One year ago, I reported here how a home buyer was disappointed that 2019 did not deliver him the buying opportunity he was hoping for. His plans for 2020 were: “I will wait until after the election uncertainty.” (!?)

As expected, this uncertainty has been resolved. If you were waiting, you might be asking:

Where Are We Now And Where Do We Go From Here?

“Life can only be understood backward, but must be lived forward.” ~ Soren Kierkegaard

- In January of 2020, the consensus among economists was that there was little risk of a 2020 recession.

- On March 31, 2020, leading scientists estimated the virus could kill between 100,000 and 240,000 in the US alone.

- In April of 2020, the consensus was that housing prices likely take a downturn due to unimaginably high unemployment numbers.

Together with countless other past predictions, these confirm what we often forget: Experts are notoriously lousy at forecasting the future.

See related article: COVID-19 – Hawaii Real Estate

But that won’t stop us from our regular market update and commentary on why the Hawaii real estate market behaves the way it does.

________________________________

Oahu Real Estate – 2020 vs 2019

We compare 2020 full-year data, January through December, with the same 12 months, January through December of the prior year 2019.

Comparing only one month of data over another makes for sensational newspaper headlines, but it does little to spot a trend. Zooming out, the bigger picture reveals that monthly comparisons merely show short-term distortions based on insufficient data.

Prices are a function of Supply vs Demand. When we compare historical Supply, Demand, in addition to MRI, and Pending Sales, we can better understand the market. Knowledge is power and might help you make better decisions.

________________________________

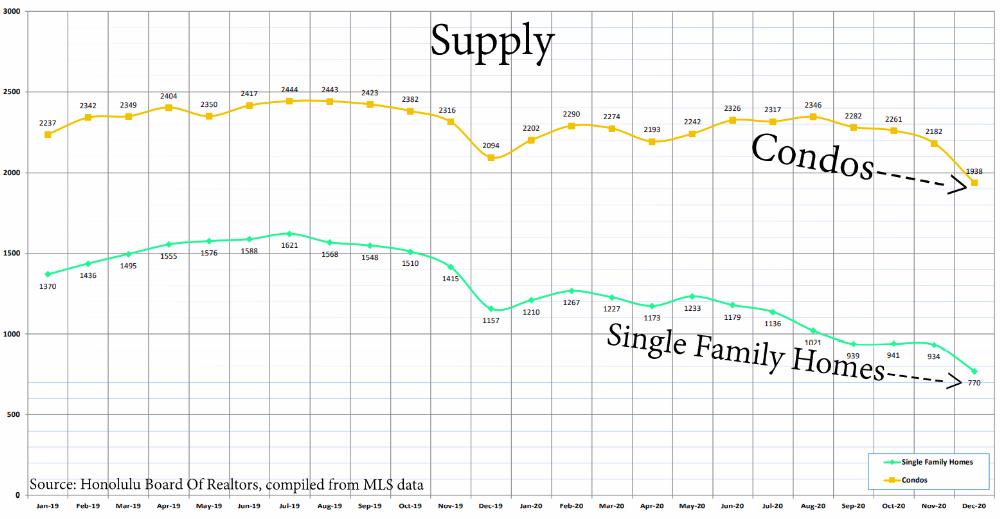

Supply

Supply = How many homes are available in the market.

- Single Family Home supply has been dwindling to record low numbers in a downtrend since June 2020.

- Condo Supply has been dwindling to record low numbers in a downtrend since September 2020.

________________________________

Demand

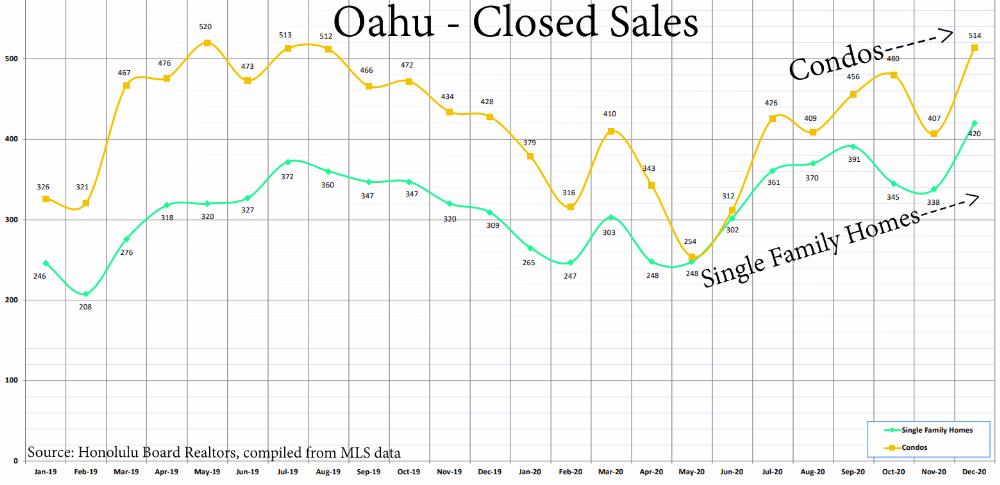

Demand = Number of Closed Sales. – How many buyers purchased a home.

