Every week we receive dozens of inquiries about Waikiki condotels. Including a 9:46 pm phone call last week from China by a gentleman who “wants to buy about ten condotel units and is starting his preliminary research.” He is convinced that “there should be plenty of deep discount bargains available for him to pick up.”

That’s the expectation that many seem to have, especially with condotels during the ongoing COVID crisis. It appears, there are many ready and willing buyers, more than ever, waiting for the right moment and price to pull the trigger. All have high hopes for substantial financial rewards.

Let’s examine the condotel market dynamics to determine:

- Where are those deep discount bargains?

- Who of those ready and willing buyers will buy and strike gold?

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” ~Taylor Pearson

High ambitions are useful. But how realistic are expectations? Instead of possibilities with wishful thinking, are we considering the probabilities of certain outcomes to make better decisions? What could go wrong?

- Tourism and the condotel revenue recovery might take longer than expected.

- The deep discount bargains might be more elusive than expected.

Both statements seem to contradict each other. How could both be true?

I don’t have a crystal ball, and I don’t want to blow anyone’s dream bubble.

We write this blog so that you may benefit from unique, valuable, and relevant insights to make smarter decisions. Don’t fall for false promises, overhyped expectations, and get rich quick schemes. With the right mindset, the proper plan, and decisive execution you will succeed.

________________________________

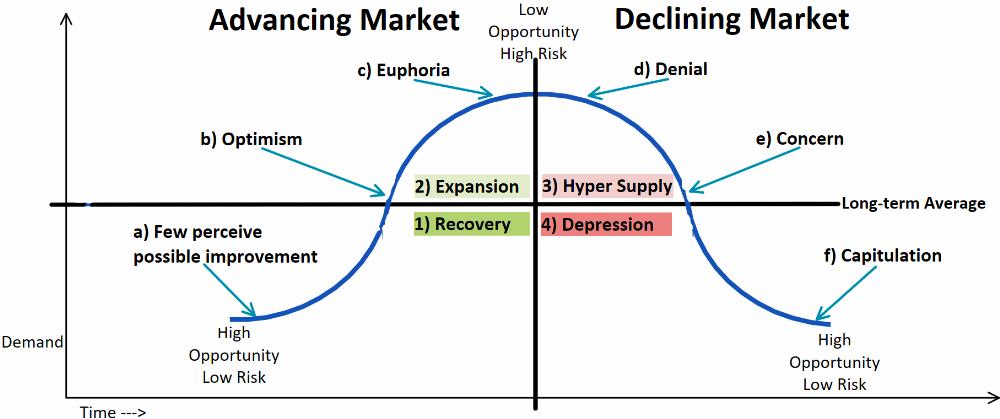

Four Phases Of A Market Cycle

Real estate markets often cycle through advancing and declining, depicted with the four quadrants:

- Recovery

- Expansion

- Hyper Supply

- Recession

In simple terms, ‘advancing’ represents increasing demand which could lead to rising prices and a seller’s market. On the other hand, ‘declining’ represents dwindling demand which could lead to lower prices and a buyer’s market.

- Buyers tend to experience three stages during Advancing Markets:

a) Only a few buyers believe improvement is possible and cautiously start buying.

b) Optimism – buyers realize that improvement is taking place and represent an opportunity.

c) Euphoria – everyone concludes everything will get better forever.

- Sellers tend to experience three stages during Declining Markets:

d) Denial – Perhaps this is just a short-term blip.

e) Concern – This can’t be true. How long will it take, and how deep will it get?

f) Capitulation – I can’t stand the pain any longer. I just want out.

See related article: How Will This Story End?

In our Market Cycle diagram, the left axis represents demand. That is ‘how many buyers are buying condotels.’

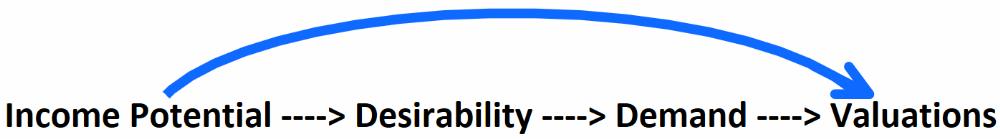

Condotels are primarily being bought by investors for income potential. Granted, we sold a few condotels for lifestyle only where the income potential seemed irrelevant to the buyer.

However, most condotel buyers seek to fulfill a hybrid goal: cash flow and lifestyle. That is ‘Income, plus having a vacation home.’ The income potential drives desirability, which drives the demand, which drives valuations.

That’s why cash flowing condotels have been increasing in value while others are not.

