— A lot has changed since COVID took center stage. Here are some stats on how we are adjusting.

Consumer Behavior

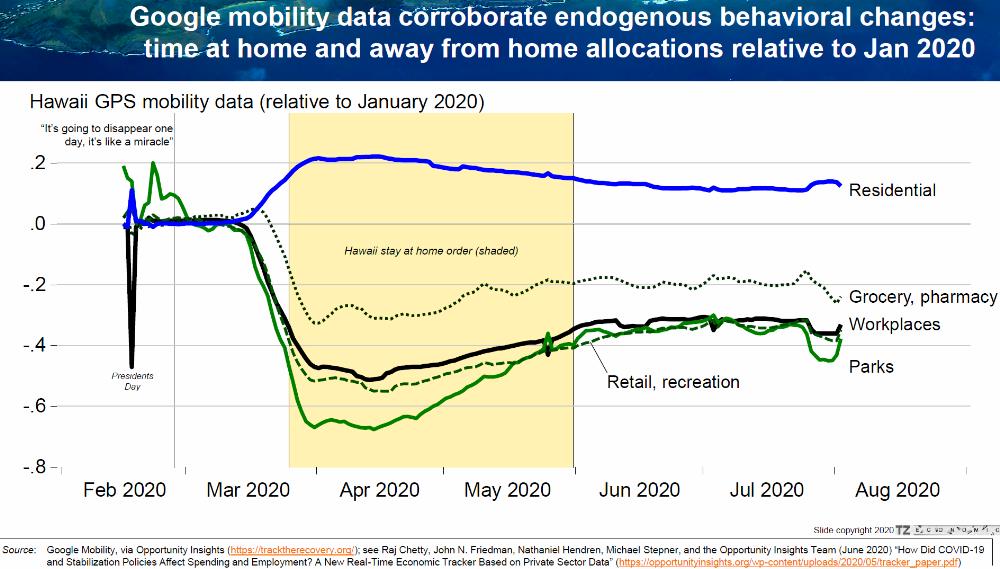

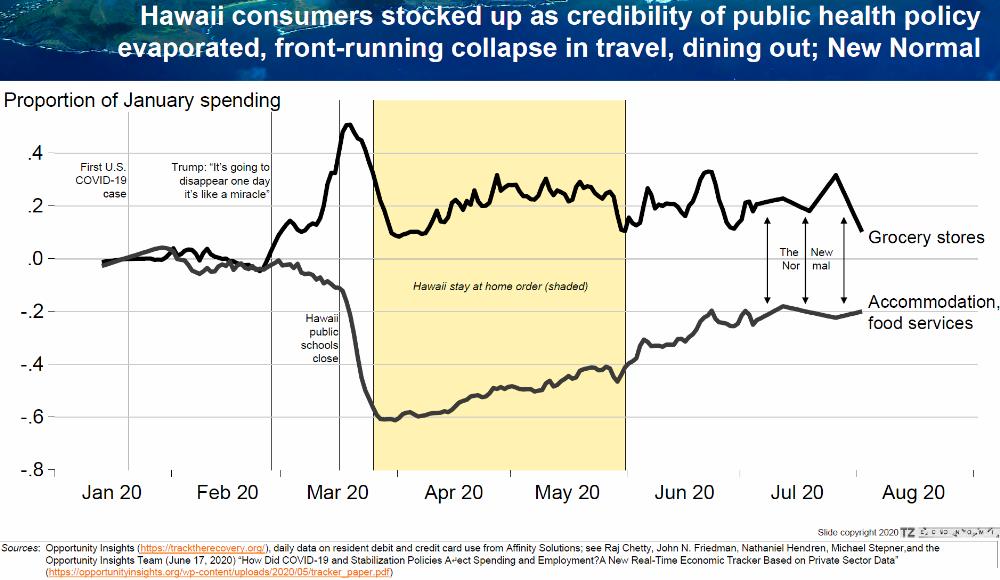

Courtesy of Paul Brewbaker, the following two graphs are from Paul’s 8.19.2020 PowerPoint presentation for the Honolulu Board of Realtors.

Google mobility data shows we are spending more time at home and less at the office/workplace:

Credit card usage data shows we are spending more money on groceries and less on dining out and travel:

- Could the current new normal turn into permanent behaviors after COVID subsides?

- How is COVID changing our housing preferences?