- Single Family Home – Demand is up by 2.3% year over year.

- Condo – Demand is down by –13% year over year.

See related article: COVID Split The Market: Homes Are Hot – Condos Are Not

Although Demand was soft in April/May 2020, Closed Sales ended the year with a bang.

- Single Family Home Demand in December 2020 was the highest since the summer of 2005!

- Condo Demand in December 2020 almost reached the Summer of 2019 levels.

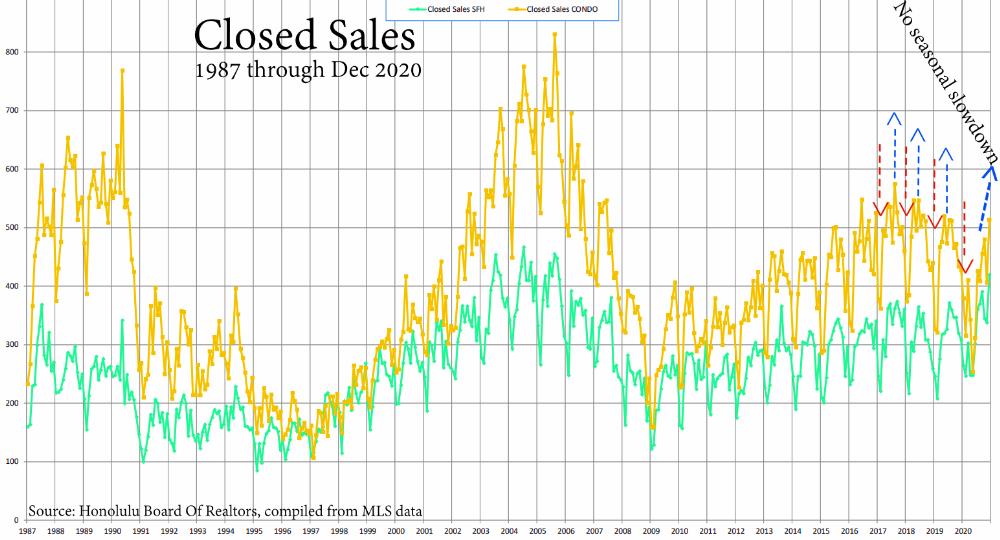

If you look at Closed Sales going back to 1987, you will recognize a typical seasonality between ‘more Closed Sales in the Summer’ and ‘fewer Closed Sales in the Winter.’

By contrast, 2020 showed a delayed Summer peak that morphed into continued strength ending with record December Closed Sales numbers. – Where is the seasonal slowdown this Winter?

________________________________

MRI – Month Of Remaining Inventory

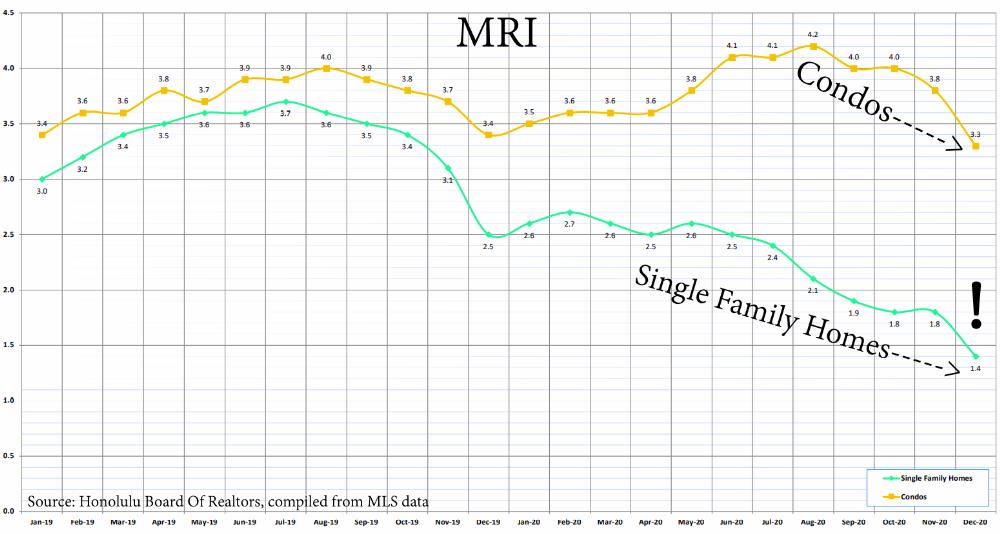

Months of Remaining Inventory (MRI) = The current number of active listings divided by the monthly closed sales rate. MRI combines both supply and demand into one number. MRI shows us if the market speeds up or slows down.

