Oahu Real Estate Market Outlook – June 2017 –

Courtesy of the Honolulu Board of Realtors, local economist Paul Brewbaker with TZ Economics recently shared his view regarding the general US economy as well as his outlook for the local Hawaii economy and the Hawaii real estate market.

Paul’s presentations are always insightful. Check here for last year’s summary: Oahu Real Estate Market Outlook – June 2016, and compare with today’s report.

We greatly appreciate Paul’s presentations and pay particularly close attention to his current Oahu Real Estate market outlook. Following are some subjective takeaway bullet point notes from this year’s presentation during the 6/14/2017 HBR regional meeting in Honolulu.

All graphs courtesy Paul Brewbaker – TZ Economics:

1.) US and Hawaii economy:

- This is the 8th anniversary of the beginning of the current economic expansion. 8 years also represents the average length of all expansions.

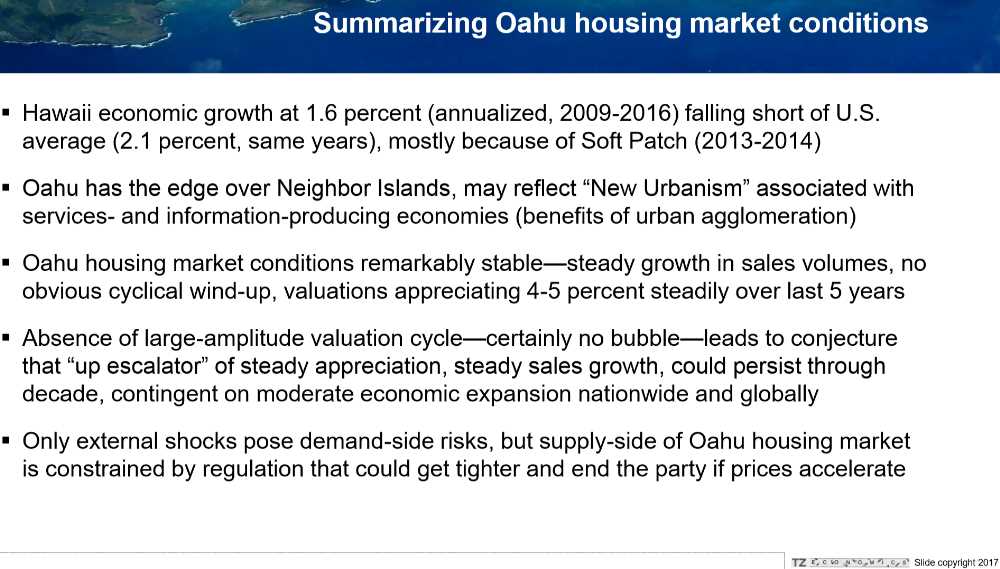

- Current US GDP growth is 2.1%. Hawaii GDP growth has been around 1.6% for the last couple of years.

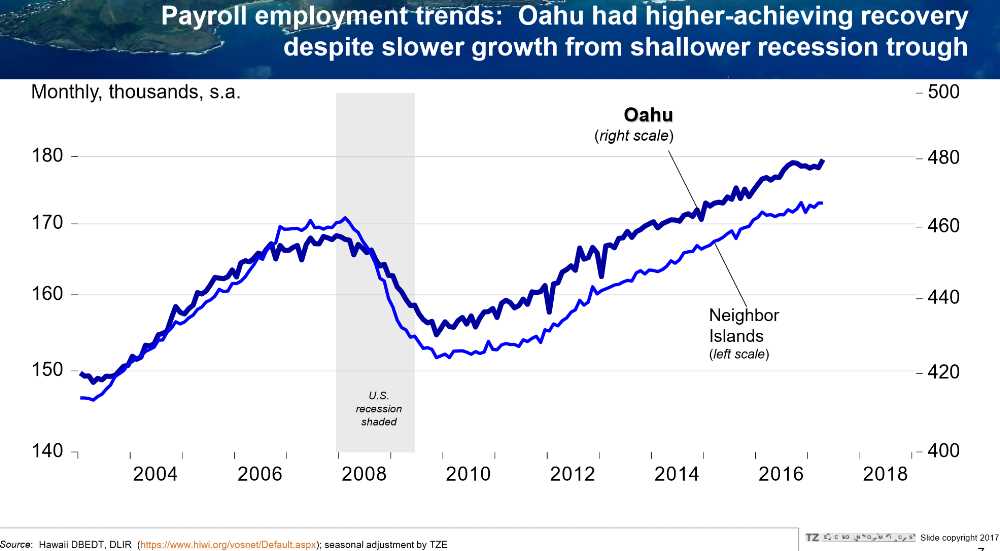

- Job recovery started in 2010. By 2015-2016 Hawaii payroll numbers have fully recovered and continue to grow. Slow job growth most likely will continue, but has been decelerating lately.

