- Beinhocker and Friedman’s view on economic success and the role of government.

- Legislative updates currently cooking.

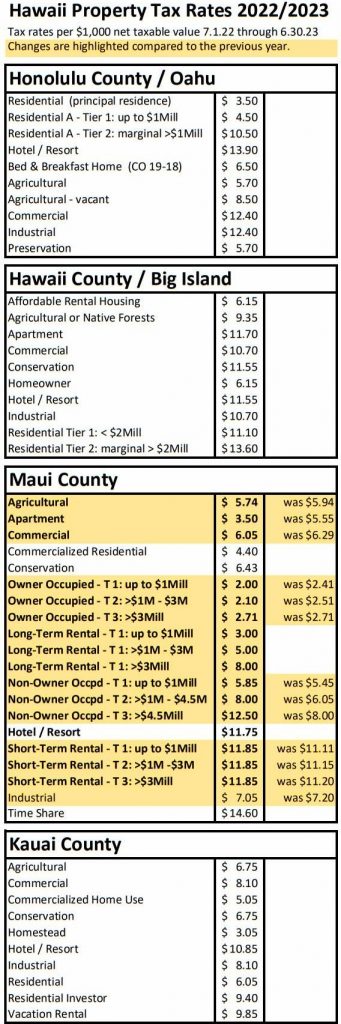

- New Hawaii Property Tax Rates 2022/2023.

________________________________

In his book ‘The Origin of Wealth,’ the author Eric Beinhocker explains that existing property rights, the rule of law, economic transparency, a lack of corruption, and other social and institutional factors play a dominant role in determining national or regional economic success.

An entrepreneur that can count on these things is much more likely to start a business. A foreign corporation is much more likely to invest in a particular country or region.

A government that behaves predictably drives innovation and investments that foster economic progress. That’s what a thriving society needs to rely on. – Can we?

Any erratic changes to existing rules erode trust in a stable business environment and stifle economic progress. – What will the government do next?

________________________________

Honolulu’s mayor signed Bill 41 (CO 22-7). Perhaps too hastily, without giving the existing Bill 89 (CO 19-18) a chance. The city decided it would be beneficial to develop some new additional rules instead of enforcing the existing ones. – Beneficial to who?

>>>>Update 10.13.2022: Federal Judge Watson ruled that the DPP and the City and County of Honolulu shall not implement and enforce changing minimum rental terms from 30 days to 90 days. All STR rule updates are here: Bill 41 (CO 22-7) – Oahu’s New Short-Term Rental Rules 2022 – Legal STR Properties <<<<

Milton and Rose Friedman argue in their book ‘Free To Choose’:

“Every accretion of government power for whatever purpose increases the danger that government, instead of serving the great majority of its citizens, will become a means whereby some of its citizens can take advantage of others.

Once government undertakes an activity, it is seldom terminated. The activity may not live up to expectation, but that is more likely to lead to its expansion, to its being granted a larger budget, than to its curtailment or abolition.”

The DPP (Department of Planning & Permitting) will handle Bill 41’s added registration requirements and enforcement of the 90-day minimum rental term. Except, the city just updated its site four days ago, 7.28.2022: “Registration for New Short-Term Rentals has been temporarily suspended until further notice.”

It’s hard to keep up with what the city will do next. – Subscribe to our latest Blog updates and stay in the know.

_________________________________

Supposedly, the DPP is hiring seven new inspectors to efficiently process the registration and rental exception requests, as well as enforcement. This is the same department that takes six to nine months (!) to approve a building permit.

It’s also the same department where the Feds indicted five city employees on bribery charges last year. The best government money can buy is also the slowest in the nation. Hawaii tops the list of having the most onerous building regulations and the largest permitting backlog in the nation. ☹

For the DPP to restore credibility, it must demonstrate a reasonable effort in streamlining operations and enforcing existing rules.

There is an opportunity here to improve. Hawaii can do better, and we must. Collectively, we get a lot more done when we aim for excellence. – Will we?

Perhaps both books mentioned above could be helpful for governmental decision-making powers.

“We lose far more from measures that serve other ‘special interests’ than we gain from measures that serve our ‘special interest.’” ~Milton & Rose Friedman, from the book ‘Free To Choose’

On that note, here is what’s cooking right now…

________________________________

Legislative Updates

Bill 41 – Legal Challenge!

In response to the 6.6.2022 and 7.7.2022 legal challenges against Bill 41, in particular, “excessive fines” and the change of the definition of a short-term rental from <30 days to <90 days, a Preliminary Injunction court date is set for 9.7.2022.

If the judge supports the motion, Bill 41 could be stalled for years until the lawsuit is settled through the courts. Bill 41’s effective enforcement date is 10.23.2022. However, rentals with existing 30 to 89-day rental terms may continue until 4.23.2023. Future Bill 41 updates are here.

