- The higher mortgage interest rate ‘shock’ has slowed real estate demand. Prices softened since the peak in June 2022.

- Some condotels are bucking the trend and are selling at top valuations, reflecting their cash-flow potential.

________________________________

In June 2022, we discussed the Real Estate Market’s Inflection Point. That was the same month when real estate prices rolled over. That inflection point was triggered by the following:

- The Fed’s commitment to reign in elevated inflation by raising short-term interest rates, and

- The potential risk of a looming recession as a result.

So far, the Fed has successfully lowered inflation to some degree without causing a recession. How much additional slowing of economic activity and cooling off the housing market is needed remains to be seen.

According to this CME Fed Watch Tool, for next week’s Fed meeting, markets are pricing in a 73.1% chance of a 25-bp hike and a 26.9% probability of no hike. A week earlier, markets were pricing a 69.8% chance of a 50-bp hike and a 30.2% probability of a 25-bp hike. This shift is due to a moderating job growth rate and recent troubles at Silicon Valley Bank.

It proves again, nobody has a clue about predicting the future.

“There Are No Adults. Everyone’s making it up as they go along. Figure it out yourself, and do it.” ~ Naval Ravikant

Professional pundits continue arguing several outcomes for 2023:

Rolling Recession, or a Hard Landing vs. Soft Landing, or even No Landing?

Many are wondering which of these scenarios is most probable. The more qualified the experts think they are, the greater their peculiar blindness. Doomsday predictions get more attention, but against all odds, many predicted recessions never happened.

See related article: Let’s Check The Crystal Ball

Locally, according to Hawaii’s think tank DBEDT, Hawaii’s economy is expected to outperform the nation in 2023.

So, take your pick. Decide which future you would like to experience. Read the paragraph ‘The Certainty Of Outcomes’ at the bottom of this article on how you might benefit and navigate.

But before that, let’s look at…

________________________________

Where We Are Today

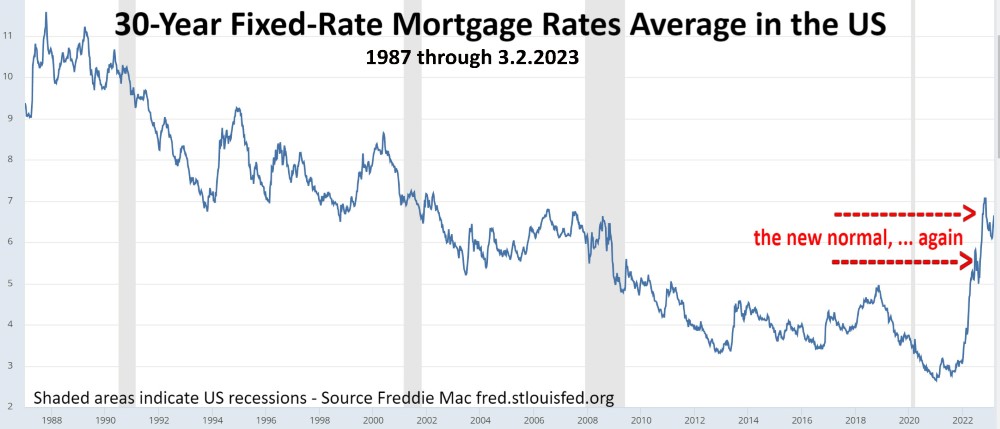

It’s the speed of the bullet, not the weight, that harms. Mortgage interest rates increased at a record pace from an unprecedented record low base level. 30-year fixed mortgage rates in the 3% range are gone, for good.

Mortgage rates in the 6% range are the new norm, just as before from 2001 through 2008. That was normal before COVID and the financial crisis. Get used to it again.

1) 30-year Fixed-Rate Mortgage Rates – 1987 through March 2, 2023. (Check today’s mortgage rates).

