— Recently a buyer and his agent visited one of my condo listings for sale. The buyer asked me directly: “what do you think Oahu real estate prices will do in the next 6 months?”

It turned out the buyer was looking to educate himself on Honolulu condos but has no intentions to buy until perhaps later in 2019. This buyer was fully expecting that ‘with higher interest rates, prices will have to come down.’ He was looking for a confirmation of his hope and expectation.

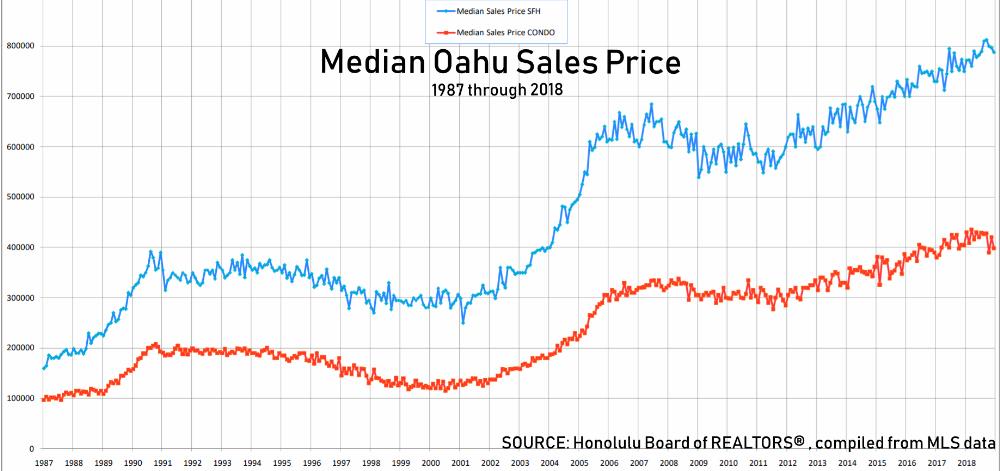

Except, there is no measurable inverse correlation between prices and interest rates in Hawaii. That is according to data we analyzed for Oahu’s Housing Affordability going back to 1987.

I don’t know what the market might do in 3 or 6 months. But I am convinced that Oahu real estate values could move significantly higher during the next 3 or 6 years.

Until then we can look back at the year 2018 and see where we have been and what’s new for 2019.

Where we have been in 2018

2018 appears to be another record year for tourism with about $10Mill visitors.

Oahu’s unemployment rate dipped to 2% during 2018, the lowest in about 50 years, and currently hovers at a remarkably low 2.5%.

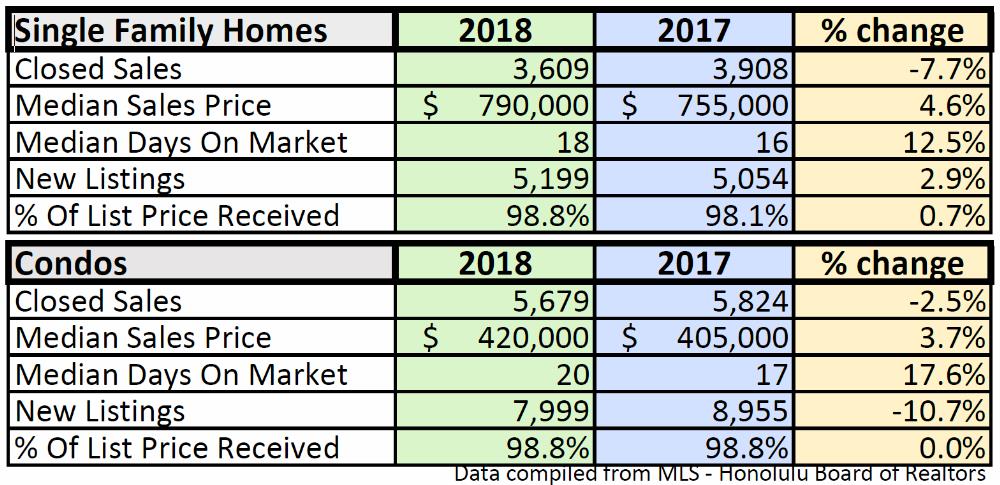

Oahu’s 2018 year over year real estate closed sales activity shows a slowdown of -7.7% for single family homes and -2.5% for condos.

Median sales prices eked out a gain of 4.6% for single family homes and 3.7% for condos.