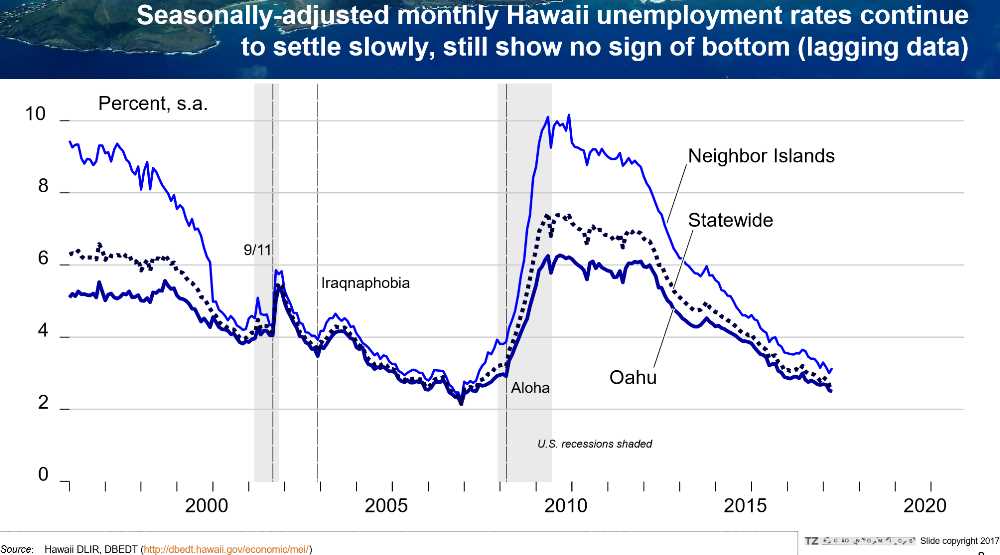

- Hawaii unemployment rate is dipping down to a very low 2.5% – 3%, still no sign of bottoming yet.

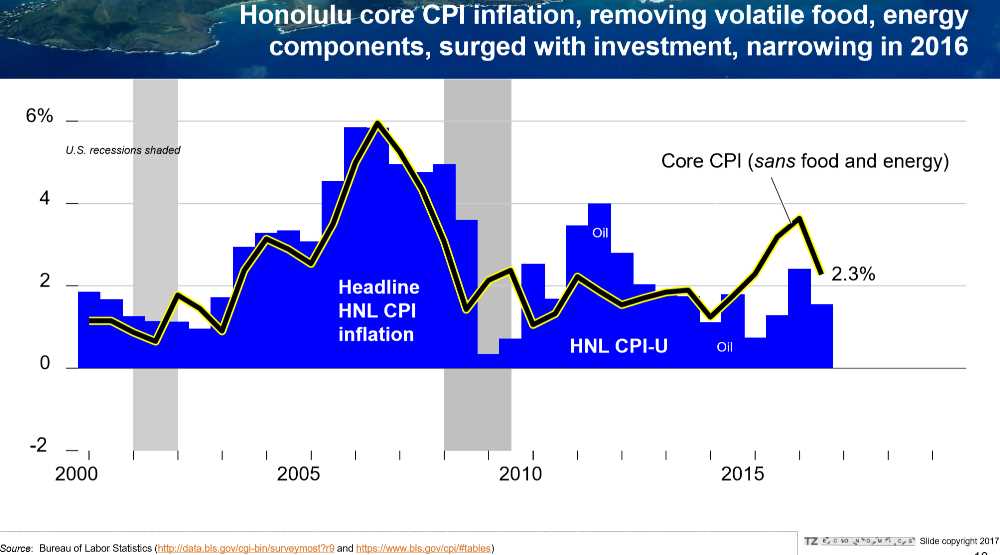

- Honolulu Core CPI inflation rate is currently 2.3%, and has been hovering around a steady 2% since 2008.