________________________________

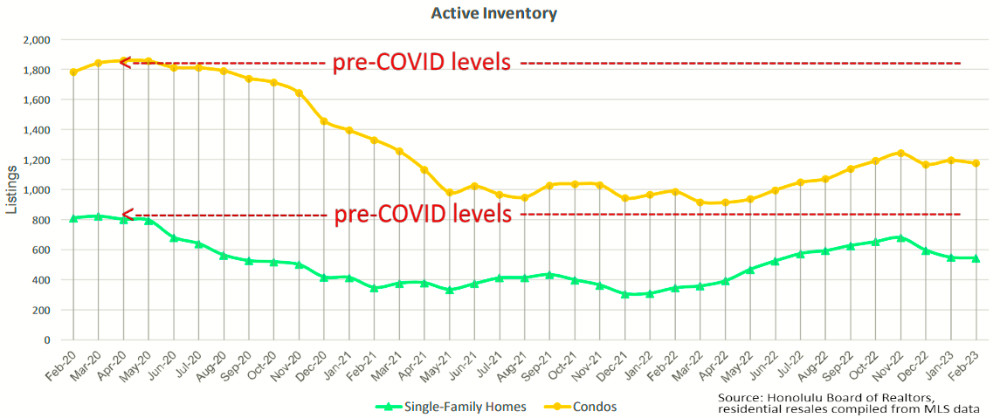

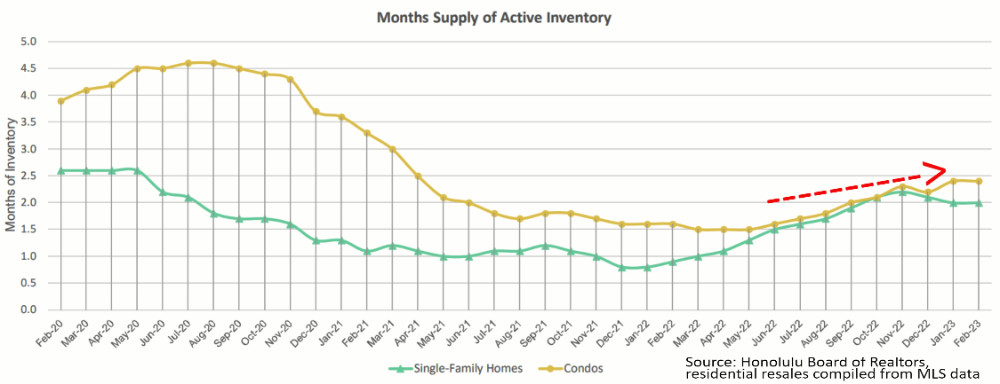

2) Supply – Active inventory, Oahu homes & condos.

Active inventory has been inching upward since spring 2022 but remains far below pre-COVID levels. (Data through 2.28.2023):

________________________________

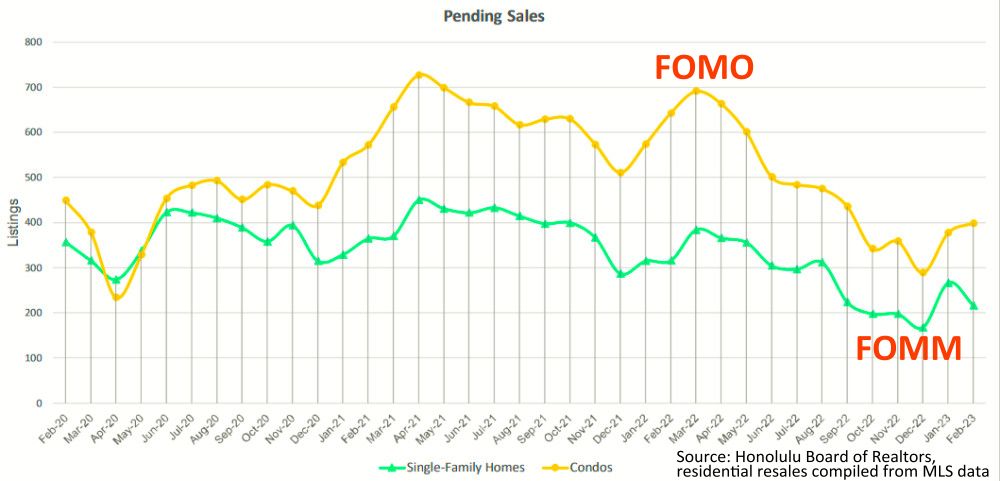

3) Demand – Pending Sales, Oahu homes & condos currently in escrow and scheduled to record.

