— Rule #1: Nobody knows what the future will bring.

— Rule #2: Knowing what you now know, determine the single best immediate step forward for this moment. Don’t worry about two weeks, two months, or six months from now. Any subsequent step will reveal itself.

We are discovering daily how expert future predictions are futile. The February consensus among economists was that there was little risk of a 2020 US recession. Within a matter of days, the stock market dropped by 30%. The skyrocketing US unemployment is now projected to reach a staggering 32%.

The world is changing ever faster. 12 hours today feel like what two weeks felt yesterday. Everything in this post will be outdated by tomorrow, ancient by the end of next week, and entirely incorrect in a month from now.

The vast number of COVID-19 models and predictions might turn out to be way off the mark. On March 26 it was projected that by April 1st, there would be 50,000 hospitalizations in New York. Only five days later on April 1st, the actual number was 12,000. We are in uncharted territory and we simply don’t know enough about all variables that can affect the outcome.

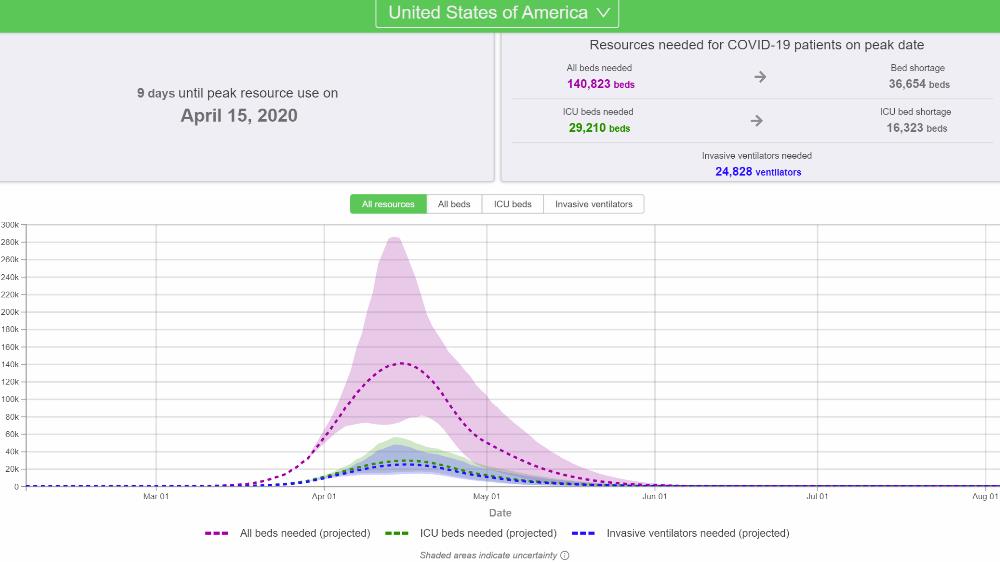

Here is Hawaii’s projection as of 4.6.2020:

And for the US:

You can also check each US state’s projections for deaths per day and total deaths here.

Today, as well as in a year from now, some will complain that the US should have shut down the economy much earlier to save precious lives.

On March 31, 2020, leading scientists estimated the virus could kill between 100,000 and 240,000 in the US alone.

If these numbers turn out to be less, then some will complain that shutting down the economy was overreacting and unnecessary. Could less drastic steps have sufficed? Between a rock and a hard place? Will hindsight be 2020?

Any loss of human life is tragic. How much loss would be acceptable? Relative to what?

“When a man sits with a pretty girl for an hour, it seems like a minute. But let him sit on a hot stove for a minute—and it’s longer than an hour. That’s relativity.” ~ Albert Einstein

Human nature tends to discount the need for drastic and inconvenient measures, perhaps even more after those measures succeed.

The final number of COVID-19 fatalities in comparison with today’s projections will be argued as evidence if the current measures were indeed necessary or not. Except, we might never know the true measure of effectiveness. Some are still debating today if the massive economic stimulus package and bailouts during the financial crisis were necessary to avert a more dire outcome.

We don’t need to A/B test the effectiveness of wearing a parachute when skydiving, or A/B test the effectiveness of wearing a seatbelt when driving in traffic. Keep it simple. We already know the answer. In doubt, it’s better to be safe than sorry. Might as well wear a mask and keep 6 feet distance when you buy your groceries.

“When you change the way you look at things the things you look at change.” ~ Wayne Dyer

Because of rule number #1 above, we should simply use common sense and cautiously follow rule #2:

Practice ‘physical’ distancing (social distancing is a misnomer). Reach out and safely engage, socialize and conduct business via Skype, Zoom, phone, and other communication tools. Stay home, but if you must leave, always wear a mask, bandana or scarf when in public to protect others and yourself.

