— Update 10.13.2022: Federal Judge Watson ruled that the DPP and the City and County of Honolulu shall not implement and enforce changing minimum rental terms from 30 days to 90 days! One of the key provisions of Bill 41 has been rendered void.

— Update 9.8.2022: During the 9.7.2022 court hearing to challenge Bill 41’s 90-day rule, Judge Watson instructed both parties to meet with U.S. Magistrate Judge Rom Trader and work out a resolution by 10.23.2022. More here: Courthouse News Service. Stay tuned for more…

— Update 7.19.2022: In response to the 6.6.2022 and 7.7.2022 legal challenges to block Bill 41, a Preliminary Injunction court date is set for 9.7.2022. If the judge supports the motion, then Bill 41 could be stalled for years until the lawsuit is settled after going through the courts. Bill 41’s effective enforcement date is 10.23.2022.

However: “Existing owners of dwelling units being rented out for 30 consecutive days up to 89 consecutive days may continue to rent them, but on April 23, 2023, all such rentals must either cease renting, or convert to long-term 90 days or more leases.” https://www.honolulu.gov/dppstr

During a mandatory meeting to avoid further litigation, attorneys Greg Kugle for HILSTRA and Brad Saito for the City & County of Honolulu discussed creating a “grandfathered” NUC (Non-conforming Use Certificate) system for existing 30-day rentals. That decision would have to be made at the highest level, the Mayor’s office. – Stay tuned for more…

— Update 6.6.2022: The Hawaii Legal Short-Term Rental Alliance (HILSTRA) filed this lawsuit to try to block portions of Oahu’s new short-term rental rules Bill 41 (CO 22-7). Civil Beat reported it here.

________________________________

We saw it coming, on April 26, 2022, Mayor Blangiardi signed into law the final version of the controversial Bill 41 (CO 22-7). We documented the audacity of earlier versions of the bill here.

In summary, Bill 41 (CO22-7) brings these three most significant changes to Oahu:

- 1) Rental terms of less than 90 days (formerly 30 days) in residential neighborhoods are illegal. Enforcement with hefty fines starts on 10.23.2022.

- 2) Short-term rental properties (with rental terms of less than 90 days) must be registered and are subject to additional restrictions and requirements, including a $1K initial registration fee, and a $500 annual renewal fee.

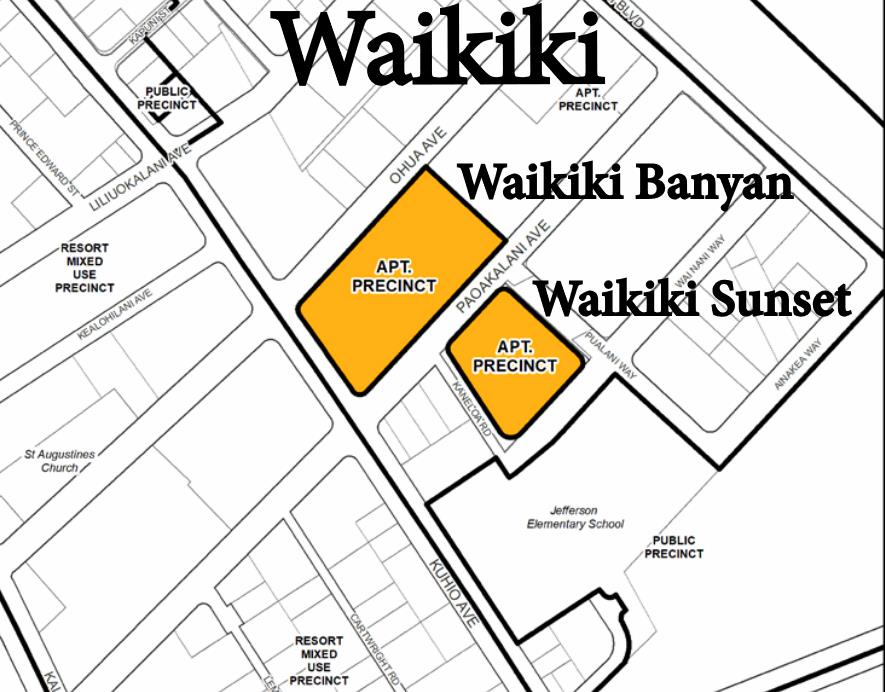

- 3) Waikiki Banyan and Waikiki Sunset units are now all legal STRs, even the ones that don’t have a NUC.

See related article: Guide to Condotels in Waikiki, Honolulu | Short-Term Rental Condos

________________________________

Which Properties Can Legally Advertise And Rent For Less Than 90 Days Per Tenant?

