— If you own Hawaii properties and collect rental income, then you need to know the recent changes to the GET tax rate that apply to rental income.

Up until January 1, 2019, Honolulu County (the island of Oahu) was the only county with a 0.5% surcharge above the 4% GET rate. Back in 2007, the surcharge was justified as a temporary measure for the construction of Oahu’s new rail.

It appears some of the neighbor island counties also need extra revenue and decided to add their own surcharge effective 1.1.2019.

Watch what will happen to the temporary rate increases at the time they are scheduled to expire.

Hawaii rental income is subject to three tax obligations:

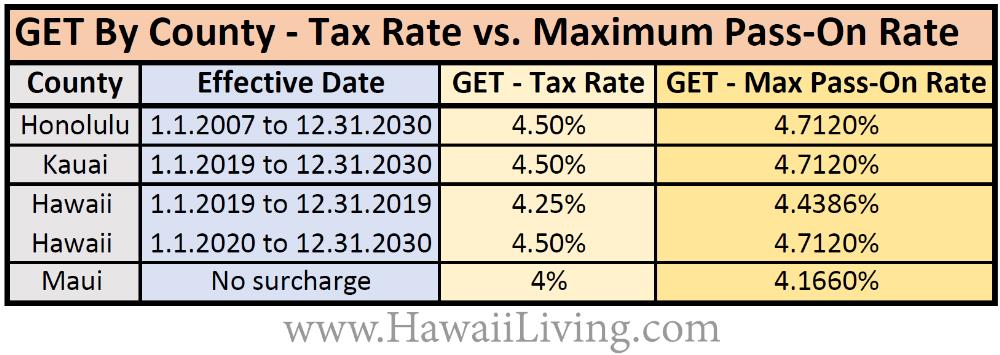

1) GET – General Excise Tax. All gross rental revenue (before expenses) from Hawaii properties is subject to Hawaii’s GET. The actual GET rate differs by county.

You may collect the GET from your tenant and pay it to the tax office. If you do, then the GET you collect increases your gross rental revenue and also becomes taxable at the same rate.

However, you may also collect the additional GET on top of the GET from your tenant. The total represents the maximum pass-on rate you are allowed to collect from your tenant.

Example of the GET maximum pass-on rate for Honolulu County:

- $1,000 gross rent received –> pay $45.00 GET (4.5% rate) = net rent $955.

- $1,000 rent plus collect $47.12 GET (4.712% max pass-on rate) = $1,047.12 gross rent received –> pay $47.12 GET (4.5% of gross rent) = net rent $1,000.

The table below shows the actual GET tax rate by county and the GET maximum pass-on rate that you are allowed to collect from your tenant to pay to the tax office:

2) TAT – Transient Accommodation Tax. In addition, all rental revenue from rental terms shorter than 180 days (plus cleaning fees collected) is subject to Hawaii’s 10.25% TAT.

3) UPDATE: OTAT – Oahu Transient Accommodation Tax (Oahu). Effective 12.14.2021, all rental revenue from rental terms shorter than 180 days (plus cleaning fees collected) is subject to an additional 3% OTAT. – (Rates for the neighbor islands may differ!)

See related article: GET, TAT & OTAT in Hawaii – The Easiest Way to File & Pay

If you collect rental income from a Waikiki condo, Oahu condo, or any Oahu property with rental terms of less than 180 days per tenant you will need to pay all three taxes, GET, TAT, & OTAT.

GET, TAT & OTAT filing requirements come with stiff penalties. There is no statute of limitations for audits. We strongly recommend to always file and pay your GET, TAT & OTAT diligently.

4) State Income Tax – You will also need to file a Hawaii State Income Tax Return, typically form N-11 or N-15, depending on if you are a Hawaii resident or part-year/nonresident.

Typically you would first file your federal tax return and then transfer the relevant figures onto your Hawaii tax return.

Going into more details is beyond the scope of this summary. We recommend you always consult with your favorite qualified tax professional.

________________

Owning real estate also requires paying the appropriate property taxes and following local rental restrictions.

________________

Additional new TAT requirement:

A new law took effect on July 1, 2019, requiring hotels, resorts, and other short-term rental operators to pay TAT on any mandatory extra charges that the guest is required to pay as part of their short-term rental booking. Mandatory extra charges might include a resort fee, and also the cleaning fee if it is collected as part of the rental booking.

Those fees are to be included in the gross rental proceeds. Check the details here: SB380 SD1

________________

Let us know your thoughts. We love to hear from you. Reciprocate Aloha: ‘Share’, ‘Like’ and ‘Comment’ below. ~ Mahalo & Aloha

Thinking of renting a room to a traveling medical professional. Do I still need to pay TAT & HCTAT, if after their duration, they stay and house sit for my home?

Aloha Carol S!

I’m not sure I’m clear on your question.

— If your tenant signs a lease shorter than 180 days, then the rental income is subject to TAT and HCTAT (plus GET).

— If your tenant signs a lease shorter than 180 days and turns into a month-to-month lease after the initial lease period, then the first 180 days are subject to TAT and HCTAT (plus GET). Beyond the first 180 days, the rental income is subject to GET only.

But don’t take our word for it. Always check with your favorite qualified tax professional.

We are only realtors and not tax experts.

