- Markets are normalizing. – Some metrics are regressing to the mean. The extraordinary fiscal and monetary policy that distorted the supply and demand ratio during the last two years has ended.

________________________________

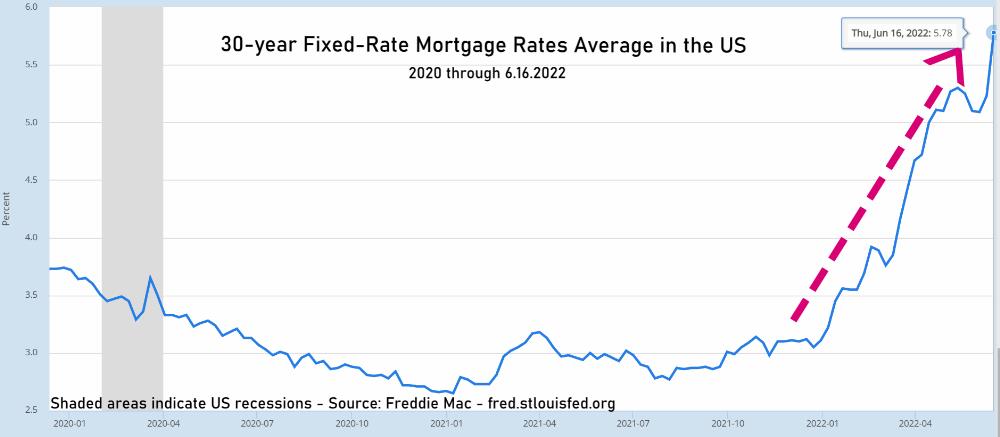

In early 2022, we saw a culmination of FOMO (Fear of Missing Out) among eager home buyers chasing dwindling record low supply while trying to lock in some of the lowest mortgage interest rates before they were expected to move up.

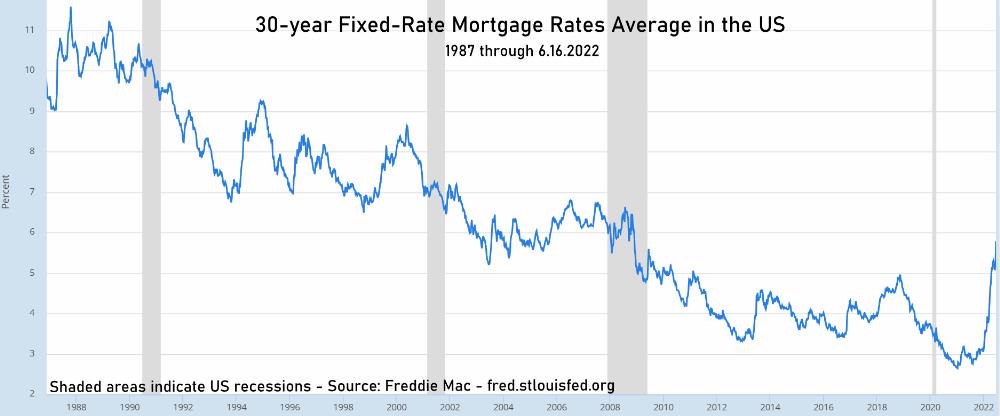

This buying frenzy peaked when properties recently received as many as 38 offers and sold at up to 30% above their list price. But mortgage interest rates shot up to 5.78% (6.16.2022), the highest since 2008, and are double compared to six months earlier. It’s not just the magnitude but the speed of change that suddenly creates an affordability sticker shock. Demand quickly cooled off in the last few weeks, proving that experts’ predictions were entirely wrong, ..again.

________________________________

How Did We Get Here?

During COVID, the Fed massively increased the money supply, known as QE Infinity. Near-zero % short-term rates lowered borrowing costs and fueled consumer demand for goods and real estate. Eventually, inflation moved up during 2021. However, Fed chair Jerome Powell tried to avoid a repeat of the 2013 taper tantrums. Many now view his cautious wait-and-see approach last year as having acted too slow.

Supply chain interruptions and rising energy prices, notably since Russia’s invasion of Ukraine, spiked the CPI to 8.6%, the highest level since 1981. What the Fed in 2021 considered ‘transitory inflation’ has suddenly mushroomed into a threat to stable financial conditions and economic activity. On June 1, 2022, Treasury secretary Janet Yellen admitted that until recently, she misjudged the inflation risk.

The Fed’s Dual Mandate is to implement monetary policy promoting maximum long-term employment and stable prices of goods and services bought by consumers.

