cumulative effect of these, compounded over time that can create impressive wealth.

Each component acts like a booster rocket driving your investment, and propelling you towards financial orbit. Financial orbit is where your investments generate enough return to pay all your living expenses for the rest of your life. You have arrived.

Back to basics, let’s analyze these real estate booster rocket wealth building components individually:

1.) Cash Flow, 2.) Tax Benefits, 3.) Appreciation, 4.) Equity Pay Down, 5.) Force Equity, and 6.) Buying On Discount.

The first two components, Cash Flow & Tax Benefits add ‘spendable cash’ in your pocket. These cash gains are realized gains that are liquid and ready to deploy.

The remaining components, Appreciation, Equity Pay Down, Force Equity, and Buying On Discount add ‘equity’. These equity gains are unrealized gains, means they are only gains on paper. Equity can be turned into spendable cash once you refinance or sell your property.

You want both, spendable cash and equity gains for building long term wealth.

Real estate investors need to understand each component before we explore how the cumulative compounding effect of them grow financial returns over time. Let’s get started:

1.) Cash Flow – Net Operating Income (NOI)

This should be the first component to look at, and easy to calculate. Cash Flow keeps you out of trouble. It is the life blood of your financial house. It pays your bills and unexpected expenses. Rule of thumb: Only buy properties that will rent with net positive Cash Flow.

Net positive Cash Flow is any money left over after you pay all monthly expenses associated with the property. We call this: Net Operating Income (NOI)

The Net Operating Income formula is: NOI = Gross Rent received – Expenses

One practical way to quickly compare different properties’ cash flow is to calculate the cash flow as an annual percentage of the investment purchase price. This is your annual ‘cash on cash’ return on your investment. We call this CAP rate.

The formula is: CAP rate = Annual NOI / Purchase Price

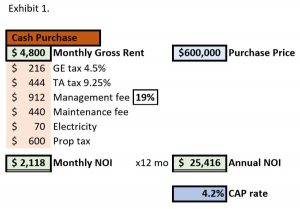

Exhibit 1. shows actual numbers for a sample Waikiki condotel unit at the Ilikai. This 500sqft 1bdr / studio with full kitchen, two double beds and an ocean view allows short term vacation renting, produces about $4,800 monthly gross revenue (including GET & TAT) and could be bought today (2017) around $600K. This unit generates $25,416 annual NOI and the Cap rate is ~4.2%.

Notice that for simplicity the CAP rate calculation does not consider financing. This simple one measure reduces the property analysis to ONE single relative number and allows for quick and easy comparison between different properties.

Many astute investors are requiring a ‘must have at least “X” CAP rate’. Hawaii’s market reality is: the vast majority of Hawaii properties rarely produce anything close to 5% CAP rate. If someone claims otherwise, they either: a.) miscalculate, b.) understate the expenses, or c.) possibly conduct illegal rental activity!?! Also check our other post Waikiki’s Condotel Reality – Cash Flow vs Lifestyle

Real estate investors have been chasing diminishing yields ever since the financial crisis created the backdrop for some of the lowest interest rates in history. In today’s world 5% CAP rate is as good as it gets in Hawaii. If you are looking for higher yield, look somewhere else.

Cash flow tends to grow over time as rents tend to increase with the rate of inflation.

The beauty with real estate investing is, there are several additional components that cumulatively make up the total investment return.

2.) Tax Benefits

A.) Expenses associated with your investment property are tax deductible. In our example above monthly expenses are highlighted light orange. Every single one of these expenses, the total of $2,682 monthly, or, $32,184 annually can be deducted on your tax return, Schedule E.

This is a direct deduction against your taxable income, thus reducing your taxable income.

B.) Mortgage Interest Deduction allows you to deduct all mortgage interest paid on your investment property. Let’s say you purchased the $600K investment sample condo above and you took out a $420K (70% LTV) investor mortgage loan @ 4%. Your initial cash down payment is $180K and your monthly P&I payment would be $2,005 per month. The total interest paid during the first year amounts to $16,665.

