— ‘Every property owner gets excited when their property value goes up. But nobody wants to pay the additional property tax.’

Update 12.15.2020: On December 15, 2020, the tax office mailed out the Honolulu County Tax Assessment Notices.

An increase in value might make you feel good. But what if the assessed value of your property is higher than the real market value? Could the tax assessor have made a mistake and over-assessed? Would you want to pay more property taxes than you should?

Of course not. The good news is you can appeal your property tax assessment.

Before we discuss who could and how to appeal, let’s understand how the assessed value gets established.

Unlike California’s Prop 13, all Honolulu County (island of Oahu) properties get assessed once every year on October 1st based on comparable sales that have recorded between October 1st of the prior year through June 30th of the current year.

Technically, comparable sales data through Sept 30th of the current year, not just through June 30th, should be considered. However, the tax office needs weeks to sift through all the data to complete the assessments on time. Therefore, the last 3 months of eligible data often get neglected.

Property owners receive their October 1st assessment notice as early as December 15th. The new assessed value will be used to calculate the property tax for the following fiscal year starting July 1st.

See related article: Guide To Honolulu Property Taxes

The point of contention is the accuracy of the assessed value. A discrepancy of $500K in assessed value translates into a difference of $1,750/year (w/ 0.35% residential tax rate) or $6,950/year (w/ $1.39 resort tax rate).

The tax assessor never sees your property and any of the comparable properties! The assessor might not realize how your property differs from a comparable sale that otherwise on paper looks similar in size and age.

Consider the following two real-world scenarios:

1) Your home #A might be located along the busy highway one lot away from the beach without an ocean view. A recently sold comparable home #B next door might be of similar size and age but is located one lot away from the busy highway and directly on the beach! Your home #A might be worth $1Mill because of the busy highway. The recently sold comparable home #B could have fetched $3Mill because of the superior ocean front location. That is a whopping $2Mill difference in real market value!

2) Similarly, in a condo building, your condo #A might be on the noisy street side next to the smelly dumpster at the loading dock with no ocean view. A similar size condo #B on the same floor but on the ocean side with unobstructed views might have recently sold for $500K more than what you would be able to sell your condo at. The tax assessor would not know the difference and assess both condos similar even though the real market value for both properties is far apart.

In both cases, property #A has the inferior view and location and has been unfairly assessed significantly above the real market value. Perhaps the assessor used seemingly similar comparable sales unaware that they are superior and more valuable.

Who Should Appeal

You should appeal if you can show supporting evidence that the tax assessed value of your property is higher than the real market value.

Perhaps you have additional sales data that the tax office failed to consider, especially from the last 3 months of the eligible period, July 1st through Sept 30th. Or you can document other circumstances that mistakingly skewed the assessment, similar to the two real-world scenarios described above. You must be able to provide convincing evidence to support your claim.

The tax assessor reserves the right to be off by 10%! Any smaller discrepancy in the tax assessed value might not be sufficient to convince the tax assessor to adjust the assessed value. But as in the two examples above, I have seen discrepancies where the assessed value can be 20% or 30% (!) higher than the real market value.

If that applies to your property, I recommend you go ahead and appeal. But there is more:

Do you want to lower your tax assessment because a) it is unfairly above the real market value as described above, or do you want to lower your tax assessment because b) you can, by using inferior comps and arguing they are comparable to your property?

Let’s assume you own the more desirable and more expensive property #B in either one of the above two sample scenarios. Now, your property #B has the superior view/location and is assessed accordingly perhaps close to the real market value. But recent comparable sales, although less desirable with inferior view/location, sold at a lower price than the assessed value of your property #B.

Could you, or should you, appeal your property assessment simply because inferior comparable properties sold at lower prices than your tax assessment? In other words, the assessed value for your property #B might be at real market value but you don’t feel like paying more property taxes than what the inferior properties will have to pay.

You have the knowledge edge, and the tax assessor might not be able to accurately establish the real market value to disprove the validity of your appeal. In that case, you could appeal, but should you? – That’s a moral question for you to decide.

