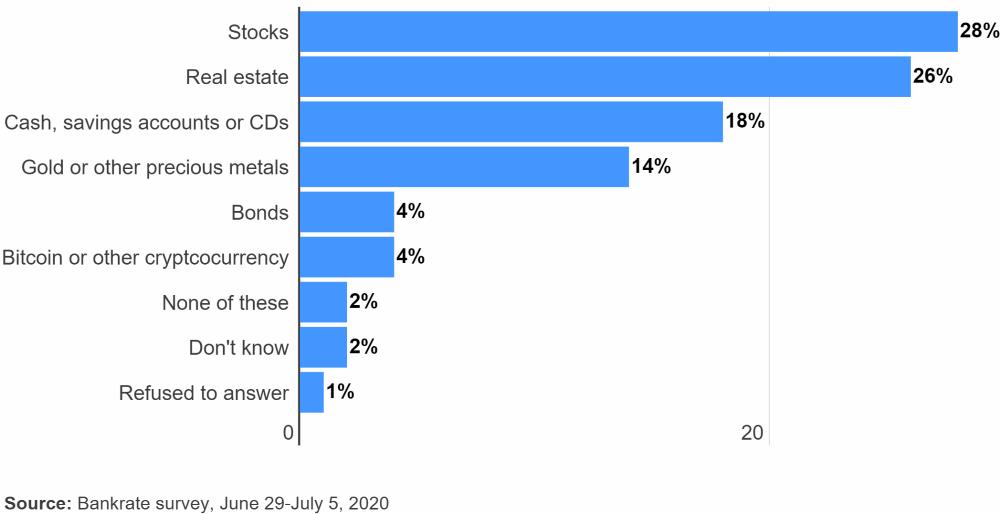

— Last week media outlets circulated a story with headlines like this: “Real estate is no longer Americans’ favorite long-term investment.”

Over the years we’ve seen similar headlines when the stock market and real estate periodically trade places competing for the top spot.

The story was based on a recent survey by www.BankRate.com. The survey question was: “For money you wouldn’t need for more than 10 years, which ONE of the following do you think would be the best way to invest the money?”

Nearly 28 percent of Americans polled selected the stock market as the best way to invest for 10 years or more, dethroning real estate from the prior-year survey.

According to Greg McBride, CFA, Bankrate chief financial analyst: “The swift (stock market) rebounds this spring (2020) and following a 20 percent decline at the end of 2018 have convinced more investors of the market’s long-term merits.”

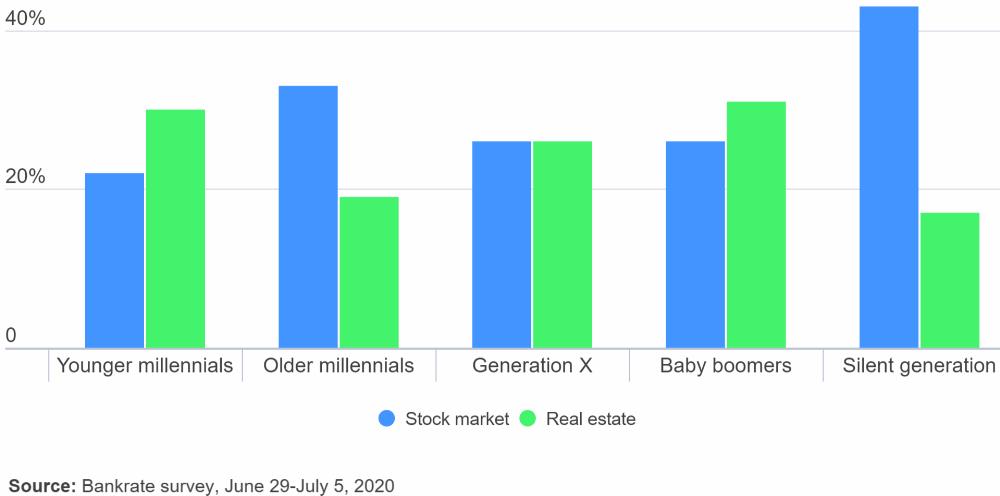

Interestingly, age group results showed differing preferences:

The silent generation (ages 75-92) preferred the stock market at a whopping 43% rate and the lowest 17% preference for real estate. Older millennials (ages 31-39) followed with a 33% preference for the stock market and 19% for real estate.

________________

Advantageous Divergence

If you lost a lot of money when the market cratered in March, then welcome to the club. Don’t be too hard on yourself. You are not the only one that was caught by surprise.