Rental terms of less than 90 days per tenant are limited to specific properties that are within one of these four categories:

1) Properties zoned “resort mixed-use” or “resort.” – This category includes the following legal STRs in Waikiki: Ilikai; Ilikai Marina; Waikiki Shore; Waikiki Beach Tower; Trump Tower; Ritz-Carlton; 2465 Kuhio; Marine Surf; Pacific Monarch; Bamboo; Luana; Regency On Beachwalk; Waikiki Grand Hotel; Cabana at Waikiki; Imperial Hawaii Resort; Kalakauan; Kuhio Village; Niihau Apartments; Royal Aloha; Seashore; Tradewinds Plaza;

also, in Ko Olina: Ko Olina Beach Villas; at Turtle Bay: Ocean Villas at Turtle Bay; and in Makaha: Cottages at Mauna’Olu.

2) Individual properties with a NUC (Non-Conforming Use Certificate). – See all legal STR properties with NUCs: 793 NUC properties. The city stopped issuing NUCs in Sept. 1990.

3) The condo building is grandfathered as a “non-conforming hotel” and exempt from the NUC requirement. – This category includes the following legal STRs in Waikiki: Aloha Surf; Hawaiian Monarch; Island Colony; Palms at Waikiki; Royal Garden at Waikiki;

also, outside of Waikiki in urban Honolulu: Ala Moana Hotel; Executive Centre.

4) Select properties allowed under Bill 41 within the “apartment precinct” and zone “A-1” and “A-2.” – This category includes the following legal STRs in Waikiki: Waikiki Banyan; Waikiki Sunset.

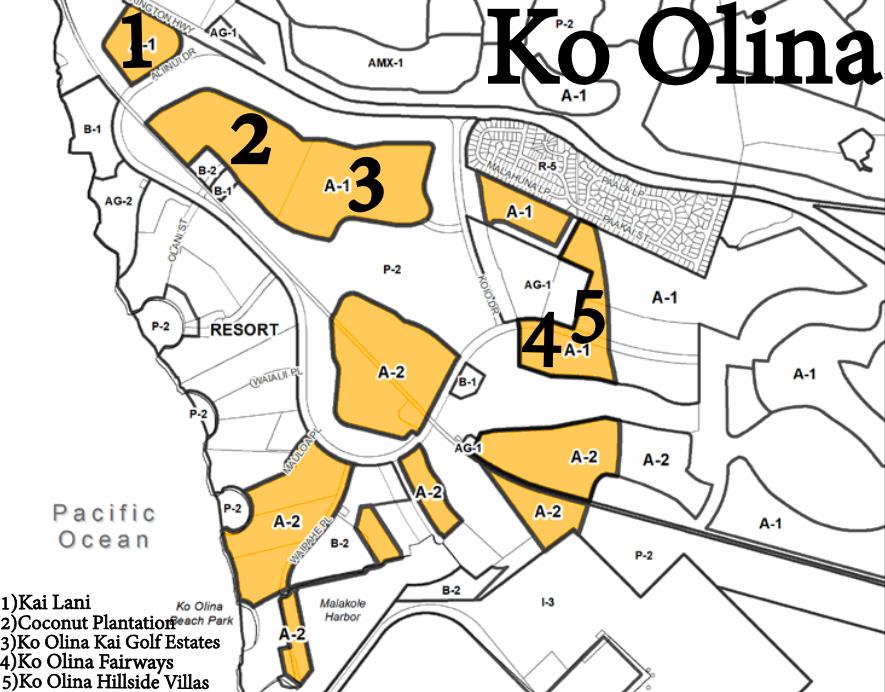

Also, in Ko Olina (subject to respective house rules): Kai Lani; Coconut Plantation; Ko Olina Kai Golf Estates; and the western sections of Ko Olina Fairways and Ko Olina Hillside Villas.

