GET, TAT & OTAT in Hawaii – The Easiest Way To File & Pay

— Regardless of where you live, if you collect income from rental properties located in the State of Hawaii you need to file and pay local state and county taxes on the rental income.

There are two types of taxes on rental income that go to the State of Hawaii:

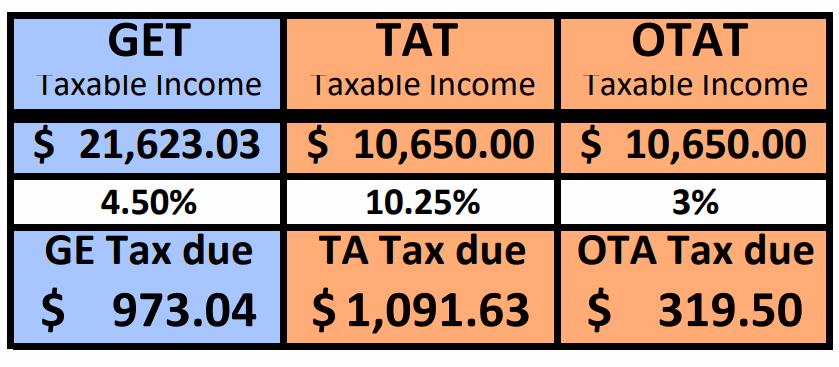

1) GET – General Excise Tax is due on all rental income (plus cleaning fees collected), regardless of the length of the rental term. On Oahu, the GET tax rate is 4.5%, and must be calculated on the “GE Taxable Income”

2) TAT – Transient Accommodation Tax is due on all rental income (plus cleaning fees collected) from rental terms less than 180 days per tenant. 10.25% TAT must be calculated on the “TA Taxable Income.”

Besides these two State of Hawaii taxes, each county requires their own respective TAT – Transient Accommodation Tax. For the City & County of Honolulu (the island of Oahu), effective 12.14.2021, that new tax is…

3) OTAT – Oahu Transient Accommodation Tax is due on all rental income (plus cleaning fees collected) from rental terms less than 180 days per tenant. 3% OTAT must be calculated on the “TA Taxable Income.”

If you collect rental income from a Waikiki condo, Oahu condo, or any Oahu property with rental terms of less than 180 days per tenant you will need to pay all three taxes, GET, TAT, & OTAT.

See related article: Revised GET Tax Rates By County & Updated TAT Requirements

How Often And When Do I File And Pay:

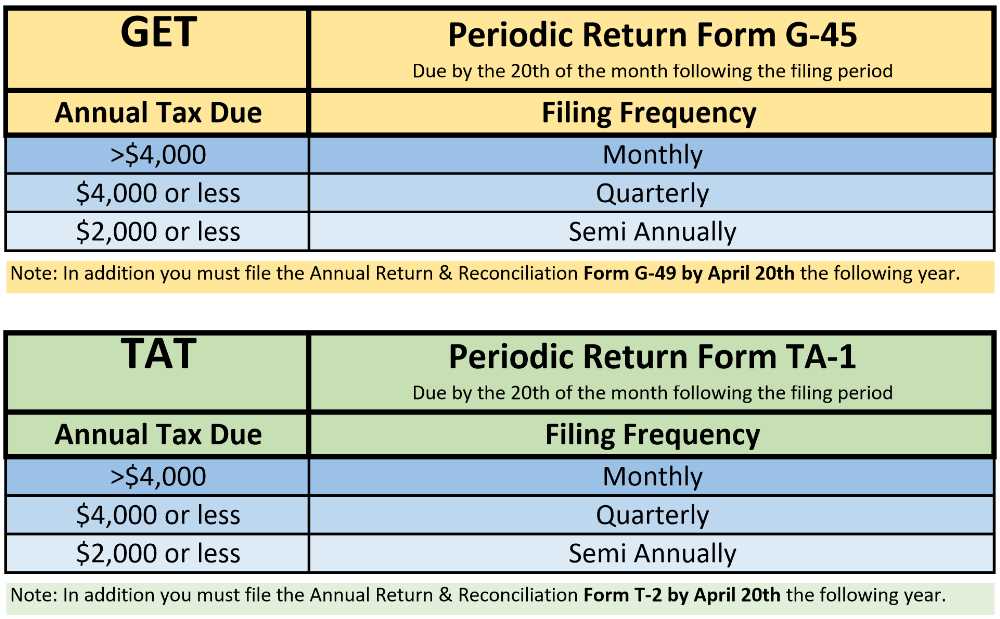

All three taxes, GET (form G-45), TAT (form TA-1), and OTAT (City & County form TA-1) are due by the 20th of the month following the end of filing period.