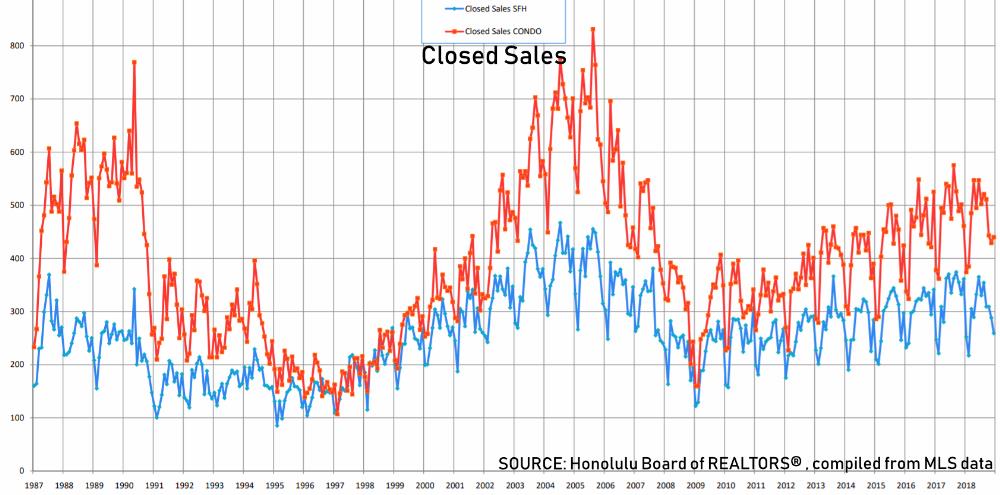

Notice the slowing of sales activity as indicated by some of the lower highs and lower lows during 2018 compared to 2017.

Notice a softening of prices during the last few months in 2018.

What’s new for 2019?

We start 2019 with the typical wall of worries:

- What is now the longest economic expansion on record is perceived as a sign that a recession must be imminent. – Really!?

- US Stocks dropped 20% in late December 2018, off their October 2018 peak. – An omen, or just a typical random correction?

- The IMF trimmed its global growth forecast (by 0.2%) to 3.5% for 2019. China is expected to slow down to only 6.6% growth. – Still impressive.

- US/China trade tariffs and the Brexit uncertainty could potentially trigger a 2019 recession. – Unless it turns out to be business as usual.

- Washington’s political turmoil/government shutdown is an embarrassing distraction. – Until it ends.

Last year the wall of worries included the new 2018 Tax Cuts & Jobs Act. In a letter to Congress, the NAR predicted: “..a plunge in home values across America in excess of 10 percent, and likely more in higher cost areas.” – It didn’t happen.

I’m not an economist and I’m right barely 50% of the time. However, I’m a rational optimist and I have learned to recognize doomsday predictions as a result of a prevailing declinism bias. That’s how our brains are wired. Remember Y2K?

In early 2019, the US economy enjoys slightly slower growth, record low unemployment, steady wage growth, strong corporate earnings, and benign inflation. These are all signs of a healthy economic environment. ‘All good things eventually come to end’ does not mean that a recession is imminent.

Here are two possible scenarios that could develop during 2019:

- A self-fulfilling prophecy. – Could the mere expectation of an economic slowdown turn into reality? Perhaps. How likely could that be?

- Continuing sustainable growth. Could real estate prices move temporarily sideways instead of down? Perhaps. That would disappoint the buyer that has been sitting on the fence hoping for a lower entry point.

Everyone needs to decide if buying or renting is better. Do you think waiting is the better approach? Could scenario #2 with “continuing sustainable growth” be more probable?

What if property values don’t drop to the extend you are waiting for? Perhaps in the future you look back and realize that you should have bought today.

“Your thoughts determine the character of the reality you live in.”

For now, let’s focus on enjoying the present. In case you missed it:

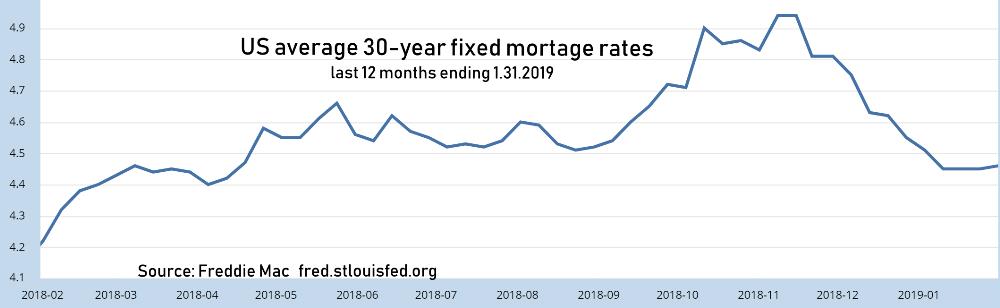

- 30-year fixed mortgages rates dropped to a 14-month low (updated 3/31/2019), averaging 4.06%. Last year at this time, 30-year rates averaged 4.44%.

- Effective 1.1.2019, conforming loan limits for Hawaii increased by 6.9% to $726,525.

Conclusion

Contrary to popular opinions, we do not believe that Hawaii real estate prices and mortgage interest rates will favor those who wait.

Instead, we believe that the best time to buy your home is when: a) you find a suitable home you want to buy, and b) you are ready emotionally, financially and otherwise.

Trying to time the market based on interest rates, seasonality, or any other indicators is a fools game.

———————————————————-

What do you think Oahu real estate prices will do in the next 6 months?

We love to hear from you. We are here to help.

Reciprocate Aloha! –‘Like’, ‘Share’, and ‘Comment’ below.

~ Mahalo & Aloha