- If you are already familiar with HARPTA & FIRPTA and just want to avoid the pitfalls, then scroll down to the bottom to ‘The Tax Office Claims That The Withholding Is Delinquent!’ Check the real life stories with lessons learned and tips to keep you out of trouble.

- However, if you are new to HARPTA & FIRPTA, then read on:

Regardless where you live or where you are from, buying Hawaii real estate is simple. However, when you sell your property, then it makes a difference where you live. You might be subject to tax withholdings when you are not residing in Hawaii at the time of the sale.

Both, the state of Hawaii and the federal government had previously been missing out for years when out of state and out of the country property owners sold their Hawaii properties and failed to pay their capital gains taxes.

As a result, HARPTA (Hawaii Real Property Tax Act) and FIRPTA (Foreign Investment in Real Property Tax Act) tax laws were established to prevent the loss of tax revenue.

Other states, e.g. California, have similar withholding state tax laws. This isn’t uniquely cooked up in Hawaii.

The tax withholding laws don’t replace or increase the actual capital gains tax that is due. They are merely a mechanism to withhold a sufficient amount larger than the actual tax due. It’s to prevent the seller from riding off into the sunset without ever paying the tax.

Technically, it’s the buyer’s responsibility to make sure the seller’s withholdings are mailed to the tax office. But in reality, the escrow company withholds from the seller’s proceeds and sends the funds to the tax office. This is per the terms P-1 & P-2 of the standard Hawaii Real Estate Purchase Contract.

________________________________

HARPTA

HARPTA applies when you don’t live in Hawaii at the time when selling your Hawaii property.

HARPTA is a Hawaii State law (Hawaii Revised Statutes sec. 235-68). It requires withholding of 7.25% of the sales price (not of the gains) (formerly 5% until 2018)

The seller must provide the buyer with affidavit Form N289 certifying where the seller lives.

The seller is exempt from the HARPTA withholding when the seller certifies that he/she is:

- a Hawaii resident person or entity (includes resident aliens), and

- a Hawaii taxpayer, with the seller’s home address and taxpayer ID number.

Other Exceptions to the HARPTA Withholding Requirement:

- If the seller does not realize a gain or loss with the sale, e.g. 1031 exchange. Or,

- If the property was used as the seller’s principal residence for the year before the sale and the sales price is $300K or less. Or,

- If the seller is an out-of-state corporation registered to do business in Hawaii and current on HI tax payments.

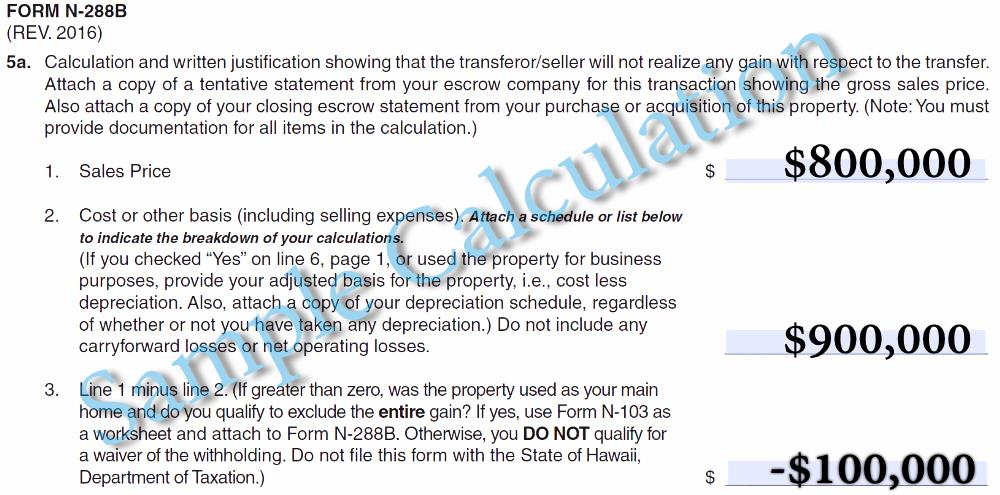

Immediately after opening escrow, the seller may also submit to the tax office the application Form N-288B for a ‘waiver’ or ‘adjustment’ of withholding:

- If the seller can prove that he or she will not realize any gain from the sale. Or,

- That there will be insufficient proceeds to pay the withholding required.