2.) Oahu Real Estate:

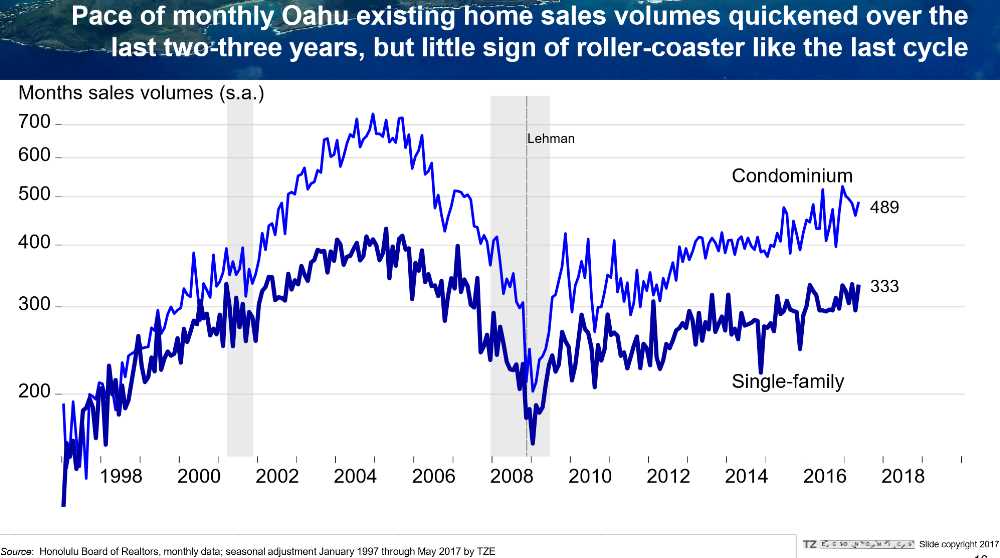

- No roller coaster this time. Modest sustainable steady pace of sales growth is expected to continue until something unforeseen happens.