Masks have been working fine in Japan, China, and Korea. We will get used to it, just like wearing a seatbelt. Wash your hands and avoid touching your face. Practice healthy habits and maintain a strong immune system. Get 8 hours of quality sleep, eat nutritious quality foods and exercise regularly. I rediscovered jump roping, burpees, and pull-ups in my closet. You already know what you should do.

Let’s all find ways to improve and do better in preventing the spread of the virus.

Nobody knows how long this might take, but slowly, as if a curtain gets pulled to the side, some patterns are emerging.

The Beginning Of The End Of The Pandemic

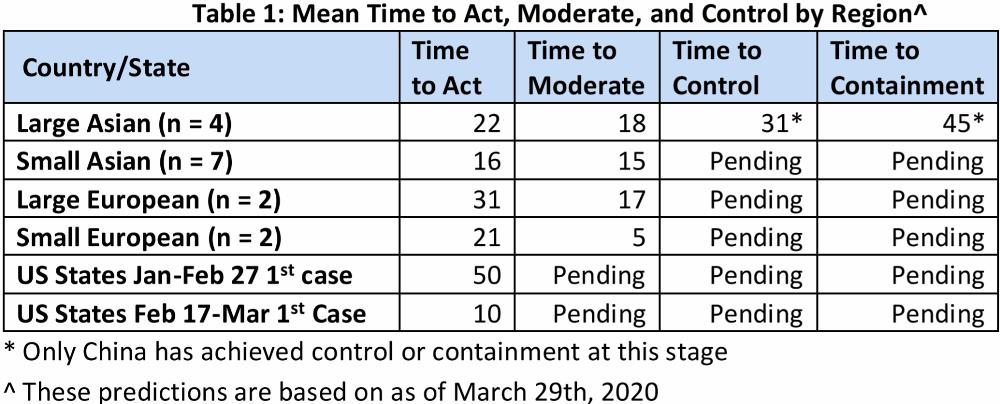

Despite rule #1 above, a curious mind can make better decisions. This university research paper analyzed the top 36 countries and 50 US states affected by COVID-19 as of 3/30/2020. Here is a summary of the findings:

“Any moderation or slowdown has so far been due only to aggressive intervention. Countries take an average of about three weeks to act. However, even aggressive intervention does not show immediate results. Countries take an average of about three weeks to moderate, four weeks to control, and over 6 weeks to contain the spread of the disease, after aggressive intervention. Substantial differences exist between large and small and Asian and European countries in time to act. Using these findings, we predict the likely dates of moderation and control for specific countries and States of the US.”

The paper defines measurable benchmarks to target:

- Moderation: The growth rate stays below 10%.

- Control: The growth rate stays below 1%.

- Containment: The growth rate stays below 0.1%.

This is the most telling graph:

Based on these benchmarks, China achieved ‘containment’. During the 1st week of April 2020, South Korea achieved ‘control’, and Spain, Italy, Germany, France, Iran, and the UK all reached ‘moderation’ (<10% daily growth in active cases). The US reached ‘moderation’ on April 5th, 2020. You can check here daily how each country’s numbers are improving.

Hawaii dodged a bullet. With 10 Million annual visitors from all corners of the world, Hawaii could have easily followed New York’s path and become the new epicenter. On 3.25.2020, and not a day to early, Hawaii mandated a stay-at-home order. All new visitors are subject to an automatic 14-day quarantine period upon arrival. Tourism is effectively shut down.

I learned from a doctor at Queen’s hospital that as of 4.5.2020, Hawaii now has a COVID-19 speed test capability of 100 tests per day. Speed tests in Hawaii return results within 24 hours. I don’t know what the additional capabilities are for the regular slower test. Hawaii ranks in the top 10 states in the nation for tests done per state capita. (Total tests: 13,665; Tests per 1Mill population: 9,610; as of 4.6.2020)

As of 4.14.2020, Hawaii ranks in the top 3 mask-wearing states according to geotagged Twitter data.

Abbot Labs’ new 15-minute test will greatly increase testing capabilities. Perhaps air travel could come back by requiring mandatory tests within 24 hours before boarding. Travelers must show a negative result certificate. Additionally, temperature checks before boarding and the new upcoming antibody test could reduce anxieties and restore airline travel and tourism.