Oahu Real Estate

Both, Oahu homes and Oahu condos are remarkably resilient. However, lately, there has been a run on single-family homes that represents a new shift in Oahu’s housing trend as a result of COVID.

A couple of weeks ago a client of ours submitted an offer on a single-family home in Hawaii Kai that was listed just below $1Mill. The property received 8 (!) offers within a few days and sold substantially above the asking price. Seven buyers didn’t get a house and are presumably still looking to find a home below $1Mill in Hawaii Kai.

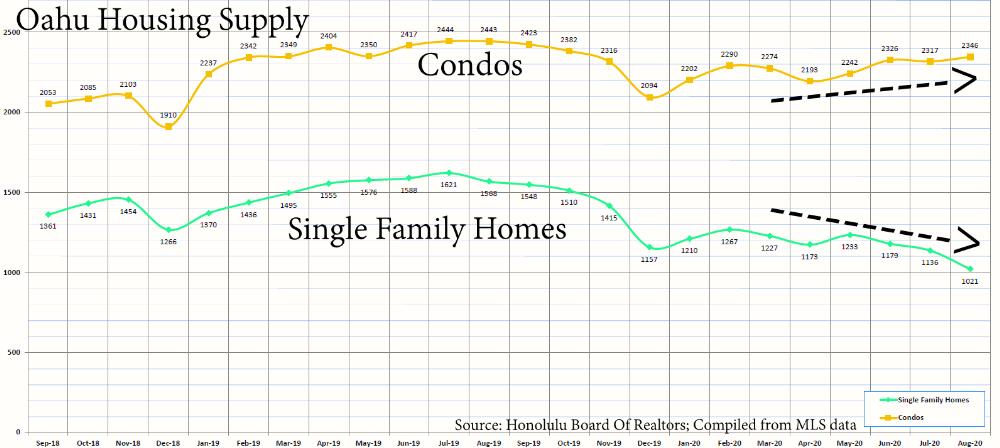

Supply

The most recent housing data through 8.30.2020 shows a severe shortage of single-family homes. The supply of homes has dropped a remarkable 35% since August last year and represents a multi-year record low.

See how the home inventory trend (green line) differs from condo inventory levels (yellow line).

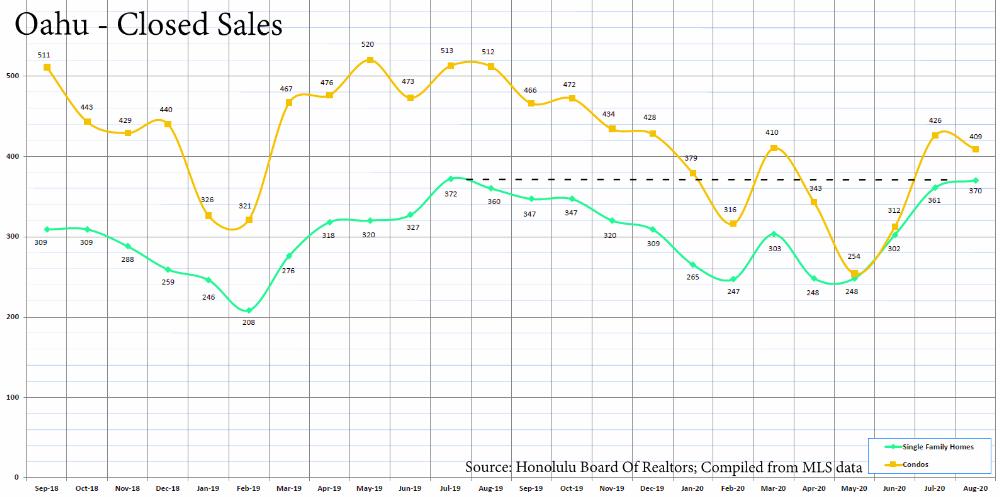

Demand

Demand is defined by how many homes and condos are selling, aka ‘Closed Sales.’ Despite high unemployment, single-family home closed sales are on par with summer 2019 peak numbers (see the dotted horizontal line between the green line peaks).

In contrast, condo closed sales numbers are about 20% shy of last year’s numbers (yellow line).