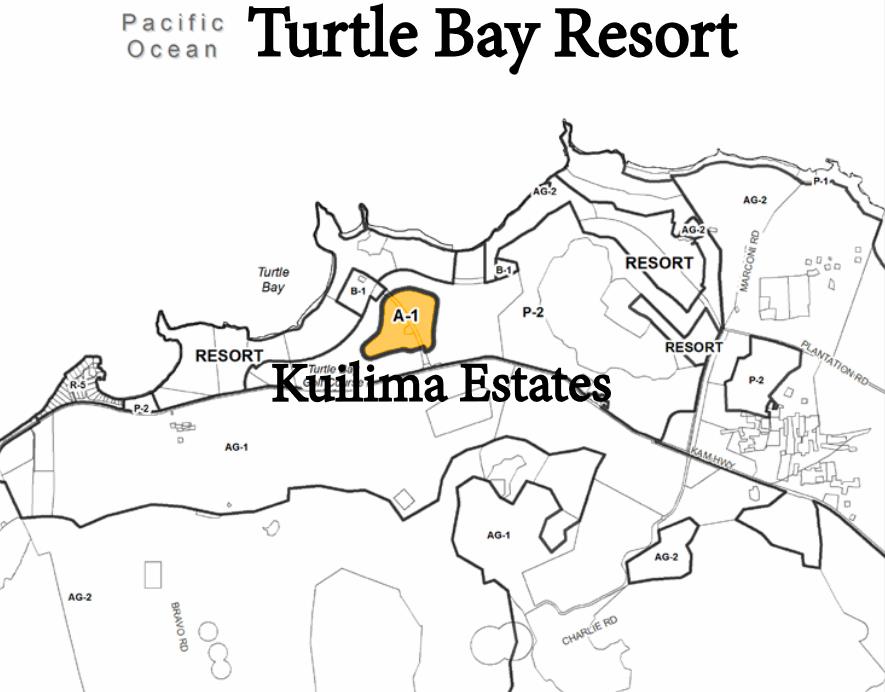

In addition, at Turtle Bay: Kuilima Estates.

That’s the universe of Oahu’s legal short-term rental properties.

See related article: Waikiki Condotel Reality: Cash Flow vs Lifestyle

_________________________________

Will The City Allow Special Rental Term Exceptions?

Some rental terms shorter than 90 days in residential neighborhoods may be allowed for temporary contract workers, traveling nurses, buyers and sellers waiting to close on new homes, others whose homes are undergoing renovations, and other special cases e.g., off-island family members who care for loved ones. This is subject to an application and approval process which the city will clarify before 10.23.2022.

________________________________

How Will The City Enforce The Rules?

Since 2019 when CO 19-18 (Bill 89) took effect, the city planned to hire seven more city inspectors. But due to a lack of funds, the inspectors never got hired. Hence the enforcement of CO 19-18 (Bill 89) was largely non-existent.

This time the city appears committed to hiring additional staff to aggressively monitor rental ads and wiping out illegal rentals. We will see how effective the DPP code enforcement will become.

________________________________

Will The New Rules Accomplish The Stated Goals Of Freeing Up Housing Stock And Improving Housing Affordability?

Bill 41 supporters forcefully argued that rental restrictions are needed to “get tourists out of residential neighborhoods” and to “increase Oʻahu’s housing supply by inducing owners to convert their short-term rentals to long-term rentals for local residents.” This is supposed to “improve housing affordability (!?)”

“Extraordinary claims require extraordinary evidence.” ~ Carl Sagan

That sounds like a classic case of fluency heuristic. It’s an idea that can be explained simply and is easy to believe even though the simple-sounding idea is nonsense. E.g., building a train will not fix traffic congestion. Some will opt to take the train which will incentivize others to drive by car. It’s a variant of Parkinson’s Law applied to urban traffic. Dig a hole deep enough on the beach next to the ocean and it will fill up with water.

Then what results can we reasonably expect?

- “Get tourists out of residential neighborhoods.” – It remains to be seen if Lanikai or the North Shore will indeed become less crowded with fewer rental cars.

- “Increase Oʻahu’s housing supply… and improve housing affordability.” – Sounds like a noble goal we can rally behind, but will Bill 41 do the trick?

Perhaps enforcing the existing CO 19-18 (Bill 89) could have shut down some illegal STRs in residential neighborhoods. Regretfully, the DPP claimed to be overworked, understaffed, and proved to be ineffective. Will Bill 41’s tighter restrictions and additional requirements help ease the DPP’s challenges?

Just to be clear, I’m against illegal STRs in residential neighborhoods and fake 30-day rental contracts. But changing the threshold from 30 days to 90 days also comes with drawbacks.

As far as Bill 41 improving affordability? It is likely to disappoint and prove to be a misfit, a square peg in a round hole. It’ll do diddly squat to counteract the lack of affordable housing. We shall compare notes in the fullness of time. Housing values will remain what they have always been, elevated.

________________________________

What Are The Legal Challenges To The New Rules?

Some legal experts are objecting to the bill based on two concerns:

A) Could it be government overreach and illegal taking of long-standing constitutional property rights? The city modified the Land Use Ordinance and changed the definition of a Transient Vacation Unit from 30 to 90 days without protecting property owners’ continued lawful use of their property.