“We don’t see things as they are; we see them as we are.” — Anaïs Nin

QE – Infinity

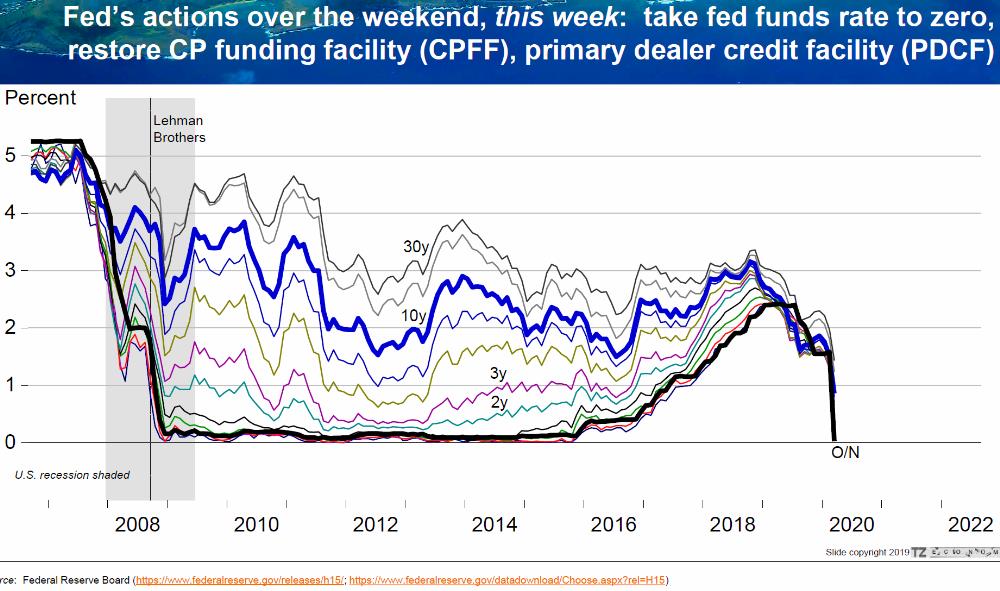

The US economy was artificially put in a coma. This has never been done before. Bringing back the patient will be a learn-as-we-go process. QE1, QE2, and QE3 (2008 to 2013) were merely dress rehearsals and are dwarfed by the tools that are being applied today.

Meet QE-Infinity. – In a concerted effort, the US government and other world governments have committed to do whatever it takes to prevent an economic collapse and ensure a speedy recovery. On March 26, 2020, Fed Chairman Jerome Powell announced that the Federal Reserve would “aggressively and forthrightly continue its efforts and not run out of ammunition.” Besides just having lowered the Fed Funds rate to 0%, the Fed will provide essentially unlimited lending to support the economy as long as it is damaged.

Source: Paul H. Brewbaker, Ph.D., CBE, (TZ Economics)

The Fed does not want to see a repeat of a prolonged Great Recession. US unemployment is currently shooting through the roof like never before. However, tenant evictions and foreclosures as a result of COVID-19 are currently being halted. Mortgage payment deferments are being implemented to last for 3 to 12 months, or longer if needed. The government is trying to assure you: “we got your back.”

During the 2009 great recession, nobody knew which of the two most probable scenarios would unfold:

- depression, or

- hyperinflation, due to the massive stimulus.

Unimaginable back in the midst of it, the seemingly impossible tightrope walk over and through the depression abyss and the hyperinflation abyss worked out remarkably well resulting in what has become the longest sustained and steady economic expansion in US history.

There are thousands of moving parts in an aircraft and many possibilities for a plane to crash. Yet we board an airplane with the full expectation for a safe and smooth landing. – Have faith and relax. Eventually, the economic fallout as a result of COVID-19 will magically dissolve.

Move On And Be Kind

Hanlon’s Razor states that “we should not attribute to malice what is adequately explained by stupidity.”

It’s not your fault, nor anyone else’s.

You are not the only one that was inadequately prepared. The entire world was caught by surprise. Forgive yourself, your boss, partner, neighbor, mayor, governor, and every world leader. Do the best with what you got and take it one step at a time. Be the role model for your tribe, the beacon in the fog.

Our ancestors survived the black plague and the Spanish Flu without ever finding a vaccine. The odds are infinitely better for us today to overcome COVID-19 and the ensuing economic fallout. Focus on rule #2.

________________________________

We are no experts on pandemics or the economy. And we don’t have a crystal ball either. However, we are cautiously optimistic that we’ll get through this and become stronger and better prepared. How fast depends on how well each one of us follows standard protocol to mitigate the further spread of the virus. Rapid tests, antibody tests, therapeutics, and vaccine development are progressing.

Eventually, the US will reach ‘control’ and ‘containment’. The economic recovery could take several different shapes depending on many variables.

- L-shape: long drawn out and seemingly ‘no’ recovery

- U-shape: a recession for ~6 to 12 months with a slow extended recovery

- W-shape: a relatively quick recovery with a resurgence of COVID-19 cases in the fall and a subsequent additional economic lock-down.

- V-shape: swift recovery with a strong economic expansion continuing

On Thursday, April 9th Fed Chair Jerome Powell announced: “..our actions today will help ensure that the eventual recovery is as vigorous as possible.”