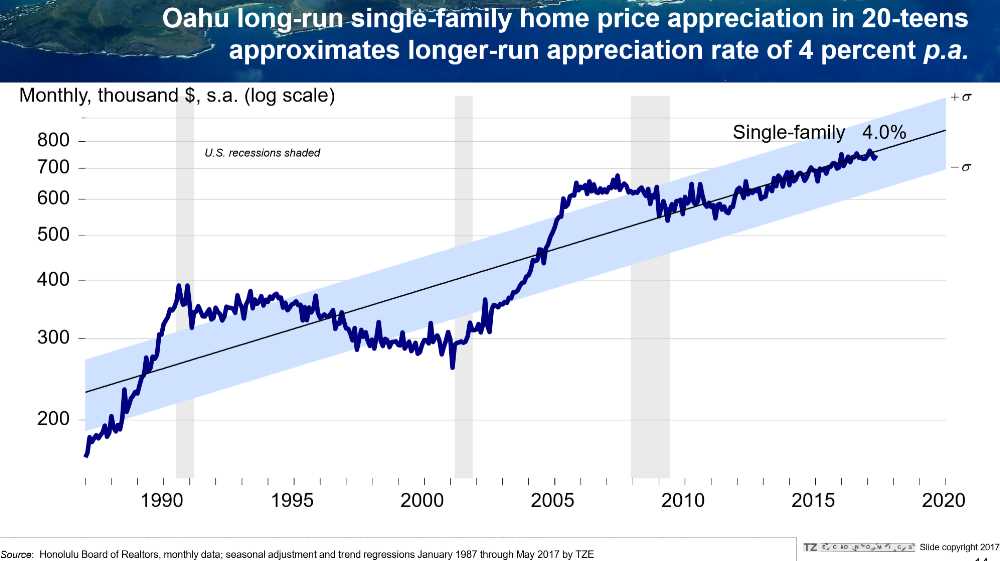

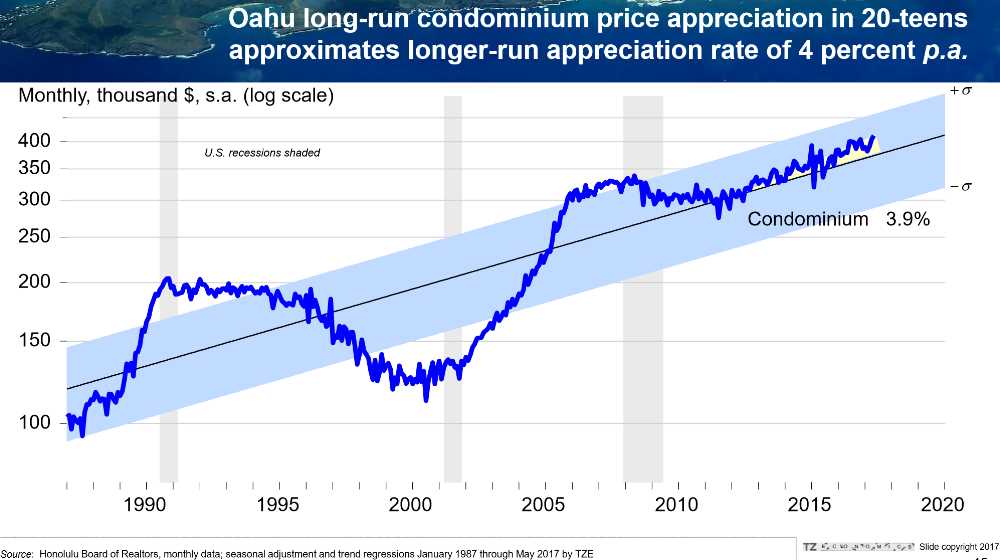

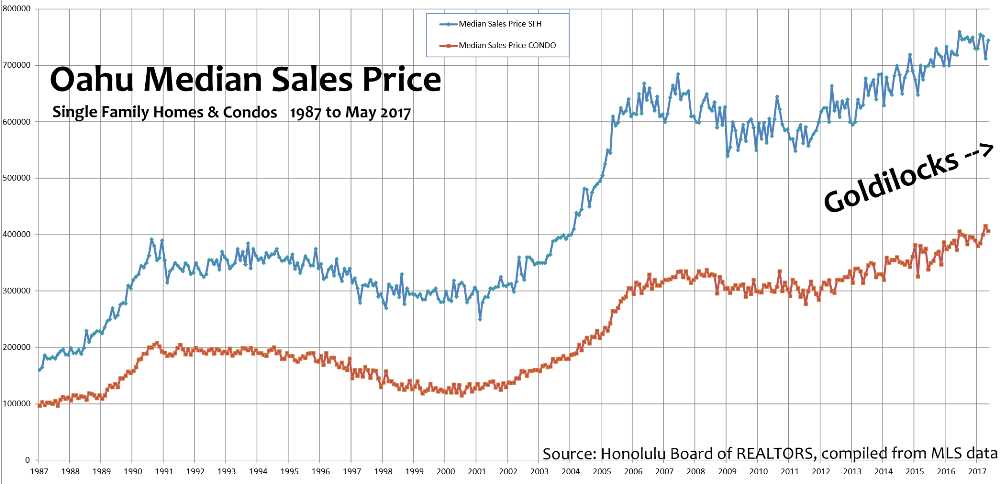

- Since 2010 (last 7 years) single family home price appreciation and condo price appreciation have both been consistent and steady at about 4% and 3.9% respectively. That represents a steady continuation of the long-term price appreciation trend, without the wild swings seen during past cycles.

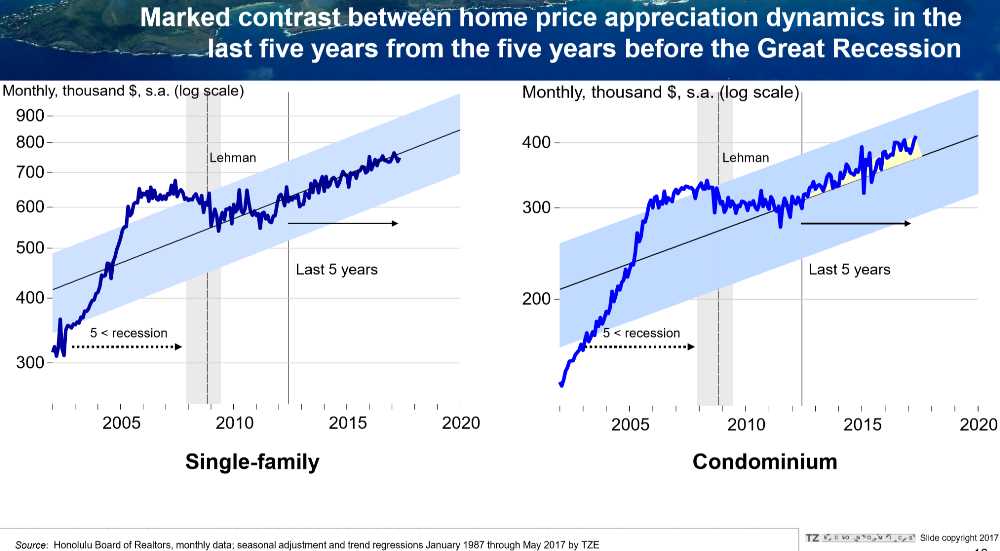

- Compare steady price appreciation rate during the last 5 years (mid 2012 to mid 2017) versus steep price appreciation rate during the 5 years prior to last recession (2003 to 2008).