The tax office may take up to 10-business days to process and approve the N-288B application. If the tax office approval is not obtained before closing, then escrow must send the withholding to the tax office.

Seller’s Refund of HARPTA Withholding:

After the closing date, the seller may file:

- Form N-288C for a tentative refund of withholding, but only if Form N-15 is not yet available.

- Form N-15 annual state tax return when available. Even if the seller already filed Form N-288C, the seller must file Form N-15 for the tax year reconciliation.

Most HI tax refunds take 4-8 weeks and a few take as long as 16 weeks. All HARPTA Forms with filing instructions are available here.

_________________________________

FIRPTA

FIRPTA applies when you don’t live in the US at the time when selling your Hawaii property.

FIRPTA is a federal law (26 U.S.C. sec. 1445). It requires a withholding of 15% of the sales price (not of the gains). (Formerly 10% until 2/16/2016).

FIRPTA is in addition to the HARPTA withholding.

The seller must provide the buyer with an affidavit certifying where the seller lives.

The seller is exempt from the FIRPTA withholding when the seller certifies that he/she is:

- a US resident person or entity (includes resident aliens), and

- a US taxpayer, with the seller’s home address and taxpayer ID number.

Other Exceptions to the FIRPTA Withholding Requirement:

- If the seller is an out-of-the-country corporation registered to do business in the US and current on US tax payments. Per sec. 897(i), the certification must include a copy of the IRS’s acknowledgment of the election received. Or,

- If the buyer intends to occupy the property as their principal residence for the next 2 years after the closing date, the required FIRPTA withholding is reduced as follows:

a.) 10% of the sales price for properties sold between $300,001 to $1Mill.

b.) 0% of the sales price for properties sold up to $300,000.

Immediately after opening escrow, the seller may also file IRS Form 8288-B and apply for a withholding certificate. The seller must notify the buyer in writing that the certificate has been applied for before the closing date. The IRS approval may grant a ‘waiver’ or ‘adjustment’ of withholding, when:

- The seller is exempt from U.S. tax, or nonrecognition treatment applies.

- The seller’s maximum tax liability is less than the tax required to be withheld.

- The seller sells under special installment sales rules. (Sec. 7 of Rev. Proc. 2000-35 allow for reduced withholding)

- There will be insufficient proceeds to pay the withholding required.

- The seller enters into an agreement with the IRS for the payment of the tax.

The IRS response ‘withholding certificate’ or a ‘denial letter’ often take within 90 days from submitting the 8288-B application. Sometimes the IRS takes as long as 6 months.

A withholding certificate issued before the closing date means reduced withholding or no withholding is required. A denial letter before the closing date means withholding must be paid to the IRS within 20 days after the closing date.

If the application Form 8288-B was submitted to the IRS before the closing date, but there is no IRS response by the closing date, then escrow should temporarily withhold and wait for the IRS response before making the payment. Once the IRS issues the certificate or the denial letter, then the appropriate withholding must be paid to the IRS within 20 days after the IRS response date.

When FIRPTA withholding is required, the buyer completes Form 8288, together with 8288–A for each seller from whom the tax has been withheld. Escrow mails to the tax office the withholding with the completed Form 8288 and copies A and B of Form 8288–A. The Buyer keeps Copy C for their records. The IRS will mail a stamped copy B of Form 8288-A to the seller.

Seller’s Refund of FIRPTA Withholding:

After the payment of the withholding to the IRS, the seller may file:

- For a tentative early refund, if the withheld amount exceeds the maximum tax liability, but only if the U.S. income tax return (e.g. Form 1040NR or 1120-F) is not yet available. The seller must first get a withholding certificate before applying for an early refund. There is no particular form, except the early refund application must include the following in separate numbered paragraphs:

- Seller’s name, address, and U.S taxpayer ID number;

- The amount to be withheld as per the IRS’s withholding certificate;

- The amount withheld (box 2 of Form 8288-A, a copy must be attached);

- The amount to be refunded.

The seller must mail the application for the withholding certificate and/or for an early refund to: Ogden Service Center, PO Box 409101, Ogden, UT 84409

- U.S. income tax return Form 1040NR or 1120-F when available and attach the stamped Form 8288-A to receive credit for any tax withheld. Even if the seller already filed for an early refund, the seller must file 1040NR or 1120-F for the tax year reconciliation.

Most federal tax refunds take about 90 days. Some take up to 6 months. All FIRPTA Forms with filing instructions are available here.