You get to deduct all the $16,665 mortgage interest if paid during the tax year lowering your taxable income by the same amount during the first year of ownership.

The Mortgage Interest Deduction decreases over time at an accelerating pace as the loan balance gets paid down. Mortgage Interest Deduction becomes $0 once the loan is paid off.

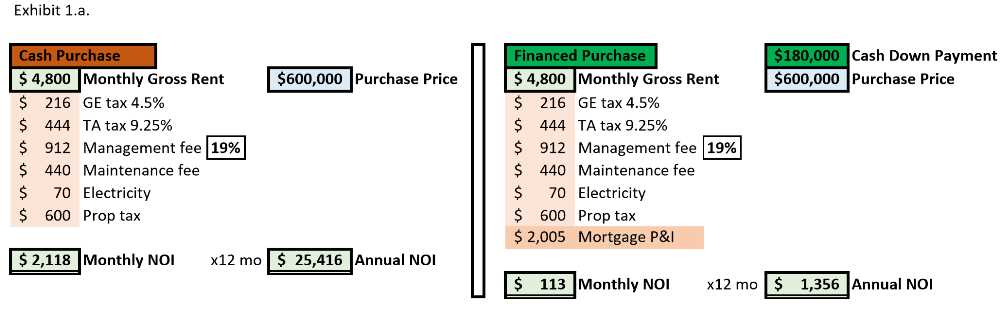

Realize that making a monthly mortgage payment is an additional expense affecting your NOI.

Exhibit 1.a. shows the same $600K sample condo purchased with 70%LTV financing results in less NOI. Leverage with financing adds tax benefits and improves your ‘ROI’ (we will discuss shortly), but it also increases your risk by diminishing your NOI.

C.) Depreciation Deduction is another powerful tax benefit where you get to depreciate the improvement value of your investment property over 27.5 years (for residential properties) or 39 years (for commercial properties). Our $600K sample condo shows the tax assessed value of the improvements at ~87% of the total tax assessed value. That translates into $522K improvement value of the $600K purchase price which you get to depreciate over 27.5 years, or $18,982 per year! This is another direct deduction against your gross income, thus reducing your taxable income.

The Depreciation Deduction is consistent every year with a straight line depreciation, until it disappears once the property is fully depreciated after 27.5 years (residential properties) or 35 years (commercial properties).

– Often deductions and depreciation create sizable paper losses to offset a good portion of your ordinary working income. With our Hawaii condo example we have a total of $67,831 combined deductions in the first year ($32,184 annual expenses, $16,665 mortgage interest deduction, and $18,982 depreciation). Remember, paper losses are good and reduce your overall tax obligation to the degree of your actual tax bracket, except there is one important cap:

Your allowable losses are limited to $25K per year for married couples filing jointly up to $100K modified gross income. Allowable losses phase out above $150K modified gross income. But, you may carry any unused losses including unused depreciation forward for years until you can, even until the day you sell your property! Then you may use all deferred paper losses to offset taxes and possibly even eliminate the need to do a 1031 exchange.

In short, if you are a couple filing jointly with $100K modified gross income, you may only claim $25K deductions per tax year. At that income level your combined Federal and State income tax bracket might be around 30% (depending on the State you reside in) translating into actual cash savings of $7,500 per year. If you earn more than $150K modified gross income filing jointly, sorry you won’t be able to claim any deductions, at least not during this tax year.

There is however one more incredible gift horse tax benefit for the truly ambitious:

Sec #469 of the IRC, – Unlimited Deductions. If you become a full time real estate investor with a.) more than 750 hours / year of active involvement in real estate activity, and b.) you dedicate more hours to your real estate investing business than any other business, than the sky is the limit. Your real estate deductions become unlimited. In our example all $67,831 combined deductions can be used to offset your ordinary income. With our Waikiki condo example, actual cash savings add up to $20,350 / per year, or more depending on your combined Federal and State income tax bracket.

We barely scratched the surface. Tax calculations can get complicated. For more real estate tax breaks check our complete Real Estate Tax Benefit Guide.