You will also need to file the Annual Return & Reconciliation for GET (form G-49), TAT (form T-2), and OTAT (City & County form T-2) by April 20th of the following year.

Filing frequency depends on how much tax you expect to be paying for the full year:

–> Filing frequency for the new OTAT should match whatever your TAT filing frequency is.

How To Calculate The GET, TAT & OTAT On Hawaii Rental Income

- GET is 4.5% (Oahu) based on the “GE Taxable Income.”

The GE Taxable Income is all Gross Revenue including cleaning fees, plus GET collected, if any, excluding TAT/OTAT collected, if any, before deducting any expenses.

– Note: Although the GET rate is 4.5%, you may collect from your tenant 4.714%. That’s because any GET you collect is also taxable at 4.5%. Collecting 4.714% covers the tax on the tax! <–That’s not a typo.

- TAT is 10.25% based on the “TA Taxable Income.”

The TA Taxable Income is all Gross Revenue from transient accommodation rental income (any rental terms less than 180 days/tenant), including cleaning fees, excluding GET, TAT & OTAT collected, if any, before deducting any expenses.

- OTAT is 3% and it is also based on the “TA Taxable Income,” same as the TAT.

________________________________

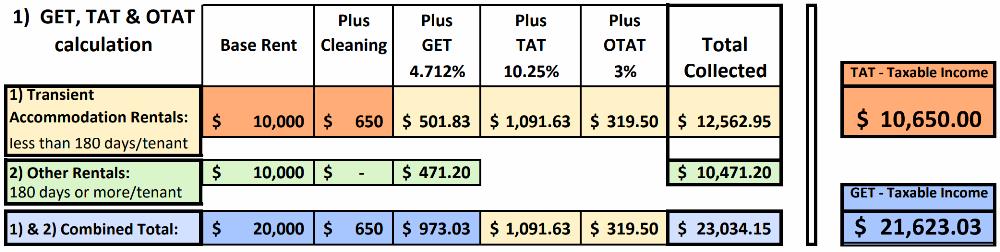

Two Examples on how to calculate the proper tax:

#1) – Collecting the GET, TAT & OTAT separately from the tenant:

- Base rent from Transient Accommodation Rentals: $10,000. – Collected separately: $650 cleaning fee, $501.83 GET, $10,91.63 TAT, and $319.50 OTAT.

- Base rent from Other Rentals: $10,000. – Collected separately: $471.20 GET

________________________________

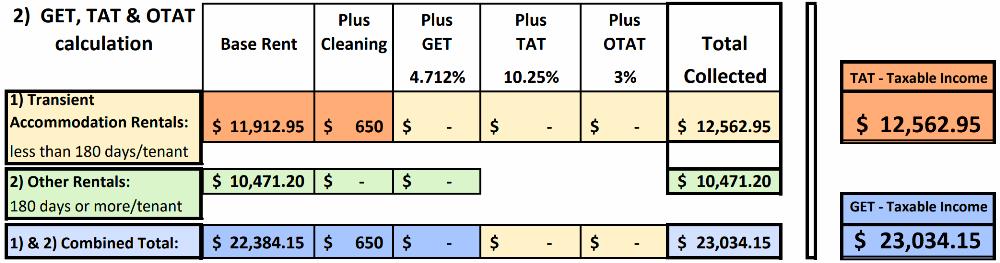

#2) Collecting a flat rent without separately collecting GET, TAT & OTAT:

- Base rent from Transient Accommodation Rentals: $11,912.95. – Collected separately: $650 clean fee.

- Base rent from Other Rentals: $10,471.20. – Nothing else collected.

–> Notice how both examples above show the same total gross revenue collected. However, #1) sample calculation results in a lower tax burden because the tax (GET, TAT & OTAT) was collected separately as a pass-through tax.

If you do not collect GET, TAT & OTAT separately as a pass-through tax, then you must calculate and pay the tax on the total gross revenue collected.

________________________________

The Easiest Way To File & Pay In Less Than 5 Minutes:

GET and TAT goes to the State of Hawaii. Their payment portal site is called Hawaii Tax Online: https://hitax.hawaii.gov

Our short tutorials walk you through each step how to pay online in less than 5 minutes without writing checks, licking stamps or envelopes.

Part 1: GET

• If you are just getting started, first register your business and sign up for your GET license.

• Set up your online account.

• File and pay your GE tax in less than 5 minutes.

Part 2: TAT

• File and pay your TA tax in less than 5 minutes.

Part 3: OTAT

OTAT goes to the City & County of Honolulu (island of Oahu): www.honolulu.gov/otatpay

Each island/county has their own county TAT. If your rental property is on the island of Hawaii, then you file HCTAT here. On Maui you file MCTAT here. On Kauai you file KTAT here.