In the past, a balance between a buyer’s and a seller’s market is typically observed when MRI hovers around 5 or 6.

- Single Family Home MRI in December 2020 dropped to a mindboggling low MRI 1.4. This is a new record low, the lowest MRI that I have ever seen.

- Condo MRI in December 2020 dropped to a low MRI 3.3. This is the lowest MRI during the last two years.

These numbers are clearly below the 5-6 MRI equilibrium, indicating a Seller’s market. However, the Condo MRI number doesn’t tell the whole story. The condo market includes both, 1) residential condos, and 2) condotels. The latter are depressed due to COVID and the lack of tourism revenue.

See related article: Condotel Opportunities – COVID And The K-Shaped Recovery

So far we looked in the rearview mirror. The following indicator is forward-looking.

________________________________

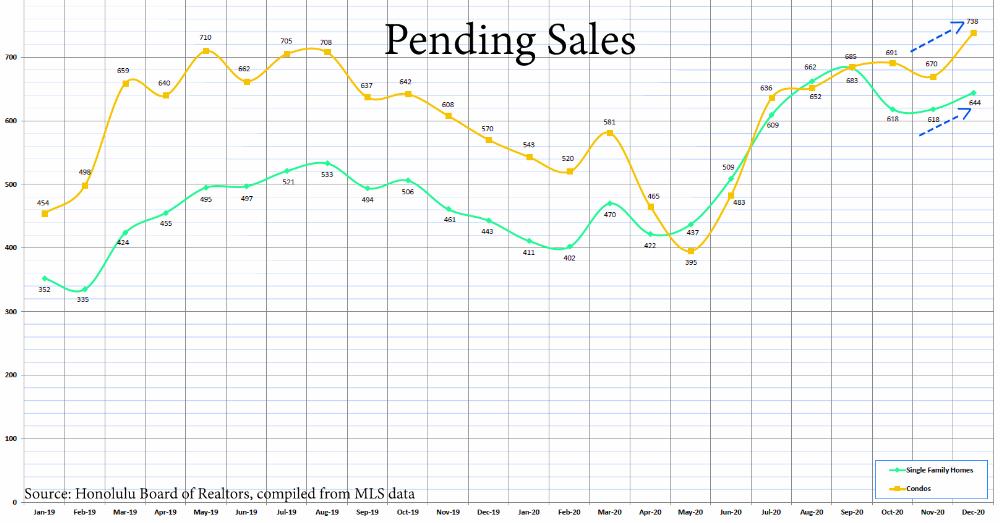

Pending Sales

Pending Sales = Properties under contract and expected to close soon.

- Single Family Home Pending Sales in December 2020 are hovering close to the Aug/Sept 2020 Summer peak and far exceed the 2019 peak.

- Condo Pending Sales in December have reached a new record high, above the 2019 and 2020 peaks. The strong uptrend has been in place since June 2020.

The unusual peak buying frenzy in the middle of Winter shows that…

________________________________

Oahu Real Estate – 2021 Is Starting With A Bang

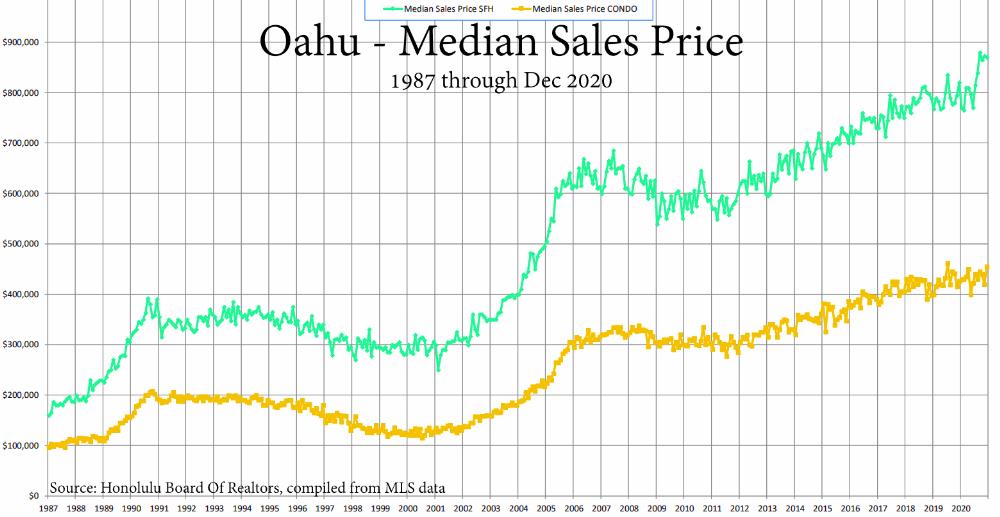

Supply, Demand, MRI, and Pending Sales give us a view of the past, a snapshot of today, and an indication of the future market direction. That’s until circumstances change. For now, the market looks remarkably robust as reflected in the Median Sales Price:

Median Sales Price

- Single Family Home Median Sales Prices jumped dramatically in the Summer of 2020 and now far exceed the previous 2019 peak. – Prices are near record highs.

- Condo Median Sales Prices did not jump during 2020 and remain resilient near 2019record highs.

________________________________

Free Money – Negative Real Rates!

The real driver for the strong demand is the substantial drop in mortgage rates. The average 30y fixed mortgage rate dropped from 3.74% (12.26.2019) to an unbelievable low 2.66% (12.26.2020). Mortgage rates are expected to remain low during 2021.

A 2.66% rate translates into a 1.862% rate after tax-deductibility (assuming 30% combined federal and state taxes). Consider that the Federal Reserve Board is actively pushing for inflation to exceed 2%.

The means that the real cost for your 30-year mortgage loan drops to minus -0.138%, after taxes and adjusted for inflation (1.862% – 2.00 = minus -0.138%). That’s below zero. – Better than free.

Here is a sample calculation assuming a $1Mill mortgage:

- $1Mill, 30y fixed at 3.74% = $4,625.48 P&I /mo

- $1Mill, 30y fixed at 2.66% = $4,034.90 P&I /mo

That’s a whopping $590.58/mo in savings, 12.77% lower compared to a year ago. A significant improvement in affordability.

Anybody that has not lost their job can now afford 14.63% ($590.58 / $4,034.90 = 0.1463) more house compared to a year ago, all else being equal. That’s huge. Buy a better and more expensive house with the same monthly cost!

If there was ever the best time to lock in the lowest interest rates for the next 30 years and upgrade your living environment, it is now.

See related article: Looking For Foreclosures In Hawaii?

________________________________

What To Expect In 2021

Eventually, COVID vaccinations will get us back to normal living.

Eviction moratoriums and foreclosure moratoriums will end. On 1.20.2021, President Joe Biden extended the federal eviction moratorium until the end of March 2021. Perhaps it gets extended again. – But better get ready. Because this free ride will end soon.

Get Out Of Forbearance

If your lender granted you mortgage forbearance or deferment and you no longer need it, consider getting out of it asap. It makes little sense to kick the can further down the road.

Instead, work on catching up with your payments. Lenders will not refinance your loan at today’s super-low rates unless you are current on your existing mortgage payments for at least three months.

Mortgage rates remain low for now. But they are unlikely to move lower. And eventually, they move up. If you have been thinking about buying a home or refinancing your existing one, today’s low mortgage rates are as good as it gets.

See related article: Confessions Of A Real Estate Investor

Condos Could Be Outperforming Single Family Homes

COVID and the desire for more ‘social distancing’ space have depleted Single Family Home inventories. Low rates increased affordability by ~12.77% and fueled the frenzy that drove demand through the roof. That’s why some Single Family Home neighborhood values increased by more than 10%, partially offsetting the cost savings from low mortgage rates.

Condos have not seen the same excitement and price move. However, that might change in 2021.

Here are five reasons why:

- 1) Vaccination success will reduce COVID anxieties. 2021 could bring back a renewed appreciation for condos with their unique perks of convenience.

- 2) Arbitrage – Why chase after scarce Single Family Home inventory when Condos are readily available and attractively priced. There are currently 2.5x (!) more Condos available than Single Family Homes.

- 3) Regression to the Mean – Condos are undervalued compared to Single Family Homes. Because of COVID anxiety and despite super-low mortgage rates, Condo values have been stagnant at parity with 2019 levels. The spread between Condo prices and sharply higher Single Family Home prices might have widened too far. Many condos appear to be attractive bargains.

- 4) The ‘Pending Sales’ graph foretells Condo Closed Sales are poised to move up.

- 5) Demand and prices for Condotels are expected to recover as soon as tourism returns. – Today we are already seeing the first signs of it.

We don’t have a crystal ball but the median sales price for Oahu condos could jump to new record highs in 2021.

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit. We love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support, and we remain committed to constant learning and growing with you. ~ Mahalo & Aloha