If you recovered some or all of your losses recently, then congratulations on keeping your fears in check and maintaining the necessary long-term vision. You recognized that human drive and ingenuity will prevail and eventually restore vibrancy and economic opportunity. You deserve the gains for having the foresight and taking a calculated risk of investing in the market.

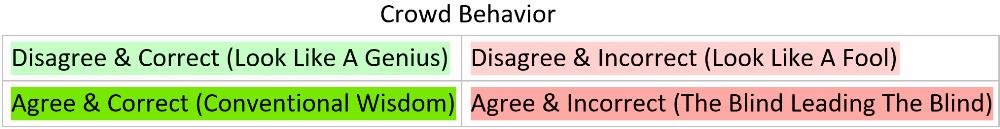

Big returns can come from advantageous divergence. That’s when you bet against conventional wisdom and you are correct! Then you look like a genius. That’s super hard.

But when you bet against conventional wisdom and you are wrong, then you look like a fool. Most of us are afraid of failure and looking like a fool. That’s why many choose to follow conventional wisdom which produces conventional returns. – Consider independent thinking and acting responsibly instead of the convenience and comfort of following the crowd.

Stock Market Allure

The stellar stock market rebound from the March 2020 low is fueled in part by two underlying dynamics:

1) Massive fiscal and monetary stimuli are inflating stocks beyond their true ‘intrinsic value.’ Because:

- Consumers and businesses tend to increase spending when interest rates are low. That’s causing stock prices to rise.

- Investors search for higher returns and are willing to take on the extra risk of owning stocks for potentially greater gains. Low bond yields and CD interest rates are out of favor because of substandard returns. Warren Buffett argued in the past that stretched stock market valuations can be justified when interest rates are at historically low levels.

- The Fed’s commitment to accommodate is long-term. The stock market could be outperforming possibly for an extended time into 2021.

2) Market indexes are masking a split market (bifurcation). Post COVID-19, companies that benefit from social distancing have been increasing their revenue despite the crisis, e.g. Amazon, Microsoft, Alphabet (Google), Netflix, Facebook, etc. By contrast, brick & mortar retail, travel, airlines, and cruise ships are struggling.

COVID-19 has been accelerating market trends that were already building up over the last decade. It’s always tragic when workers lose their jobs.

This is an economic stress test to force companies to innovate and become efficient, cleaning out the excess capacity, and naturally selecting what works best in the market today.

A handful of the largest companies that are thriving during the crisis are leading the stock market higher. Many other companies are severely lagging until eventually they either partake in the recovery or disappear like the Dodo bird. The overall market could continue to move higher.

“Markets can remain irrational longer than you can remain solvent” ~ John Maynard Keynes

Real Estate Bliss

We are blatantly biased advocates for homeownership. We recognize the tremendous benefits of owning your home in addition to owning a sensible portfolio of investment properties for wealth creation and retirement planning. Real estate can function as both:

- A lifestyle choice for personal enjoyment. It could be your principal residence, a 2nd home, or a vacation home. Buying your principal residence often makes sense when you are committed to living in the neighborhood for at least 3+ years if you can afford it. It gets you out of the renting business.

- An investment for wealth creation. It could be a rental property that generates positive cash-flow.

See related article: 7 Residential Real Estate Investment Strategies

________________

Excitement for stocks and or real estate comes and goes depending on the public perception of how the current trend will unfold (recency bias). Most of us are not swapping stocks for real estate and real estate for stocks because of the latest survey or news headline. Instead, we tend to form an investment opinion based on our comfort level and execute according to our current financial ability and future needs.

I made a bunch and lost a bunch. But over time we win more than we lose. That’s if we take measured calculated risk.

With prudent investing, we can substantially increase the odds of reaching financial independence during our lifetime. – But what should we invest in?

“If you are not financially independent by the time you are 40 or 50, it doesn’t mean that you are living in the wrong country or at the wrong time. It simply means that you have the wrong plan.” ~ Jim Rohn

________________

Should We Invest In The Stock Market Or Real Estate?

How about investing in both, stocks and real estate. Your total investment portfolio will be better diversified and balanced to weather economic shocks.

- Stocks as in low-cost diversified index mutual funds, or ETFs (exchange-traded funds), and

- Real estate as in cash-flowing rentals.

I like both, and for different reasons.

Why And How?

U.S. Stock Market

Since the 1929 inception, the broad-based S&P 500 index shows an average annual return of 9.8%. That’s about 7% on average after inflation.