• Set up your online account.

• File and pay your OTA tax in less than 5 minutes.

________________________________

Both, the Hawaii State Department of Taxation and the City & County of Honolulu made filing and paying simple with easy online access. There really is no excuse not to file and pay. Fines are stiff and there is no statute of limitation if you ever get audited. Play by the rules, file and pay on time and mitigate financial nightmares.

________________________________

Disclaimer: We posted this article with tutorials as a free service to help you efficiently file and pay online GET, TAT & OTAT on your Hawaii rental income. – We are not tax professionals or CPAs. Always check with your favorite qualified tax professional or contact the Hawaii State Department of Taxation at 808-587-4242.

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

I live in California but have rented out my studio condo in Honolulu since Oct.on a one year lease I have a 1099 for 4,716.12 for 2022. Now what? do I pay Federal and State Tax and what forms do I use and when is it due – how often do I file?

Thank you!

Jane

Thank you for this in depth article! I have filed a G45, G49, TA1 and TA2 for the past two years on my condo in Honolulu. I am wondering if I have paid too much, as I have just been told I only need to file one GE and TAT, not both. Can you clarify?

Hi George,

How do we file reconciliation for HCTAT? I’ve been submitting monthly payments using the website by selecting the TA-1 form. There is a TA-2 selection but the periods are either June or December. Is that the form for reconciliation or do we need to file the paper form? I tried to use the website but there is nowhere for me to say that I already paid $X this year. The reconciliation for GE and TAT are super easy online but not very intuitive for HCTAT.

Hi George! How do I apply for a refund on the GET and TAT overpayment?

Thank you!

Aloha Jacki Quinlan!

To claim a refund for overpayment of taxes, you must file an amended G-45 for GET, and or an amended TA-1 for TAT.

You can contact the Hawaii State Department of Taxation at 808-587-4242, and they will help you click through the online system.

Good luck.

~ Mahalo & Aloha

I’m trying to list and rent my Kauai time share. VRBO is asking for a TAT and GET tax ID. When I followed your YouTube video I tried to create an account. I got stuck when it asked me for a…

Either a letter ID, recent payment amount, or the most recent refund amount

This seems to relate to Hawaii income.

VRBO also says I need a Parcel Number (Tax Map Key). I’m not sure what this is.

Thanks

Steve Smith

Steve,

In order to list my Maui timeshare on Airbnb I had to get those same IDs and while I can’t recall the exact steps I do know that it didn’t require a letter ID, recent payment amount, or recent refund amount. Honestly the HI tax authorities and website are not very helpful but I seem to recall that I finally stumbled upon a page on their site where I generated my IDs without much documentation other than address, name, etc.

Aloha Steve!

1) Register your business (the business of renting your HI property for a profit) and sign up for your GET license here: https://hitax.hawaii.gov – Look for “Register New Business License”

2) Set up your online account so that you may file and pay your taxes afterward.

Your ‘tax parcel number’ is on your property tax bill and identifies your property. It is also on your deed/conveyance document.

~ Mahalo & Aloha

In my case any transient accommodations revenue that I earn via the likes of AirBnB is used to offset our annual timeshare / HOA dues & maintenance fees. It’s a mostly break-even situation, so I’m curious whether those dues & fees can be claimed as an exemption or deduction when I’m paying my taxes to the state of Hawaii?

Aloha Daniel C!

GET/TAT/OTAT are due on the ‘gross’ rent as explained in the article.

HOA/maintenance fees do not offset or reduce GET/TAT/OTAT.

That’s like drinking Coke Zero to try to offset the calories from French fries.

However, you get to deduct GET/TAT/OTAT on your federal tax return, Schedule E.

The numbers then flow from your federal return onto your N-15 HI state return.

Check here:

https://www.hawaiiliving.com/blog/real-estate-tax-benefits/

and here:

https://www.hawaiiliving.com/blog/personal-use-hawaii-vacation-rental/

— For tax matters, always check with your favorite qualified tax professional.

We are only realtors providing most exceptional real estate services. 🙂

All the Best.

~ Mahalo & Aloha

Hi. Thank you for the breakdown and explanations. Do you know if platforms like VRBO and AirBnB visually separates taxes collected? I’m confused by the State’s wording about taxes visually or not visually passed on, especially since I’m unclear if sites like VRBO and AirBnB clearly separates the taxes or if the taxes are lump-summed when charged to guests. I’ve entered into these site the individual taxes. I just want to make sure I’m filing them correctly.

Also, I’m confused by the cleaning fees I collect, as I keep getting mixed messages. Some have told me to exclude cleaning fees from my TAT gross income, but you have clearly stated that it should be included in TAT gross income. Is is normal to get confused by this?