The Fed’s commitment to do whatever it takes with virtually unlimited resources might make the recovery look more square-root shaped: a bounce-back recovery and a slow expansion continuing similar to the past few years. Could the current recession be short-lived because of the massive monetary and fiscal stimulus? Unemployment is still likely to lag.

Figuring out how to revive the economy involves more unknown variables than the Drake equation.

Past ‘Black Swan’ Shock Events

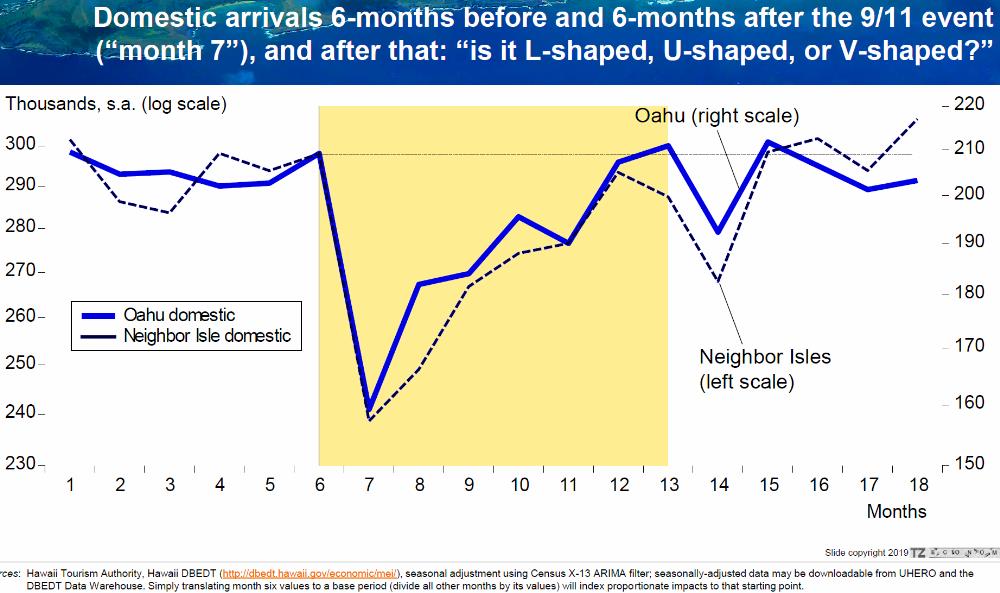

Although past performance is not an indicator of future results, it is useful to look back and analyze how past shock events affected Hawaii tourism and Oahu’s real estate.

Following are slides from a recent 3/18/2020 presentation by Paul H. Brewbaker, Ph.D., CBE, (TZ Economics)

Each Black Swan Shock Event had specific characteristics regarding:

- swiftness of the onset

- length

- geographic reach (local vs global)

- swiftness of the recovery

For example, the geographic reach of the perceived Y2K threat was worldwide. The onset of Y2K was a gradually increasing anxiety leading up towards 12/31/1999. Because the event was anticipated, Y2K hardly qualifies as a shock event. Instead, it was only a temporary perceived threat. By the time the clock had turned over at midnight, the perceived threat instantaneously evaporated.

