Whether you are an aggressive vulture investor looking for deep-discount distressed properties, or you are just curious about what the market might bring, either way, the ‘expected’ tsunami of foreclosures might dissipate into nothingness. Here are six reasons why:

1) Nobody Wants To Foreclose

Utilitarianism promotes ‘the greatest amount of good for the greatest number of people.’ There are clear benefits for the general economy to avoid foreclosures:

- Banks don’t want to foreclose. They learned their lesson from the financial crisis in 2009.

- The federal government doesn’t want foreclosures. They implemented a Foreclosure Moratorium. Means banks aren’t currently allowed to foreclose.

Instead, banks offer generous payment plans for borrowers to work things out and avoid foreclosures:

- Deferment. – The borrower can skip a few months and the lender will tack the skipped months to the end of the loan.

- Forbearance. – The borrower can skip a few months but the lender requires future double payments or a lump sum payment to catch up.

These programs keep the borrower from losing their home and keep the housing market and economy afloat. The borrower is on a sugar pill. No payment required. That’s all good until the sugar pill wears off.

See related article: Confessions Of A Real Estate Investor

What happens when the foreclosure moratorium expires? That’s where people predict things will unravel. Except…

________________________________

2) The Real Estate Market Remains Strong

Before the COVID crisis, the economy was humming on all cylinders. Unemployment was below 3% and the housing market was strong with valuations at peak levels.

During the COVID crisis, unemployment shot up through the roof. Currently, US unemployment is at an elevated 6.7% (Dec 2020) and trending down. Hawaii’s unemployment is still at a staggering 10.1% (Dec 2020) and trending down from a record whopping 23.4% in May 2020, and 14.2% in October 2020.

These are tragic numbers. Many people lost their jobs permanently. Everyone is asking, “why is the housing market so strong?”

See related article: Market Update – Mid-Year 2020

________________________________

3) Monetary Policy

The federal reserve board sets monetary policy. Since COVID, the fed swiftly pulled all levers and committed to an accommodative monetary policy. The fed expanded the money supply and lowered the federal funds rate to zero. This loose credit policy makes borrowing money more affordable and encourages spending to boost the economy.

On Wednesday 12.17.2020, federal reserve chair Jerome Powell reconfirmed what has been the theme since the crisis started:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well anchored at 2%. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to ¼% and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.” ~ Jerome Powell 12.17.2020

Further, federal board members project the federal funds rate near zero until the end of 2023. – That’s three more years!

This forward-looking transparency we have never seen before. The fed is signaling to the economy and its participants: ‘We got your back. We will not leave you hanging. We will do whatever it takes to ensure a speedy, robust, and full recovery. Until then, the watering spigot will be wide open.’

________________________________

4) Fiscal Policy

Fiscal policy is set by Congress and the Administration, which is the president together with the treasury secretary. Joe Biden replaces president Trump, and Janet Yellen replaces Steve Mnuchen.

Janet Yellen is no slouch. The former federal reserve chairwoman is well qualified with a wealth of federal reserve board experience since the 1990s. She appears to be an excellent fit for her new position to fully restore the US economy.

On Sunday 12.20.2020, Congress finally agreed on a new $900 billion fiscal stimulus COVID relief package. That is desperately needed financial relief for the American people.

More rescue packages for the US economy and its participants are likely.

- Monetary and Fiscal policies are working in tandem to minimize economic fallout and restore maximum employment.