The Fed has reversed from an accommodating stance to aggressively tightening to reign in the corrosive effects of high inflation. On June 15, 2022, the Fed raised its key interest rate by 3/4 of a point, the most significant increase since 1994. More rate hikes are expected in the following months to cool off the U.S. economy for a soft landing, hopefully without causing a recession. Consumer and business loans are now pegged to 1.5% – 1.75%. The Fed forecasts a doubling of that range by the end of 2022. It also projects to lower inflation to a 2.2% rate through 2024, with the unemployment rate only rising to 4.1%.

With this type of demand destruction, the Fed’s rate hikes are bound to slow demand-pull inflation. However, they won’t mitigate the cost-push inflation risk, mainly due to soaring gas, energy, and food costs. There is no quick fix for that.

30-year mortgage rates aren’t directly linked to the FED funds rate, but mortgage finance costs will remain elevated for as long as inflation rate expectations are not tamed.

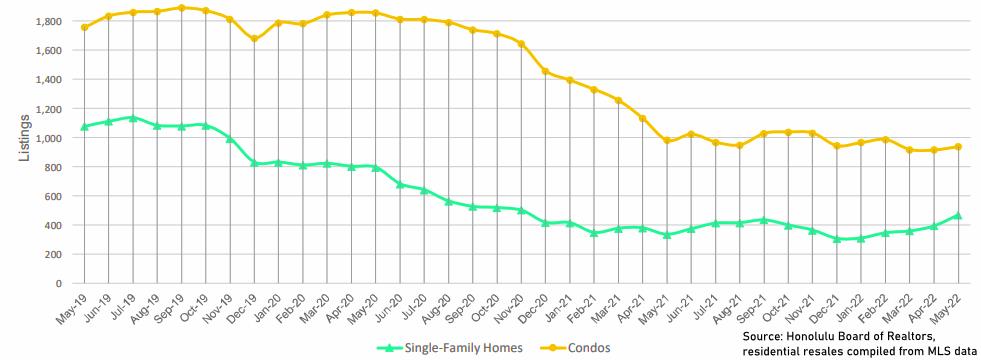

- The crazy home-buying frenzy of Hawaii real estate is gone, but the housing supply stays low.

________________________________

What’s Next?

“Improving decision quality is about increasing our chances of good outcomes, not guaranteeing them.” ~Annie Duke

We don’t pretend to know the future. We leave that up to others. Instead, we observe, share, and set the sails accordingly.

How many buyers will postpone their purchase, for how long, and how will it affect the market?

Millennials vs. Baby Boomers

According to this CNBC’s millionaire survey, 44% of millennial millionaires say higher interest rates have caused them to delay purchasing a home. Yet the same study also claims that millennials are more optimistic about the economic outlook and their investments than boomers:

- 55% of millennial millionaires said inflation would last less than a year. – Two-thirds of baby boomers said it would last at least a year or two.

- 90% of millennial respondents are confident or somewhat confident in the Fed’s ability to manage inflation. – 38% of baby boomers are not at all confident.

- 70% of millennial millionaires believe the economy will be stronger or even much stronger at the end of 2022. – Two-thirds of boomers said it will be weaker or much weaker.”

The Best Inflation Hedge

Unexpectedly, one of my long-time clients decided to buy another investment property. He already owns plenty of rentals and stopped buying about ten years ago. However, he explained that the Jimmy Carter era of high inflation made him wealthy because he had bought lots of real estate then. He thinks that “high inflation will prevail for some time and tangible assets like real estate will be the best inflation hedge.”

We will know in the fullness of time. For now, we review the most current available graphs in their historical context:

- 1) 30-year Fixed-Rate Mortgage Rates – 1987 through June 16, 2022:

________________________________

- 2) 30-year Fixed-Rate Mortgage Rates, zoomed-in – 2020 through June 16, 2022:

________________________________

- 3) Supply – Active inventory, Oahu homes & condos.

Near record low levels but lately trending upward. (Data through May 31, 2022):

________________________________

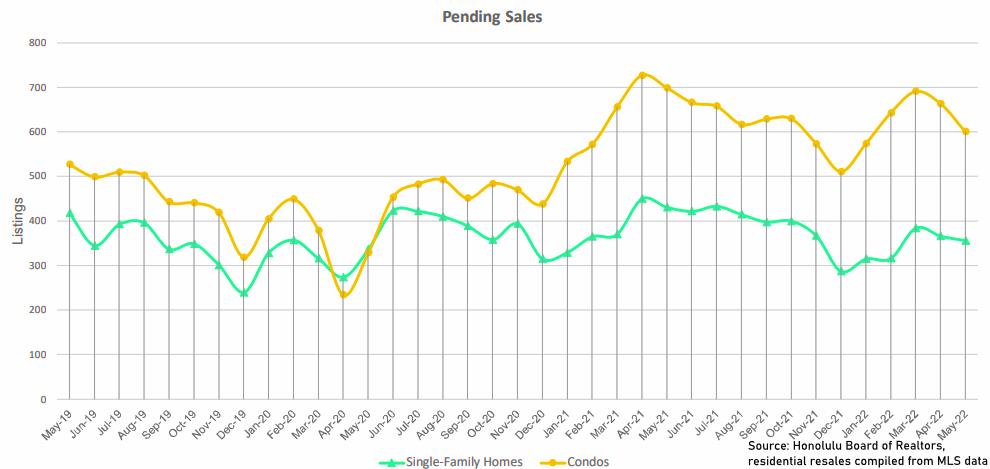

- 4) Demand – Pending Sales, currently in escrow and scheduled to record.