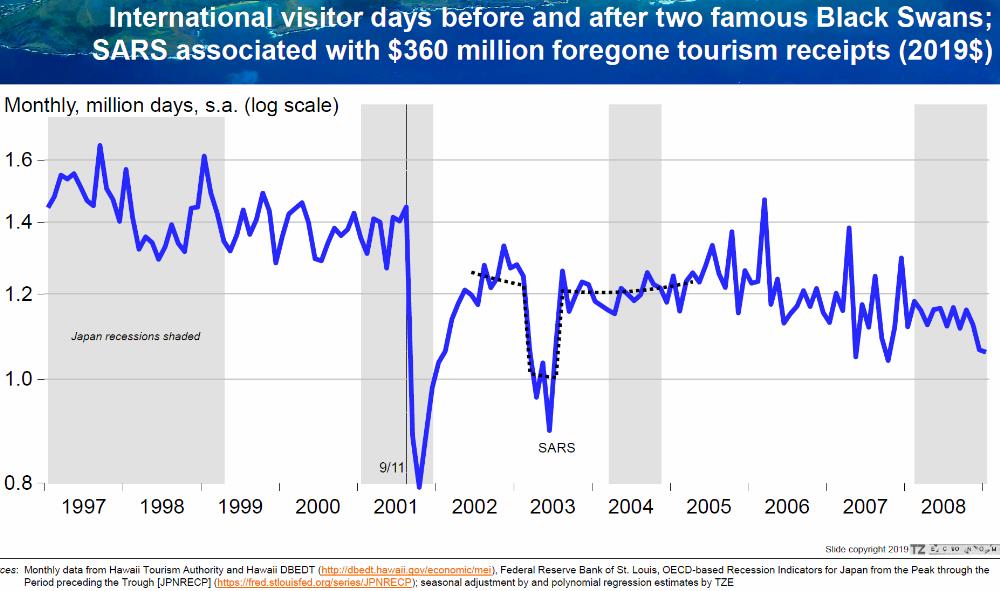

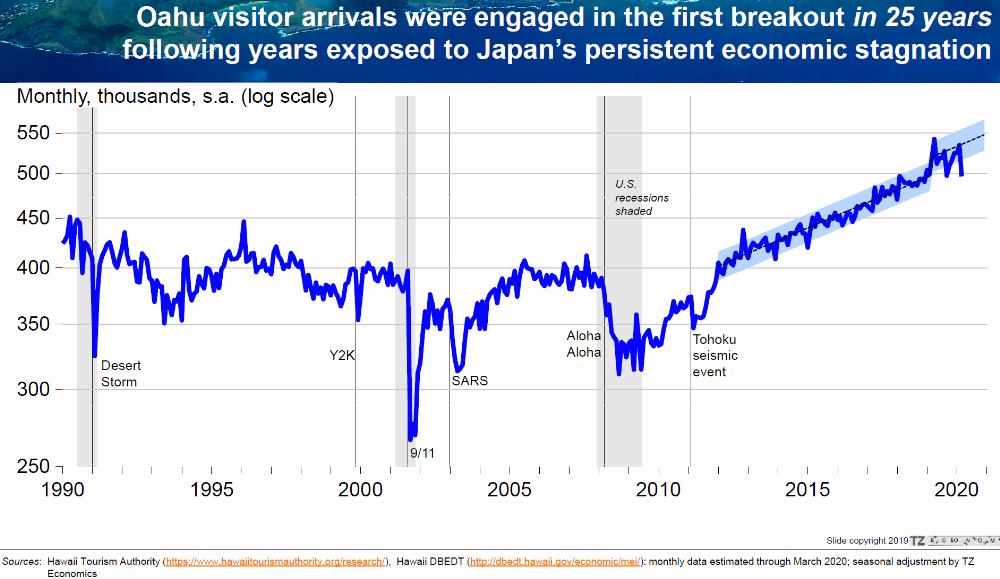

In comparison, the 9/11 event had a shockingly swift onset with a nationwide reach. The following graphs show how domestic arrivals on Oahu recovered within 7 months. Although, international arrivals took longer.

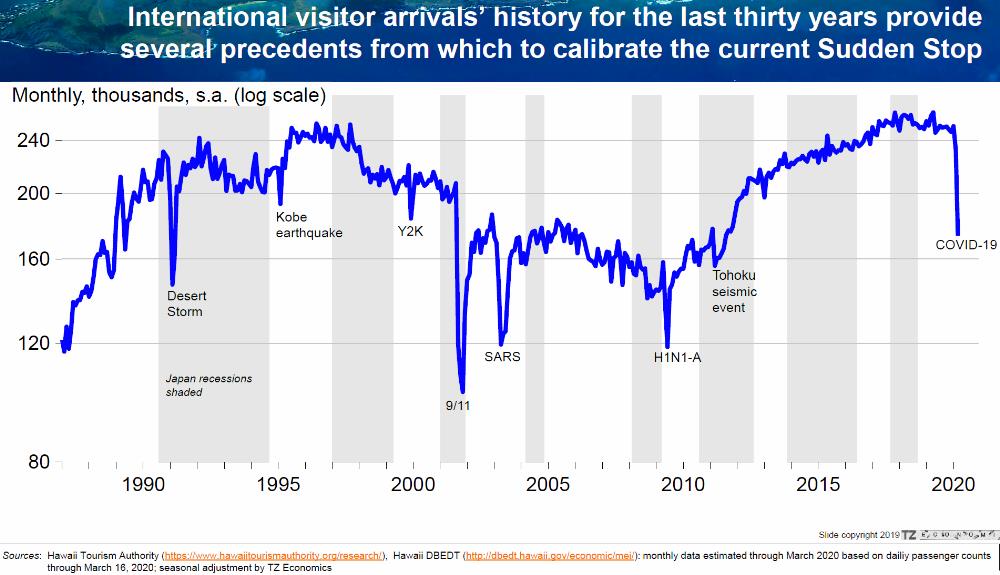

The SARS outbreak lasted from November 2002 to May 2004. International visitor days largely recovered within 10 months from the onset of the outbreak.

The Great Recession in the US officially lasted for about 19 months (December 2007 to June 2009). Visitor arrivals took close to 4 years to make a full recovery from the date of onset.