Appreciate your response.

Aloha Trish!

We don’t vouch for VRBO or AirBnB, or what their services include.

Last time I checked, AirBnB did not collect GET/TAT/OTAT separately.

Yes, it is normal to get confused, based on all the other questions/comments on this thread.

It is always best to verify with your favorite qualified tax professional.

We are only realtors providing most exceptional real estate services. 🙂

All the Best.

~ Mahalo & Aloha

Hi, George! I enjoyed reading your article. I have a question about paying for GET, TAT, OTAT for a property with multiple owners… one side is a revocable trust (husband and wife owning 44% of the property) and another is a co-owner (me) owning 56%. We are thinking of renting it out on Airbnb. Do we have to get two separate accounts for filing the GET, TAT, and OTAT for that one property? Hope you could shed some light on this. Thank you!

Aloha Dan!

I appreciate your patience, catching up…

The answer is yes!

Two entities receiving two separate portions of the income are responsible for their respective filing/paying of the tax on the income they receive.

Check with your favorite qualified tax professional.

We are only realtors providing most exceptional real estate services. 🙂

All the Best.

~ Mahalo & Aloha

Hi George,, I’m so grateful I found your article! And now at the same time also confused. I rented a timeshare in Oahu last year and was just looking whether I need to correct the tax rates for this year, in case I rent it out again. for last year the TAT for HI was 10.25% and for the Oahu Surcharge, which you also have to report with your GET return, was 0.5%.

Do I understand your article right: apart from the 10.25% TAT HI and the GET (incl. the Oahu Surcharge), there is now an additional 3% ISLAND SPECIFIC TAT?

I know that the Marriott Vacation Club for example charges TAT by themselves, when my guests arrive there. Is this the OTAT you are talking about? – I am a little bit confused now. From my understanding, a timeshare owner has only to pay the GET and TAT. The local TAT is charged by the timeshare company once the guest arrives.

Thank you in advance for a clarification. It’s highly appreciated!

Aloha TaxFun!

I appreciate your patience, catching up…

To clarify, you as the owner must file/pay GET 4.5%, TAT 10.25%, plus the new OTAT 3%, unless your property manager is filing/paying these taxes on your behalf.

Always check with your favorite qualified tax professional.

We are only realtors providing most exceptional real estate services. 🙂

All the Best.

~ Mahalo & Aloha

Hi George. I am a Hawaii-nonresident and own a weekly timeshare in Maui. For the first time in December 2021, I rented it out thru a rental company. When I submitted it for listing, the company asked how much I would like to net. They then calculated and added on the Maui GET & TAT, as well as their commission and distribution network fee, to get to the final rental price charged to renter. Presumably, they paid the GET & TAT collected to the appropriate Hawaii government tax department, and they paid me the net. I did not get a Form 1099 because rental was less than 10k. Do I have to file a Hawaii Form N-15? How do I show that the GET & TAT were collected and paid for by the rental company? Do I have to pay Hawaii income tax even if I already pay the tax for the Hawaii timeshare income (less maintenance fee) in my home state, or should I not report it in my home state and pay Hawaii instead? Thanks for your help.

Aloha Joyce!

I appreciate your patience, catching up…

Check with your property manager if they indeed paid the GET & TAT on your behalf.

Not all property managers offer that service. Remember, it is the owner that is on the hook for the proper filing and payment of taxes.

Besides your home state income tax filing, you must also file Hawaii Form N-15.

All numbers from your federal tax return flow to your N-15.

— You should check with your favorite qualified tax professional. We are only realtors providing exceptional real estate services. 🙂

All the Best.

~ Mahalo & Aloha

I can’t see the GET or TAT videos? Are they missing from the post? Mahalo!

Aloha Lee!

Thank you for letting us know. 🙂

Fixed. Should be ok now.

Either YouTube or WordPress pulled a fast one and caused a glitch.

~ Mahalo & Aloha

Awesome, thanks so much! Great article! Aloha 🙂

How do I pay the OTAT tax?

Aloha Karon!

I’m correcting my initial reply…

Besides the 10.25% TAT that goes to the State of Hawaii, you must now file and pay 3% OTAT to the City & County of Honolulu here:

http://www.honolulu.gov/otatpay

If you had paid the additional 3% to the State (instead of the City & County), then you may have to amend your State TAT return and claim a refund.

Don’t delay or skip your 3% OTAT payment. Otherwise, the tax office will come looking for you.

I will update the article above as soon as I find some time to reflect this change:

City council approved Bill 40 charging the additional 3% Oahu Transient Accommodation Tax (OTAT) on top of the regular 10.25% State Transient Accommodation Tax (TAT).