Bill 4

Bill 4 sets the preconditions to establish a higher property tax rate for short-term rental (STR) properties outside of the ‘resort mixed use’ or ‘resort’ zones. The city has not yet set that rate.

That new property tax rate could end up being as high as the ‘resort mixed use’ or ‘resort’ property tax rate. In May 2022, Bill 4 passed the 2nd reading and was referred to the Committee. More to come…

Bill 9

Bill 9 proposed an extremely high property tax rate for properties deemed “vacant,” defined as not occupied by a Hawaii resident for at least six months of the year. In February 2022, Bill 9 passed the 1st reading and was postponed in March. More to come…

________________________________

New Hawaii Property Tax Rates 2022/2023

— Hawaii’s new property tax rates are effective July 1st, 2022, through June 30th, 2023. (Fiscal 2022)

See related article: Guide To Honolulu Property Taxes

No change for the island of Oahu, Honolulu County. No change for Kauai and the island of Hawaii as well.

However, Maui County introduced several changes this year, including new and modified tier brackets. Maui owner-occupants enjoy the lowest property taxes in the nation, while short-term rental property owners and non-resident owners pay higher taxes.

________________________________

Recap – Oahu’s Two-Tiered Residential Rate ‘A’:

For residential properties other than your principal residence (No Home Exemption, this is either a 2nd home or a rental property) with an assessed value at $1Mill or above, the assessed value above $1Mill is taxed at $10.50 per $1,000 assessed value (1.05%).

Oahu’s property tax rate Residential ‘A’ applies to the following properties with a tax assessed value of $1Mill or above:

- Condominium units without Home Exemption.

- Residential lots zoned R-3.5, R-5, R-7.5, R-10, and R-20, with either one or two single-family homes, without Home Exemption.

- Residential vacant lots zoned R-3.5, R-5, R-7.5, R-10, and R-20.

Suppose you own a residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value below $1Mill. Then your property tax rate is $3.50. – Residential ‘A’ only kicks in if your property’s tax assessed value is $1Mill or above.

________________________________

This Is How The Two-Tiered Residential Rate ‘A’ Gets Calculated:

But what if your residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) has a tax assessed value above $1Mill? In that case, your blended property tax rate is $4.50 for the assessed value up to $1Mill, plus $10.50 for any portion of the assessed value above $1Mill.

– Example: A residential property without Home Exemption and a net assessed value of $2Mill is taxed $15,000/y ($4.5K on the 1st $1Mill plus $10.5K on the additional value above $1Mill).

________________________________

What Can You Do About It?

If you are eligible, as an owner occupant you may claim your Home Exemption by September 30, 2022, but only if the property is your primary residence. The home exemption reduces your property tax rate to the low $3.50 per $1,000 (0.35%) residential rate starting July 1st, 2023.

See related article: Two Tips How To Lower Your Honolulu Property Tax

The city mailed Oahu tax bills to property owners, and payment is due by August 20, 2022.

See related article: Claim Your Honolulu Home Exemption

Oahu’s Home Exemption Brackets:

- The standard home exemption amount is: $100K

- 65 years and older: $140K (you must be 65 years of age by June 30th preceding the tax year the exemption is filed).

Additional home exemption age brackets that were previously available have been eliminated.

The new tax assessment notices for the fiscal year 2023 (which starts July 1, 2023) will be sent by December 15, 2022. You may appeal the newly assessed value only between December 15, 2022, to January 15, 2023.

See related article: How To Appeal Your Property Tax Assessment

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We’d love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Hi,

Any idea when you are going to publish a new market updai?

Thanks

Aloha Lee!

Thank you so much for your endless patience!!!

New market update: https://www.hawaiiliving.com/blog/oahu-real-estate-market-update-spring-2023/

Our most urgent focus is servicing our buyer and seller clients. All the free stuff for the public gets done afterward, burning the midnight oil. Sorry about that. Thx for your continued support.

— Call us when you are ready to buy or sell. That’s what we do best. 🙂

We are here to help.

~ Mahalo & Aloha

Any updates on the bill 41 lawsuit? Can’t find anything about a preliminary injunction that could have happened on thurs 9/8?

Aloha SystemR!

No decision yet. Instead, during the recent court hearing to challenge Bill 41’s 90-day rule, Judge Watson instructed both parties to meet with U.S. Magistrate Judge Rom Trader and work out a resolution by 10.23.2022.

All Bill 41 updates will be posted here:

https://www.hawaiiliving.com/blog/bill-41-co-22-7-oahus-short-term-rental-rules-legal-str-properties/

~ Mahalo & Aloha