It appears that international visitor arrivals may have recovered sooner, within 24 months from the onset. (graph shows data through 3/18/2020)

Each shock event had a different impact on tourism. But how will COVID-19 affect Oahu real estate?

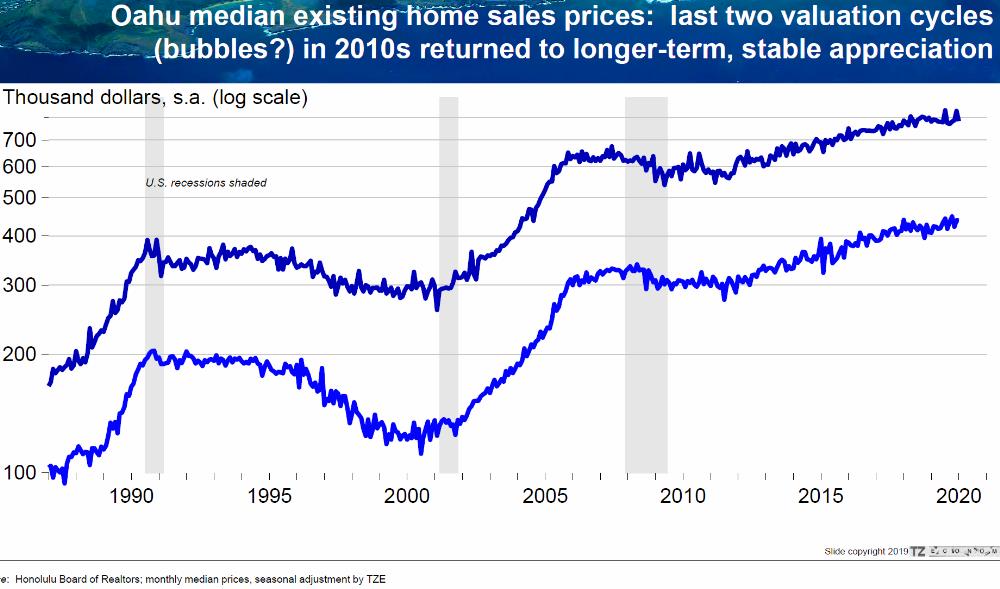

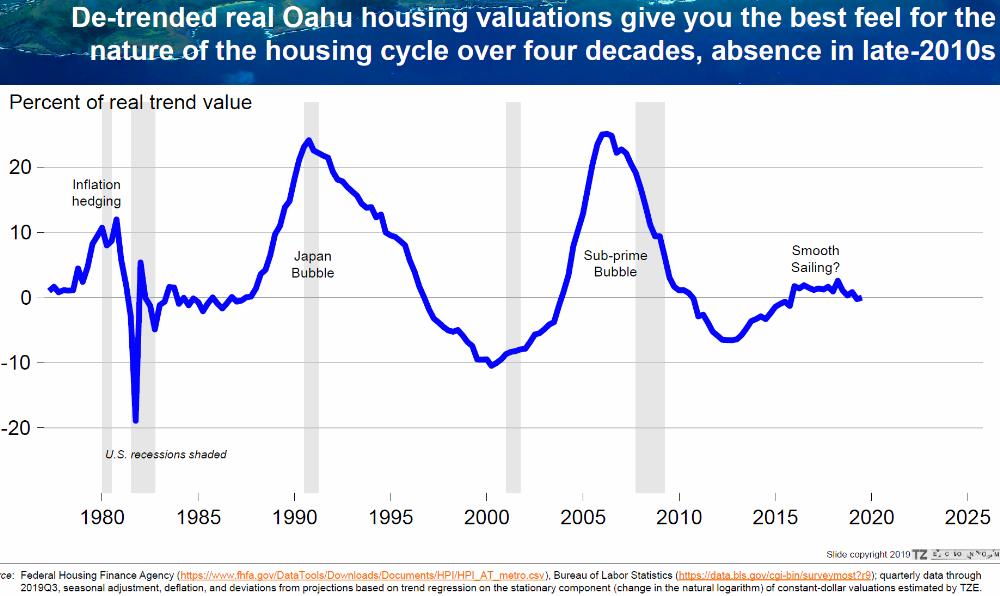

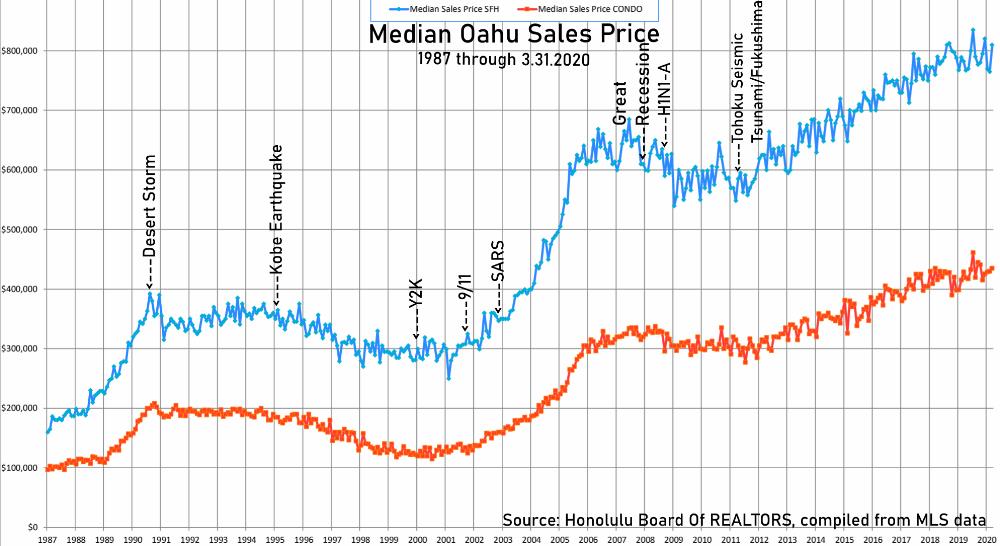

The Oahu median sales price experienced two distinct cycles with market peaks in 1990 and 2007/2008. Since 2010, there has been sustained stable price appreciation. (log scale graph):

Valuation trend changes have been minimal since 2010. – No bubble here.