See related article: Condotel Reality – Cash Flow vs Lifestyle

________________________________

If condotels typically have been valued for the rental income potential, then where are all the condotel bargains?

That reminds me of the Fermi paradox; there are 300 Million rocky planets in our Milky Way galaxy within the goldilocks habitable zone around stars like our sun. So where are all the aliens?

We don’t know where aliens hang out, but we have an idea of what you might be able to expect with condotels. We are here to help you with the decision process for finding the elusive bargains. The final result might look different than what you think.

We previously discussed the value of expert predictions here. Nobody knows how it will all play out. However, here is what we know now:

Three Markets?

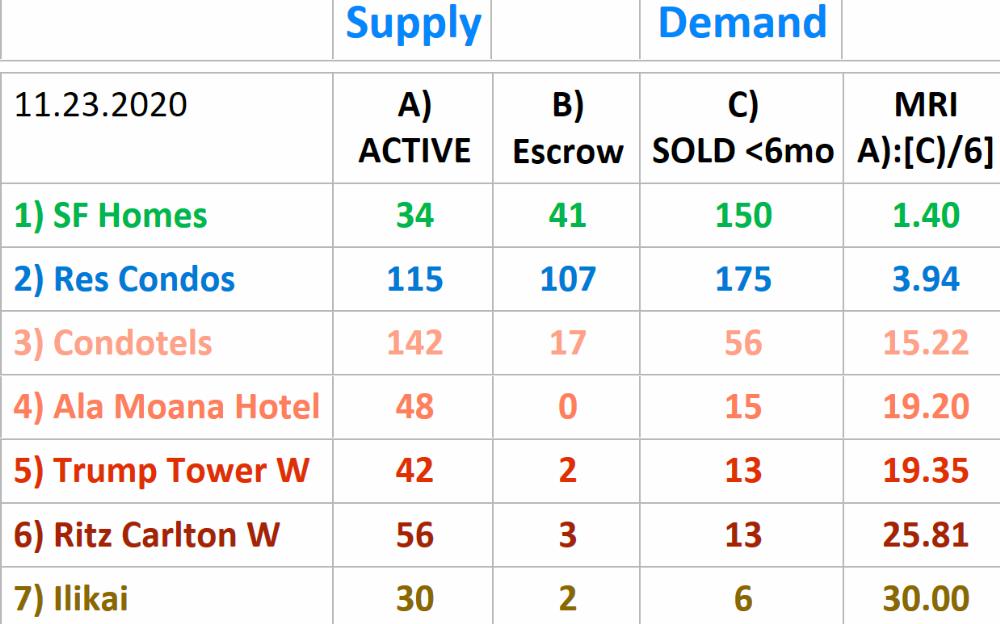

The table below shows Supply and Demand for three Honolulu sample market segments to demonstrate the current divergence.

- Single Family Homes – Honolulu <$1.1Mill (excellent & above average condition)

- Residential Condos – Kakaako, Ala Moana, Makiki <$800K (excellent & above average condition)

- Condotels – Waikiki <$800K (excellent & above average condition)

Besides the 3) Condotel proxy, the table also shows data for some of the largest condotels in Honolulu: 4) Ala Moana Hotel, 5) Trump Tower, 6) Ritz-Carlton, and 7) Ilikai.

- Supply is defined by A) Active listings.

- Demand is defined by C) Sold during the last 6 months.

- B) In Escrow indicates properties that are expected to record shortly.

The table shows a snapshot in time on 11.23.2020 and uses data compiled from the MLS.

The last vertical column shows Months Of Remaining Inventory or MRI. That’s the current number of active listings divided by the monthly closed sales rate. Active divided by (Sold/6).

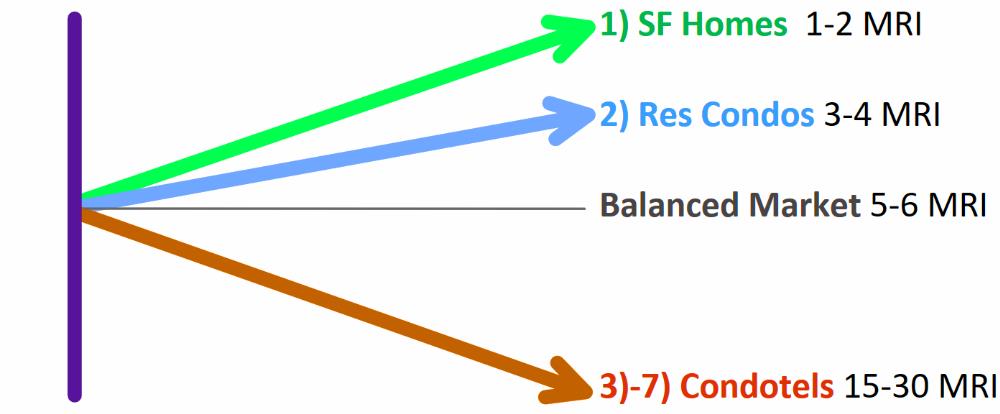

- MRI between 5-6 typically represents a balanced market.