Good luck.

Mahalo & Aloha

Will you be updating this for the new Oahu Tax in December 2021? Thanks!!!

Aloha Peter J!

Catching up with too little time…

Besides the 10.25% TAT that goes to the State of Hawaii, you must now file and pay 3% OTAT to the City & County of Honolulu here:

http://www.honolulu.gov/otatpay

If you had paid the additional 3% to the State (instead of the City & County), then you may have to amend your State TAT return and claim a refund.

Don’t delay or skip your 3% OTAT payment. Otherwise, the tax office will come looking for you.

I will update the article as soon as I find some time to reflect this change:

City council approved Bill 40 charging the additional 3% Oahu Transient Accommodation Tax (OTAT) on top of the regular 10.25% State Transient Accommodation Tax (TAT).

The new combined total TAT is 13.25% (TAT & OTAT) effective 12.14.2021, assessed on all rental income (and cleaning fees) from rental terms of less than 180 days per tenant.

~ Mahalo & Aloha

How does a Canadian pay TAT and GET? It appears you can only register online with US credentials…

Aloha Don McIvor!

Foreign nationals and others not eligible to get a US social security number will need to obtain an ITIN. File application form W-7: https://www.irs.gov/forms-pubs/about-form-w-7

Once you have an ITIN you can then file and pay your GET/TAT. Check on how to do it here: https://www.hawaiiliving.com/blog/get-tat-hawaii-easiest-way-file-pay/

Let us know when you are ready to buy or sell. That’s what we do best. 🙂

Mahalo & Aloha

Thank you George!

You are welcome!

We are here to help.

~ Mahalo & Aloha

I have recently bought two vacation (short-term) rentals at Kailua-Kona, and have a manager for them. I do not have a tax-advisor (yet) in Hawaii so am trying to come to grips with the taxes for my rentals. It looks like I can legally pass the 4.5% GET and 10.25% TAT taxes on to the guests, as well as the 10.25% tax on the cleaning fee (etc.), right? So, if my guest stays 6 nights at $300 per night, they would be billed $1800 plus (4.5% GET of 1800=$81); plus (10.25% TAT=$184.5 ); plus 10.25 % of 150 cleaning fee=$15.40; plus the $150 cleaning fee; for a total of $2230.88. In other words I get $1800 (less my manager’s commission) and the State gets $430.88 plus my income tax. Is this the right arithmetic?

I just caught the error that I included the $150 cleaning fee with the amount due to the State, So the State would actually receive $280.88.

Aloha Mike Griffin!

Almost correct. The total GET & TAT due is $291.76.

Review the calculation in my response to your initial question. Also, check our article https://www.hawaiiliving.com/blog/get-tat-hawaii-easiest-way-file-pay/

— Btw, hold on to your hats: Each island/county is working on increasing their respective TAT rate by up to an additional whopping 3% above the current 10.25%! Eventually, only the better-off visitors will be able to afford vacations in Hawaii.

Good luck. ~ Mahalo & Aloha

Aloha Mike Griffin!

Great question. Here is the correct calculation:

If you collect the GET & TAT separately from your guest, given your $1,800 room stay plus $150 cleaning fee example, then you may collect from the guest as follows:

$1,950 – room stay plus cleaning

$91.88 – GET 4.712% (pass-on rate, based on $1,950)

$199.88 – TAT 10.25% (based on $1,950)

Notice that the collected TAT is exempt from GET, but only if you collecte the TAT separately as a ‘visible pass-through tax.’

If you do not collect the GET & TAT separately from your guest, then the entire lump sum amount collected is subject to both GET & TAT.

–Don’t just take our word for it. Check the TAT brochure:

http://files.hawaii.gov/tax/legal/brochures/tat_brochure.pdf:

“The TAT that is visibly passed on to the guest or tenant is exempt from the GET. However, the GET that is visibly passed on is included in taxable income subject to the GET. If you charge your guest or tenant a flat fee without separately stating the GET and the TAT, you are required to pay GET (including a 0.5% county surcharge if applicable)

and TAT on the entire amount.”

In doubt always check with your favorite qualified tax professional.

Call us when you are ready to buy or sell real estate.

Good luck. ~ Mahalo & Aloha

How do you get these licenses? Is there an application link? Thank you

The application fee is $500 (which, (if the STVR-permit is actually issued by the State), is good for 5 years, (I think).

Aloha Mike Griffin!

I believe Jess Dickie was asking about how to get a GET & TAT license, ..see my reply to Jess.

‘STVR-permits’ are an entirely different animal. Those vary by island/county.

Oahu’s short-term vacation rules and updates are here:

https://www.hawaiiliving.com/blog/category/condotels-short-term-rentals/

~ Mahalo & Aloha

Aloha Jesse Dickie!

The nominal one-time application fee for a GET and a TAT license is $20. GET & TAT licenses do not expire. You may apply for a new GET license, or add a TAT license to your existing GET license here: https://hitax.hawaii.gov/_/ –> Register New Business License –> BB-1 Business Application.

Good luck.

~ Mahalo & Aloha

The cleaning fee too?! ROBBERY

Aloha Marina Yamamoto!

Thank you for checking in and commenting. Let us know if there is anything else we can do for you.

~ Mahalo & Aloha