The recent peaks on this graph reflect the buyers’ ‘FOMO – Fear Of Missing Out’ rush to get into escrow during the first three months of 2022. That was the last push before mortgage interest rates jumped in spring 2022 and reversed the trend of pending sales downward to some of the lowest levels in the previous two years. ‘FOMM – Fear Of Making a Mistake’ has returned. However, notice the slight rebound in pending sales. (Data through 2.28. 2023):

________________________________

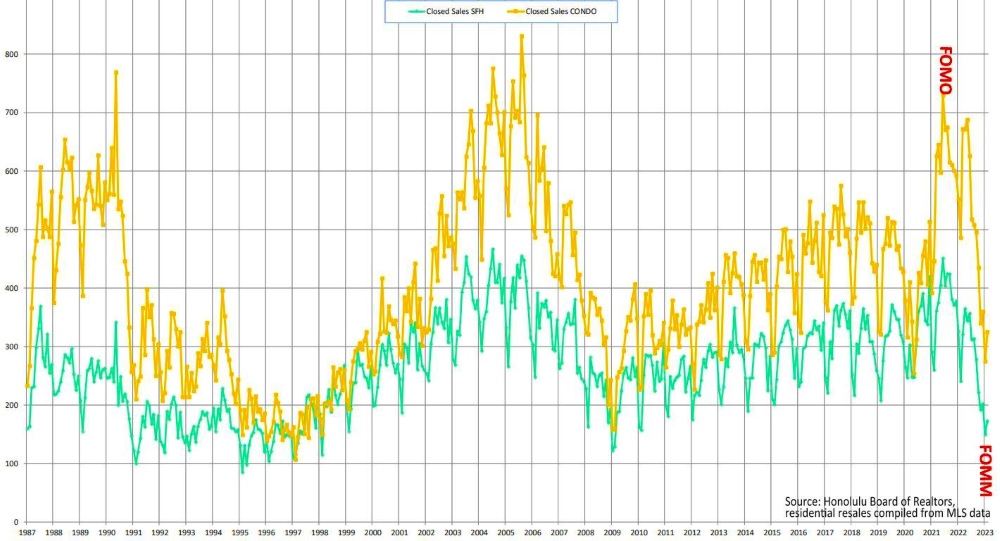

4) Demand – Closed Sales.

Eventually, pending sales will turn into closed sales 30 to 60 days later. Closed sales just marked a new low point as a response lag to the interest rate shock. Could this low trough represent the maximum FOMM – Fear Of Making a Mistake? (Data through 2.28. 2023):

________________________________

5) MRI – Months of Remaining Inventory, aka Months’ Supply of Active Inventory.

MRI combines supply and demand into one ratio. MRI is the current active listings divided by the monthly closed sales rate. MRI shows us how fast the existing inventory sells. Or, how many months it would take to sell the current active inventory at the current monthly sales rate. The lower the MRI, the faster the existing inventory sells. When MRI is trending up, then the market is slowing down.

MRI hit a multi-decade record low at the start of 2022, has been inching up through most of 2022, and has paused in the last couple of months. MRI is well below 5.0, historically considered the mid-range benchmark for a balanced market. (Data through 2.28.2023):