Both the Hawaii and Federal constitutions protect a pre-existing lawful use as a vested property right which cannot be taken away without due process of law.

H.R.S. Section 46-4(a) prohibits counties from using their zoning powers to adopt ordinances that prohibit “the continued lawful use” of a purpose for which the property was used at the time the ordinance was adopted.

Section 20 of the Hawaii Constitution, prohibits “damage” to property value and use without just compensation. Rentals offering stays between 30 and 90 days have been legal for decades. Private property owners expended substantial time, effort, and money acquiring and investing in monthly rental properties. Bill 41 severely damages, if not effectively destroys, the reasonable, investment-backed expectations of these property owners with no opportunity to continue the use through nonconforming use permits.

B) Could unfair favoritism establish hotels as a privileged class? That may have been one of the original primary hidden goals of Bill 41. Because hotels are not subject to the new regulation.

Bill 41 inappropriately penalizes legal short-term rentals in resort zones with the undue burden of excessive registration fees, additional restrictions, and administrative requirements while hotels are exempted.

Proponents of Bill 41 were pandering to the masses by promising to crack down on illegal short-term rentals in residential neighborhoods. However, penalizing legal B&Bs and TVUs in resort zones does nothing, zippo, zilch to advance the official stated goals.

— Attorneys are reviewing lawsuit precedents such as this one and preparing for legal actions. Stay in the know and sign up for our Blog updates.

________________________________

What’s Next?

Bill 2 (CO 22-6) took effect on March 28, 2022.

Sellers of residential real property must provide to the buyer this Short-term rental (STR) disclosure form stating whether the property may be legally used as a STR.

1) If the residential real property is being used as a short-term rental, the Seller shall provide the following evidence of legal use as a short-term rental to the Buyer before the execution of a real estate purchase contract by the Buyer:

- The applicable government permit number, the NUC number, or the short-term rental registration number; and

- Tax clearance certificates evidencing the current payment status of GET, TAT, and OTAT.

Further, within 7 days after the closing of the sale, the Seller must email the DPP (Department of Planning and Permitting) the completed form with supporting documentation to STR@honolulu.gov.

2) If the Seller discloses that the property being sold may not be legally used as a STR, then the Seller only needs to check box #2 on the form and provide it to the Buyer.

________________________________

Bill 4 (2022) is currently being deliberated.

Bill 4 proposes a separate property tax classification for B&Bs and TVUs that operate outside of the ‘resort mixed-use’ and ‘resort’ zone.

The city’s goal is to increase tax revenue by collecting a higher property tax from STRs that should not be classified as ‘residential’ or ‘residential A.’

Stay tuned for what the revised property tax rate will be.

________________________________

The Silver Lining

No doubt, Mayor Blangiardi’s stated intent to crush illegal short-term renting in residential neighborhoods is reflected in the recent legislation. Not stated is that Bill 41 and Bill 4 will blatantly benefit the hotel industry at the expense of legal STRs.

This new dynamic confuses some real estate investors in assessing the risk/reward balance of STR properties.

I have been an outspoken fan of legal STRs for wealth creation. We have assisted many buyers of legal STRs over the years. Congratulations to you if you bought the right property for the right reasons.

However, if you have been waiting on the sideline for the outcome of Bill 41 and Bill 4, don’t fret any longer. Because life is simple if you focus on what’s important.

Here are two reasons why the future profit potential for legal STRs looks bright:

- Hawaii will always be a top tourist destination for the ones that can afford it.

- Bill 41’s attempt to shut down illegal STRs will bring a net benefit to legal STRs.

See related article: How To Improve Your Hawaii Condotel Rental Income

That’s why I just bought another legal Waikiki STR property just a couple of months ago. The glass is half full. Will you move forward this year and fulfill your dreams? You deserve it. ~ May you live well and prosper.

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Firstly thanks for this informative blog, it’s very useful!

On this STR article you mentioned that Hawaiian King does not offer STR but I see that VRBO, a local agency (Hawaii Dream Realty) and even unit 101 has it’s own website are all offering short term in the building. Has anything changed since the blog article was written or are they probably breaking/ignoring the rules?

Aloha JR!

We believe that the blog article is correct.

If someone has written evidence from the DPP to the contrary, then we will humbly update.

Yes, some are probably breaking/ignoring the rules.

~ Mahalo & Aloha

Has there been any update or information shared regarding the application, approval process and affidavit for exempted parties? i.e. Travel Nurses

Aloha Isaiah!

Update as of 10.13.2022: Federal Judge Watson ruled that the DPP and the City and County of Honolulu shall not implement and enforce changing minimum rental terms from 30 to 90 days! One of the key provisions of Bill 41 has been rendered void.