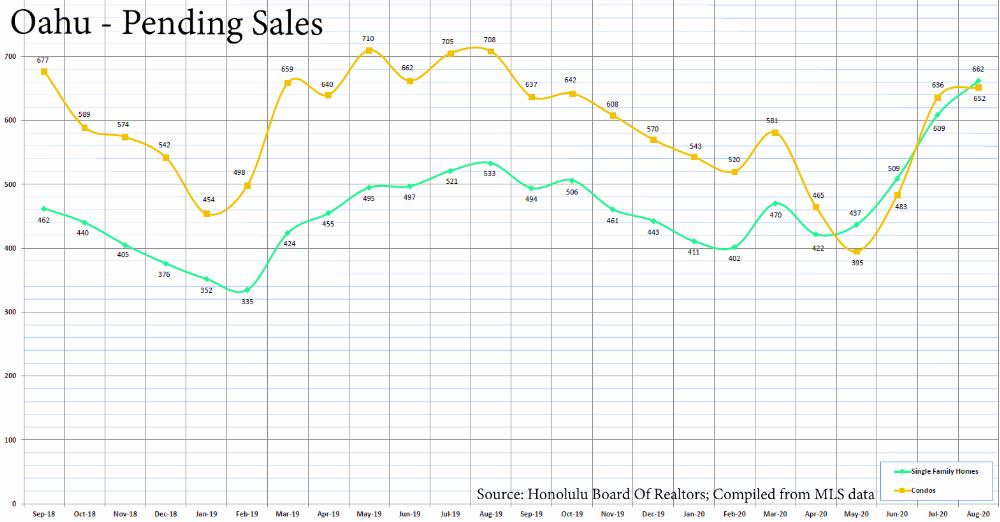

Pending Sales

The Honolulu Board of Realtors tracks the number of pending sales in any given month. It reflects the current buyer enthusiasm at that time and gives us a sense of future closed sales expected within the next 30 to 60 days. Granted, a few of those pending sales might not close at all.

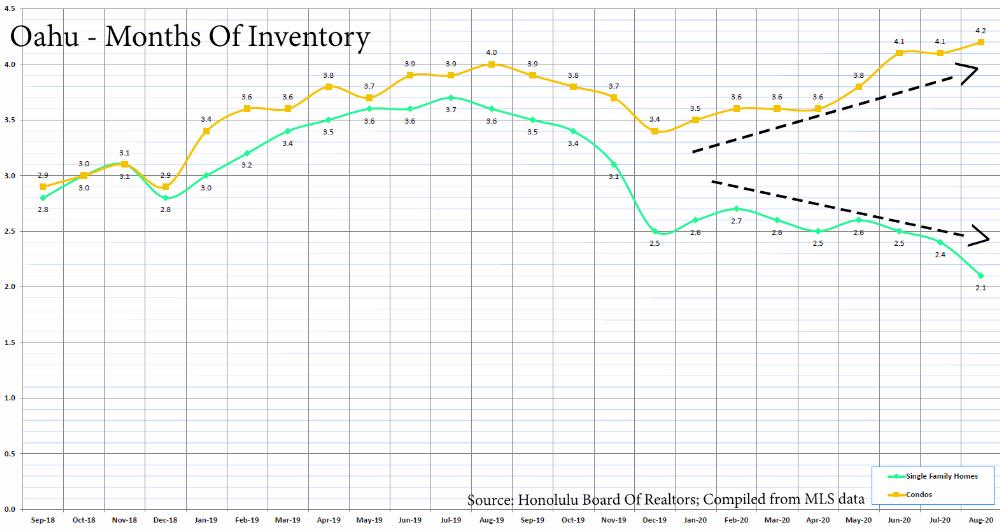

MRI

Months of Remaining Inventory (MRI) is the current number of active listings divided by the monthly closed sales rate. MRI combines both supply and demand into one number, giving us a measure of if the market speeds up or slows down.

In the past, a balance between a buyer’s and a seller’s market is typically observed when MRI hovers around 5 or 6.

This is where it gets interesting.

4.2 MRI for condos has been trending up steadily since last December (yellow line). The condo market is slowing down.

2.1 MRI for single-family homes has dropped to record low levels (green line). The single-family home market is on fire!

Since I became a licensed realtor in 1995, this is the largest spread ever between the single-family home MRI and condo MRI numbers.

Although only a snapshot in time, today’s decoupled MRI data suggests another jump in single-family home prices is possible. Condo prices are more likely to lag.

