- Leasehold property values gravitate towards $zero.

- The investment aspect is flawed and speculative at best with many unpredictable variables.

- Leasehold ownership is more of a lifestyle choice.

________________________________

We recently received this inquiry: “I have heard that Makaha is exempt from Bill 41 (and allows short-term renting). We are looking to purchase a unit at the Hawaiian Princess. Have you heard anything about Makaha?”

Here is the skinny: Makaha is not exempt. But eighteen units at the Hawaiian Princess have NUCs (check page 15 of the report) and are allowed to do short-term renting. – Good.

However, be aware that the Hawaiian Princess condo is still a leasehold property. – Not good. ☹

________________________________

Fee Simple properties have become scarce and expensive since the recent run-up in the Hawaii real estate market. No wonder many buyers express renewed interest in alternative, more affordable leasehold properties.

As the headline suggests, we don’t recommend buying leasehold properties. If you must, we often refer you directly to the listing agent representing the seller.

But if you still insist that we represent you with your purchase, we have you sign a hold harmless/liability waiver spelling out that you acted against our recommendations.

That’s because we don’t want you to make the wrong move. We care for you to succeed! That’s why we share our thoughts and aim to provide you with the best advice and service available on the planet.

Buying a leasehold property comes with a uniquely inherent risk of diminishing value. When owning a leasehold property, you only own the improvement or structure. Someone else owns the land underneath, aka the ‘Fee interest.’ You pay a monthly lease rent to the Fee owner until the lease expires. The rent is above the customary property taxes and applicable HOA/maintenance fees.

The lease rent could increase during the lease term, also referred to as lease rent ‘renegotiation.’

Lease Rent ‘Renegotiation’ Is A Misnomer

Your lease rent increase (renegotiation) occurs at predetermined ‘renegotiation’ dates. However, the term renegotiation is a misnomer. It implies that you get to negotiate what the new lease rent might be. That’s not the case.

The renegotiated lease rent is calculated based on a predetermined formula within the lease agreement and is subject to a current fair market commercial appraisal.

Be prepared that a higher current fair market appraisal value will automatically translate into a higher renegotiated lease rent.

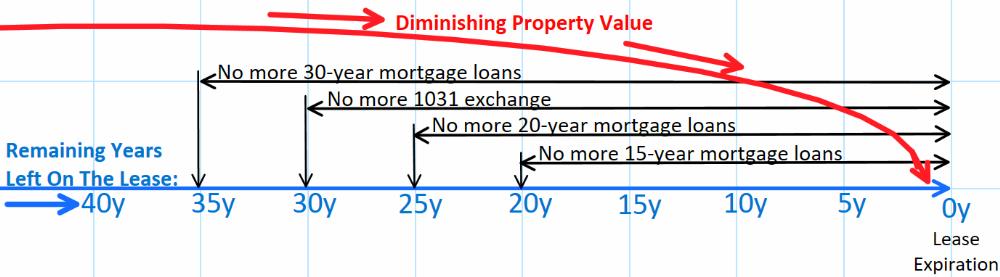

As if an increasing lease rent is not bad enough, consider that it also gets more challenging to finance the property as you get closer to the expiration of the lease.

Mortgage lenders require the remaining lease term to be at least five years longer than the mortgage term.

With less than 35 years remaining on the lease, you will no longer be able to get a 30-year mortgage loan.

To make matters worse, with less than 30 years remaining on the lease, the property no longer qualifies for a 1031 exchange.

The shorter the remaining lease, the less desirable the property becomes, and the more the property value evaporates. Approaching the expiration of the lease term is like watching an ever-shortening fuse on a time bomb. Will you be able to find a greater fool that will take on the risk and buy the property from you? Will you be able to cash in your poker chips before the ship sinks?

Eventually, you must be prepared for three possible outcomes at the lease expiration.

________________________________

Lease Expiration – Three Possible Outcomes

- The Fee becomes available. – This would be the most favorable outcome. You get to buy your proportionate interest in the land (the Fee) and turn the property into a Fee Simple property. However, the price of the Fee is set by the landowner and offered on a ‘take it or leave it’ basis. You are entirely at the mercy of the landowner.