________________________________

Keep Your Records For 5 Years

According to one escrow company, if the seller only recently moved away within less than 180 days of the sale, then the seller might still be considered a resident person and be exempt from the withholding.

The buyer may rely on the seller’s certification of the ‘nonforeign status’ for FIRPTA, and the ‘Hawaii resident status‘ for HARPTA. However, if you are the buyer and you know that the certification is false, then you could be on the hook to pay the withholding! Keep the seller’s certification on file for at least 5 years from the date of sale.

The IRS requires the buyer’s tax ID number on Form 8288 at the time of purchase. Foreign buyers without an existing tax ID number must apply for an ITIN (International Tax ID Number). Some passport notarization services and local CPA companies that are qualified as a CAA (Certified Acceptance Agent) can notarize the foreign buyer’s passport and help obtain an ITIN for the buyer.

As long as the foreign buyer does not generate income in the US, the buyer is not required to file annual tax returns. That is until the buyer sells the property.

These are the basics. This is dry stuff and we won’t bore you with additional technical details, except, we live in an imperfect world. What could go wrong?

The Tax Office Claims That The Withholding Is Delinquent!

Imagine weeks after you closed on your purchase, you get a letter from the IRS or the Hawaii tax office claiming that you owe big bucks because the required withholding hasn’t been received!? – Surprise.

According to Hanlon’s razor, “we should never attribute to malice what could adequately be explained by incompetence or stupidity.”

You will need to call the escrow company and request a copy of the cashed check as proof that the withholding was indeed mailed and cashed by the IRS or the Hawaii tax office. Mail the evidence to the requesting tax office and hope that they can get their records straight. We have seen glitches with both the IRS and the Hawaii tax office.

We are all human and make mistakes, not just the tax office. We’d like to share three real-life Hawaii real estate transactions where seemingly careless actions caused some unintended consequences.

________________________________

We Want You To Avoid The Pitfalls

We write this stuff so that you may benefit and keep yourself out of trouble. Always check with your favorite qualified tax professional for your particular situation. We are expert realtors ready to assist when you are ready to buy and sell real estate, but we are not tax advisors.

Three Real Life Stories:

1) Owner Moves To The US Mainland, Rents His Principal Residence Before Selling, And Files N-288C Instead Of N-288B Before Closing

This owner wanted to test-drive mainland job opportunitiesfirst, before committing to selling his Hawaii principal home. He rented out his home for 1 year. When the tenant vacated, the owner was ready to sell his Hawaii home so that he could buy his next home close to his new job.

Although, the owner/seller had a tenant for one year before the sale, the IRC sec. 121 Capital Gains Exclusion – Tax Exemption still applies to exclude gains of up to $250K for an individual tax filer (or up to $500K for married filing jointly). That’s because the owner lived in his principal residence for at least two years out of the last five years before selling. He also did not use the sec. 121 exclusion during the 2 years before the sale.

See related article: Real Estate Tax Benefits

Therefore, no Capital Gains taxes should be due. However, the seller is no longer a Hawaii resident. The tax office must approve a HARPTA exemption application to avoid withholdings.

Typically the owner would file Form N-288B (Application for Withholding Certificate for Dispositions by Nonresident Persons of Hawaii Real Property Interest) with original wet signatures together with Form N-103 (Sale Of Your Home). The application requires supporting documents including an estimated closing statement for this sale. The best time to file is immediately after opening escrow. The tax office approval takes up to 10-business days and must be obtained before closing.

But the owner was too busy and ran out of time to mail in the completed N-288B application during escrow. At closing, escrow withheld 7.25% of the sales price and sent it to the tax office. The owner/seller decided to file Form N-288C for a tentative refund of HARPTA withholdings immediately after closing. This works ok with investment properties and takes a few weeks for the tax office to process.

Except, when you sell your principal residence you cannot use Form N-288C together with Form N-103 after closing. – Oops.

The closing date was at the beginning of the year. Without the possibility to file for a tentative refund immediately after closing, the next opportunity to claim a refund is by filing the N-15 Individual Income Tax Return for a non-resident or part-year resident.

But filing N-15 isn’t available until the beginning of the next year! How do you feel about waiting for a refund of your 7.25% withholding for a full year? – Double oops. So much for planning to buy a new home with the proceeds of the sale.