Back to what it always was:

30-day minimum rental terms per tenant in residential neighborhoods are allowed. No application or approval process is needed for <90-day exceptions for traveling nurses, etc.

~ Mahalo & Aloha

Hi George. I am looking for a STR. Would you please contact me?

thanks,

Joan Kendall

Aloha Joan Kendall!

For the most expeditious service, call us or use our contact form when you are ready to proceed.

We are here to help.

Mahalo & Aloha

Hi

We have been renting various properties for over 25 years. These politicians will learn a hard lesson about the importance of tourism to their economy in all regions. We will be moving our 10’s of thousands of dollars annually to other tropical locales.

Aloha Randy!

Thank you for your comment and contribution.

~ Mahalo & Aloha

I’ve always been amazed that the government never discusses landlords who are honest tax paying citizens. Who have registered and are legal GET & TAT tax payers. Who charge their guests these taxes and remit the taxes quarterly.

No consideration to these landlords are ever mentioned, and we all know there’s a few landlords who are not registered and don’t collect or submit taxes to the state.

You would think honest landlords would be able to continue 30 day rentals even if they aren’t in a resort area, as long as the condos they own have like minded neighbours and the Residental area they live in doesn’t object to this type of 30 day rental. Tourists need this type of accommodation and are willing to pay the state taxes.

Is the state willing to lose this tax money? What will losing this tax income do to future state budgets?

What will the loss of tourist dollars do to the economy (car rentals, restaurants, excursions, grocery stores, etc)?

There’s a lot at stake here, and the state should be thinking about protecting honest 30 day landlords and the revenue brought into the state by these rentals.

Aloha Brian Lecompte!

Thank you for your comment and contribution.

~ Mahalo & Aloha

Thank you for this web site and any updates to Bill 41. We are long time visitors of Hawaii, since 1990, with typical stays of 30 days on Oahu, and 3-4 weeks on the other islands. Our usual expenditure per week on the islands is around $1000-$1500 or more in some cases. In order for us to stay our preferred 30 days on Oahu, we’d have to consider an extremely small pool of ‘permitted’ STR’s or a hotel, both of which have the advantage of charging a very premium rate. Unfortunately we will no longer be visiting Hawaii until this Bill is struck down. In the meantime we are taking our dollars to other tropical locations.

Aloha Mark Filip!

Thank you for your comment.

As mentioned, we don’t vouch for the government’s actions and don’t know if the government reads our blog and your comment. 🙁

You may write to city council directly:

https://www.honolulucitycouncil.org/home/#councilmembers

We are only expert realtors, aiming to provide the best real estate services on the planet.

Let us know if there is anything else we can do for you. 🙂

We are here to help.

~ Mahalo & Aloha

Hi George,

For legal STR’s after 4/26/2022 do you know which buildings will require you to use hotel management, versus which ones will allow you to self-manage under the new rules?

Thanks,

Joey

Aloha Joey!

Bill 41 takes effect 10.23.2022 and does not remove the self-management option.

Contrary to earlier versions of Bill 41, the final version was signed into law without mandating monopolized central booking agents/front desk operators. Halleluja. Some common sense prevailed.

However, a few condotel building AOAOs have internal requirements and limit self-management/third-party property management options, e.g., Trump Tower Waikiki and Ritz Carlton.

The Island Colony e.g. requires a license agreement with fees that go to the front desk. 🙁

We discussed ease of management as a key component for maximizing cash flow potential here:

https://www.hawaiiliving.com/blog/improve-condotel-income/

To maximize cash flow potential, I recommend staying away from the most restrictive condotels like Trump and Ritz.

My favorites are the Ilikai and Waikiki Banyan. I own units in both buildings. There are others.

Which units/buildings make the most financial sense depends on your budget and your long-term goals. Every morning I wake up and identify favorites that stand out as the current best available options. But that list changes daily based on availability, pricing, the upfront remodel cost, if any, required to make rent ready, etc.

Let us know if there is anything else we can do for you.

We are here to help.

Mahalo & Aloha

A specific point of contention is the exemptions. There was no transparency in how these exemptions were included in the bill. In Waikiki supposedly everything Mauka of Kuhio is not exempt, however the last revision of the bill included two properties, Banyons and Monarch, as exempt. No reason or process was divulged during public hearings and council rep Tupola made such reference saying it opened up possible litigation as Hawaii law requires inclusion to all residents.

Aloha Kirk Madsen!

Thank you for your comment.

