The overriding question is: “What else could I do with my time and my money?” The answer to this question depends on the current state of your financial affairs. Financial health requires a balance of: a) growth above the rate of inflation, and b) prudent risk management. You need both, but depending on where you are in life, your focus might be slanted toward either growth mode or preservation mode.

Growth mode means you are accumulating income-producing assets or otherwise increasing your income stream. Ideally, you want to reach the point where your financial assets generate enough passive cash flow to pay all your living expenses for the rest of your life. I call this financial orbit. To get to financial orbit you will need a sufficient escape velocity. You will need to grow your net cash flow faster than the rate of inflation. How soon you reach financial orbit depends on: a) how much of your assets you consistently dedicate toward investing, and b) the ‘real growth rate’ of your investments after inflation. Here are Seven real estate investment strategies that might help you get to financial orbit.

Preservation mode means you are more concerned about managing risk, mitigating loss, and simplifying life. You minimize risk by sheltering your assets, diversifying, eliminating debt, adding insurance and utilizing other hedging strategies.

If your disposition is towards financial growth, ask yourself the following two questions:

1. Are you able to get more financing for additional properties?

2. Are you comfortable taking on the additional leverage and risk?

—If both answers are ‘yes’: → Go for it. Get more cash flowing properties.

—If either one of the answers is ‘no’: → Consider paying down or paying off your loan(s).

Only you can determine how much risk you are willing to handle. Paying down a loan gives you a guaranteed return equal to the interest rate on the mortgage, plus the additional ‘peace of mind’ that you shorten the term and decrease leverage and risk. Paying off your mortgage requires the financial resources to retire the loan completely. We will see shortly that paying off a seasoned loan has an entirely different rate of return.

Wayne Dyer said: “When you change the way you look at things, the things you look at change.”

Here are two ways to ‘change the way you look at things’ that might help you evaluate and compare the real rate of return.