Lesson Learned And Tip To Avoid The Pitfall:

If you are eligible for the HARPTA exemption, then file N-288B early during the escrow time to prevent HARPTA withholdings at closing. Trying to claw your refund back from the tax office after closing will seem like waiting for Godot.

________________________________

2) Owner Does Not Correctly Calculate The ‘Adjusted Cost Basis’ Or Does Not Provide The Supporting Documents

An out of state owner was selling his rental property at $1,030,000. He had purchased the property 12 years earlier at $1,056,000. Many sellers might mistakenly think that this a loss without any taxable gains. However, the tax office needs to approve the loss calculation on page 2 of the Form N-288B. You need to show evidence of the adjusted cost basis including the depreciation you have been able to claim.

We represented the Buyer, so we don’t know how the Seller completed the form or what supporting documents he attached.

We do know that:

- The Seller had 12 years of depreciation which would have reduced his adjusted cost basis by a significant amount.

- The Seller mailed Form N-288B from NY by regular mail (!) instead of overnight FedEx, which took several extra days to get to the tax office.

- On the submitted form, the Seller did not specifically instruct the tax office to notify the listing realtor. Therefore, the tax office mailed the response back to the owner in NY by regular mail. That took an extra week on top of the 10-business day approval process. ☹

Regretfully for the Seller, the tax office rejected the HARPTA exemption application. It took about 4 weeks to receive the tax office response which caused an undue closing delay.

Lesson Learned And Tip To Avoid The Pitfall:

Just because it looks like a loss, it might not be one.

- Always have your qualified tax advisor prepare the calculation including the depreciation, with all supporting documents.

- Page 1 of the Form requires “Mailing address where you want withholding certificate sent.” Instead add: “Please call listing realtor X at #XXX-XXXX when the form is ready for p/u.” That way the tax office is authorized to discuss with your realtor when he or she periodically calls to verify the receipt and approval progress. This can save precious time during a short escrow period.

Of course, savvy investors have the option to avoid HARPTA withholdings entirely by using a 1031 exchange.

See related article: Climbing The Wealth Ladder With A 1031 Exchange

________________________________

3) Owner Did Not File Or Pay The Required GET, TAT & OTAT

On occasions, we get calls from owners who are having difficulty with the tax office. Either they are being audited or the tax office refuses to refund their HARPTA withholdings. As part of processing your HARPTA refund, the tax office will cross-check that any required GET/TAT/OTAT have been paid over the years.

Some time ago, a property owner who was living on the mainland had her daughter manage several of her Hawaii properties as a lucrative Airbnb business. The owner left the rental details up to her daughter, and the daughter didn’t pay the taxes on the income. Years later the daughter moved away from Hawaii and the owner filed Form N-288C for a HARPTA refund after the sale of the first property.

The tax office rejected the owner’s refund application because of missing tax filings and the suspected underpayment of GET and TAT. Also, the tax office initiated a full audit on all of the owner’s Hawaii rental properties, requiring rental records and tax records from many years back.

After years of uncomfortable wrangling, the owner gave up on claiming her refund! ☹ – Oops. So much for proper planning.

We don’t vouch for the tax office, and we don’t mop the floors after you spilled the eggs by not paying taxes on time. Do not try to Tango with the tax office. There is no statute of limitations with GET/TAT/OTAT. If the tax office suspects that you cheated on your taxes, they can require you to show all your supporting records going back to the stone ages. You are out of luck if your records are spotty.

Lesson Learned And Tip To Avoid The Pitfall:

Always file and pay the appropriate taxes on time. Don’t be a free rider and then complain that the tax office is unreasonable. There is no excuse to be delinquent on your tax payment.

See related article: GET,TAT & OTAT – The Easiest Way How To Pay And File

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit, and we love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support, and we are dedicated to constant learning and growing with you. ~ Mahalo & Aloha

I know this article is older but I have question and if you happen to see this. Please let me know if you have an answer. I filed a form 8288B with FIRPTA in Sept. 1 2023 no capital gains. Today is June 15 2024. Any idea how long FIRPTA takes to respond back.

Thanks.

Thank you for your explanations. I will call the escrow company today! I am a former resident of Hawaii many years ago but am now an out of state investor selling a condo that we have been renting out with the thought that we might retire there someday. Now, plans changed and we are settled on the mainland so we are bringing our assets closer to home. Thanks again. Good articles!

Aloha Barb!

Call us when you are ready to sell. That’s what we do best!

We don’t just write about it.

We are here to help.

~ Mahalo & Aloha