- Lower MRI means that there is low inventory that is selling fast, aka a seller’s market.

- Higher MRI means that there is plenty of inventory that is selling slowly, aka a buyer’s market.

________________________________

A Modified K-Shaped Recovery?

The Chamber of Commerce describes the US economy as experiencing a K-shaped recovery.

A portion of the economy, including technology, e-commerce, and some retail fully recovered and are flourishing. But restaurants, travel, and hospitality still suffer.

Similarly, we discover that Honolulu SF Homes are selling like hotcakes, that is because of COVID, not despite it. Residential Condo sales are robust and resilient. However, Condotel sales are soft and remain out of favor for obvious reasons.

The three Honolulu sample market segments shown above reflect a modified K-shaped recovery where SF Homes and Condos splinter higher while Condotel demand remains soft. – No surprise here.

See related article: COVID Split The Market: Homes Are Hot – Condos Are Not

________________________________

Two Crisis’ Tales: 2009 vs 2020

During the 2009 Great Recession, condotel revenue dropped by roughly 50%. In a few extreme cases, e.g. the Ala Moana Hotel, condotel prices eventually mirrored that drop with a whopping 50% slide in valuation. Other condotels, e.g. the Ilikai fared much better and prices softened by only 25% (2007 to 2011).

During the 2020 COVID crisis, condotel revenue dropped roughly 94-100%. – Why haven’t condotel prices collapsed? What is different today?

________________________________

— Financing Leverage – Skin In The Game?

The Ala Moana Hotel Condo was converted into the largest condotel in Hawaii with 1,150 condotel units. The majority of units are small studios with less than 300 sqft and no kitchen. Before the 2009 financial crisis, investor condotel financing was readily available at 80% (!) LTV, even for units without a kitchen!

Leverage cuts both ways. When income revenue dropped, cash flow turned negative and investor owners lost their appetite for paying their mortgage. Prices started sliding. Once 20% equity evaporated, investor owners walked away. With no skin in the game and little prospects of an imminent recovery, there was no incentive to keep a losing investment. Lenders started foreclosing, inventory levels shot up, prices eroded further and the downward spiral turned into a vortex.

That’s when mortgage lenders learned their lesson:

- Condotel financing is risky business.

- There are no winners when foreclosing.

Since the 2009 Great Recession, mortgage lenders increased their minimum cash requirement for condotel financing to 30% and even 35% since COVID. That is for units with a full kitchen. Financing for condotels without a kitchen has mostly vanished since.

As a result, there is far less risky financing leverage in today’s condotel market compared to 2009.

________________________________

— Deferment And Forbearance Instead Of Foreclosures

Both, the Fed and the banks are committed to preventing a downward spiral repeat. Because foreclosures magnify stress and pain in a weak economy, they should be avoided at all costs.

Contrary to 2009, this time lenders have been quick and generous to offer COVID mortgage assistance with hassle-free deferment and forbearance options. In some cases, mortgage lenders call and ask, “would you like to get a 3-months mortgage deferment extension?” – Done. Simple. Over the phone.

It’s a strange world today, but effective in preventing another market collapse.

See related article: Confessions Of A Real Estate Investor

_________________________________

— Price Viscosity

Viscosity is the measure of resistance to flow or to move.

Stocks and ETF mutual funds are highly liquid investments. They get traded by the millions, in real-time during market hours with a mouse click and virtually $0 transaction costs. That’s why stocks on occasions can, and do drop by 10+% value in a single day.

Real estate is hardly liquid. It takes prep time to list a property, marketing time to get it into escrow, and an additional 30-60 days to close the sale. Property prices tend to be less fluid, more sticky, and respond slower to supply and demand changes.

Condotel prices are poised to remain soft. But by how much depends on how long. – Which brings us to time…

________________________________

— Time Distortions And False Hopes

“The first 90% of a project is a lot easier than the second 90%.”~ Tim Sweeney

All of us can’t wait for a speedy recovery. But when and how exactly it will play out is unknown. Welcome to becoming comfortable with uncertainty.

See related article: COVID 19 – Hawaii Real Estate

Our brains are wired to look for patterns and use past experiences and narratives, trying to make sense and extrapolate how the future might unfold. – Are we 20%, 50%, or 80% through the crisis?