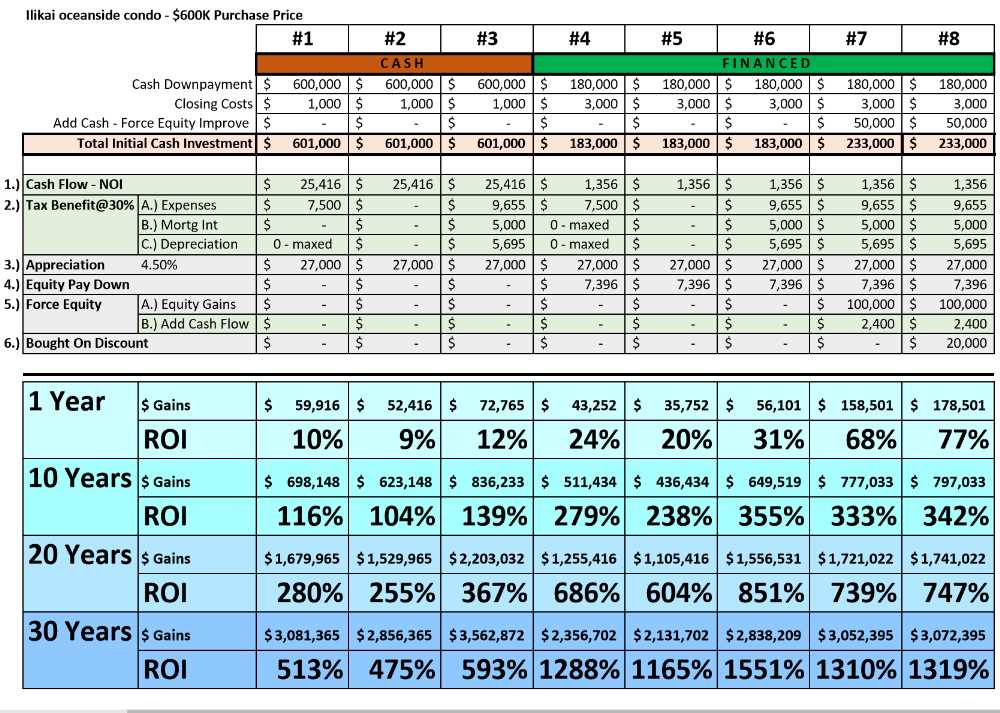

1) You may be aware that Hawaii rental properties rarely generate close to 5% net cash flow. However, the net cash flow is only one of six components that make up your real estate investment return. The six components are: 1) cash flow, 2) tax benefits, 3) appreciation, 4) financing leverage with equity pay down, 5) force equity, and 6) buying on discount. It is the cumulative effect of these six components, compounded over time, that has created substantial wealth for wise real estate investors. We explore this in the article Wealth Creation With Real Estate.

The article discusses eight purchase scenarios and calculates the cumulative real estate returns considering these eight different scenarios:

Scenario #1: Cash purchase, buyer’s income <$100K/y, not eligible for sec #469.

Scenario #2: Cash purchase, buyer’s income >$150K/y, not eligible for sec #469.

Scenario #3: Cash purchase, buyer is eligible for sec #469.

Scenario #4: Financed purchase, buyer’s income <$100K/y, not eligible for sec #469.

Scenario #5: Financed purchase, buyer’s income >$150K/y, not eligible for sec #469.

Scenario #6: Financed purchase, buyer is eligible for sec #469.

Scenario #7: Financed purchase, buyer is eligible for sec #469, + $50K forcing equity.

Scenario #8: Financed purchase, buyer is eligible for sec #469, + $50K forcing equity, + buying with $20K discount.

The chart shows scenarios #4 through #8 using leverage with financing could generate between 20% to 77% ROI after the first year. I’m in the growth mode and when I buy additional rentals I aim to find properties with a minimum of 25% total annual return. If a 25% total annual return is attainable with buying more investment properties, why would I consider paying down an existing low interest rate mortgage?

Maybe this is a mature loan where the balance has been paid down significantly over years. Could the ROI be better by paying off the loan in full?

2) Instead of looking only at the interest rate, you should consider the remaining mortgage balance in relation to the annual mortgage payment. For example, I have a few 6.75% mortgage loans going back to 1992. Paying down a 6.75% investor loan does not fit into my growth mode. But the remaining balance is rather low since the loan has been amortized over the last 25 years. If I pay off the remaining balance I would instantly eliminate my monthly P&I payment and increase my monthly cash flow by the same amount. That could yield a substantial ROI.

Sample calculation: I purchased an investment property in 1992 with a $100K, 30y fixed rate mortgage loan at 6.75%. The P&I payment is $648.60 per month or $7,783.20 per year. After 25+ years the remaining loan balance diminished to $25,722.34. At this late stage of the loan term most of the P&I payment goes towards principal. The mortgage interest deductibility dwindled to an insignificant amount. Now, if I pay off the $25,722.34 balance today, I would eliminate the $648.60 monthly payment and increase my cash flow by $7,783.20 per year – for the rest of my life. $7,783.20 : $25,722.34 = 30.26% payoff rate of return. Bingo! In this case paying off a 6.75% loan looks attractive.

— Remember: “When you change the way you look at things, the things you look at change.” Perhaps generating a 30% return makes paying off your mortgage worthwhile, even if your focus is still growth. My personal threshold return rate to pay off remaining mortgages is >25%. Otherwise, in my current growth mode, I’d rather buy more rentals. Your threshold return rate might be higher or lower. You should know what it is.