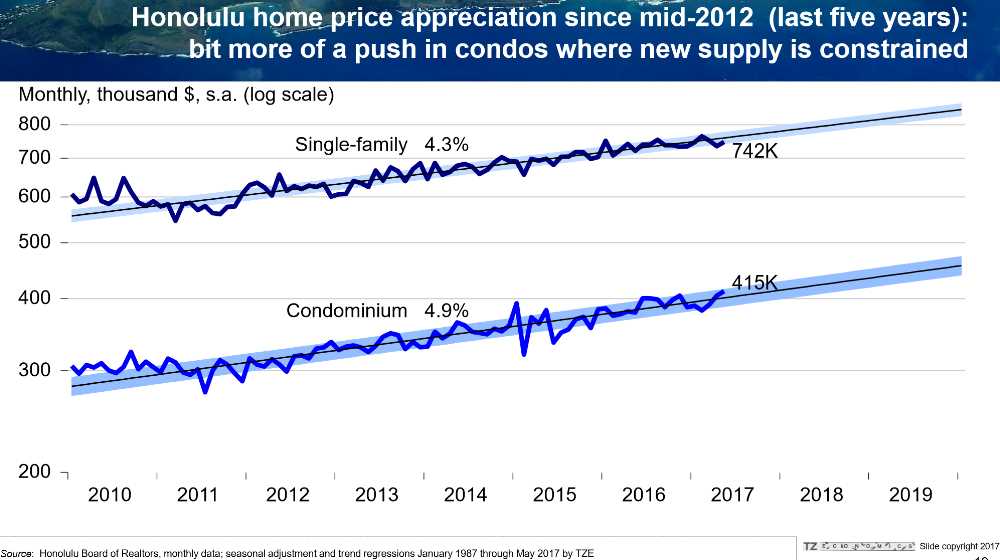

- Condos have been outperforming (!) single family homes since 2012.

- Since mid 2012 (last 5 years) Oahu real estate appreciation has been remarkably consistent and steady at 4.3% for single family homes and 4.9% for condos.

- The more affordable price range for condos represents the low hanging fruit. Limited condo supply with higher demand translates into increased appreciation lately compared to single family homes.

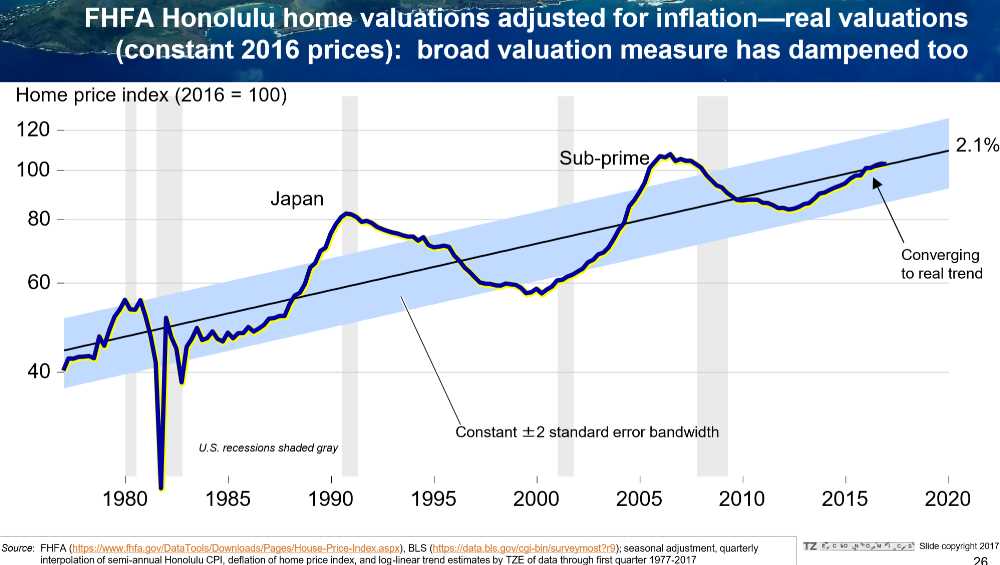

- 4% appreciation (pic #5 & #6) minus 2% inflation (pic #3) means we have about 2% real annualized inflation adjusted housing appreciation, currently converging to long term trend since the 1970s.

- This sustainable steady growth could continue throughout this decade.