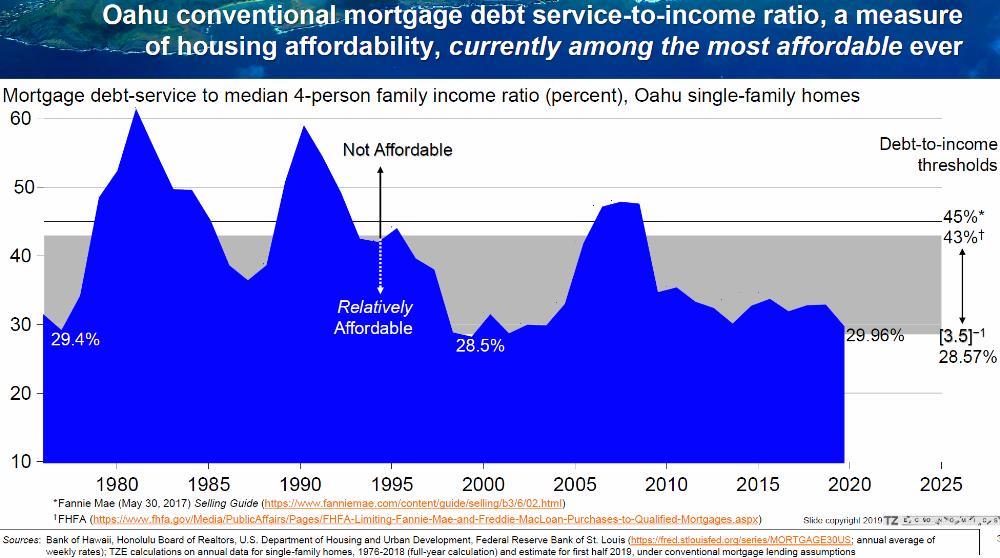

Housing Affordability for the local buyer in their respective local market is defined by the ratio of a) the mortgage payment (cost of financing at that time) to b) the median household income (at that time) at c) the median home price (at that time). The lower the ratio, the more affordable the market at that time.

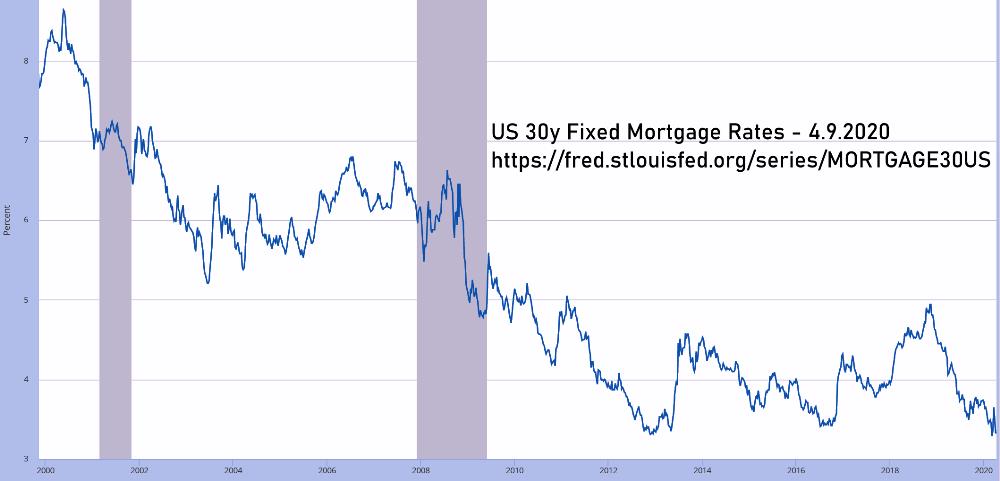

The following graph shows Oahu’s housing affordability through mid-2019. With the recent drop in mortgage rates, current affordability has just improved and now became the best since the 1970s.