There is no other asset class besides real estate where you get both: a.) ‘depreciate’ the improvement value on your tax return, while at the same time b.) enjoy ‘appreciation’ potential.

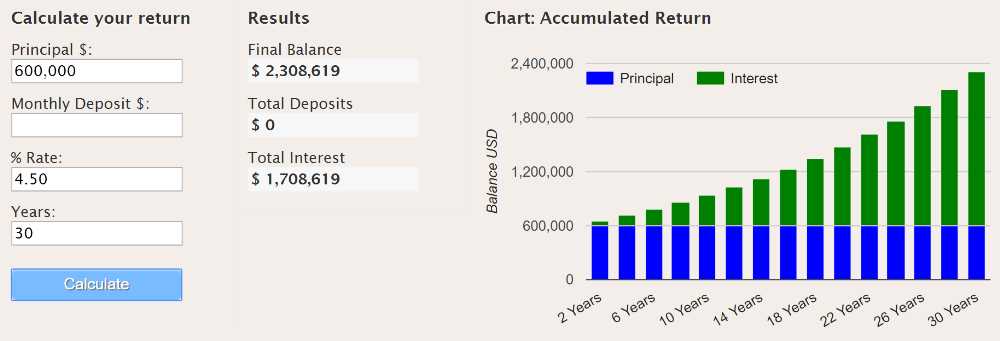

3.) Appreciation

There is no guaranty that your real estate investment appreciates every single year, but in the long run Hawaii real estate has done well. History is no indication of future returns. In the past Oahu real estate has appreciated 4.7 to 4.9% average per year compounded over the last 32 years. The current real estate market outlook predicts a continuation of ~4.5% annual price appreciation. This is speculative and does not happen in a precise straight line, but if correct, it would translate into $27,000 appreciation in the first year with our $600K condo example.

Due to the power of compound interest, in 10 years your $600K condo might be worth $931,782 based on 4.5% compound appreciation per year. After 30 years, the value might be above $2.38 Mill !

4.) Equity Pay Down

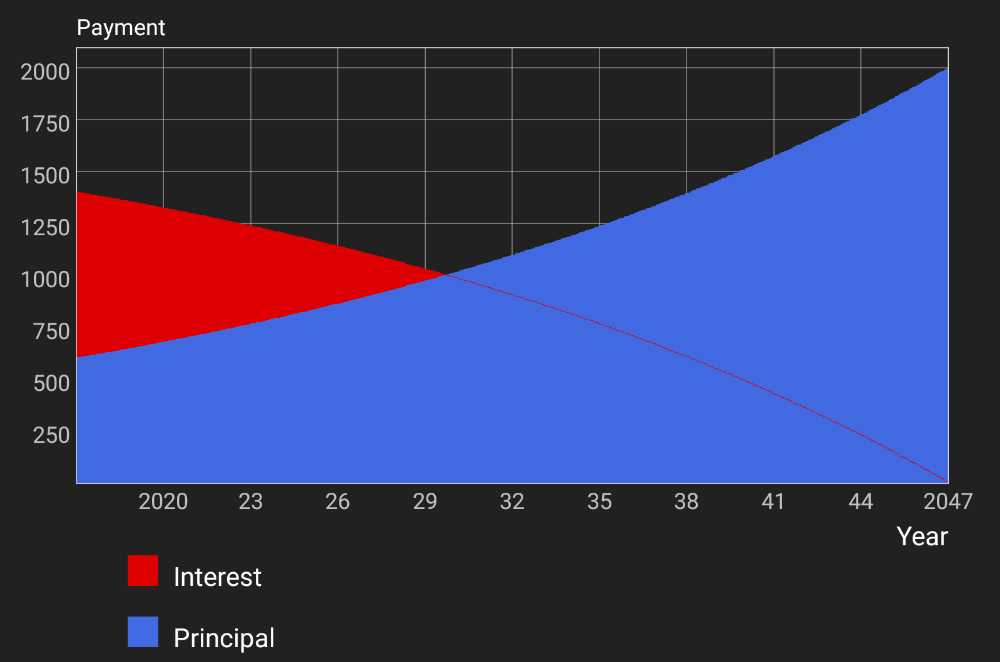

One unique tool available to real estate investors is using leverage by way of mortgage financing. Our $600K sample condo is in a condotel building (short term vacation renting is allowed) and can be purchased with a minimum of 30% down payment, or $180K cash if you qualify for a $420K mortgage loan. Our equity position is $180K while the bank’s equity position is $420K. Your monthly mortgage payment is about $2,005 which includes Principal (blue) and Interest (red) shown in Exhibit #3.