How To Appeal

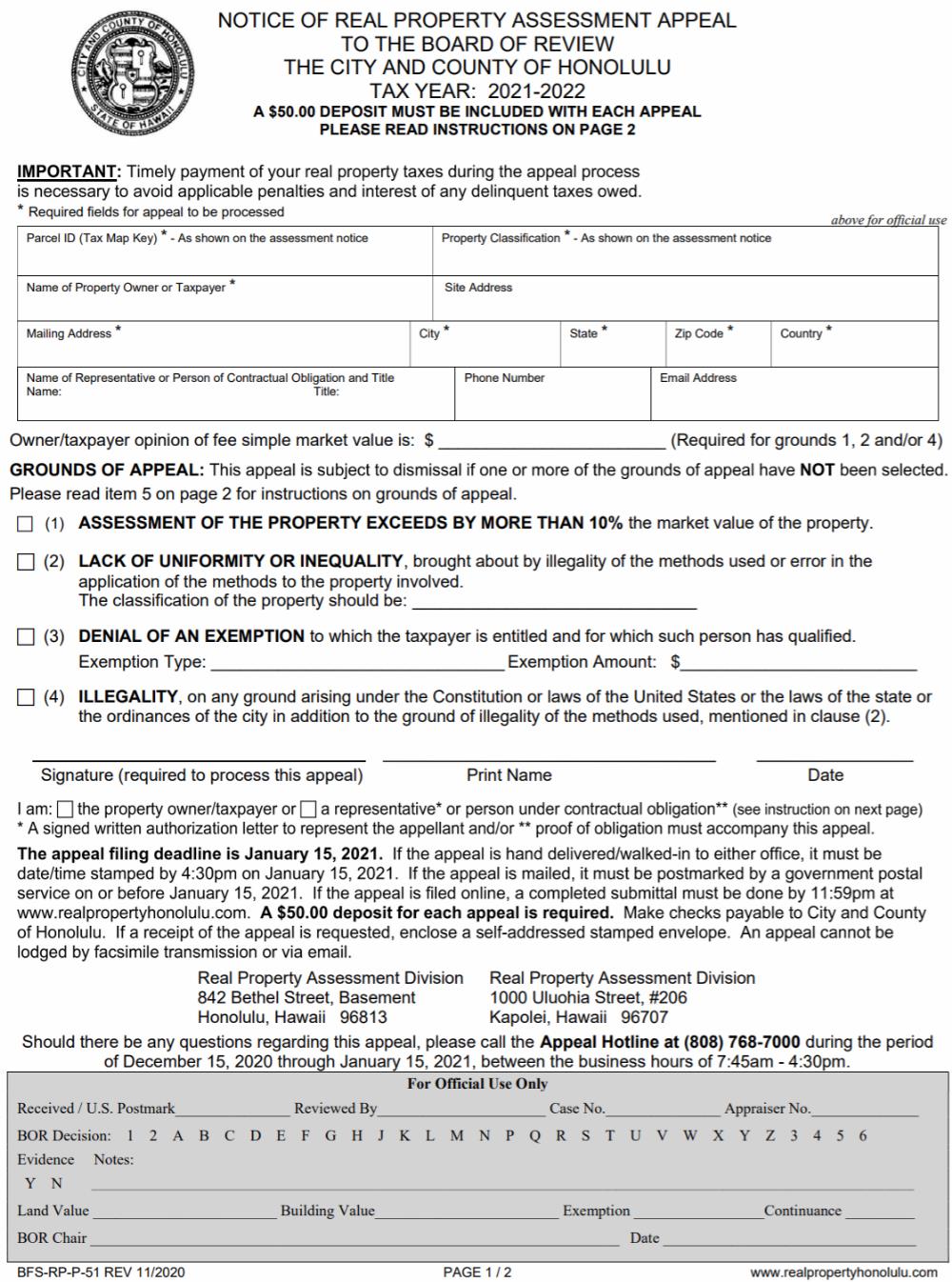

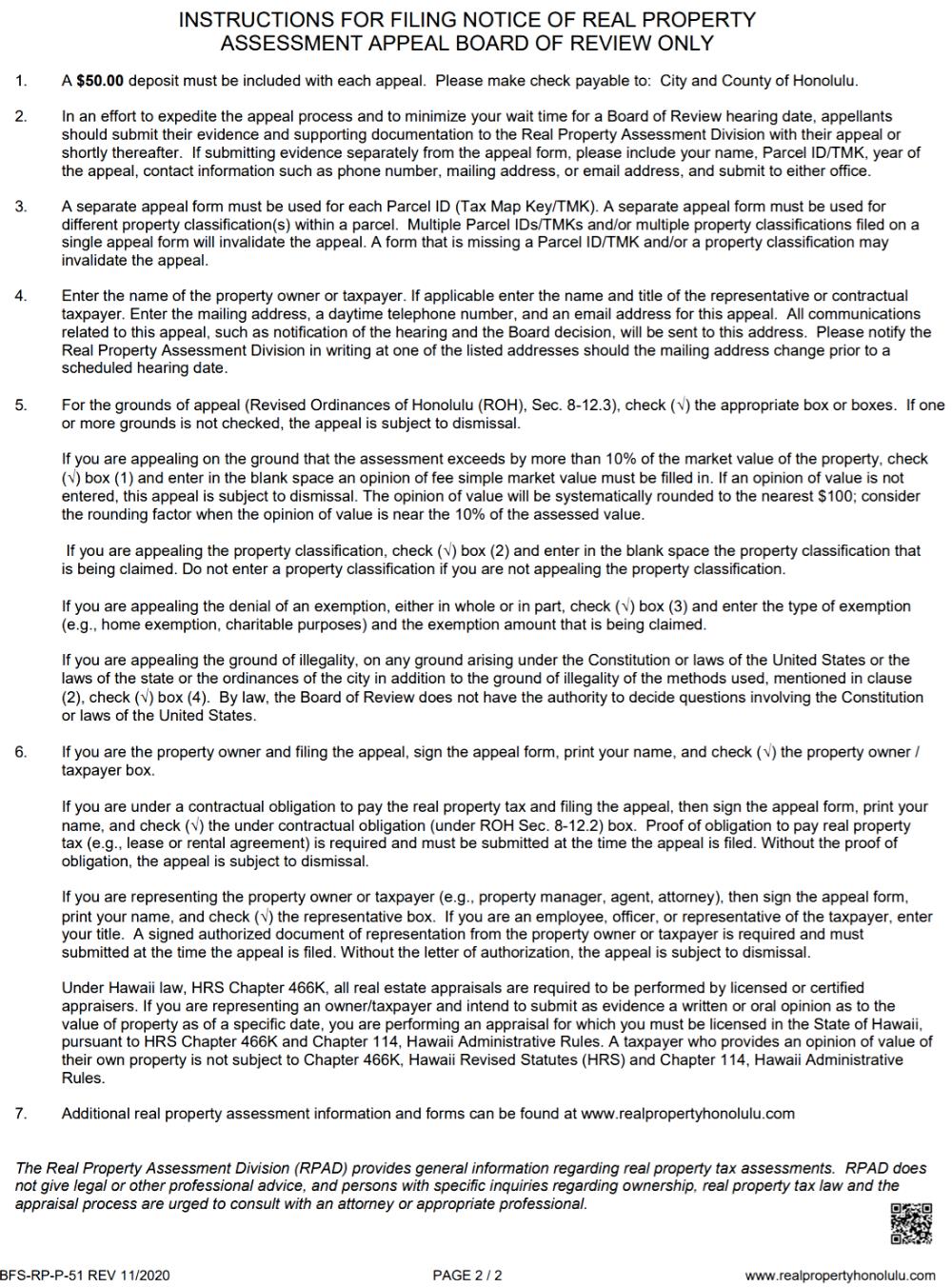

You must appeal by the January 15 deadline with the required $50 deposit, either online or by mail or walk-in at either office below:

1) Real Property – Honolulu Office, 842 Bethel St. Basement, Honolulu, HI 96813

2) Real Property – Kapolei Office, 1000 Uluohia St #206, Kapolei, HI 96707

You may also call the Appeal Hotline at (808) 768-7000, or email bfsrpmailbox@honolulu.gov with questions or concerns before the January 15th deadline. – Good luck!