The graph shows the buyers’ recent rush to get into escrow during the first three months of 2022. That was the last push before the most recent high jump in mortgage rates reversed the trend of pending sales downward. (Data through May 31, 2022):

________________________________

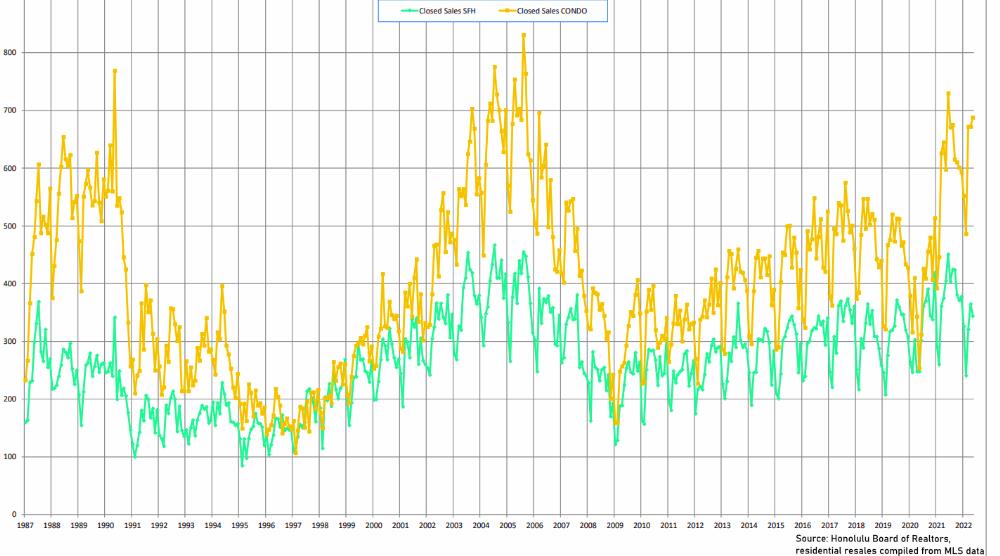

- 5) Closed Sales.

Eventually, pending sales will turn into closed sales 30 to 60 days later. With pending sales slowing, within a couple of months, we will recognize that the summer of 2021 marked the peak of closed sales during this cycle. (Data through May 31, 2022):

________________________________

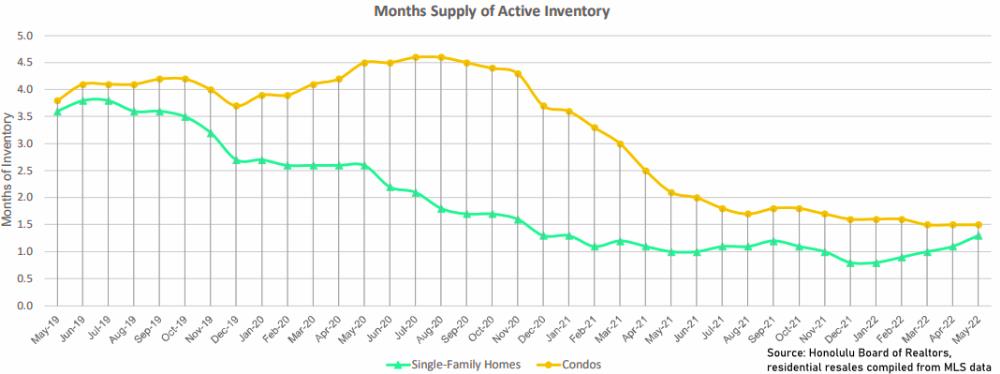

- 6) MRI – Months of Remaining Inventory, aka Months’ Supply of Active Inventory.

This is a measure where we combine supply and demand into one ratio. MRI is the current number of active listings divided by the monthly closed sales rate. MRI shows us how fast the existing inventory sells. Or how many months it would take to sell the current active inventory at the current rate of monthly sales. The lower the MRI, the faster the existing inventory sells.

