– Several Honolulu condos are located on land that is zoned for hotel/resort use. We refer to these condos as ‘condo-hotels’ or ‘condotels’ because they could be used for both ‘residential’, or ‘hotel/resort’ use.

‘Residential use’ means the property serves as your principal residence, your 2nd home/vacation home, or as a long-term rental with rental terms of thirty consecutive days or more per tenant.

‘Hotel/resort use’ means the property rents as a short-term rental with rental terms shorter than thirty consecutive days per tenant. Short-term vacation renting could potentially generate higher rental income compared to long-term renting. It might also provide greater flexibility for personal use between guest bookings.

Honolulu City Council recently adopted Ordinance 17-013 where condos that are permitted for both ‘residential’ use and ‘hotel/resort’ use will automatically be taxed at the higher hotel/resort property tax rate of 1.39% of assessed value, instead of the lower residential tax rate of 0.35% of assessed value.

Also, see the related article: Honolulu County Property Tax Rates

However, you could have the higher resort/hotel property tax rate reduced to the lower residential rate by filing the ‘Petition To Dedicate Certain Property For Residential Use (5 Year Dedication)’

But reducing your property tax rate by ‘dedicating for residential use’ comes at a price: You give up your right to rent your property as a short-term vacation rental.

What is unique about the new rule?

If the City approves your petition:

1.) The new dedication will be reflected on your October 1st assessment notice and remains valid for 5 years.

2.) The new dedication automatically renews for the next 5 years, unless:

- If you cancel the dedication in writing by September 1st in the 5th year, the dedication will not be renewed.

- If the property sells, the dedication continues until the completion of the most recent 5-year dedication period and automatically cancels at that time.

However, the new owner may apply by September 1st in the 5th year for the City’s approval to continue the dedication.

3.) You give up the right to ‘change the use’ for at least 5 years.

4.) If you violate the use restriction, the dedication is canceled retroactively including the full tax year prior to the violation. You will be charged back taxes including the full fiscal year prior to the violation, equal to the difference in tax rate, plus a 10% penalty.

5.) This ‘Residential Use Dedication’ replaces the previously used ‘Declaration Regarding Condominium Use’, now considered invalid.

6.) A Home Exemption will no longer automatically qualify a property for classification as Residential.

Go figure and be in the know!

How does it affect me?