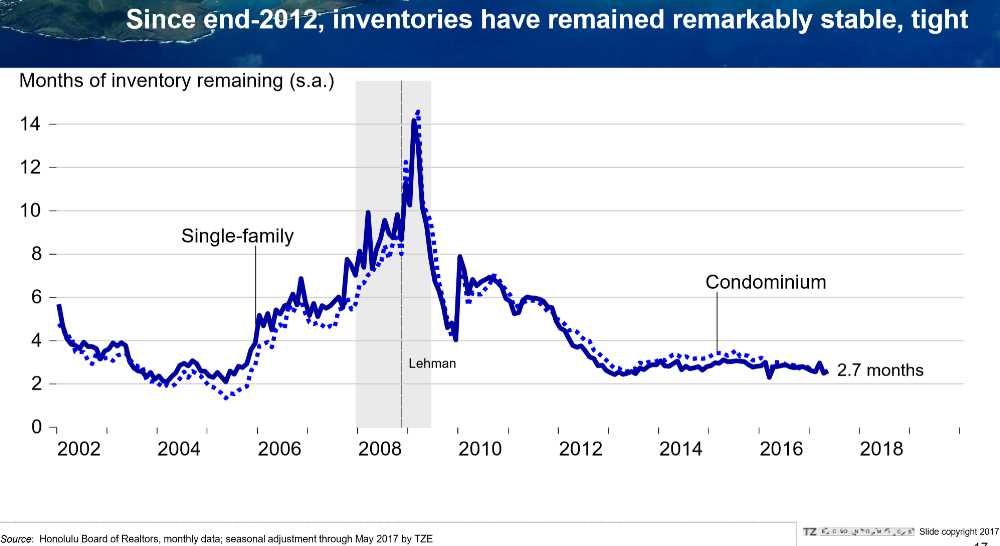

- ‘Months of Inventory’ has been remarkably low and stable at 2.7 months since 2013.

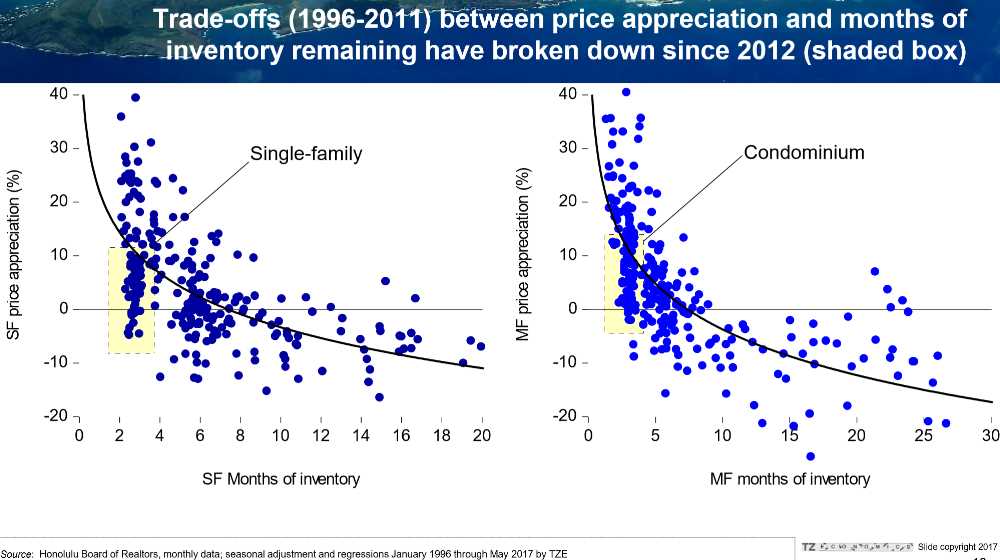

- The ‘Sklarz Curve’ (named after Mike Sklarz) shows the average appreciation and depreciation rate in relation to Months of Inventory. A steady balanced market was long considered a market with about 6 Months of Inventory.

- Fewer days on market –> faster absorption with lower Months of Inventory.

- Historically between 1996 and 2011 a very low 2.7 Months of Inventory would have translated into steep appreciation rates of 10%+.

- Since late 2012 we have seen Months of Inventory consistently hovering around 3, well below the 6 Months of Inventory long regarded as the stable midpoint between a Buyer’s and Seller’s market. Yet appreciation has been only modest around 4.5%. This new dynamic is shown in the yellow box.

- 2.7 Months of Inventory has not been lighting up sales prices as it has done before.

3.) Housing Affordability:

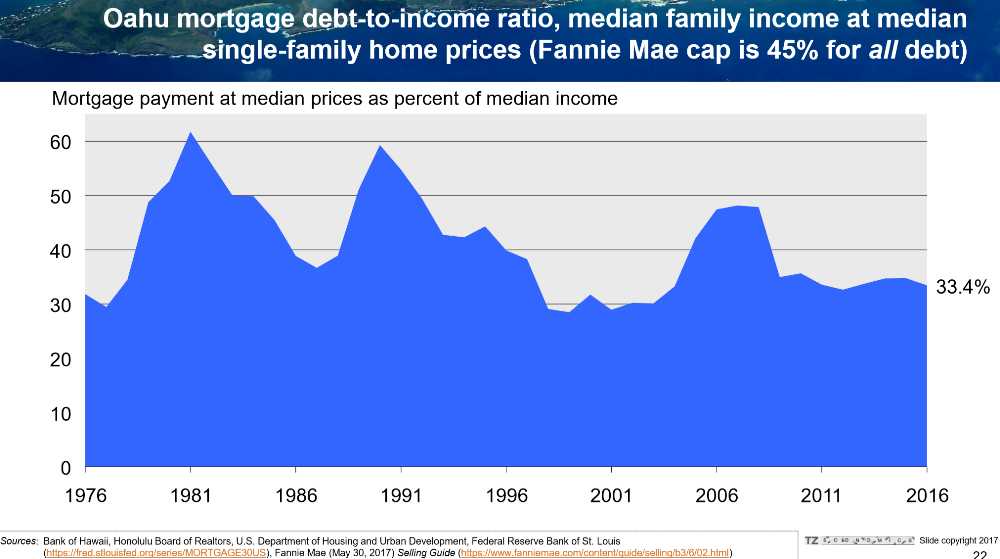

- Hawaii was never cheap, current mortgage debt to income ratio is 33.4% on Oahu. Not super high for the last 7 years and counting. Steady since 2010, no bubble here.

- Affordability is not a crisis. Home prices and nominal income both have been rising together at 4%.

- Shortage of affordable homes is the problem. – Reality: Affordability today is about as good as it ever has been, but housing supply is constrained.

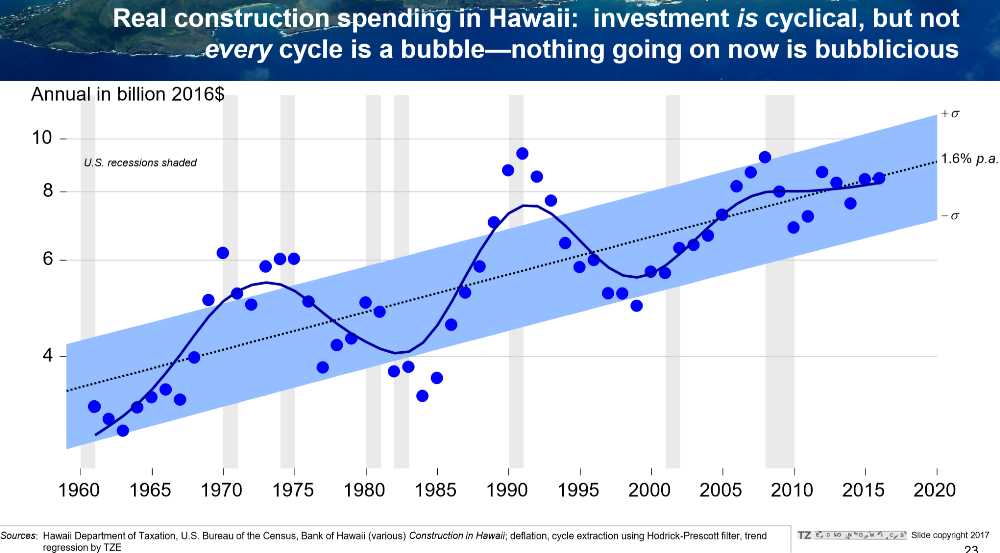

- Construction spending median growth is 1.6% converging to the trend 2.2%. 1.6% construction spending growth is lagging behind 2% inflation rate.

Buyer profile for Oahu resale units has been 78.5% local between 2008 and 2015:

- Hawaii 78.5%

- Other State 7.7%

- California 6.1%

- Japan 5%

- Canada 1.2%

- Other country 1%

- Korea 0.25%

- China 0.2%

- Be mindful of the self-destructive elements of this cycle if only expensive luxury units and not enough affordable housing units are being built.

- E.g. affordable project 801 South St (completed 2015) was priced for regular working people. 96% have not sold and won’t sell. They are holding on because it is their home.

- We need more affordable projects like 801 South St to sustain Honolulu’s real estate market.

- Howard Hughes started developing 4 years ago in up-and-coming Kakaako with a focus on new luxury condos catering to affluent buyers. In the next years new development needs to be catering to regular working people to ensure a continuation of sustainable growth.

4.) Interest Rates and Fed policy:

- http://www.FederalReserve.gov shows the dot plot chart expectation increasing the fed funds rate to 2.97% by 2020.

- Fed funds rate is now at 1-1.25%. One more increase expected later this year to 1.375%. Three more increases expected next year 2018 to 2.1%.

- Gradual removal of policy accommodation remains appropriate. – All good.

5.) Conclusion and Outlook:

- Goldilocks – steady sustainable growth conditions continue..

We love to hear from you. Share some Aloha. ‘Like’, ‘Share’ and ‘Comment’ below.