The Waikiki Banyan and Waikiki Sunset are exempt because they really should have been for decades

We wrote about both buildings and the why in previous articles.

~ Mahalo & Aloha

“Should have been for decades”? Is that a qualified exemption? Really? On what premise? There is no explanation for these exemptions that shouldn’t apply to anyone affected by this new Ordinance

Aloha Kirk Madsen!

Thank you for your follow-up comment.

You seem upset. Who do you know in city government that can adequately address your concerns?

We don’t vouch for what the city does. We are only expert realtors assisting buyers and sellers.

Since you asked ‘on what premise?’ – Waikiki Banyan and Waikiki Sunset have been matching the LUO definition for ‘grandfathered hotel use’ for decades.

We wrote about it on our Blog, including here: https://www.hawaiiliving.com/blog/co-19-18-bill-89/

— If you got beef because the city didn’t properly explain why the Waikiki Banyan/Waikiki Sunset got baked into Bill 41 and your property did not, then call the city.

— If you want to stay up to speed, then sign up for our Blog updates. It’s free to the public. We try to keep you and others out of trouble, really. 🙂 🙂

— Call us when you are ready to buy or sell real estate. That’s what we do best. We are here to help.

We wish you well.

~ Mahalo & Aloha

What the actual last day is before the 90-day min must occur is not at all clear to me. Although I see Oct 23, 2022 as the effective date, reading the Cityʻs short-term rental takeaways suggest that monthly rentals of all stripes (not just true month to month leases) can happen all the way through to April 23, 2023 (see https://www.honolulu.gov/dppstr/default.html , see Main Point 3). So essentially I can do a 1 month Airbnb rental without a certificate all the way to March 23. Am I mis-reading this?

Aloha Melissa!

You may continue to rent until 4.23.2023.

Check for continuous updates at the top of the article.

Things are subject to change.

Good luck.

~Mahalo & Aloha

George read your thoughts in which you continue to mention “legal” STRs; however, many of us were ready in 2019 with all the requirements to become legal, but the city delayed us so many times then corvid hit and then the new city council started from scratched and played ball with the hotels. I am 82 years old and a widow and was only doing this to help pay for my $389k mortgage. I will be turning my 1sr floor unit back to a long-term rental as I am fed up with the city and our government and the DPP. No matter what law or enforcement they pass, the DPP will NEVER be able to handle anything. I’ve enjoyed 4 1/2 years as a SUPER HOST in spreading the aloha spirit to all my guests. I just feel so sad that my home ownership rights are being taken away from me.

Aloha Georgietta Chock!

Thank you for your comment.

For now, you may continue renting your 1st-floor unit with 30-consecutive day minimum rental terms until April 23, 2023. Check for any updates at the top of this article.

All the Best.

~ Mahalo & Aloha

It’s best if everyone writes to the mayor and their rep about their complaints. They need to hear them.

Could send to a second r mail also

If so -bonesjones1927@gmail.com

Mahalo Donald jones

Aloha George, thank you very much for this informative summary. What about the Colony Surf, a condominium building with its own parking structure. It has zero impact on the surrounding neighborhood whether 30 day or 90 day minimum. Are you aware of any procedure for a building (HOA) to apply tot be exempt, like the Aloha Surf; Hawaiian Monarch; Island Colony; Palms at Waikiki; Royal Garden at Waikiki; etc.

Mahalo,

Dan

Aloha Dan Livingston!

Thank you for your comment.

We are not aware of any procedure for a building (HOA) to apply to become exempt today. The buildings you mentioned, e.g., Aloha Surf; Hawaiian Monarch; Island Colony; Palms at Waikiki; Royal Garden at Waikiki; etc., have been grandfathered because they continuously maintained a 24/7 hotel front desk operation for many decades.

Colony Surf owners could vote on hiring an attorney and attempt to pursue this. Other buildings have tried that, …unsuccessfully.

Waikiki Banyan and Waikiki Sunset are the exceptions. We explained the background and why in previous articles.

To be clear, we don’t vouch for what the city does.

We are only expert realtors, aiming to provide the best real estate services on the planet.

Let us know if there is anything else we can do for you.

~ Mahalo & Aloha

Hello George, I have heard that Makaha is exempt from this bill. We are looking to purchases a unit at the Hawaiian Princess. Have you heard anything about Makaha? Thank you…

Aloha Billy Sanders!

At the beginning of the article look for category “2) Individual properties with a NUC,” then click on the link that shows all 793 NUC properties.