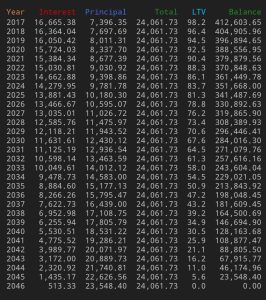

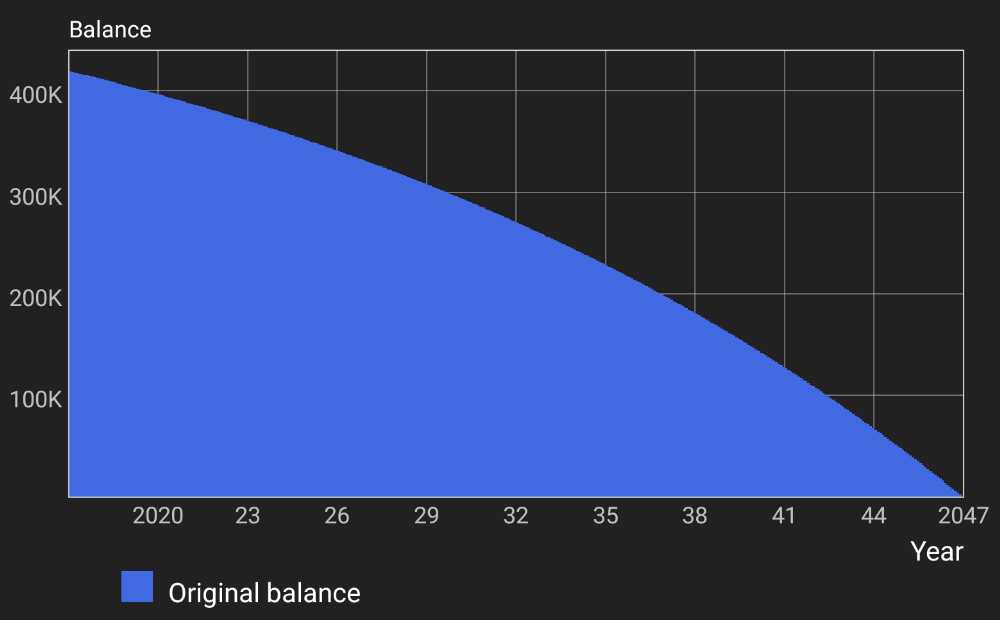

Exhibit 4. shows an Amortization Schedule for our $600K sample condo demonstrating the Equity Pay Down over 30 years.

Notice how in the beginning ‘interest’ makes the bigger share of the monthly payment (tax deductible, see ‘Tax Benefits’ above), while ‘principal’ makes up the smaller portion. This regular principal payment represents your ‘Equity Pay Down’ and gets increasingly larger over time as the loan balance diminishes. Exhibit 4. shows how after the 1st year you have automatically gained an additional $7,697 in equity just by having made your regular mortgage payments. After having made all mortgage payments over 30 years your loan is paid in full and you have automatically gained $420K in equity. This equity gain is in addition to any appreciation that may have occurred during the same time. This is how real estate investments can over time add substantial wealth.

5.) Force Equity

Forced equity is a term used when you add value to the property by making capital improvements. E.g. if you buy a fixer property for $600K, and you spend $50K to renovate kitchen and bath and the end result is a newly refurbished property worth now $700K.