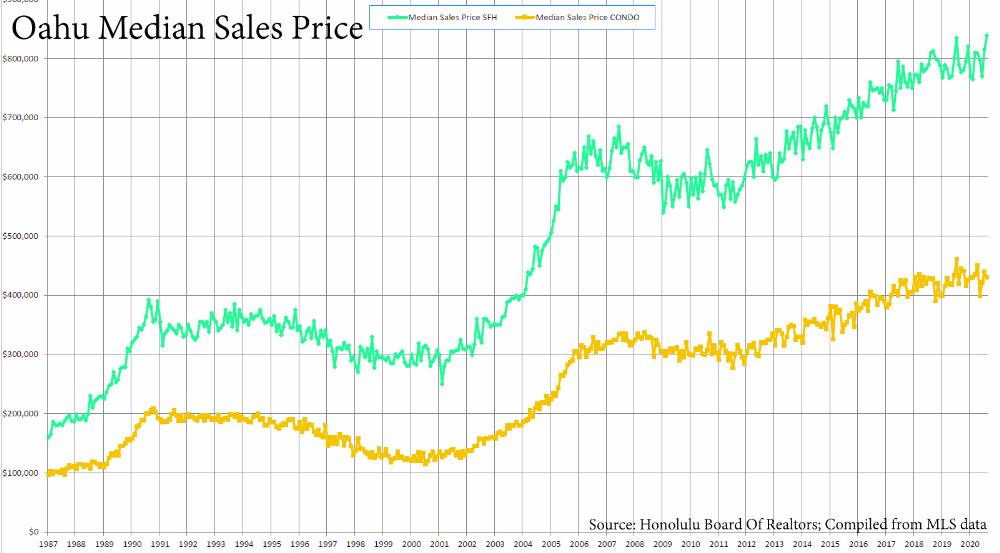

Median Sales Price

Single-family homes just hit a record high median sales price of $839,000 (green line). With record low MRI, could we see more record median sales prices in the next few months?

See related article: Market Update – Mid-Year 2020

Why?

How could this be, especially during a shattered economy with high unemployment?

Here are several potential reasons for this shift and the dramatic run on single-family homes instead of condos:

- Lower Density – Personal space and distance from neighbors are now considered paramount. – Who wants to share common condo amenities when you can have a home with a private outdoor garden, a home office, and a home gym? Sharing a condo elevator with an asymptomatic stranger or with someone cheating on their quarantine could be risky.

- Commuting has become obsolete. – The post-COVID world has increased opportunities to work from home. No need to drive to the office if the work can be done remotely.

- Record-low interest rates have lowered the affordability threshold. – Rates have dropped an entire percentage point since last year. That’s huge.

For anyone that has not lost their job, the increased purchasing power with today’s record-low interest rates has improved the odds of upsizing and buying a larger home.

- An 800K, 30y mortgage with a 3.5% interest rate translates into a $3,592.36 (P&I) payment per month.

- An 800K, 30y mortgage with a 2.5% interest rate translates into a $3,160.97 (P&I) payment per month.

- Or, ..you could now afford a $909,180 mortgage loan with a 2.5% interest rate, compared to an $800K mortgage at 3.5% last year with the same P&I payment.

In other words, the same monthly P&I payment can get you a mortgage loan that is 13.7% higher than last year. – A compelling reason for some to buy a larger house instead of a condo.

What Can We Learn From It?

Although the data is from the recent past, looking in the rearview mirror, it gives us an indication of what might happen. Knowledge can provide an edge to make better decisions when acting on opportunities.

Draw your conclusions and act according to your values and goals. As mentioned before, I’m only right 50% of the time, but here are a few possible scenarios:

- Be prepared for buyers competing against you when buying a house. If you want the house, you might need to step it up to get it.

- Once the shortage of supply and increased demand drives up home prices disproportionately, then unsuccessful buyers might again opt for condos.

- If the MRI for condos drops then condo prices might increase soon after.

- When COVID fears eventually dissipate than condo desirability will return.

See related article: Condo Or Single-Family Home

Conclusion

Single-family home prices are making new highs because of COVID, not in spite of it.

Nobody expected Oahu’s housing market to remain this resilient when COVID 19 started ravaging the economy earlier this year. However, markets can defy logic and change quickly. – Sign up for our email updates and stay in the know.

We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition.

If you are thinking about buying or selling. – Contact us today. We are here to help. ~ Mahalo & Aloha

________________

Disclaimer: We are a real estate brokerage selling real estate and not investment securities. History is not an indication of future returns. With important investment decisions, always check with your favorite qualified financial planner, accountant, tax adviser, and attorney.