Here is a copy of the application form with instructions:

________________________________

— We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. We are committed to providing the most excellent service available on the planet. We love what we do and look forward to assisting you too!

Contact us when you are serious and ready. We are here to help.

________________________________

Also…, we want to make this The Best real estate website you visit, and we love to get your feedback. Let us know any comments or ideas on how we might improve. We are humbled by your support and dedicated to constant learning and growing with you. ~ Mahalo & Aloha

Is it possible to obtain a copy of the properties that were used to determine the assessment of your own individual property?

Aloha Sarah!

That’s like fighting windmills or wrestling with a bear.

Instead, take the opposite approach:

Ask your realtor that helped you buy the property to provide you with all ‘relevant’ SOLD comps for the 12 months between Oct 1st of the previous year to Sept 30th of the current year.

Calculate the average of those comps and compare them with the city’s assessed value.

If your calculated value is at least 10% lower than the city assessed, then go for it, pay $50, and appeal. However, the deadline was January 15. 🙁

The next opportunity will be from Dec 15 through Jan 15 next year.

Good luck.

~ Mahalo & Aloha

Aloha Mr. Krischke,

I have obtained a listing of all of Condo Units SOLD prices during 2021 along with sale date for 2021.

Question: To prove whether my condo unit has been over-assessed for 2021 tax year,

do I compare 2021 SOLD prices (5 units, prior October 1, 2021) against City’s 2021 Assessment or City’s 2022 Assessment? Can you provide the reason or regulation or ordinance for your answer?

Mahalo,

George

Aloha, and welcome back Guido Panizzon!

You should compare relevant comparable sales data between 10.1.2021 and up to 9.30.2022 against the city’s next 2023 assessment notice, which you won’t get to see until 12.15.2022! –

The 2021 and 2022 tax year appeals deadlines have long passed. Water under the bridge. 🙁

The next opportunity to appeal is as follows:

— On 10.1.2022, the city establishes the new assessed property values for fiscal tax year 2023 (which starts 7.1.2023).

— On 12.15, 2022 the city will post/mail out the 2023 tax assessment notices.

— Only between 12.15.2022 and 1.15.2023 do you get to appeal the 2023 tax assessed value of your property. Mark your calendar.

You may use relevant comparable sales data from 12 months prior to the 10.1.2022 assessment date (10.1.2021 up to 9.30.2022)

— Review the article above for more details, including the ROH sections and HRS chapters referenced in the appeals form above. In doubt, call the city to verify at (808) 768-7000, or email bfsrpmailbox@honolulu.gov

I regret, we don’t vouch for what the city does. 🙁

We are expert realtors assisting buyers and sellers and we are here to help you too. 😁

~ Mahalo & Aloha

How can one on a fixed income keep up with Property Taxes that are going thru the roof due to Home Construction in my area ballooning the Taxes out of reality???

Aloha Angelo Francis Dinoto!

Thank you for your comment. We hear your concern. Welcome to the club, you are not alone. It’s referred to as being rich in equity, but ‘house poor.’

For financial planning check with your favorite qualified financial planner.

If your tax assessment is too high, try to appeal as outlined above.

If your tax assessment increased, then you could probably sell for a lot more than what you paid. 🙂

You may sell your principal home and apply the Sec. 121 – ‘Capital Gains Exclusion.’

https://www.hawaiiliving.com/blog/real-estate-tax-benefits/

We are expert realtors and here to assist when you are ready to downsize and sell.

Stay safe.

~ Mahalo & Aloha

Hello George,

want to know whether their are any property protest company or service that i can hire to do the protest in honolulu. i have a property in koolina and value has gone up crazy. If there is such a service, please give me some contact info. thanks!

Aloha Eric Tran!

I appreciate your patience. Catching up…

I suggest contacting your realtor who represented you when you purchased the property.

However, the appeals deadline was January 15. 🙁

Next opportunity to appeal starts December 15 of this year until January 15 of next year.

Good luck.

~ Mahalo & Aloha

Great timely information George. I’m sure there are many homeowners that don’t realize they have this option.

Mahalo.

Aloha Ray Beltran, Mahalo for your kind words. Let us know what else we can do for you. We are here to help.

~Mahalo & Aloha