Force Equity comes with two powerful benefits improving your overall return:

A.) With our condo example you added $100K in equity with a $50K improvement cost. This is an additional $50K net gain due to Force Equity.

Remember, equity is wealth on paper only and is not realized until you sell or refinance the property. Clever and cost effective improvements can be a great way to add substantial equity.

B.) Force Equity improvements might also allow you to increase your monthly rent, which is spendable cash. With our $600K condo example let’s assume that the newly remodeled condo might allow a $200 rent increase per month. That translates into an additional $2,400 cash flow per year.

6.) Buying On Discount

If you are able to purchase your investment property at a discount, you will have automatically made a paper profit from day 1 when you get your keys. Let’s say you purchased our sample condo valued at $600K but only paid $580K, you have an additional $20K in equity because of the discounted purchase price. And you did not even break a sweat other than identifying and negotiating a super great buy. Congratulations!

– Wealth creation with the power of cumulative compounded returns – Putting it all together

This is where the fun starts. It is the cumulative effect of the above components, compounded over time that has created substantial wealth for wise real estate investors.

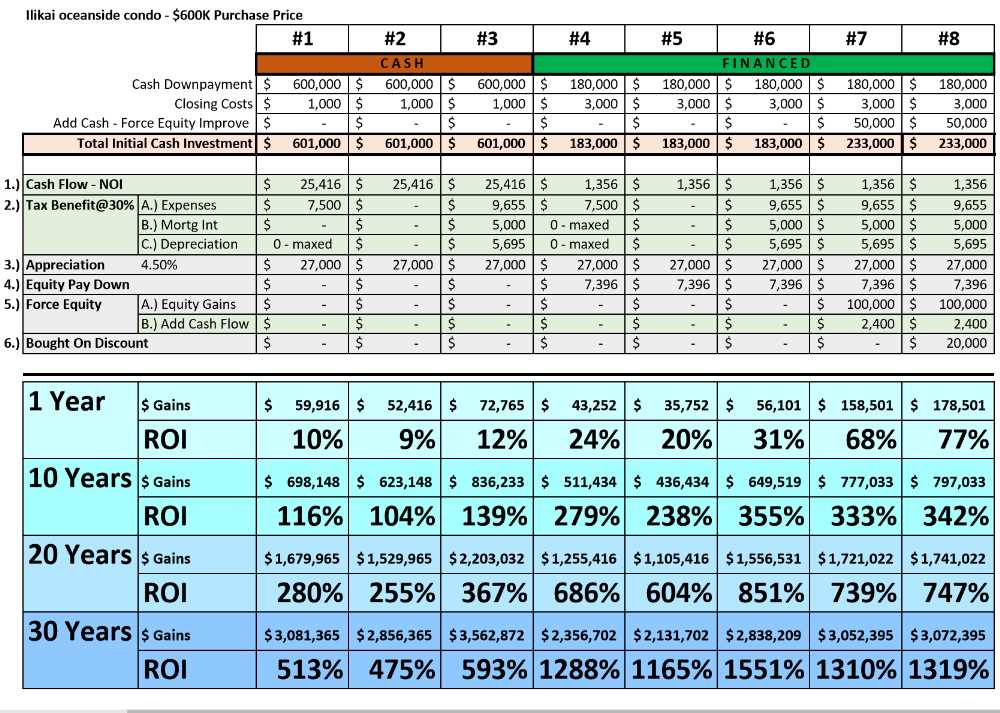

Let’s assume a few different hypothetical scenarios and see how the combination of these wealth building components affects the financial outcome over time.

Scenario #1: Cash purchase, buyer’s income <$100K/y, not eligible for sec #469.

Scenario #2: Cash purchase, buyer’s income >$150K/y, not eligible for sec #469.

Scenario #3: Cash purchase, buyer is eligible for sec #469.

Scenario #4: Financed purchase, buyer’s income <$100K/y, not eligible for sec #469.

Scenario #5: Financed purchase, buyer’s income >$150K/y, not eligible for sec #469.

Scenario #6: Financed purchase, buyer is eligible for sec #469.