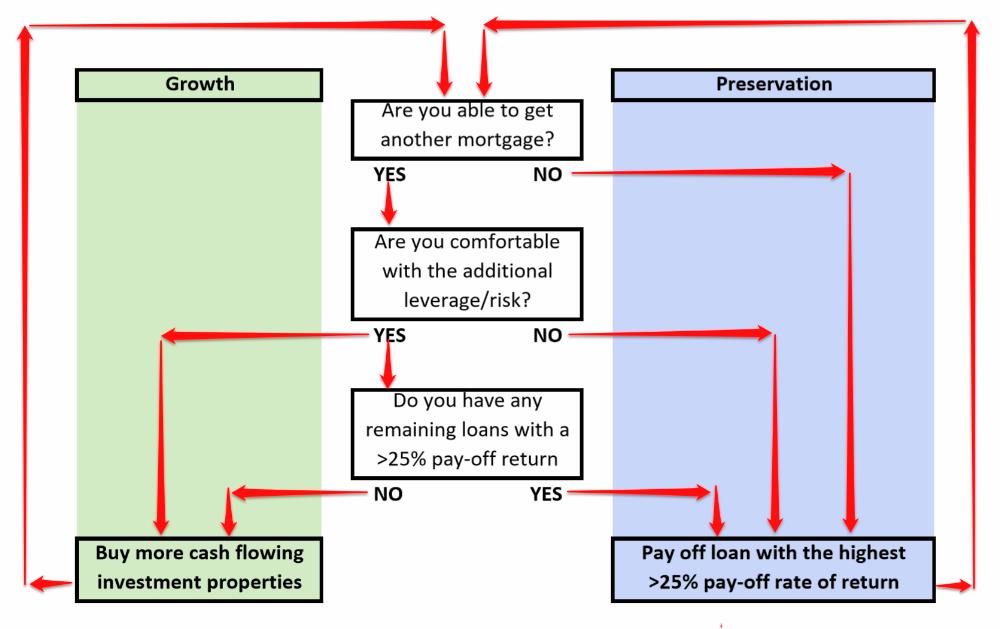

Here is a simple flowchart to demonstrate the thought process.

You are now ready to analyze and answer the main question:

- Determine if you are in the growth mode or the preservation mode.

- Ask yourself the questions on the flowchart above.

- Analyze each remaining mortgage balance in relation to its P&I payment. Determine which one, if paid off, would yield the highest payoff return.

- Establish a roadmap and a predetermined minimum threshold return rate to help you remove emotions when making financial decisions. Ask yourself: “Is the payoff rate of return sufficient and does paying off fit my current financial situation?” If the answer is ‘yes,’ ask yourself: “What else could I do with my time and my money?” If you do not have a good answer, and you have sufficient funds without compromising your emergency reserves, paying off your mortgage might be a prudent strategy.

- Depending on how many properties with mature loans you have, you might end up alternating between the two choices: 1) buying another Hawaii rental property with financing, or 2) paying off an existing mature loan. The flowchart will guide you.

Disclaimer: We are a real estate brokerage selling real estate and not investment securities. History is not an indication of future returns. With all important investment decisions, always check with your favorite qualified financial planner, tax adviser and attorney.

May you live well and prosper. ~ Mahalo & Aloha

We love to hear from you. Let us know your thoughts. Reciprocate Aloha! ‘Like’, ‘Share’ and ‘Comment’ below.

~ Mahalo & Aloha

Can you get a mortgage on a condotel like the Ilikai?

Aloha Peter Jun!

Of course you can, but you will need a portfolio mortgage loan.

All Ilikai condotel units have ‘full’ kitchens, therefore portfolio financing is readily available from a handful of local lenders.

If you buy as an investment rather than as your principal residence, then ‘condotel investor portfolio loans’ require 35% cash downpayment (65% LTV).

The typical local portfolio lenders include Bank of Hawaii, First Hawaiian Bank, American Savings Bank, Aloha Pacific, etc.

Btw, it used to be 70% LTV before COVID, but lenders now see condotel financing as riskier due to slower tourism as a result of COVID.

Sign up for our newsletter and keep up with the market.

Also, review https://www.hawaiiliving.com/blog/condotels-in-waikiki/

..and our library of other condotel articles.

When you are ready, contact us: https://www.hawaiiliving.com/contact/

We are here to help and committed to your success. ~ Mahalo & Aloha