Condotel prices are remarkably resilient because sellers have been holding out for the hope of a defined imminent end of the crisis. As a result, sellers have not capitulated yet. Of course, there is no guaranty of when that day will come.

Here is the sequence of false hopes that have been stringing investors along and continuously moved the recovery goal post:

- March 2020: It took China 4 months (Jan through April) to get the virus under control. – We could expect the same from March through June, and be back to normal by July’s peak summer travel season? – Fail

- July 2020: Tourism will come back as soon as the HI travel ban will be lifted in August…, September…, October? – Fail

- October 2020: Tourism will come back once we get a vaccine before election day…, November…, December…, peak holiday travel season? – Fail

- November 2020: Tourism will come back after vaccinations are readily available, and as a result, travelers get comfortable seeing COVID numbers decline in early 2021?

- November 2020: Tourism will come back when 70% of the US population will be vaccinated and herd immunity is reached, now expected to be May 2021?

This looks like wishful thinking. False hopes have come and gone and might continue to get shattered during early 2021. Condotel owners so far appear to be mostly in the ‘denial’ and ‘concern’ phase, hoping for the crisis to end soon.

It’s difficult to predict when property owners with vacant rentals reach their breaking point. The timing and size of a 2nd economic stimulus bill could make a difference. So far, hardly any capitulation yet. – Is the glass half-full or half-empty?

________________________________

Talkers And Doers

Enthusiasm and ambition are great. But willingness without action amounts to hot air. Unless you have been to Hawaii and have previously seen the different condotel buildings, the odds are somewhat lower that you buy. That’s regardless of how many P&L statements you scrutinize.

You might be the exception, one of the few that is ready willing, and able to prove us different.

During COVID, the Pareto 80/20 principle, the ‘law of the vital few’ is at work. About 20% of the ready and willing buyers, waiting for the right moment and price to pull the trigger are buying. The remaining 80% are waiting and waiting.

We will only know afterward when the advancing market turns into the 2nd stage. Eventually, it will manifest itself to the masses. Then the competition gets fierce and the bargains are gone.

“You must build up your life action by action, and be content if each one achieves its goal as far as possible—and no one can keep you from this.” ~ Marcus Aurelius

We believe that Hawaii tourism will rebound and eventually exceed the previous peak. We believe that unique opportunities are currently developing in the condotel market for the astute and patient investor.

To seize the opportunity, you must…

- Be content with the risk that cash flow will remain substandard for several months.

- Have enough financial staying power to endure the current substandard cash flow.

- Be ready to strike quickly.

Q: When is the best time to buy condotels to get the lowest price?

A: Anytime during the next 6 to 12 months.

But only if you submit an offer because the list price often does not reflect the seller’s true motivation. Instead, the list price may only reflect the seller’s denial, hope, and wishful thinking. Unless we submit an offer we will not be able to test the seller and get the deal.

Q: Which condotels are the best bargains?

A: Contact us for today’s Top 5 that match your budget.

We bought and sold countless Waikiki condos and reviewed hundreds of income statements over the years. We know why some buildings and some units perform better than others. We have a knack for identifying the best deals in the top buildings.

Not abundant, but opportunities are present when you know where to look.

In general terms…

- We do not recommend buildings with excessive fixed fees because they will eat your lunch and clean you out in a down market.

- We do not recommend buildings where property management options are limited or restricted.

- We only recommend Fee Simple, not leasehold. With the certainty of Newton’s law of gravity, all leasehold values will drift towards zero.

That shortens the list from hundreds of condotels to a select few suitable options that we are willing to recommend. – Are you ready to proceed?

“Remember six rules: Trust yourself, Break some rules, Don’t be afraid to fail, Ignore the naysayers, Work like hell, and Give something back.” `Arnold Schwarzenegger, commencement speech 2020

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit, and we love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support, and we are dedicated to constant learning and growing with you. ~ Mahalo & Aloha

Hi,

Very good article about condotels. I am interested in this opportunity and want to investigate further. I am impressed with the Ala Moana hotel due to my many stats there and the location is perfect. Is this condo on your preferred list? What is the income statement for this condo as a rental?

Thank you,

Douglas Ching

Aloha Douglas Ching!

Although some of the Ala Moana Hotel units are priced low, the maintenance fees are a bit high.

What is your budget? We have some other ideas with better cash flow that could be of interest.

Also review:

https://www.hawaiiliving.com/blog/waikikis-condotel-reality-cash-flow-vs-lifestyle/

– Call us when you are ready. We are here to help. ~ Mahalo & Aloha