________________________________

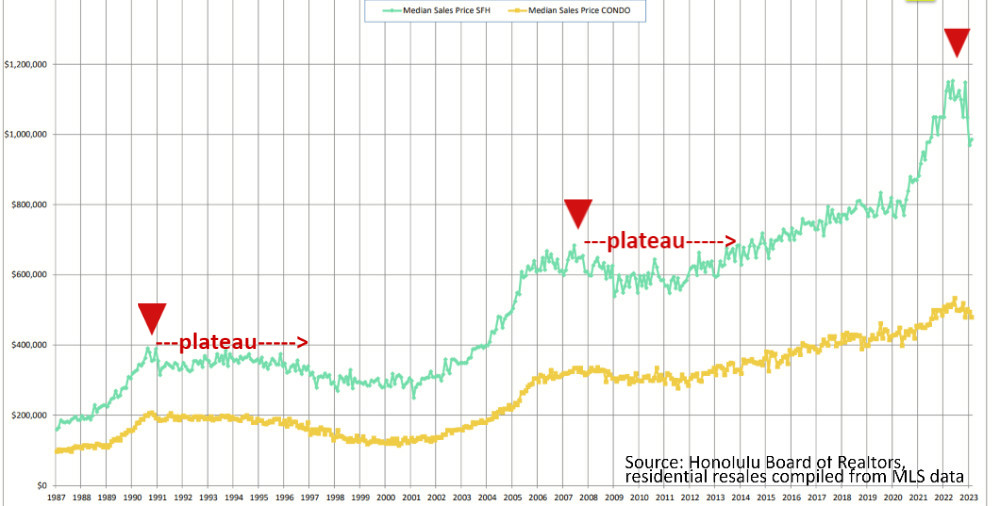

6) Median Sales Price – Oahu Single-Family Homes and Condos.

Median sales prices rose expeditiously and peaked in mid-2022. U.S. fiscal and monetary policy from March 2020 through the end of 2021 fueled extraordinary demand for Oahu real estate and drove prices to peak levels, combined with the ultra-low inventory.

The shock of sudden steep interest rates stifled demand, and the median sales price has consolidated since. After steep price increases, markets tend to overshoot their target before forming a new plateau where prices meander sideways for some time.

Could this be another familiar pattern of overshooting and plateauing? It looks similar to what happened shortly after 1990 and 2007. (Data through 2.28. 2023):

________________________________

Increased Uncertainty? – Is The Market Crashing Or Plateauing?

A client recently argued that he is reluctant to submit an offer due to increased uncertainty (?) because he is “afraid he might be buying at the top of the market, and a crash could be imminent.”

Objectively, uncertainty is ever-present. Get used to it. It always has been and always will be. It is merely an illusion that uncertainty seems elevated at any present moment. That’s because the past is no longer a threat, and we no longer recall the anxieties that previous uncertainties created.

See related article: How Will This Story End?

How did you feel at the onset of worldwide COVID lockdowns? Did you expect a crash at the time? Do you think today’s world is more uncertain? – Hardly.

How many crashes can you identify during the last 35 years in the Median Sales Price graph above? Or is it just overshooting and plateauing?

The recent drop from the Summer 2022 peak in the Median Sales Price is likely the extent of a crash we will see. Perhaps it is morphing into a new plateau.

Even with slow demand, prices could move sideways if inventory remains tight below pre-COVID levels. Watch if the inventory increases above pre-COVID levels; then prices could soften further.

Consider that we are closer to the end than the beginning of the Fed’s short-term rate hikes. 30-year mortgage rates reflect inflation expectations and can move 0-3 months before the 10-year treasury yield moves. Once mortgage rates move lower, demand and sales activity will rebound.

Also, remember that Hawaii is perceived as paradise. Hawaii real estate is a global commodity and a safe haven, especially during uncertain times.

If you missed the buying opportunity during the ‘affordable’ price plateaus from 1998 through 2001, from 2009 through 2011, and during the record low <4% mortgage rates from 2012 through the spring of 2022. Don’t fret. The next opportunity plateau is forming right now. Don’t miss it. It will only last as long as FOMM hangs around.

________________________________

Inverse Correlation vs. Interest Rate Sensitivity

A famous old myth is making the rounds again: “Since interest rates doubled, property values are still way too high and have to come down.”

However, no measurable inverse correlation exists when you superimpose the median sales price graph over the mortgage rate graph. We discussed this before in this related article: The Market Is Up. Should I Sell My Hawaii Investment Property?