________________________________

5) Record Low Mortgage Rates Drive Housing Affordability

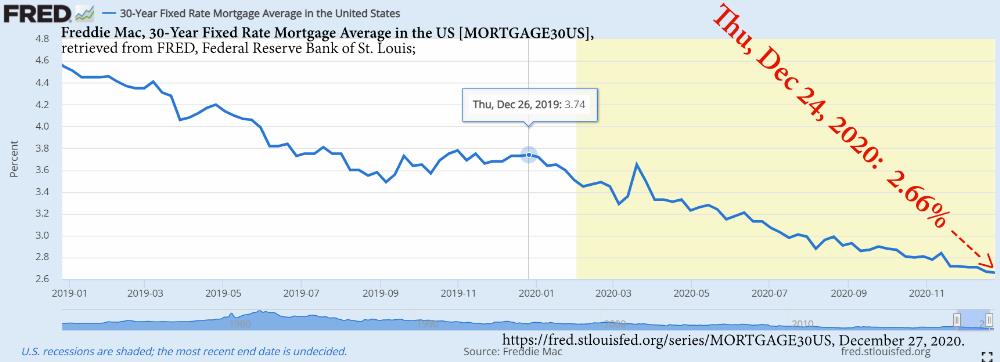

Mortgage rates don’t mirror the fed funds rate. Instead, mortgage rates tend to trend parallel with the 10-year treasury rates and are a reflection of future inflation expectations. The fed’s commitment to keeping the fed funds rate near zero for another three years translates into: ‘This economy is not likely to overheat any time soon.’

With high unemployment and a sluggish economy, inflation expectations are low.

Since COVID, the fed’s greater concern has been to minimize the risk of deflation. With little inflation concern, mortgage rates are expected to remain low.

This week, 30-year mortgage rates hit a new all-time low of 2.66%.

The average 30y fixed mortgage rate dropped from 3.74% (12.26.2019) to an unbelievable low 2.66% (12.26.2020). This may not seem that impressive until you run the numbers to understand the true impact:

- $1Mill, 30y fixed at 3.74% = $4,625.48 P&I /mo

- $1Mill, 30y fixed at 2.66% = $4,034.90 P&I /mo

That’s a whopping $590.58/mo in savings and a 12.77% improvement in affordability. That means that today, anybody that has not lost their job can afford 12.77% more house compared to a year ago, everything else being equal. You can buy a bigger, better and more expensive house with the same monthly cost!

If there was ever the best time to lock in the lowest interest rates for the next 30 years and upgrade your living environment, it is now. That’s huge.

Know you know why some residential neighborhoods have increased in price by 10% over last year. For now, condo prices lag.

See related article: COVID Split The Market: Homes Are Hot – Condos Are Not

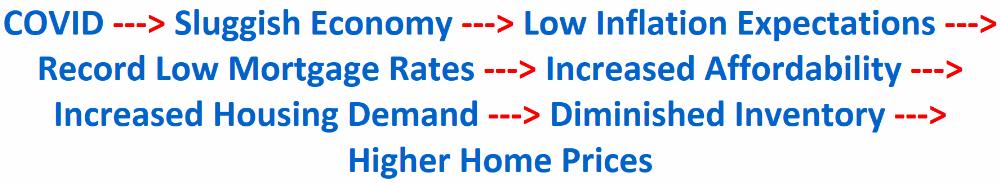

The chain of events looks as follows:

- In short, housing prices are up because of COVID, not despite it.

Just one more thought about the cost of money:

Today’s Mortgages Are Free!

How so? Because the true cost of the money is affected by these two factors:

- 1) Mortgage Interest Deduction. This translates into huge tax savings! You get to deduct the mortgage interest you pay on new mortgage loans up to $750K. Whether you know it or not, most of us pay about 30% in combined federal and state income tax.

With the mortgage interest deduction, the cost of your 2.66% mortgage drops to 1.862% (2.66 – 30% = 1.862%) after taxes.

- 2) Inflation. Currently running shy of 2%. Review the fed’s statement above, “the Committee will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well anchored at 2%.”

The number is 2%. That means that the real cost of your 2.66% mortgage drops down to minus -0.138% (1.862 after taxes – 2.00 = minus -0.138%) after taxes and adjusted for inflation.

That’s right. The real cost of borrowing is minus -0.138%, which is below zero! – Better than free.