~Mahalo & Aloha

George, the graph #12 shows debt to income ratio 2016 at 3:1. With new mortgages averaging $3500 these days, then adding in PMI (who has cash 20% down + closing costs?),taxes and Insurance, puts real time house payments in the $4,200 per month range for current home buying. No way that median income is $10,000 – $13,000/month. The inflated housing bubble has to burst as it has in the past. Who can afford these homes? $800K for a 1500 SF average house! Only multiple families pooling together under one small roof or the wealthy top 1%. Definately a sellers market, in turn resulting lower demand will cause a downswing in house prices. Look at the hundreds of listing on Zillow. About half the current listings show a “price cut” as most have been on the market for months, often in excess of one year. You realtors tell a deceptive story of what a great investment Oahu still is. Your sole interest is painting a rosey picture for buyers and sellers. Bottom line is your commision which is understandable in business but buyers will lose their investment… Get real!

You are correct Dave, the medium income is not in that range for working class people. Units are being bought by wealthy investors and rented. Just like on the mainland.

That’s a good point about affordability. If Oahu mortgage to income ratios are low, but the reality is that things aren’t pencilling out, I’m wondering if graph 12 is based on what mortgages people are already paying–say on prices in the last 20-30 years- rather than on new ones taken out today reflecting current market prices.

I hope that helps.

Still, I really appreciate this article. The point about not every investment cycle being a bubble is a good one, and that construction spending has tracked 1.3 percent pa (graph 13) is another argument in favor that there isn’t a bubble- at least from that perspective.

Aloha Dave Sonstein!

Thank you for commenting and your patience with my delayed response. I haven’t checked here in a long time.

— Here is the latest market update January 2020:

https://www.hawaiiliving.com/blog/oahu-real-estate-market-update-2020/

Compare the article above with how reality has transpired, or if indeed “we were painting a rosey picture.”

Here is an article that explains how every generation struggled to succeed with obtaing homeownership while Oahu’s market has always seemed expensive:

https://www.hawaiiliving.com/blog/how-to-buy-hawaii-real-estate-market-is-expensive/

In case you are serious about obtaining homeownership, I published a book with tips how to make it happen:

https://www.hawaiiliving.com/blog/book-hawaii-real-estate/

Both, buying or renting comes with many benefits and risks. It is up to you to decide which one is more suitable for you at any given time.

We are here to help when you are ready to buy.

Contact us here: https://www.hawaiiliving.com/contact/

~ Mahalo & Aloha

Aloha Terry Duchow!

Thank you for commenting.

Graph #12 is based on ‘new’ mortgages taken out at that particular time in history in combination with the median sales price and the median local household income during that moment.

Otherwise the graph wouldn’t make sense as a housing affordability proxy.

In case nobody noticed, current mortgage rates are hovering at a 3-year record low.

Let us know if you need assistance with buying or selling.

We are here to help.

~ Mahalo & Aloha

Can you explain why the price of non-affordable homes has skyrocketed in the last couple of years? Am I meant to believe that the average price of a home will gain in value by 3.9% for the next decade even your article states that “We need more affordable projects like 801 South St to sustain Honolulu’s real estate market”. You then say “Be mindful of the self-destructive elements of this cycle if only expensive luxury units and not enough affordable housing units are being built”. The fact is that there is a shortage of affordable homes, non-affordable home prices have soared, but the market is not in trouble? This article contradicts itself. Who are the people buying these homes? Military? BAH and COLA fluxuates and is lower today than in 2014-15. Foreign Investors? I have read that they are decreasing. You stated that it is not native Hawaiians. So who is buying and how can this trend continue? It appears as if the bubble IS about to pop. If I am wrong, please explain.

Aloha Chris,

Thanks for checking in. Property values are a function of supply & demand.

-Oahu’s residential construction has been lagging behind Oahu’s net population growth since 1980 (!). We continue to have a housing shortage. No bubble here.

– Oahu has always been expensive. We measure ‘Affordability’ as a function of ‘mortgage payment for the median home price’ vs ‘Oahu’s median household income’. There have only been two (!) recent time periods when Oahu real estate was more affordable than today: 1976-1977 and 1998-2004, see pic #12. No bubble here.

-Check the graph at the top of this post. Oahu’s median home & condo prices dropped 10% in 2009 during the most severe recession since the 1930s Great Depression. Do you expect an imminent similar economic shock?

Buying vs renting is a personal choice. Home ownership comes with incredible benefits, but requires a commitment and sacrifice. It’s not for everyone. If you want to buy and you are committed to live in HI for at least 3 years, I would buy today, if you can. I expect the market to move up.

Let me know if there is anything else we can do. We are here to help. ~ Mahalo & Aloha