You could achieve 7% by owning a broadly diversified U.S. index fund with low expenses, e.g. the popular Vanguard Total Stock Market mutual fund or its ETF equivalent.

The biggest challenge for most is a) getting started early, and b) sticking with it.

Talk is cheap. You have to do it. For that you need a third success mantra: c) Keep it simple.

I recommend starting today and automating the process. Set up regular automatic drafts from your paycheck or bank account.

Fund all your tax-deferred retirement accounts, e.g. SEP IRA, Roth IRA, and regular IRA. Maximize your contributions and consistently invest by dollar-cost averaging (DCA) through the decades. These tax-deferred funds will grow tax-free and are not to be touched until retirement. Short-term stock market fluctuations are to be ignored as irrelevant noise. Focus on your long-term goal.

“Among the various propositions offered to you, if you invested in a very low-cost index fund — where you don’t put the money in at one time, but average in over 10 years — you’ll do better than 90% of people who start investing at the same time.” ~ Warren Buffett

Most of us don’t have 80 hours per week to analyze which stocks to invest in. Even expert fund managers don’t get it right over extended periods. Winning streaks are attributed more to luck than skill.

Warren Buffett once offered a $500,000 reward to any professional that could select a portfolio of at least five hedge funds that would match the performance of the Vanguard S&P 500 Index Fund over 10 years. So far nobody was able to claim the prize.

It’s about the ‘time-in-the-market,’ rather than ‘timing’ the market. The sooner you start the greater the potential for compounding gains.

________________

After maximizing all retirement accounts, consider the benefits of real estate.

In many US markets, real estate matches or outperforms the rate of inflation. However, real estate is local. Different locations can have different economic dynamics. Study the local trends and what drives the local market cycle.

See related article: Market Update – Mid-Year 2020

Buying your home does not compare to investing in the stock market. It is an investment in a stable secure living environment which provides pride of ownership. For a financed home purchase, you are replacing ‘paying rent’ with ‘paying down your mortgage, building equity, and enjoying some tax breaks.

No landlord can raise your rent or tell you to move out. The ‘dividend’ of owning your home is that you get to live in it.

Reap more financial benefits when you own cash-flowing rentals. Consider dedicating a portion of your income towards investing in income-producing real estate.

U.S. Real Estate

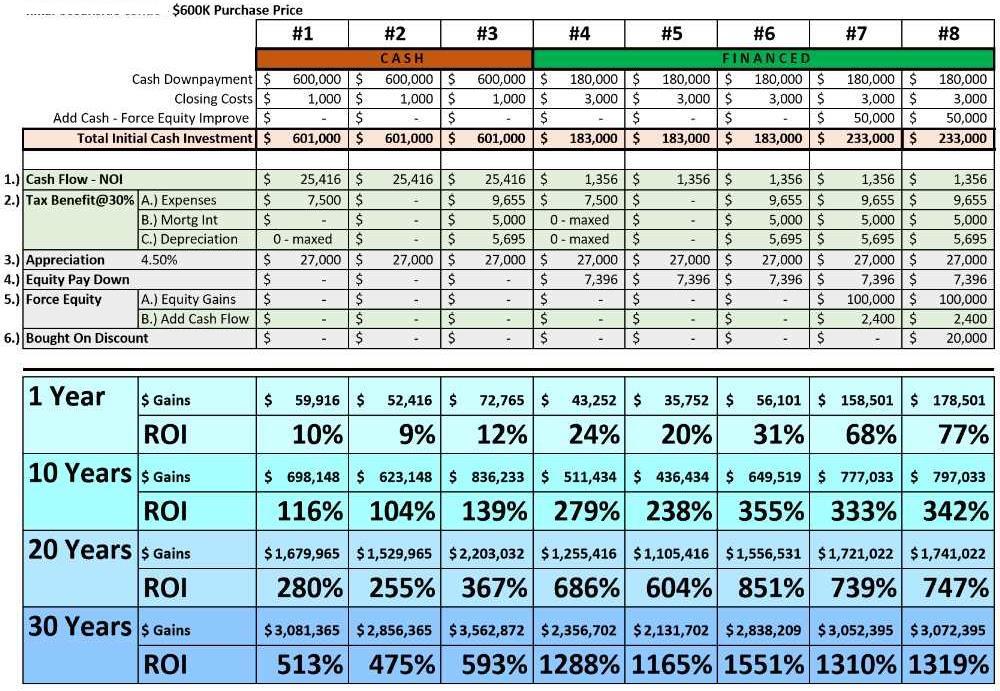

Long-term investing in real estate can create substantial wealth because of the cumulative effect of six individual wealth-building components compounding over time.