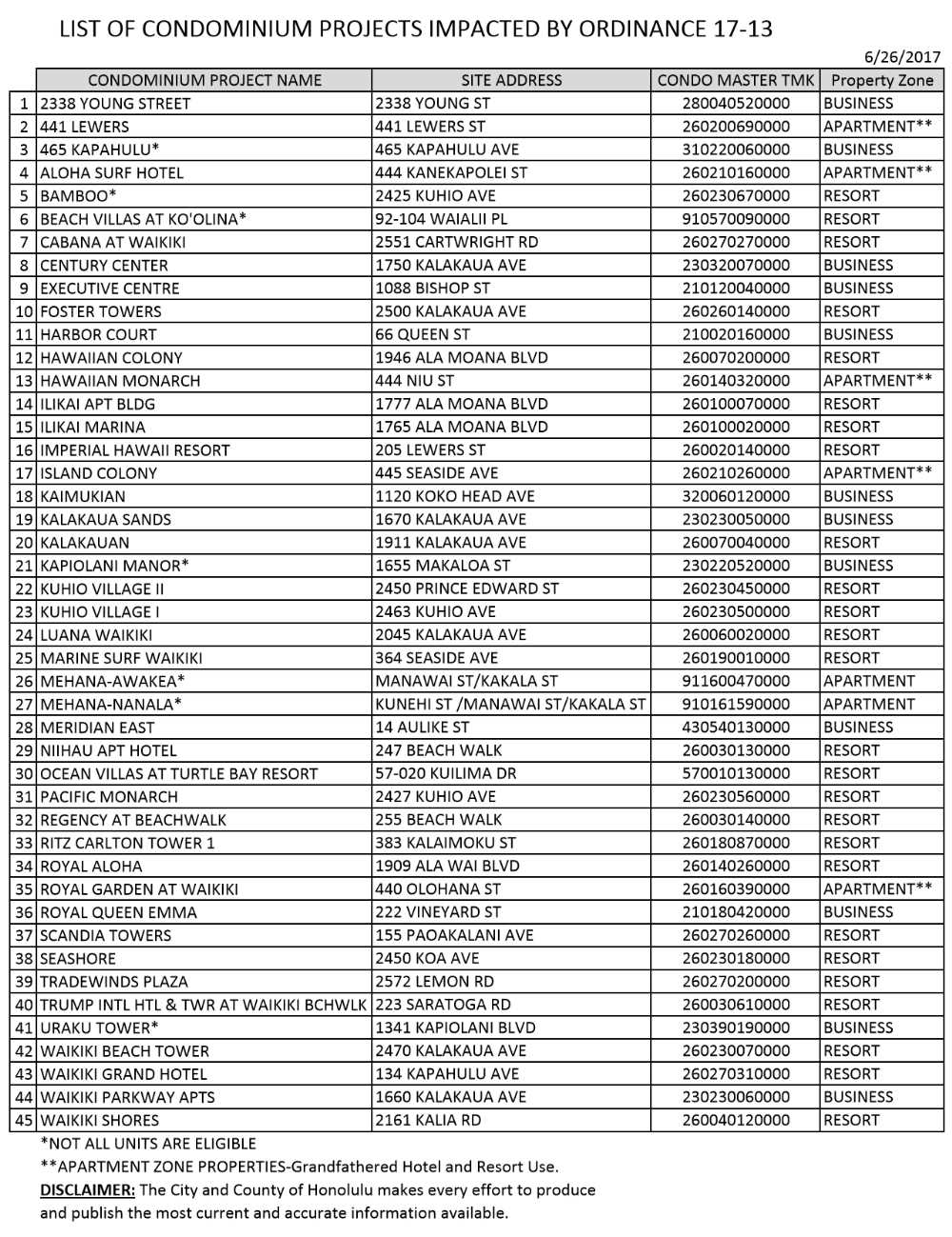

1.) If you own a Honolulu condotel, e.g. the Ilikai, Ilikai Marina, Waikiki Shore, Luana Waikiki, or Trump Tower Waikiki, etc. and, for the next 5 years (!) you do not plan to rent your unit as a short-term vacation unit for less than 30 days per tenant, then you may apply for the residential dedication and claim the lower property tax rate.

2.) If you use the unit for short-term vacation renting while the 5-year residential dedication is in place, you will be charged back taxes including the full fiscal year prior to the violation, equal to the difference in tax rate, plus a 10% penalty.

Click here to download the Petition form and file it by September 1st.

Click here to read the Ordinance.

Final Thoughts:

The city is trying to reduce workload and increase revenue at the same time. The higher tax rate could be triggered for unassuming owners that have had previously filed a ‘Declaration Regarding Condominium Use’, which is now void.

A full fiscal year of retroactive back taxes could mean 12 to 24 months of additional taxes, depending on the timing, plus the penalty adds up to some significant bucks. This could catch some people by surprise.

The burden is on the homeowner to keep current. That’s why we write this blog! Sign up for updates 😉

— Here is a copy of the City letter mailed to about 8,000 Honolulu property owners on 7/7/2017:

Other news from the Honolulu Real Property Tax Division here: https://www.realpropertyhonolulu.com/whats-new/

For all legal matters, always check with your favorite qualified professional legal counsel.

