– What’s new for 2018 Hawaii Real Estate?

Today an H&R Block tax preparer from Arizona called. He asked on behalf of his client, “who is responsible for filing and paying GET & TAT? The owner, or the property manager?”

I don’t give tax advice but that one I know: The owner is responsible unless the property manager agrees to file and pay on the owner’s behalf. That reminds me, the TAT rate increased to 10.25% effective 1.1.2018! And while we are at it, let’s summarize what’s new for 2018 Hawaii Real Estate:

1) TAT increased to 10.25%:

This is an increase from 9.25% in 2017. – If you collect income from rental properties located in the State of Hawaii you need to file and pay General Excise Tax (GET) on all gross rents, and Transient Accommodation Tax (TAT) on all gross rents from rental terms less than 180 days per tenant.

If you collect rent from rental terms less than 180 days per tenant you need to pay both:

a) 4.5% GET on the GE Taxable Income = Gross Rent plus GET collected (if any), before deducting expenses, and

b) 10.25% TAT on the TA Taxable Income (Gross Rent, before deducting expenses).

Late 2017 the city improved their website how to easily file and pay online. Check the video tutorial in our comprehensive post: GET & TAT In Hawaii – The Easiest Way To File & Pay.

2) Tax Cuts and Jobs Act 2018:

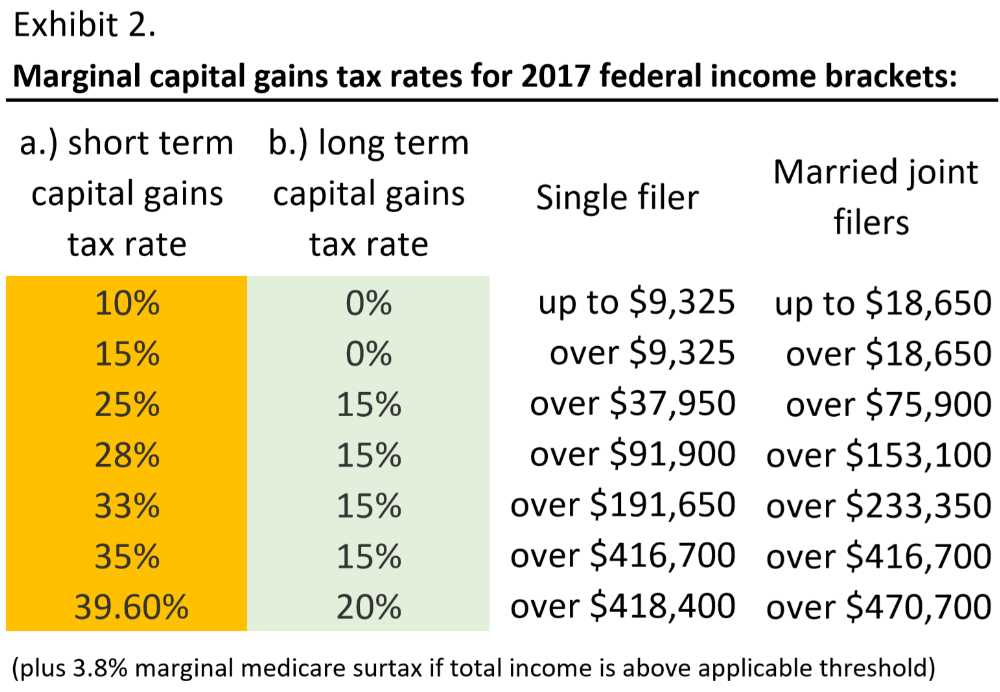

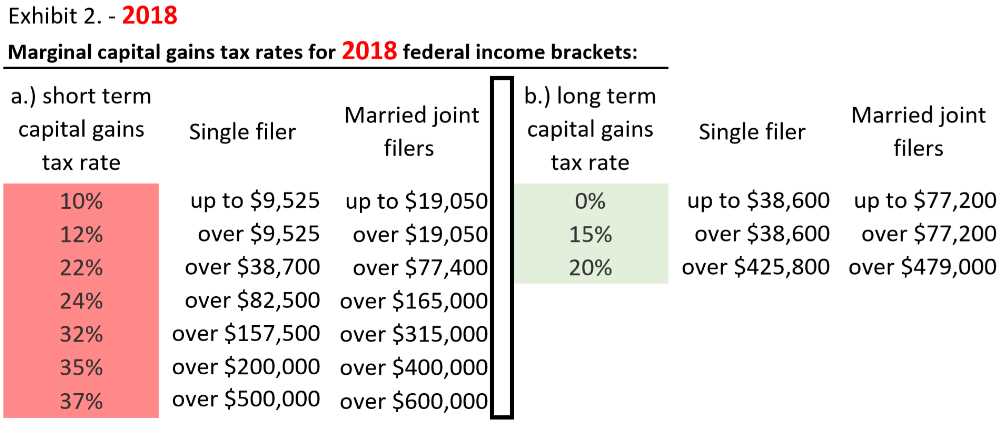

President Donald Trump signed into law the ‘Tax Cuts and Jobs Act 2018,’ effective 1.1.2018 and set to expire in 2025. This is the most substantial tax reform since the 1986 Tax Reform Act. Corporate tax rates and individual tax rates changed. There is also a new ‘flow-through small business 20% deduction.’ Compare 2017 marginal tax rates with the new 2018 rates for single filers vs. married joint filers:

- Real estate related tax changes are as follows:

Mortgage Interest Deduction: Sec. 11042-11045. (Changes to Schedule A, itemized deductions). Effective 1.1.2018, you may deduct mortgage interest paid during the tax year on new mortgage loans up to $750K. This is a change from the $1Mill cap before. Only for existing mortgages, you may continue to deduct mortgage interest up to $1Mill.

Home Equity Line Of Credit (HELOC) Interest paid during the tax year is no longer deductible. This is a change from the $100K cap before. The exception is if you use a HELOC to buy or improve investment property. Then you may deduct all HELOC interest on your Schedule E, rather than Schedule A.

Property Tax Deduction: Sec 11042-11045. (Changes to Schedule A, itemized deductions). Effective 1.1.2018, you may deduct all property taxes in the tax year paid, but only up to a $10K limit for the aggregate amount of state, local, and property tax you paid during the tax year.

Good news: There is no change to Sec. 121 Capital Gains Exclusion – Tax Exemption for owner occupants living 2 out of 5 years in their residence, and no change to the Sec. 1031 Tax Deferred Exchange provision for real estate investors.

Read more in our comprehensive Real Estate Tax Benefits Guide.

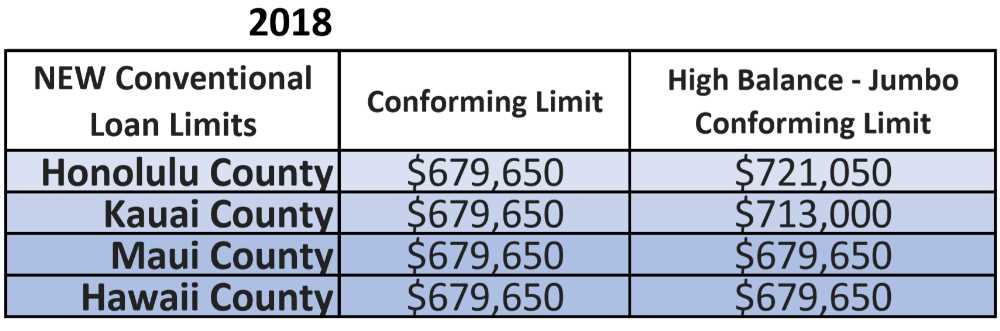

3) New 2018 Hawaii loan limits:

$679,650. This is a significant increase from $636,150 in 2017. Here is the breakdown by County:

In case you are wondering what today’s interest rates are, courtesy of AmeriSave.com, today’s 30 year fixed rate is at 3.75%. With tax deductibility and inflation hovering around 2%, that is just about free money and very close to the lowest point of the range during all of 2017. It is a great time to get a mortgage.

4) Smart Living:

This is the new urban condo living trend we will see more during 2018. Are you ready to live in a modern micro space with Murphy bed and built-in collapsible desk? Consider the brand new upcoming Aalii condo project with efficiency units and impressive amenities. Stay tuned for more..

5) New book: “Buying Paradise” – Real Estate In Hawaii: The Ultimate Guide How To Turn Your Dream Into Reality

I’m excited my book is now available on Amazon.

Here is what others are saying:

– “This is a must-read for anyone that has ever had the dream of living in paradise. Buying real estate anywhere is challenging but Hawaii is an entirely different kind of monster. Going in with the knowledge George Krischke provides in this book gives you a leg up on the other buyers you will be competing with for the same property. He shares his experiences to help others avoid the pitfalls he faced along the way as he accumulated his wealth and his piece of paradise. He shows in chapter after chapter how anyone with the right drive, determination and discipline can be successful in making the dream of owning real estate in Hawaii a reality.”

Kindle Unlimited subscriber can read for FREE. Otherwise, you can buy it for the price of a Starbucks coffee. Get your Kindle copy today. I guarantee you will learn something new by reading it! Write an honest review if you like it. That helps other readers find the book. Much appreciated. ~ Mahalo & Aloha

Let us know what you think. We love to hear from you. Reciprocate Aloha! -‘Like’, ‘Share’, and ‘Comment’ below. Also, don’t miss out, sign up for our blog on the right.

~ Mahalo & Aloha