- The landowner extends the lease term. – That’s done by offering you a new proprietary lease, typically at less favorable terms and again on a ‘take it or leave it’ basis.

- The landowner takes back the property. – You get a friendly letter thanking you for making all those payments. The party is over. You get to pack your bags and give it all up. That is a real risk. It’s called reversion.

________________________________

Lifestyle/Personal Enjoyment Vs. Investment

Buying a leasehold property for lifestyle/personal enjoyment might be ok under certain circumstances. But be prepared that all good things end when the lease expires.

If you buy a leasehold property for lifestyle, you must have no concerns about the future property value. That might be all right if you are mature in age and don’t care about leaving a financial legacy for your heirs or your favorite charity when you meet your maker. Enjoy the ride and live it up.

In contrast, be careful if you buy a leasehold property as an investment. It baffles me how many investor buyers are trying to justify their leasehold purchase by arguing as follows:

- Because it is cheaper, I can afford it and could pay with all cash. No need to get financing.

- The CAP rate (net cash flow vs. purchase price) is much better, and I could get ahead faster financially.

- The Fee might eventually become available at a favorable price.

- I could always sell the property before the lease term expires.

- Most owners in the condo already bought the Fee. The landowner won’t be able to tear down the building.

- The AOAO turned the condo into 2/3rds Fee Simple because they purchased two out of the three parcels below the condo building. (e.g., Discovery Bay)

There are several flaws with these arguments.

Granted, the CAP rate, or cash flow in relation to the purchase price, is often better. And in the short term, it might seem you’re ahead financially.

However, do not neglect to calculate that your leasehold investment gravitates towards a $0 value.

Cash flow should be paramount when deciding which investment property to buy. Appreciation potential is only secondary because it is speculative at best and not guaranteed. Since your leasehold ‘investment’ depreciates and gravitates towards zero, you must deduct from your cash flow the value of the leasehold investment prorated over the remaining years until the lease expires.

Let’s take the Hawaiian Princess example above with a 2036 lease expiration. That leaves only 14 years remaining on the lease. Let’s assume you pay $280K for a leasehold unit. $280K : 14 years = $20K/year : 12mo = $1,666/mo. Although the value does not necessarily depreciate in a straight line, we could argue that your leasehold equity erodes by $1,666 per month.

Is it still a good investment, or are you engaged in a reckless endeavor? It’s like swimming across the lake with bricks tied to your legs. – That’s not how I like to invest.

Instead of gambling and hoping to stay ahead financially before the party runs out, I prefer investments that have the potential to appreciate over time. Fee Simple properties could probably double in the next 12-14 years and quadruple over the next 24-28 years. And if it takes 30 or 35 years instead of 28, so be it. Certainly better than $zero at lease expiration. ☹

Go for the long-term benefits over short-term gratification. Remember the Stanford marshmallow experiment?

See related article: Wealth Creation With Real Estate

In response to the last two questionable arguments, 5. and 6. from above:

5. Although the landowner won’t be able to tear down the building, he can take back your leasehold condo.

6. A property is either Fee Simple or leasehold. There’s no such thing as 2/3rds Fee Simple. It’s still leasehold. Granted, the landowner can no longer take back your leasehold condo. At best, you are avoiding the worst-case scenario only. The rest is hope and wishful thinking.

________________________________

The Six Pillars Of Financial Freedom:

- Cash Flow

- Debt Management

- Emergency Funds

- Proper Protection – Hedge/Insurance

- Building Equity/Wealth

- Preserving Wealth

If you are investing in real estate to gain financial freedom, then recognize that when you invest in a leasehold property, both ‘Building Equity’ and ‘Preserving Wealth,’ two out of the six crucial pillars are entirely missing.

________________________________

Returns Are Irrelevant Unless They Are Sustainable

Human nature habitually looks for shortcuts to success. It’s like a dangerous sugar craving while ignoring the risk of diseases and shortened life expectancy.