_________________________________

6) Distressed Property Owners Have Options

The COVID crisis caused great financial hardship, especially for the people that permanently lost their jobs and can’t make mortgage payments. Foreclosure moratorium, forbearance, and deferment have saved the day for now. But some will not be able to find a job soon and will be forced to consider these options:

- Work out a continued forbearance or deferment extension with your lender. What do you have to lose? Let them know your difficulty and discuss payment options.

- Sell your house, pocket the money, and downsize for now. Lucky for the sellers that need to sell, unless you own a temporarily out-of-favor condotel, the best time to sell is now. Demand is high, supply is low and prices are close to record highs. With the prospects of a strengthening economy and super-low interest rates, that window of opportunity to sell remains through 2021.

- If you are one of the unfortunate few that have no equity in the property, then ask your lender for a short-sale approval.

________________________________

If Not Now, Then When?

Some are arguing that the housing market and the economy will eventually collapse because of:

1) Hyperinflation. That is based on the simplistic belief that increased money supply is inflationary. Eventually interest rates will rise to unaffordable levels which will collapse housing prices. That might be true in principle but it overlooks the prevailing deflationary counter-trend of increasing production efficiencies with technology and globalization.

The same hyperinflation argument was made during QE1, QE2, and QE3 (2008 to 2013). Instead of hyperinflation, the US economy emerged from the Great Recession with the longest sustained recovery with persistently low inflation shy of 2%. The federal reserve frames their policy around 2% inflation. – No hyperinflation here.

2) Huge Shadow Inventory. The same huge shadow inventory argument was made during the Great Recession. The consensus was that banks would foreclose on millions of homes. Although we have seen some foreclosures during the Great Recession, the majority of distressed properties was absorbed by the market as bank approved short sales.

This time, the majority of distressed homeowners will avoid foreclosure. Because they can, for the reasons mentioned above. – No huge shadow inventory here.

________________________________

What Could Go Wrong?

An asteroid could fall on our heads and wipe us all out. Lots of things could go wrong. Nobody knows what the future brings. All experts are notoriously lousy at predicting the future. That includes us.

See related article: COVID-19 – Hawaii Real Estate

Doomsday predictions about market collapses and runaway inflation are popular. Because our brain is wired to be alert of looming dangers and to avoid disaster. It’s an evolutionary survival skill that has been ingrained in us through natural selection since our ancestors walked the Savanah. That’s why news channels feed us horrible stories. A cheap trick to get their ratings up.

However, saber tooth tigers are no longer poised to ruin your day. What was once a useful survival skill in an uncertain world has become a distracting vestigiality. The fear of uncertainty is holding you back from realizing your goals and full potential.

It may not seem obvious, but I will argue that today’s world is far less uncertain than any other time before.

Today’s world is experiencing a new and predictable technological revolution. AI, robotics, genetic engineering, nanotechnology, and communication connectivity will bring massive productivity gains in a low inflationary world. The trend is inevitable. Better, cheaper, faster will always win.

COVID might have temporarily distorted our outlook. But the future looks bright, and the human species is capable of finding unlimited solutions to all the problems of the world. Infinity is in front of us. We are barely getting started. I guess that makes me a rational optimist.

For Hawaii real estate: Commercial properties and condotels will remain soft for some time. Honolulu’s residential homes and condos will most likely flourish through 2021.

In conclusion, if you are looking for foreclosures, they aren’t here in Hawaii.

If the year 2020 has been a challenge, commit to making it a remarkable remaining 90% of this decade. Don’t hang yourself up on what could go wrong. Instead, focus on what could go right. Take the necessary steps to actualize whatever you are trying to achieve. May you live well and prosper. ~ Happy New Year.

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit, and we love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support, and we are dedicated to constant learning and growing with you. ~ Mahalo & Aloha

But the stats show Hawaii has the most backlogged Foreclosures in the USA? There must be some Short Sale opportunities?