–- UPDATE 6.20.2020: New Hawaii Property Tax Rates 2020 -2021

— We saw it coming, Honolulu’s City Council adjusted property tax rates for the island of Oahu effective July 1st, 2019 through June 30th, 2020.

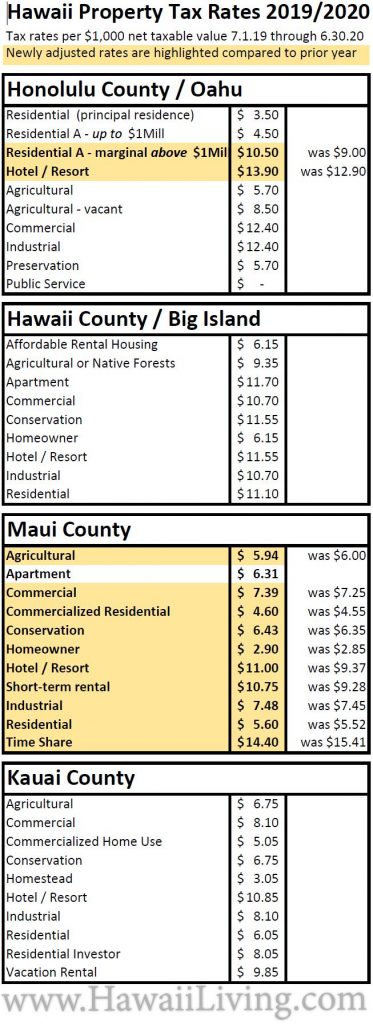

Maui County property tax rates changed even more dramatically. There are no changes for Hawaii County (Big Island of Hawaii) and Kauai County property tax rates. Any rate changes from the prior year are highlighted below:

Three big changes for Honolulu County / Island of Oahu:

Update 12.15.2019: CO 19-32 was signed into law by Mayor Caldwell. This new city ordinance establishes that all new B&Bs obtaining permits under CO 19-18 will be placed in a new “B&B Home” property tax category. The tax rate will be established before taking effect 7/1/2020. This law does not change the tax category of the existing 793 NUC properties (B&Bs & TVUs).

The first two changes are increases in property tax rates.

See related article: Guide To Honolulu Property Taxes

1) Residential Rate A:

For residential properties other than your principal residence (No Home Exemption, this is either a 2nd home or a rental property) with an assessed value at $1Mill or above, the assessed value above $1Mill will now be taxed at $10.50 per $1,000 assessed value (1.05%).

Oahu’s property tax rate Residential ‘A’ applies to the following properties with a tax assessed value at $1Mill or above:

– Condominium units without Home Exemption.

– Residential lots zoned R-3.5, R-5, R-7.5, R-10, R-20, with either one or two single family homes, without Home Exemption.

– Residential vacant lots zoned R-3.5, R-5, R-7.5, R-10 and R-20.

How will this affect you?

– If you own a residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value below $1Mill, your property tax rate will remain the same at $3.50. – Residential ‘A’ only kicks in if your property’s tax assessed value is $1Mill or above.

The two-tiered rate Residential ‘A’ works as follows:

– If you own residential property on Oahu other than your principal residence (No Home Exemption – either a 2nd home or a rental property) with a tax assessed value above $1Mill, your blended property tax rate is $4.50 for the assessed value up to $1Mill, plus $10.50 for any portion of the assessed value above $1Mill.

– Example: A residential property without Home Exemption and a net assessed value of $2Mill is taxed $15,000/y ($4.5K on the 1st $1Mill plus $10.5K on the additional value above $1Mill) effective 7/1/2019.

That is an increase of $1,500/y compared to the prior year.

Tax bills will be mailed to property owners by July 20, 2019, and payment is due by August 20, 2019.

What can you do about it?

If you are eligible, as an owner occupant you may claim your Home Exemption by September 30, 2019, but only if the property is your primary residence. The home exemption reduces your property tax rate to the low $3.50 per $1,000 (0.35%) residential rate starting July 1st, 2020.

See related article: Two Tips How To Lower Your Honolulu Property Tax

2) Hotel/Resort tax rate:

Properties zoned ‘hotel/resort’ will now be taxed at 13.90 per $1,000 assessed value (1.39%).

Honolulu city council in its quest to secure additional revenue decided that hotel/resort zoned properties are the low hanging fruit. They think this is the gift that keeps on giving.

Squeezing additional revenue from legal short-term vacation rental properties has been much easier than from the estimated 6,000 to 8,000 illegal short-term rentals scattered throughout residential neighborhoods.

New short-term vacation rental regulation CO 19-18 will be taking effect. This might increase tax collection for the state and also tighten the enforcement of zoning rules. Illegal vacation rental owners will need to be prepared for possible fines.

See related article: The Risks Of Short-Term Vacation Renting

How will this affect you?

If you own a condotel that is zoned ‘hotel/resort’ (allows for short-term vacation renting) then your property tax rate increased by $1 per $1,000 assessed value.

Example: A condotel zoned ‘hotel/resort’ with a net assessed value of $1Mill is taxed $13,900/y effective 7/1/2019.

That is an increase of $1,000/y compared to the prior year.

Tax bills will be mailed to property owners by July 20, 2019, and payment is due by August 20, 2019.

What can you do about it?

You could dedicate your ‘hotel/resort’ zoned condotel for residential use. This will reduce your property tax rate to the lower Residential Rate (3.5%) if your property is assessed below $1Mill, or to the Residential Rate “A” (4.5%/10.5%) if your property is assessed at $1Mill or above.