Scenario #7: Financed purchase, buyer is eligible for sec #469, + $50K forcing equity.

Scenario #8: Financed purchase, buyer is eligible for sec #469, + $50K forcing equity, + buying with $20K discount.

Exhibit 6. shows the financial returns after 1 year, 10 years, 20 years and 30 years in total dollar gains. Total gains represent the combined gains of both: a.) all the cash flow received (light green), plus b.) your equity gains (light gray) (un-realized gains). Remember: Cash flow pays your bills / unexpected expenses. Equity gains build your wealth (on paper until you sell or refinance).

Exhibit 6. also shows the total gains in relative terms compared to the initial cash investment. We call this: Return On Investment or ROI.

ROI is measured as a percentage. In our sample calculation ROI expresses the profitability ratio of all gains (cash profits and equity gains) in relation to your initial cash investment aka initial cost.

Initial cost is cash down payment plus closing costs (other than pre-paids). Our $600K sample condo purchase requires ~$1K closing costs if purchased all cash, or ~$3K closing costs if purchased with financing.

The Return On Investment formula is: ROI = Total Gains / Initial Cost

ROI of 100% means your investment has grown by 100% over your initial cost, means you have doubled your money. ROI of 1,000% means your investment has grown by 1,000%, 10x over your initial cost. Means your investment turned 1 into 11 (1x cost + 10x gains = 11). Congratulations!

Exhibit 6. shows our 8 different scenarios generating 9% to 77% gains after the first year, and 104% to 355% gains after the first 10 years.

The scenarios above are hypothetical in a ‘perfect world’ and based on several assumptions, e.g. the condo stays fully rented consistent with today’s occupancy rate, rents and expenses increase by 3%/y adjusted for inflation, and appreciation is consistent at 4.5% compounded.

Life sometimes throws curveballs, e.g. tenant issues, special assessments, an unexpected AC repair, or tax laws change. Every opportunity comes with risks associated, and if it would be easy as pie everybody would do it. It takes a long term vision and commitment to succeed.

– Take Away – What we learned today

Here are a few rules of thumb we learn by analyzing Exhibit 6.:

1.) The power of compound interest works financial wonders over time. In all the above scenarios, the 30-year return is significantly higher compared to the 10-year return multiplied by 3x. The returns increase exponentially! It is not about timing the market, it is about time in the market. Since wealth building takes time, it is better to start today rather than postpone.

2.) Leverage with financing (scenarios #4 through #8) substantially increases ROI compared to all cash purchase (scenario #1 through #3). No surprise. But, big ROI comes with additional risk as your NOI cash flow is very thin. Determine your financial strength / staying power and decide how much risk is sensible.

3.) ‘Force Equity’ and ‘Buying on Discount’ have the greatest impact in the early years, but add diminishing gains on the overall ROI the longer you hold the property. Means:

a.) The shiny new ‘Force Equity’ improvements you made to the property adding $100K in value today won’t be looking shiny any longer after 10+ years of ownership.

b.) ‘Buying on Discount’ is great but don’t skip buying real estate just because you can’t get the property at a steep discount, provided the property is a good performer for a long-term hold.

4.) Any of the above scenarios #1 through #8 provide great returns, even the ones where all deductions are phased out due to your income exceeding the $150K limit. – Means: Don’t make excuses and become victim of analysis paralysis. Do your thorough research and if it looks like a great investment property, buy it. Nobody creates wealth just by thinking about it. You need to take action.

May you live well, long, and prosper

Disclaimer: We are a real estate brokerage selling real estate and not investment securities. History is not an indication of future returns. With all important investment decisions, always check with your favorite qualified financial planner, attorney and tax adviser.

‘Like’, ‘share’ and ‘comment’ below. We like to hear from you.

Let us know if you would like to receive a copy of Exhibit 6. – Excel spread sheet.

~ Mahalo & Aloha

Wow, what an in-depth breakdown on real estate as a tool to generate wealth. Thanks.

Aloha B!

Thanks for your kind words 🙂

Glad we can help.

~ Mahalo & Aloha