The new combined total TAT is 13.25% (TAT & OTAT) effective 12.14.2021, assessed on all rental income (and cleaning fees) from rental terms of less than 180 days per tenant.

Call us when you are ready to sell or buy. That’s what we do best. Stay safe.

~ Mahalo & Aloha

Hi, thank you for your article! I am out of state and am considering buying a condo in Waikiki as a vacation home/short term rental. I plan on hiring a Host to manage my condo short term rental. With the GET and TAT do the home owner have to register and paid for it or does the Host do?

Aloha Johnny Le!

The property owner is ultimately responsible for the timely and accurate filing and payment of the GET/TAT.

However, some property managers offer this service for an additional fee. Any good tax preparer can also get it done.

As I tried to explain in the tutorial, it isn’t rocket science.

— I wonder, was that you that talked to me recently about your Ilikai 2-bedroom unit?

Let me know if there is anything else we can do for you.

We are here to help.

~ Mahalo & Aloha

Hi, I just purchased a new condo in Kihei and I am getting conflicting information from airbnb. Do they collect and pay the taxes now or do I? Please advise?

Aloha Patrese!

I regret, we are not affiliated with airbnb. We don’t vouch for what they say or do. 🙁

We are expert realtors and happy to help when you are ready to buy or sell. 🙂

~ Mahalo & Aloha

I rented a few days in Dec 2020 thru VRBO. I thought they had paid the taxes as they had represented to me. Later found that they hadn’t drown that because I hadn’t subscribed to the tax service (expensive for a one of time situation). Through the blog videos I can do it myself this time. But my question is how do I reconcile for the 2020 Dec rental and what the penalties might be. At that Gross rental income about $3500.

Aloha Ravi Ravindra!

We are expert realtors assisting clients with buying and selling, but we are not tax experts. Always check with your favorite qualified tax professional.

However, if the 2020 reconciliation forms G-49 (GET) and T-2 (TAT) show delinquent on your online tax portal, then you should file those. The penalty might auto-populate.

Alternatively, if the 2020 reconciliation forms G-49 (GET) and T-2 (TAT) are no longer shown as available to file on your online tax portal, then perhaps try filing whichever current form is available to file. The tax office might contact you afterward if you owe a penalty.

Call us when you are ready to sell or buy. That’s what we do best. Stay safe.

~ Mahalo & Aloha

Cont. from last comment:

If sale is out of state client, then where does the tax go?

Aloha,

I am new resident of Honolulu, Hawaii.

I am a retired artist, with continued small self-employed art consultant business which is not quite often income producing, but ending up quite a lot of community service, and some sale of design products.

Now, my question is what is the category for professional service activity tax? GET or TAT? And how do I get Tax ID number? Is there specific minimal $amount to qualify for legit business? I ask this, because I am still trying to settle into new location, but my business expenses are to cover moving expense. I appreciate your expert guidance on this.

Welcome and Aloha Junco!

Complete a State of Hawaii Basic Business Application, BB-1 Packet here: https://files.hawaii.gov/tax/forms/2018/bb1_f_packet.pdf ,

More GET info here: https://tax.hawaii.gov/geninfo/get/

You don’t need a TAT license.

Good luck.

Aloha George.

I’m a Canadian citizen who is lucky enough to have owned a Condo in Hawaii for the last 7 years. . When I’m not here I rent the unit out through the most common on line rental web sites.

When I charge the guest I use the following criteria.

E.G.

$100.00 + taxes]+ $115 per night (GET & TAT).

Cleaning fee (separate from base rate) $125. (One time fee)

Total per night $115 (cleaning fee is added to the total at end of the guest stay.

When I file online I enter the total amount per month received.

From there the system automatically calculates what I owe.

Seems simple & straight forward to me.

My big question is though that when I file with the IRS I also have to file with Hawaii. 2 years ago they charged me income tax but every other year they haven’t. Maybe it was because I actually am owed money back. Not sure.

Any idea’s why???

Aloha Mel!

It’s possible that no Federal or HI State taxes are due in some years, while the GET/TAT can be substantial. That’s because you typically claim a pletoria of tax deductions on Schedule E of your U.S. Federal tax return, including the depreciation expense, and even the expense of having paid the GET/TAT. Check here: https://www.hawaiiliving.com/blog/real-estate-tax-benefits/

You would not be due any Federal or HI State tax refund unless you actually overpaid any Federal or HI State taxes during the tax year.

GET/TAT are entirely independant from Federal or HI State taxes. They are also the largest revenue sources for the State of HI.

– Btw, the TAT rate just increased to 13.25%! (from 10.25%). That’s on top of the 4.5% GET rate. Total combined GET/TAT is therfore 17.75% (4.5% + 13.25%) on all rental income with terms of <180 days and on the cleaning fee.