Eighteen units at the Hawaiian Princess have NUCs (page 15 of the report) and are exempt from Bill 41.

https://www.hawaiiliving.com/assets/editor/nucreport_dec_8_2020.pdf

Make sure you buy the right one. 😁

Also, understand the risks of buying leasehold property: https://www.hawaiiliving.com/blog/leasehold-properties-risks/

Good luck.

~ Mahalo & Aloha

Aloha!

Just wondering if you know if there’s a certain date for bookings grandfathered into this rule or who is the best to contact to find out. I have folks that booked for March about six months ago.

Any info or contacts you may have are appreciated.

Thank you,

Andrea

Aloha Andrea!

Enforcement of Bill 41 for existing rentals (30 to 89 days) starts on 4.23.2023 (pushed back from 10.23.2022, see the top of the article)

Any bookings that don’t comply with Bill 41 on 4.23.2023 will be subject to fines. I regret, there is no early bird special.

But don’t take our word for it. We are only realtors that assist buyers and sellers with buying and selling real estate. 😉

Also, always check for the latest updates on our Blog. Things can change.

We are here to help.

~ Mahalo & Aloha

My husband and I bought a condo in Makaha Valley Towers, closing in February of 2021. It is zoned residential. We bought it as a vacation home for our family, and as a place for us to retire in. In order to afford the second home we have to rent it out when we are not able to be there. We cannot afford to keep the condo otherwise. My husband still works on the mainland, but we are able to spend up to three months in the condo ourselves. We researched the laws on short-term rentals, obtained a permit, followed ALL the rules and the law, and we pay our TA, GE and property taxes. We are not causing any traffic or parking problems and we have only rented it out for 30 days or more, since the beginning. This new law will force us to either sell the condo, or move into the condo full-time. We can’t move until he retires and if we rent it out to a permanent tenant we cannot use the condo ourselves. Not many people will rent out a condo for 90 days! The previous owner, rented it out as a short-term rental, for no less than 30 days at a time, for years. They let us know that we could not rent it out for any less than 30 days when we bought it. It seems this law was created to address illegal STRs, parking congestion and a lack of affordable housing in residential areas. Our condo is our retirement home. We will spend at least 90 days a year there. We’ve been legal since we bought it. Thanks a lot Mayor! Makaha is NOT Honolulu. So much for owning a place to retire in!

Aloha Linda S!

Thank you for your comment.

I’m so sorry to hear about your hardship.

I regret, we don’t know if the mayor reads our blog. 🙁

Perhaps, someone could kindly forward your message to him.

We don’t vouch for any governmental entity. We are only expert realtors, happy to help when you are ready to buy or sell real estate.

Stay safe.

~ Mahalo & Aloha

Does this new lawsuit against Bill 41 put the Waikiki Banyan and Waikiki Sunset status as legal STRs carved out in Bill 41 in jeopardy if the Bill were to be defeated?

Aloha Garrett!

Not likely, but nobody knows. The suit challenges only parts of Bill 41.

If Bill 41 were to be defeated entirely, then Waikiki Banyan non-NUC units could still be legal STRs under the 10.22.2019 ruling for ‘Stipulation to Stay Proceedings’ originally filed on 8.1.2019.

Not sure about the Waikiki Sunset non-NUC units.

Some smart attorneys could weigh in and add clarity to this discussion. 😊

We are only realtors and not attorneys.

~ Mahalo & Aloha

Thanks for the most detailed description of this new bill I have found out there. There are a few properties in this pink/resort zone (https://www.honolulu.gov/rep/site/dpp/str/STR_Waikiki.pdf) not mentioned so I’m wondering about the Kalakauan and Pavilion at Waikiki.

If we bought a unit in either one of these and wanted to STR it, we would need to pay the permit/renewal fees, the specific STR taxes and that is all? If it wasn’t previously used as a legal STR, is there still a moratorium on new permits even if it’s in the resort zone?

Mahalo!

Aloha and welcome back Kelly Alliger!

We had communication in January regarding the Ilikai. 🙂

— In case of inconsistencies between zoning and house rules, the more restrictive rules always prevail!

We get countless emails from buyers that made the wrong purchase decision on incomplete or erroneous information.

1) The Kalakauan is listed above as legal STR property because the house rules allow short-term renting, consistent with the zoning. That is unless a specific unit has been ‘dedicated for residential use,’ explained here: https://www.hawaiiliving.com/blog/new-rules-dedicating-condotel-residential-use/

2) The Pavilion At Waikiki house rules prohibit STRs! 🙁

Here is a picture from a notice posted in the Pavilion At Waikiki elevator lobby: https://www.hawaiiliving.com/blog/risks-of-short-term-vacation-renting/

— Make sure that the property you buy meets all the STR legal requirements as outlined on our site.