________________________________

— We don’t just write about this stuff. We are expert realtors representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you’ll visit. We’d love to get your feedback on how we might improve. We are humbled by your support and remain committed to constant learning and growing with you. ~ Mahalo & Aloha

Is the Petition to Dedicate form in the Closing documents when I buy a property zoned Hotel & Resort, or is it something separate that I have to do on my own? And if I purchase a property after September 1st, how will I qualify for the .35% vs. the 1.39% property tax rate? Looking at my property taxes, I’ve been paying the 1.39% rate even tho I’ve been residing there since 2022.

Aloha Harold Lawson!

— 1) We are licensed realtors at Hawaii Living, and yes, all our buyer clients either get the link to file online or a hard copy application form when they indicate that they don’t want to do short-term renting in the Resort zone. This is a follow-up service we provide upon closing to ensure that our clients don’t miss the Sept 1st filing deadline and lose out on big bucks’ savings.

I have not seen escrow companies provide this application, however, many escrow companies provide instructions to file for the owner-occupant ‘home exemption.’ More on that here: https://www.hawaiiliving.com/blog/claim-honolulu-home-exemption/

I can’t speak for what other real estate brokerages do.

Sorry if you missed out. That’s why we write this blog. It’s free. Might as well sign up. 😉

— 2) The annual filing deadline is on Sept 1st every year.

If you missed Sept 1st this year, then file now to make next year’s Sept 1st deadline. The tax savings will kick in effective the following year on July 1st after having met the filing deadline. Good luck!

Call us when you are ready to buy or sell. That’s what we do best. 🙂

We are here to help.

~ Mahalo & Aloha

“Declaration regarding condominium use” , wasn’t that the form that was only valid for a few month every year and then expired. And they couldn’t tell you when they would publish the new one. So if you had been wrongly classified as hotel and resort you would have a really hard time changing your classification?

Aloha Matsumoto Kyoshi!

I’m sorry you had trouble filing the “Petition To Dedicate Property For Residential Use.”

So far the form has been the same since 2017. Our article above includes a direct link to the form on the city’s website. However, you must follow the instructions on the form and file by the Sept 1st. deadline for the dedication to take effect for the next fiscal year starting July 1st. the following year.

To be clear, we don’t vouch for the city. Perhaps the form could change in future.

— We are expert realtors trying to provide helpful information for free. May you benefit in some way.

We wish you well.

~ Mahalo & Aloha

And on July 15, 2022 as the 5 year dedication is coming to an end we have received a letter titled “Audit for residential use program” from the property tax department asking to fill a form which among others has an open text box asking “Please explain how you are using this property :” They could have made this a multiple choice question with e.g. “are you still using this property exclusively as a long term residential rental”, or “are you using your property as your personal residence”, …. But I’m sure they are hoping that some unsuspecting owners write something vague or not matching the exemption definition an they then can reclassify the property tax to the highest and best -> short term / resort property tax rate. Also the owner has to respond by Sept. 1st or else he will be automatically upgraded, of course. Btw. What wording do you recommend if one uses his condo only for as a long term rental?

Aloha George Hunter!

Yes, the property tax rate will default to the higher tax rate either by not replying to the audit by September 1st, 2022, or by responding with a statement that you are renting the property on a short-term basis with rental terms of less than 30 days per tenant.

Suggested sample wording to maintain the residential dedication: “The property has been consistently rented with 1-year rental terms.”

Good luck.

~ Mahalo & Aloha

Hi George thanks for the info. I will make sure to mail it via certified mail. 😉

Aloha George Hunter!

Good idea.

Hello – so looking at the grandfathered condo hotels I notice that Executive Centre is zoned as business rather than with the grandfathered status. With that said due to this lack of specific grandfathered status are STR allowed in this building to be independently managed rather than a hotel pool. IE what makes the Executive Centre different from Century Center or Waikiki Parkway Apt.

‘Residential use’ means the property could serve as your principal residence, or as a long-term rental with rental terms of 30-consecutive days or more per tenant.