-- I will update the article shortly to reflect the increase.

Always check with your favorite qualified tax professional. Call us when you are ready to buy or sell. That's what we do best. 😉 ~ Mahalo & Aloha

Whoever came up with the idea of adding a separate TAT taxation on to the cleaning fee should be horsewhipped as a scoundrel! The State will collect tax from the cleaner when they file their income tax. The act of adding taxation to the cleaning fee is therefore double taxation, and passing it on to a guest/visitor to Hawaii is bad for tourism-business, and this practice should be stopped immediately! Let’s stop treating our guests as pockets to be picked!

Aloha Mike Griffin!

Thank you for your comment.

Your observation is correct: GET and TAT represent double taxation on multiple levels.

~ Mahalo & Aloha

Hi George,

I own multiple condos in Waikiki. Do I need to file GET/TAT taxes separately for each unit? Or can I lump them all together as “income”? If separately, then I assume I would need different tax ID numbers for each, correct? Mahalo.

Aloha Henry!

Thank you for your question. Regardless how many properties or income streams you have, you only need one tax ID number and lump all the income together. Check our article on how to scale your investments with the SSA method: https://www.hawaiiliving.com/blog/scale-your-real-estate-investments/

~ Mahalo & Aloha

Hello,

I have my GET and TAT, If I own a condo in Waikiki that I will rent out for short term rentals when I am not there do I need a Hotel license?

Aloha Russ!

All you need is your GET/TAT license and file/pay your taxes on time. You will also need a local emergency contact so that your tenants can reach someone in case of an emergency at the unit.

— Call us when you are ready to buy or sell real estate. ~ Mahalo & Aloha

I already have a GET Tax license, how do I apply/ add for a TAT tax license?

Aloha Mark Shnax!

Thank you for your question.

You may apply for a new GET license, or add a TAT license to your existing GET license here: https://hitax.hawaii.gov/_/ –> Register New Business License –> BB-1 Business Application.

A nominal $20 one-time application fee applies. GET & TAT licenses do not expire.

Good luck.

~ Mahalo & Aloha

What specifically are you allowed to deduct from TAT

Aloha Joshua Sahara,

Very little. 🙁

Page 6 of the instruction booklet shows the TAT exclusions, exemptions, and deductions:

https://files.hawaii.gov/tax/forms/2019/ta1ins.pdf

–Also, for general reference, the State of Hawaii Tax Dept just revised their TAT brochure here: https://files.hawaii.gov/tax/legal/brochures/TAT_brochure.pdf

–Call us when us when you are ready to buy or sell. That’s our expertise. We are here to help. ~ Mahalo & Aloha

VERY! Helpful and informative. Thank you! Just one quick question. At the end of the year when we file our HI tax return. What number is used for the “gross income”. Is it the GET Number or the TAT number reported. I was told matching is key.

Aloha Ralph Hoover!

You prepare your federal tax return first, including Schedule E for your investment properties. Typically, rental income numbers for your HI state tax return come from Schedule E of your federal return.

— Contact your favorite qualified tax professional to get it right. Let us know when you need help buying or selling real estate. 🙂

That’s what we do. We would be delighted to help.

~ Mahalo & Aloha

Hi George,

Why does the Hawaii tax online website list that I file quarterly AND annually? For TAT & GE. Shouldn’t it be one or the other? Seems like a double-charge!

Aloha Jenna Baker,

As mentioned in our article above, the annual filing is the tax filing ‘reconciliation,’ due by April 20th of the following year. For GET it is form G-49, and for TAT it is form T-2. – No double charge.

Contact your favorite qualified tax professional to get it right. Let us know when you need help buying or selling real estate. 🙂

That’s where we excel. We would be delighted to help.

~ Mahalo & Aloha

Hi George! Thank you for the article. If the property is under a living trust, what should I file? As ‘sole proprietor’ or ‘trust’? The tax id of a living trust is same as the trustee of the trust.

Aloha Jian Liang!

Best to check with your favorite qualified tax professional.

— Let us know if you need help buying or selling.

That’s what we do best.

~Mahalo & Aloha

Jian: Did you get any answers? I have the same scanario.

Hi George,

Thanks for the info. Are you positive that GET is revenue minus TA? I had called into the Dept of Tax today before researching this info here, and I thought she said that GET is on anything collected (she didn’t mention excluding what you collected for TA.)

I will say that she also didn’t seem too sure in her answer. Are you sure that this is the way it should be properly paid?

Aloha

Aloha Mariel Hallahan!

Are you collecting TAT separately from your guest as a visible pass-through tax? ==> Then TAT is exempt from GET.