Granted, today’s buyers that need financing inadvertently feel the pinch of higher mortgage rates. That explains the steep drop in demand.

But a robust labor market with low unemployment combined with stubbornly low housing supply limits the downside risk for sales prices. It could be less than some sitting on the sidelines might expect.

Here are two creative ways in which some buyers and sellers have returned to the market while coping with higher interest rates.

- Instead of a 30-year fixed-rate mortgage, buyers select more affordable adjustable-rate mortgages, expecting to refinance when 30-year fixed rates become favorable again.

- Some sellers and developers offer closing cost credits for buyers’ up-front points to buy down the mortgage interest rate.

— When people still need to move while rates are high, buyers and sellers get creative.

________________________________

More thoughts on FOMM – Fear Of Making A Mistake

In early 2022, a buyer client of mine carefully researched many different condo options. She would interview the building managers inquiring about upcoming capital improvement projects and possible special assessments. She would take measurements of room dimensions for future remodeling plans and furniture placement ideas. She would give herself additional time to process newly gathered information and eventually come to her final conclusion:

“We have discussed at length, and we are nervous about what Russia’s plans re Ukraine are and what impact that will have on all Nations and currencies. We would like to see what transpires after the Winter Olympics have ended, so we will just sit tight for now and take our chances as to whether this apt is still available.”

Putin invaded Ukraine, and the condo was sold. FOMM got this buyer nervous. Over-analysis turned into paralysis. The buyer got overwhelmed and talked themselves out of it.

It is entirely up to you what you like to do. Everyone must get comfortable with their decisions. We won’t ever pressure you to make hasty moves.

Every opportunity comes with certain risks. And every crisis that seems like an apocalypse creates an equal or greater opportunity. Will you be able to recognize it?

“Many situations in life are similar to going on a hike: the view changes once you start walking. You don’t need all the answers right now. New paths will reveal themselves if you dare to get started.” ~ James Clear

________________________________

All Apocalypses Are Local – The Market Segment That Is Bucking The Trend

We reviewed plenty of data on how past recessions, geopolitical events, and the pandemic have affected Hawaii’s real estate market.

See related articles: COVID-19 – Oahu Real Estate, also COVID Split The Market, and the K-Shaped Recovery

In 2023, the properties selling near record-high prices are cash-flowing condotels. These units get valued based on their cash-flow potential. Their performance depends on various factors. Call us to find out which condotels make the most financial sense.