Dedicating your ‘hotel/resort’ zoned condotel for residential use will lower your property tax rate effective July 1st, 2020. However, you will no longer be able to rent out your unit as a short-term vacation rental (rental terms shorter than 30 days per tenant). Violating the ‘dedication for residential use’ will trigger penalties.

— We recommend to follow the law when it comes to short-term vacation renting your property. You may only rent your property for rental terms shorter than 30 days per tenant, if all three apply:

- the underlying zoning is ‘hotel/resort’, and

- the unit has not been dedicated for residential use, and

- the building house rules do not prohibit short-term vacation renting.

In case that the underlying zoning is not ‘hotel/resort’, then there arethree exceptions that would allow short-term vacation renting:

1) The individual condo unit has a valid NUC (Non-confirming Use Certificate), or..

2) the condo building has an ongoing active hotel operation and the property is exempt from requiring owners to hold a valid NUC, as per an unofficial list from 1990 by the Dept of Planning & Permitting, or..

3) the property has a legal Bed & Breakfast license (for single-family homes).

See related article: Guide To Condotels and Short-Term Vacation Rental Condos

3) $20,000 increase in real property tax home exemption:

The standard home exemption amount that an owner occupant can claim for their principal residence has been increased by $20K.

This has been long overdue and is a small relief, especially for property owners that are on a fixed income and struggling with their ever-increasing property tax bills based on increasing tax assessed values.

See related article: Claim Your Honolulu Home Exemption

Here are the new home exemption brackets:

- The standard home exemption amount is now: $100K (formerly $80K)

- 65 to 79 years of age: $140K (you must be 65 years of age by June 30th preceding the tax year the exemption is filed).

The following home exemptions are available subject to meeting the required age by June 30th preceding the tax year the exemption is filed:

- 80 to 84 years of age: $160,000

- 85 to 89 years of age: $180,000

- 90 years of age and over: $200,000

However, these last three home exemption brackets for owners age 80 and older are also subject to a) re-applying every 5 years (!), and b) subject to “low-income” limits as per Section 8-1 0.20(a). “Low-income” means the annual income of the household can not exceed 80% of the area’s median income for the county as established and updated annually by the US Dept of HUD.

This new city ordinance CO-19-7 and several others lately tend to include some trip wires to automatically revert to a more favorable tax revenue default setting.

That’s a bit sneaky if you think about it. How many low-income 80 years and older residents do you think will remember to re-apply every 5 years for the next home exemption bracket. Otherwise they will automatically drop back down into the lower $140,000 home exemption bracket. — Be in the know and mark your calendar to re-apply again in 5 years from now.

The new tax assessment notices for fiscal year 2020 (starts July 1, 2020) will be sent by December 15, 2019. You may appeal the newly asssessed value only between December 15, 2019, to January 15, 2020.

See related article: How To Appeal Your Property Tax Assessment

———————

Let us know your thoughts. We love to hear from you. Reciprocate Aloha: ‘Share’, ‘Like’ and ‘Comment’ below.

~ Mahalo & Aloha

Does Hawaii have a school tax? And how high are the property tax?

Aloha George,

Your website is very helpful and informative and I appreciate all the detailed information! I just received my Real Property Asessment for 2021 and was surprised to see the property class went from Residential to Residential A. I did not know what any of that means (I recently took over ownership of our house) and through your website got the information I needed to learn about it. Unfortunately my mom passed away so they removed the exemption and when I called the Real Tax office they said there is nothing I can do about 2021, but I can file the exemption for 2022. Is this true? I see an appeals form on their website and it says the property class can be appealed but on the form it does not have a checkbox for it. Do you know if the property class can be appealed? Or could you please refer me to someone who could advise me? It is a HUGE difference between Residential and Residential A.

Mahalo nui loa,

Lisa

Aloha Lisa Kanayama!

To get the lower residential tax rate, you must file and qualify for a ‘Home Exemption.’

If you took possession and missed the Sept 30th filing deadline this year, then there is little you can do to appeal.

Instead, you must file before next year’s Sept 30th filing deadline.

The ‘Home Exemption’ tax break plus the lower residential tax rate take effect on July 1st of the year after the filing deadline.

Here is how and where to file:

https://www.hawaiiliving.com/blog/claim-honolulu-home-exemption/

–Don’t take our word for it. Always check with your favorite qualified tax professional.

We are expert realtors here to help when you are ready to buy or sell real estate. ~ Mahalo & Aloha

George Krischke, Principal Broker, Hawaii Living LLC

George Krischke, Principal Broker, Hawaii Living LLC Mahalo Nui for your reply George! I filed immediately for the Home Exemption for next year. Happy Holidays!! Aloha, Lisa =)

Excellent! Happy Holidays. ~ Mahalo & Aloha

Hello,

The only question I have and haven’t had an exact answer is this:

Are there Properties in waikiki that are eligible for short term rentals AND owner can occupy on off months (not renting) for more than 2 weeks? If so, what are the building names so I can look into buying. Or, If there are properties that will offer long term lease like 9-10 months then owner occupy for 2-3 months. Thanks!

Aloha Lisa Rivaldo-Dillon!

Welcome back. – Of course there are plenty of properties like that.

We have helped hundreds of clients buy condos where the buyer wants exactly what you want: Maximize the rental income and only occupy for 2 weeks or 2-3 months.

What is your budget?

Contact us here: https://www.hawaiiliving.com/contact/

Also, review my response to your comment here:

https://www.hawaiiliving.com/blog/new-rules-dedicating-condotel-residential-use/

..and here:

https://www.hawaiiliving.com/blog/real-estate-tax-benefits/

We are here to help.

~ Mahalo & Aloha

George Krischke, Principal Broker, Hawaii Living LLC