If not collected separately, then the entire amount collected is subject to GET & TAT.

–Check the TAT brochure:

http://files.hawaii.gov/tax/legal/brochures/tat_brochure.pdf:

“The TAT that is visibly passed on to the guest or tenant

is exempt from the GET. However, the GET that is visibly

passed on is included in taxable income subject to the GET.

If you charge your guest or tenant a flat fee without

separately stating the GET and the TAT, you are required to

pay GET (including a 0.5% county surcharge if applicable)

and TAT on the entire amount.”

— Let us know if you need help buying or selling.

That’s what we do best.

~Mahalo & Aloha

Aloha George! Thanks for the follow up – so just to be clear, if we itemize the price break down – the TAT collected won’t be included in total revenue when paying GET, and the GET and TAT collected won’t be included in total revenue when paying TAT?

Thanks

Aloha Mariel Hallahan!

Correct, if you itemize GET/TAT when collecting it from the guest. But don’t take our word for it. We are only expert realtors, not tax experts.

Always confirm with your favorite qualified tax professional.

— Let us know when you are ready to buy or sell.

That’s what we do best. 🙂

~Mahalo & Aloha

Thanks for the great info George! My situation; I own 3 timeshare weeks on Kauai that I pay approx. $2200 per week for maintenance fees. I usually rent out 1 or 2 of the weeks through Red Week for $3500 per week and, after paying the Red Week fees, usually make about $1100 profit per timeshare week ($3500 minus $2200 minus $200 (fees)). If I understand correctly, I have to pay tax on the $3500 gross, not the $1100 profit, correct?

Aloha Ken Hall!

That is correct.

~Mahalo & Aloha

Hey george do i have to file a Tat tax if im renting out to long term rentals?

Aloha Feng Law! Thank you for checking in. TAT is due on all rental income from rental terms of less than 180 consecutive days per tenant. ~ Mahalo & Aloha

I appreciated your article on GET and TAT explanations on taxes. I am still confused on the cleaning fee. In the brochure by Gov Ige on TAT, he states cleaning fees are subject to the TAT; I have heard something about it being pass-through income but I’m not entirely sure what that means. Our previous management company used to only charge guests GET and TAT on the rental portion, never the cleaning portion. It seems like you are stating collect TAT and GET on rental, but that we only need to collect and pay the GET on the cleaning fee to the state.

EX: It sounds like you’re saying we should collect the TAT and GET for the rental portion only (so if fee is $150 and $100 of that would be for the rental portion, we would collect a total of $14.42) and pay it to the state, and only collect (or just pay) the GET (not TAT) on the cleaning fee, correct?

And what if the cleaner – who receives the collected cleaning fee – pays the tax to the state; we wouldn’t have to pay it as well if we pay her the tax collected, correct? How do you suggest as owners, we collect and pay the cleaning fees that are provided by an independent cleaner?

Aloha Gary Burkhardt! Thank you for your patience. I am correcting my initial response: Yes, any cleaning fee that is collected from the guest at the time of booking is also subject to both GET & TAT(!).

You ‘may’ collect from the guest the GET & TAT on the cleaning fee.

— Example for Maui:

a) Collect $100 for cleaning + GET (4.166%) + TAT (10.25%) = $114.42. –> Pay $4.17 GET; Pay $10.25 TAT.

b) Collect $100 for cleaning, no GET no TAT = $100. –> Pay $4 GET; Pay $10.25 TAT.

— Example for Oahu:

Collect $100 for cleaning + GET (4.712%) + TAT (10.25% = $114.96. –> Pay $4.71 GET; Pay $10.25 TAT.

b) Collect $100 for cleaning, no GET no TAT = $100. –> Pay $4.50 GET; Pay $10.25 TAT.

~ Mahalo & Aloha

This is the response I received from the Tax Technical Section in regards to not having to pay TAT and/or GET on cleaning fees:

Cleaning fees which are required to be paid in order to stay in the transient accommodations are considered gross rental proceeds subject to both the general excise tax (GET) (plus the county surcharge, if applicable), and the transient accommodations tax (TAT). Cleaning fees that are charged to the guest and are not required to be paid in order to stay in the transient accommodations are only subject to the GET. The cleaning fees cannot be deducted from your gross rental proceeds for GET and TAT purposes.

Therefore it appears that even if the cleaning fee is ‘charged separately’, we must collect TAT due to the fact that we don’t allow guests to rent without paying a cleaning fee (for the cleaners).

Aloha Gary Burkhardt! Thank you for your patience and thank you for your comment to clarify the TAT on the cleaning fee.

You are correct!

I corrected my previous response above to reflect your accurate findings. I appreciate you taking the time to help us with updating the info.