Each component acts like a booster rocket driving the investment, and propelling you towards financial orbit. That’s when your investments generate enough passive cash-flow to sustain your desired lifestyle and pay all your living expenses for the rest of your life. Then you work for pleasure only.

The six real estate booster rocket wealth-building components are:

1.) Cash Flow, 2.) Tax Benefits, 3.) Appreciation, 4.) Equity Pay Down, 5.) Force Equity, and 6.) Buying On Discount.

The first two components, Cash Flow & Tax Benefits add spendable cash in your pocket. These cash gains are realized gains that are liquid and ready to deploy.

The remaining components, Appreciation, Equity Pay Down, Force Equity, and Buying On Discount add equity. These equity gains are unrealized, which means they are only gains on paper. Equity can be turned into spendable cash once you refinance or sell your property.

You want both, spendable cash and equity gains for building long-term wealth.

The individual components are explained in detail in the article: Wealth Creation With Real Estate.

The table below shows a sample Honolulu condo purchased a few years ago to demonstrate returns over time taking into account the six different wealth building components.

- Scenario #1: Cash purchase, buyer’s income <$100K/y, not eligible for sec #469.

- Scenario #2: Cash purchase, buyer’s income >$150K/y, not eligible for sec #469.

- Scenario #3: Cash purchase, the buyer is eligible for sec #469.

- Scenario #4: Financed purchase, buyer’s income <$100K/y, not eligible for sec #469.

- Scenario #5: Financed purchase, buyer’s income >$150K/y, not eligible for sec #469.

- Scenario #6: Financed purchase, the buyer is eligible for sec #469.

- Scenario #7: Financed purchase, the buyer is eligible for sec #469, + $50K forcing equity.

- Scenario #8: Financed purchase, the buyer is eligible for sec #469, + $50K forcing equity, + buying with $20K discount.

The total Return On Investment (ROI) is a combination of the six factors mentioned and can easily outperform the average stock market return. Granted, there are certain assumptions as outlined in the article, but that is the case with every investment analysis.

________________

It doesn’t matter which racehorse temporarily leads by a nose. Both, stocks and real estate have performed well over extended periods. I believe in a diversified investment approach and prefer investing in both.

Redundancy And Margins Of Safety

Rocket scientist, professor, author, and podcast host Ozan Varol served on the operations team for the two Mars exploration rovers, Spirit and Opportunity.

In his book ‘Think Like a Rocket Scientist,’ Ozan explains ‘moonshot thinking’ and the importance of Redundancy and Margins Of Safety when flying in the face of uncertainty.

- Redundancy – A ‘system’ should be designed to continue operating even if a component fails. That’s why systems should have duplicate (redundant) components, e.g. emergency brakes, a spare tire, or two rovers (not one) on a mission to Mars.

I apply this concept to my investment approach which is the ‘system’ to reach ‘financial orbit.’

The ‘system’ includes the redundancy of two independent investment components, that is two asset classes: stocks and real estate. Each component is an investment vehicle designed to get me to financial orbit independent from the other. If either one, stocks, or real estate, ends up performing short, then the other investment vehicle (redundancy) should suffice to reach financial orbit.

- Margins of Safety – That’s building the spacecraft stronger than what appears necessary. That’s also having a little extra fuel beyond adequate levels to reach the destination. Is the probability and the cost of failure high? Then go for higher margins of safety.

That’s why I invest a little extra in each investment vehicle than what I think might suffice to reach financial orbit. I rather overshoot the target instead of falling short.

You don’t have to be a rocket scientist to apply these concepts. Gaining some basic understanding of both investment vehicles and learning the tools to successfully manage your finances is useful and should be a lifelong goal. — Godspeed.

________________

We don’t just write about this stuff. We are expert realtors specializing in representing buyers and sellers of real estate in any market condition. Contact us when you are ready. We are here to help. ~ Mahalo & Aloha

________________

Disclaimer: We are a real estate brokerage selling real estate and not investment securities. History is not an indication of future returns. With important investment decisions, always check with your favorite qualified financial planner, accountant, tax adviser, and attorney.

I am working in Canada real estate company. i admired your knowledge is very helpful for real estate knowing importance with stock exchange prespective.