MRI for single-family homes hit a multi-decade record bottom in December 2021 and has been trending up since January. MRI for condos is still near the bottom and will show an upward reversal in the next month’s data. – MRI trending up means that the market slows down. (Data through May 31, 2022):

________________________________

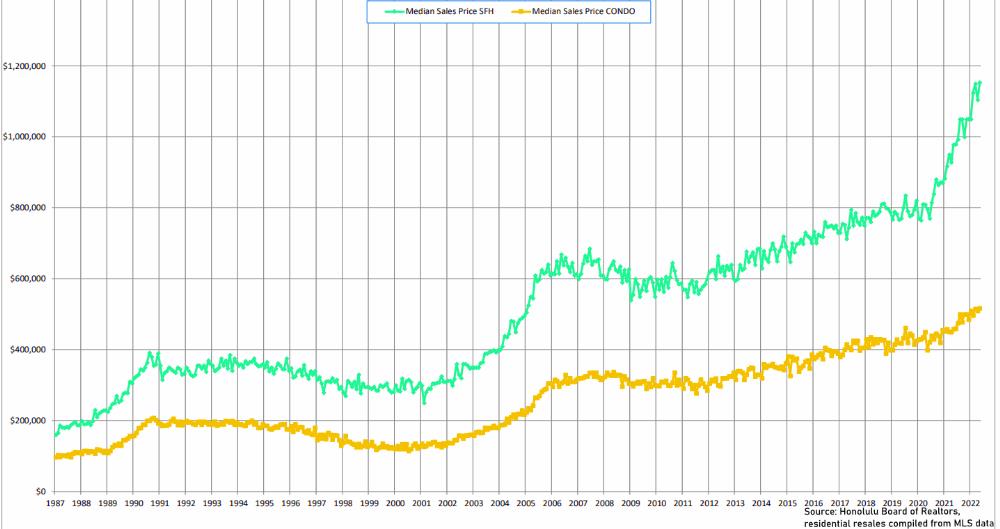

- 7) Median Sales Price – Oahu Single-Family Homes and Condos.

U.S. fiscal and monetary policy during the last two years fueled Oahu real estate prices to reach record levels. When interest rates move higher, and demand slows down, the rate of price increases will normalize.

However, Hawaii is perceived as paradise. Hawaii real estate is a global commodity and a haven, especially during uncertain times. If the inventory stays low, and even with the risk of a recession, prices could remain elevated and form a new price plateau. Waiting for prices to drop might be another futile attempt to time the market. (Data through May 31, 2022):

________________________________

What Does It Mean For Buyers?

- Cash is King. If you don’t need a mortgage loan, then you sit in the catbird seat.

- There will be fewer buyers competing for properties than during the last two years. During the most recent few months, the average sales price compared to the list price was 100%(!) Perhaps you no longer need to overbid to get your property.

- If a 30-year fixed-rate mortgage seems unaffordable, consider an adjustable rate, e.g., a seven or 10-year ARM. This is not for the faint of heart. You must foresee your financial ability to refinance when rates move lower again. Eventually, they will.

What Does It Mean For Sellers?

- For the last two years, properties have been flying off the shelf at record speeds. Be prepared; less demand means it might take longer to sell your home.

- During the last two years, aggressively overpricing property often worked out ok for most sellers because many buyers were chasing fewer properties at ever briskly increasing prices. However, overpricing properties might turn counterproductive in today’s market.

________________________________

Conclusion

— If you think timing the market is tough, we agree. That’s why we recommend buying:

- When you are committed to living in the same neighborhood, and

- When you find a suitable home that fits your budget and needs.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Hawaii has the wonderful weather all year and great food.

Lived in East, West, Windward Oahu & owned in North Oahu. Sold real estate for 25+ years. I’d say Kailua is the best place to live or invest. Even presidents vacation in Kailua. Its has beautiful beaches, friendly ppl, lower crime, stores, excellent schools near Marine base. Our favorite area is Kalaheo Hillside in Kailua as rare large lots, lush hillside not in tsunami flood zone, walk to beach and easy access to freeway and all.

Avoid Aikahi as sewage treatment smell is awful. Lanikai is nice only low lying and narrow road in and out.

Maunawili is nice if you don’t mind the wet.. East Hawaii Kai Koko Kai is very nice. In South East Waialae Nui or W- Kahala is nice. North & West shore is great for surf & beaches only too much drugs and crime. Favorite best place to live is Kailua.

Aloha JS JS!

Thank you for your comment.

Yes, we are lucky to have wonderful weather:

https://www.hawaiiliving.com/blog/hawaii-living-quality-of-life-and-why-we-have-the-finest-weather-on-the-entire-planet/

Not sure if you still live in Kailua or where on Oahu.

If not, come back when you are ready.

All the Best.

~ Mahalo & Aloha