—————————

I guess what I need clarification on is:

According to above information I would be in a lower residential tax rate of 0.35% of assessed value if I am NOT in the hotel/condo catagory. That’s great but do I disqualify if I use my rental property for MORE than 14 days as equivalant to the condo/Hotel short term rental? I want to rent 9 months then use my personal property during the summer. Thanks again for the clarification. Sorry to be a bother.

Lisa Rivaldo-Dillon

Aloha Lisa Rivaldo-Dillon!

Thank you for your excellent question. “I want to rent 9 months then use my personal property during the summer.” – That’s perfectly fine. We have many clients that ‘reside’ and ‘rent’ part of the year.

There is NO minimum requirement for personal use with the residential dedication. The only minimum requirement applies to ’30-consecutive days or more per tenant’ if you do rent.

— However, you should be aware that your federal tax benefits will change if you split personal use with investment use. That is if your personal use exceeds 14 days, or 10% of the number of days rented at fair market rent, whichever is greater. ‘Personal use property’ deductions get itemized on Schedule A and ‘investment property’ gets reported on Schedule E. You will then need to proportionately allocate the mortgage interest and property taxes between ‘personal use’ on Schedule A and ‘rental use’ on Schedule E.

For any ‘personal use’ days, none of the rental expenses can be deducted. Any remaining rental expenses may be used to offset the rental income but can no longer generate a loss on Schedule E.

Splitting your property expenses on both Schedule A and Schedule E could increase your chances for an IRS audit. Maintain immaculate records!

See our article: https://www.hawaiiliving.com/…/personal-use-hawaii…/

— We don’t just write about this stuff. We are expert realtors.

Contact us today and we will find the right property that fits your needs. We are here to help.

~ Mahalo & Aloha

George Krischke, Principal Broker, Hawaii Living LLC

THANK YOU SO MUCH!!!!!!

Lisa Rivaldo-Dillon, you are welcome.

Your questions are excellent! We have helped many clients with similar questions. We are here to help, ready when you are. To get started contact us here: https://www.hawaiiliving.com/contact/

~ Mahalo & Aloha

Hello,

What if I want to buy a condo NOT in the condo/hotel venue and rent it for lets say 9-10 months during the year and use the rest of the time for my personal use? I can’t seem to find anything that gives clear guidelines. I don’t want the property as my main place of residence as I live on the mainland. Help?

thank you,

Lisa Rivaldo-Dillon

Aloha Lisa Rivaldo-Dillon!

See my detailed response to your 8.11.2019 question. Contact us directly and we will make it happen. We are here to help.

~ Mahalo & Aloha

Hello George, thank you for posting this information. My understanding is that if you dedicate as residential and during the 5-yr period you decide to move the unit into vacation rental, you can do it but the “cost” is one year of back tax at the higher rate (less what you already paid at residential rate) plus a 10% surcharge on those taxes. Am I understanding correctly?

Aloha Rob Randel, thanks for checking in. The “cost” of breaking the 5-year dedication includes the full prior fiscal year of back taxes plus 10% penalty. The timing makes a difference in the total “cost”. Example: You own a $1Mill condotel used as a long-term rental (>30-day rental terms) with a 5-year residential dedication. On January 1st, 2020 you start short-term vacation renting the unit. The “cost’ in back taxes and penalty would be: $11,440 for fiscal 2018 ($13,900 – $3,500 = $10,400 + 10% = $11,440), plus $5,720 for half of fiscal 2019 (13,900 – $3,500 = 10,400 : 2 = $5,200 + 10% = $5,720). Total “cost” for 12 + 6 months back taxes plus penalty: $17,160 ! Small numbers add up over time. ~ Mahalo & Aloha

George Krischke, Principal Broker, Honolulu HI 5, LLC Thank you for that example George. It helps illustrate the impact more clearly. I had not been considering the timing portion of the change in use status in determining the total cost/impact. Very good to know and thank you for the explanation.

Glad we can help. � ~Mahalo and Aloha