That’s also what pushed popular meme stocks like AMC, GameStop, Robin Hood, and others to the moon until they came crashing back.

We love short-term rental properties’ cash flow potential and have advocated prudent investing in condotels. But not when the property is leasehold like the Hawaiian Princess condo. That’s the equivalent of buying meme stocks. Similarly dangerous, speculative, and prone to miscalculation.

Seeking the highest possible CAP rate because of a low leasehold purchase price sounds fun. But that’s Icarus flaming out shortly after flying too close to the sun.

Chasing short-term rental cashflow riches with expiring leasehold properties is short-sighted. Returns are irrelevant if they are unsustainable. You are better off to compound returns over a long time. And the longer the time, the greater the heavy lifting. It’s time in the market, not timing the market.

For almost all big fortunes, it’s not the returns; it’s the endurance and longevity that create substantial success. That’s true for your investments and health, so cut the sugar and rethink your desire to buy a leasehold property.

Warren Buffet, Carl Richards, and others famously stated buying a house is one of the best investments most people ever make. But not because of the return, which is substandard if you live in the house and don’t collect any rent. It’s also not because of the leverage. Instead, it’s because…

“People are more likely to buy a house and sit on it without interruption for years or decades than any other asset. It’s the one asset people give compounding a fighting chance to work.” ~ Carl Richards

________________________________

Two Scenarios When It’s Ok To Consider Leasehold Properties

- The Fee is readily available, and you can buy it a) at a defined known price and b) at the appropriate time, preferably simultaneous with the leasehold interest. In effect, you can convert the property to Fee Simple with full knowledge of the total cost and timing. Or, …

- You have no concern about future valuations. – You got no money constraints, and the purchase is for pleasure only.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

What are your thoughts on using a net present value of future cash flow to determine if a leasehold is worth it?

Aloha Erick!

Go for it if all your modeled assumptions are correct.

Not my cup of tea.

Good luck.

~ Mahalo & Aloha

Boy, I don’t seem to be able to stop thinking about this subject!

I know that you mention that a LH property can be attractive if you can simultaneously by the fee (effectively buying a fee simple property). How efficiently do you see that understanding? I ask because I see a few Makiki properties currently LH but offering the fee as well — the combined pricing seems low for the area. Of course, there may be a short sale and/or foreclosure involved and maybe those complications exert their own price pressure.

But is the LH market (with fee available) efficient or are there untapped opportunities there?

Mahalo for all of the insights!

Aloha Melissa!

Thank you for your comment/question.

Human psychology is as fascinating as selling real estate.

The “Efficient Market Hypothesis” EMH suggests that financial securities are always priced correctly.

But that quickly breaks down, especially with real estate, due to the small number of market participants, high transaction costs, human emotions, information asymmetries, and market psychology.

We are all monkey-brain humans. Some do better than others in recognizing and acting on opportunities despite fear. The world is packed with talkers and sparse with doers.

There is an infinite number of untapped opportunities, but only for the doers.

If you see that the combined pricing (Leasehold + Fee interest) is low, then go for it and buy it. That is if it otherwise fits your lifestyle and financial plan.

The qualifying question is, “What else better could I be doing with my time, energy, and money?”

Call us when you are ready to buy or sell.

We are here to help.

~ Mahalo & Aloha

You are the most excellent and kind educator in this field!

Thank you much for your sharing your knowledge with common man like me!

Aloha Lucas Le!

Welcome back.

Mahalo for your kind words.

Glad we can help.

I really commend you for writing this frank, thoughtful article. Many buyers of leasehold in the 80s and 90s were in for a rude shock. There were many realtors who didnʻt do well by their clients

Aloha Melissa!

Thank you for your kind words.

It’s true, on occasion, buyers share that they bought the wrong property based on spotty advice.

It’s better to call us before buying. We are here to help.

~ Mahalo & Aloha

Simply and beautifully stated.

Thank you

Great article.