~ Much Mahalo & Aloha

George – great article and information. One quick question and here’s the scenario:

– I have a short term rental on Maui through Airbnb

– I do not bill the GET and TAT seperatly, I include it with the nightly rate and make it known in the listing

– Example:

$10,000 collected (excludes airbnb fees – includes GET/TAT/Cleaning fees)

So my gross rental income is $8752.74 (10,000 minus 1,247.26) I got the $1,247.26 with is the GET/TAT 14.25% collected

– For TAT, I report $8752.74 as my gross rental income and file $897.16 (8,752.74 X 10.25%)

– for GET, I report gross rental plus GET colleceted = $9,102.84 (8,752.74 + 350.11) as my gross rental income and file $364.11 for GET

Does this look right? I have a spreadsheet I can share with you to see if this looks accurate.

But the bigger question is that Airbnb does not collect taxes on our behalf and simply pays out whatever they collect minus their fees.

Would this suffice the state requirements for GET/TAT as a visable pass on?

Thanks

Aloha Cary Cheung! Those numbers look ok to me. ~ Mahalo & Aloha

thank you for sharing Cary! your way of calculating is different than former post George

Hi – Thank you for the post! When I go to register it wants me to select: Corp, Sole Proprietor, Estate, General Partnership, Limited Liability, etc. what do I choose?

Aloha Lianne,

If you own the property (or business) in your own name you would be filing as ‘sole proprietor.’

The rest is simple as follows: Corporations register and file as corporations, estates as estates, GP as GP, etc.

~ Mahalo & Aloha

What if our property if owned in the name of a Trust with me as Trstee, what kind of business I should registere in order to rent my condo shortterm, which is already in the resort-like compond where short term rental is allowed?

Thank you for the informative post!

My current GET/TAT amount owed, as of April 2018, is less than $2,000, but I have only been collecting income for 3 months. After 6 total months of ownership, I expect my GET/TAX amount owed to be greater than $2,000 but less than $4,000 for 6 months of income. Should I choose Quarterly filing or Semi-annual filing?

If I look at GET/TAT now it seems I should choose semi-annual. But if I look at the GET/TAT amount in June, then I should have choosen Quarterly.

And what defines the actual calendar dates when choosing Monthly, Quarterly, or semi-annual schedule? is it the 1st, 20th, or some date?

Thank you

Aloha Ken, Thanks for your question.

1) The filing frequency depends on how much tax you expect to be paying for the ‘full’ calendar year. Looking at the numbers you provided, it appears you expect to pay more than $4,000 for the ‘full’ year. Therefore, you should file/pay monthly! Otherwise you will be charged late filing fees! – Good luck trying to convince the tax collector they shouldn’t.

2) Both, GET (form G-45) and TAT (form TA-1) are due by the ’20th of the month following the end of filing period.’ Since you should be filing monthly, here is a monthly example:

Monthly filing period 4/1 through 4/30 ==> must file and pay by 5/20.

Let me know if there is anything else we can do.

We are here to help.

~ Mahalo & Aloha

George Krischke, Principal Broker, Hawaii Living LLC OOPS! Thank you! Followup question…I operate short term rental business on Maui. Do I need to remmit GET & TAT from income generated from cleaning fee, resort fee, or insurance fee? These are fees outside of the night rate that are paid by guest.

Aloha Ken Ngo, Careful. GET is due on ALL gross revenue collected including collected cleaning fees, and anything else you might collect from the tenant, including collected GET (except collected TAT).

Example: You collected from the tenant a total of: $12,425/mo. ($10K/mo room rate revenue; plus $400/mo GET 4% Maui; plus $1,025/mo TAT 10.25%; plus $1,000/mo cleaning)

–> GET income to file: $11,400/mo; ($12,425 minus $1,025 collected TAT)

–> TAT income to file: $11K/mo; ($10K + $1K cleaning) TAT is due only on the room rate revenue for rental terms shorter than 180 days, plus any other fees that you collected at the time of the booking, e.g. cleaning fee.

Any fees or expenses e.g. mgmt fees you pay to your property manager, marketing fees, airbnb fees, or any other expenses you need to deduct after the GET and TAT.

Regardless if it seems fair or not, many get this wrong.

Always check with your favorite qualified tax professional or the HI Dept of Taxation 808-587-4242.

Awesome explanation, George. Mahalo for taking the time to teach.Question: If income is earned on a neighbor island but I am a resident of Oahu, do I pay GET at 4.5% or 4%?

Mahalo, George!

Aloha Sue, regardless where you live, if the income is from your neighbor island rental, you pay 4% GET. If the income is from your Oahu rental, you pay 4.5% GET. Good luck.