Call us when you are ready to proceed.

We are here to help.

~ Mahalo & Aloha

The Pavillion sign is illegal. The association is trying to change the CC&R’s to a minimum 30 day but as of now there is nothing in the CC&R’s about minutes

minimum rentals.

Aloha Ronnie Ferguson!

Thank you for commenting and your contribution towards clarity.

— Help us understand what makes the sign illegal.

The house rules prohibit rental terms of less than 30 days.

If this changed recently, please forward written evidence and we will humbly update our Condotel Guide.

~ Mahalo & Aloha

Hi George,

Great blog with lots of useful information.

The government in Hawai’i is doing what governments do best: make problems worse. It appears that they are making life miserable for people who own real estate on Oahu.

Money moves to climates where it gets treated best and unfortunately with all that has happened in Hawai’i over the past 30 years or so it just keeps getting worse for owners. (Hawai’i is not alone in that regard either.)

When we first started to spend out summer holidays in Waikiki we used to rent a unit in the Pavillion for a period of 30 days and sometime 6 weeks, This was in the late 80’s and early 90’s.

So at one time they allowed these type rentals or maybe the owners just ignored the rules.

In any event the building was conveniently located and the rental cost was quite reasonable.

We also stayed at other units in a variety of buildings on our other trips too including the Ilikai, Waikiki Sunset, Hawaiian Monarch, and Discovery Bay.

Our rental period in these buildings ranged from ranged from a few weeks to a little over a month.

Some non conforming Condo Tels like Palms at Waikiki is also subject to $1K initial registration fee, and a $500 annual renewal fee? And also potentially pay higher tax under Bill 4?

Aloha Jia Kang!

1) Non-conforming condotels that have been ‘grandfathered’ for hotel use in the apartment precinct, e.g. Palms At Waikiki, Aloha Surf, Hawaiian Monarch, Island Colony, and Royal Garden, are all subject to Bill 41’s $1K/$500 registration/renewal fees.

2) However, the proposed Bill 4 (separate property tax classification) will not apply to these specific grandfathered condotels, because they are already being assessed the highest $13.90 Hotel/Resort property tax rate by default since CO 17-013 was signed into law in 2017.

That is unless the individual unit has been “dedicated for residential use.”

See details here: https://www.hawaiiliving.com/blog/new-rules-dedicating-condotel-residential-use/

Let us know if there is anything else we can do for you.

We are here to help.

~ Mahalo & Aloha

As far as I know two properties in Ala Moana area are allowed to do a short-term lease (30 days minimum) such as One Ala Moana and Park Lane. Because of Bill 41, what do you think will happen to those two properties? Do you think their AOAO must follow this 90 days minimum guide line as well?

Aloha Takashi Misawa!

The more restrictive rules always prevail!

In the case of One Ala Moana, Park Lane, and others, Bill 41’s 90-day rental terms are more restrictive and prevail over AOAO/house rules that would have otherwise allowed 30-day rental terms.

Let us know when you are ready to buy or sell again.

That’s what we do best.

We are here to help.

~ Mahalo & Aloha

Aloha George. Thank you for detailed updates on Bill 41. I am an owner of a legal STR (Ilikai Marina) wondering if legal STR located in the Resort and Hotel zones on Oahu need to be registered separately under Bill 41?

Any other changes that affect legal STR in the Resort zones? Mahalo

Aloha Alex!

All STRs must get registered under Bill 41 and are subject to the initial $1K registration and $500 annual renewal fee afterward. That includes your Ilikai Marina unit in the Resort Mixed Use zone.

Except, current NUC units are subject to renewal on October 1, 2022, and every two years after that (last two-year renewal fee was $600 in 2020).

Bill 41 also requires that you prove that you are current on your GET/TAT/OTAT payments and carry $1Mill liability insurance. The city will let us all know how/what/where we need to provide that and anything else before October 23, 2022, that’s the day Bill 41 is expected to take effect.

The entire Bill 41 is here: https://hnldoc.ehawaii.gov/hnldoc/document-download?id=13949

We will see how effective the city will be in implementing the new rules.

— Your Ilikai Marina unit is in the Resort-Mixed-Use zone. So your property taxes will remain the same at $13.90.

For all other STRs outside of the ‘resort’ and ‘resort-mixed use’ zone that are currently being assessed at the lower ‘residential’ and ‘residential A’ rate, the proposed new Bill 4 is expected to raise property taxes shortly.

As mentioned, the situation is fluid. Stay tuned for updates.

We are here to help.

~ Mahalo & Aloha