However, unfortunately, affordability is meaningless for anyone that just lost their job and income.

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, April 9, 2020.

See related article: Oahu’s Housing Affordability – Trying To Time The Market?

Hawaii Real Estate – The New Normal

There is no doubt that the depth and the length of the economic lockdown will translate into slower demand and softer real estate values. The question is: how much softer?

While the Great Recession saw both stocks and US real estate values drop in tandem, Oahu real estate values stayed more resilient compared to other US states.

The following graph (linear scale) shows how Oahu median sales prices performed during previous Black Swan events.

Except during Desert Storm and the Great Recession, Oahu’s median sales price hardly budged during any of the other shock events.

The current economic crisis is like none other before. Perhaps the closest comparable shock is the Great Recession, at least when it comes to the swiftness of the onset and its global reach.

What about the ‘length’ of this crisis? And the ‘swiftness of recovery’?

Today’s speedy mortgage payment forbearance and deferment options for struggling homeowners will minimize the risk of defaults and foreclosures, while also protecting home values. In a year from now, nobody can say the Fed didn’t do enough.

The question remains: how long will it take to get back to normal?

Can we succeed with social distancing, scaled rapid testing, temperature checks, antibody testing, mandatory pre-boarding health clearances, face masks, contact tracing, quarantine, and strict isolation. Could the US achieve ‘containment’ by June 1st, 2020? (growth rate of COVID-19 cases stays <0.1%)

If yes, then is it possible that the US economy could recover within 6 to 12 months afterward?

Perhaps the scale of the current economic crisis is even greater than the Great Recession. But with strong COVID-19 monitoring in place, some of the current restrictions could gradually be lifted soon. Social distancing and mask-wearing will need to continue until a vaccine is developed. The Fed’s commitment and toolbox could bring today’s recovery quicker than the last one from the Great Recession.

Hawaii’s tourism might start to trickle back this summer, but a full recovery could take until the availability of a vaccine (12-18 months?)

UHERO’s report outlines prudent steps on how we could bring back Hawaii’s economy.

Conclusion

Hawaii’s real estate values are poised to be soft for several months because we will have a slower market with fewer buyers than sellers. How much values will soften depends on how long it takes before we collectively go back to work.

In particular, short-term rental properties will be most affected. These properties will hardly generate income unless repurposed for long-term renting, or until tourism comes back. Investors value rental properties based on their income potential. Short-term rental properties will be the last ones to recover.

See related article: The Risks Of Short-Term Vacation Renting

Overall, we do expect a quicker recovery this time compared to the Great Recession. There is no glut of housing supply, and Hawaii is still perceived as paradise. A recovery is imminent. Whether it is shaped like a ‘V’-, a ‘W’-, or a ‘square root’ makes little difference. Yes, there will be bargains during the next few months. Will you recognize them?

Follow rule #2, keep your immune system strong, stay safe, healthy, and nimble. Learn how to manage uncertainty. Because.., remember rule #1.

________________________________

We specialize in representing buyers and sellers of real estate in any market condition. Contact us when you are ready. We are here to help. ~ Mahalo & Aloha

There may be a lot of Airbnb places now on the market for sale. Is it reasonable to assume that there will be a 5% to 15% drop in prices over the next year with supply overwhelming demand?

If not, explain why not?

As a business valuator for portfolios that sometimes contain Hawaii Airbnb properties, I see a drop.

Aloha Eric Jordan!

Yes, it appears softer prices could be coming.

Airbnb properties have been coming on the market since City Ordinance, CO 19-18 took effect last summer cracking down on the ‘illegal’ short-term rentals. The Covid-19 economic lock-down will now add more of the ‘legal’ short-term rentals to the available inventory. There will be more sellers than buyers. Investors value rental properties based on the income potential, which will be limited for the next 12 months or so.

Stay safe and healthy.

~ Mahalo & Aloha

Aloha Eric Jordan!

Looking back, rule #1 was correct again: “Nobody knows what the future will bring.”

~ Mahalo & Aloha

Great article!

Thank you Diane Petty for your kind words!

Stay safe and healthy.

~Mahalo & Aloha