See the related article: How To Improve Your Hawaii Condotel Rental Income

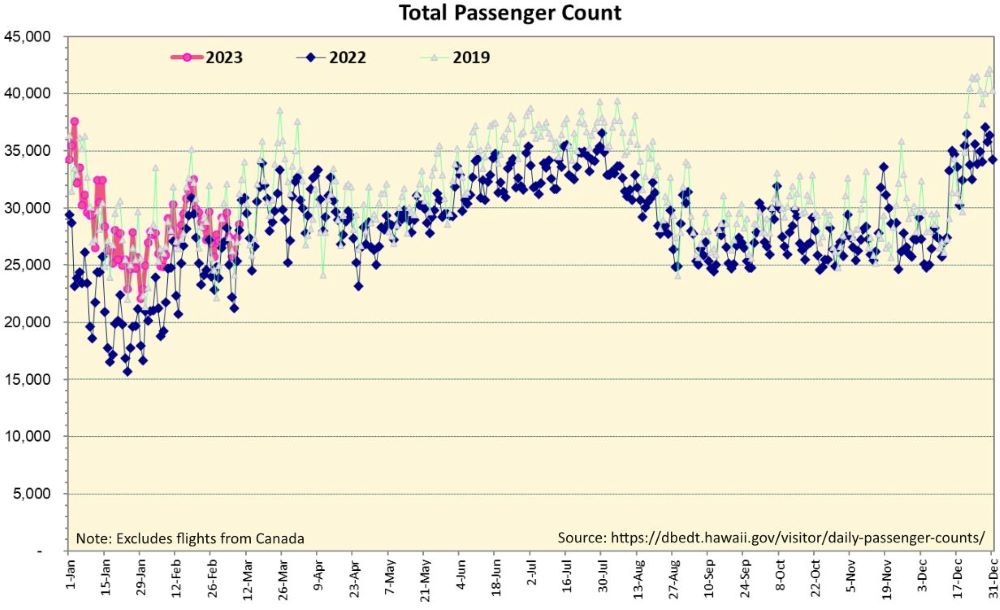

In 2022 visitor arrivals clocked in just shy of the 2019 record year. However, net dollar revenue set a new record. So far in 2023, the daily passenger count runs at full speed and has not been curbed by fears of an economic slowdown or a looming recession.

________________________________

The Certainty Of Outcomes

Perhaps the latest news headlines got you nervous. Inflation, the highest mortgage rates since 2008, Russia’s abominable invasion of Ukraine, recession risk, bank failure, climate change, etc.

The internet is packed with doomsday news that could curb your enjoyment of a world filled with endless beauty and opportunity.

The journal Health Communication published a study stating that 16.5% of about 1,100 people surveyed showed signs of “severely problematic” news consumption, increasing stress, anxiety, and poor health.

Stop ‘doom-scrolling!’ It’s when you continuously scroll through bad and depressing news. It offers no benefit and holds you back from designing your most desirable future and becoming the best version of yourself.

“Nothing is ever as good or as bad as it seems.” ~ General Slim

There is a 100% certainty that one of the following three outcomes will come true.

- your future will be more favorable for you, or

- your future will be more or less the same, or

- your future will be less favorable for you.

There is a better than two-thirds of chance that either 1) or 2) will come true.

I choose to act and move with full expectation toward the outcomes I desire. I cannot control any external circumstances. However, I welcome temporary setbacks as ‘opportunities in the making.’

My default outlook is that the Hawaii real estate market is not crashing, and the world is not ending. That’s why I bought another Hawaii condotel last year. And, regardless of short-term market gyrations, I’m committed to purchasing another one in 2023.

“Your input determines your outlook. Your outlook determines your output, and your output determines your future.” ~ Zig Ziglar

________________________________

Why I bought Another Condotel

Simple. I like to collect passive rental income for the rest of my life. Plus, I enjoy the appreciation potential with forever-limited supply in a scarce market. I explained more details in Wealth Creation with Real Estate. I consider some cash-flowing legal Hawaii condotels an excellent vehicle to accomplish that, because…

- Hawaii will always remain a desirable tourist destination for the people that can afford it, and

- Honolulu’s commitment to aggressively crack down on illegal short-term rentals further increases the demand for legal short-term rentals.

See related article: Guide to Condo Hotels in Waikiki, Honolulu – Short-Term Rental Condos

________________________________

Final Thought

Unless you live with your parents, you rent or buy. Renting offers the flexibility of moving with short notice. But if you are committed to living in Hawaii, buying might be the better long-term option.

When you rent, you pay off your landlord’s home with little to show. When you buy, you pay off your own home and build equity. Waiting for lower prices and trying to time the market is a fool’s game.

Instead, consider that the best time to buy is when:

- you are ready to commit to living in the same neighborhood, and

- you found a suitable home that you can afford.

Choose, visualize, and design your desired outcome. Then take the most practical, feasible, and necessary action toward making it come true.

Manufacture your luck by positively influencing the areas of your life that are within your control.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you’ll visit. We’d love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Thanks for the update!

Aloha Joanne!

You are welcome.

Let us know if there is anything else we can do for you.

We are here to help.

~ Mahalo & Aloha

Excellent well written article!

Aloha Stan!

Thank you for your kind words.

Happy belated Birthday!

All the Best.

~ Mahalo & Aloha

Hi,

Thanks for the market update. Hawaii is a really interesting real estate market with all sorts of factors affecting supply and demand and then price.

Aloha Lee!

Thank you for your comment.

Let us know if there is anything else we can do for you.

We are here to help.

~ Mahalo & Aloha